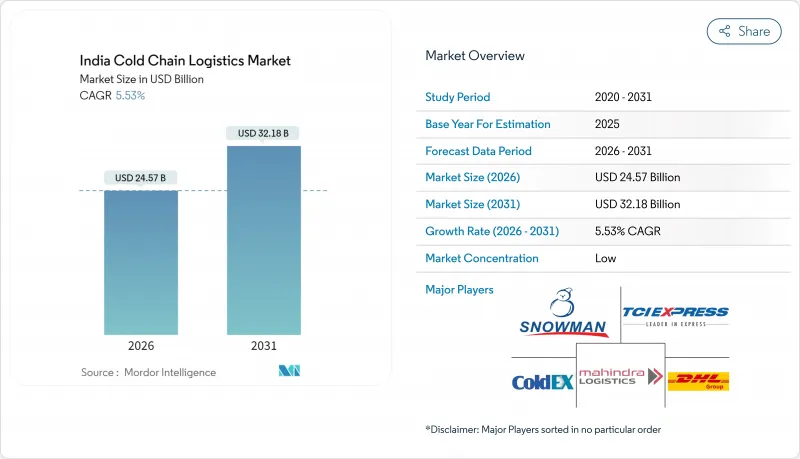

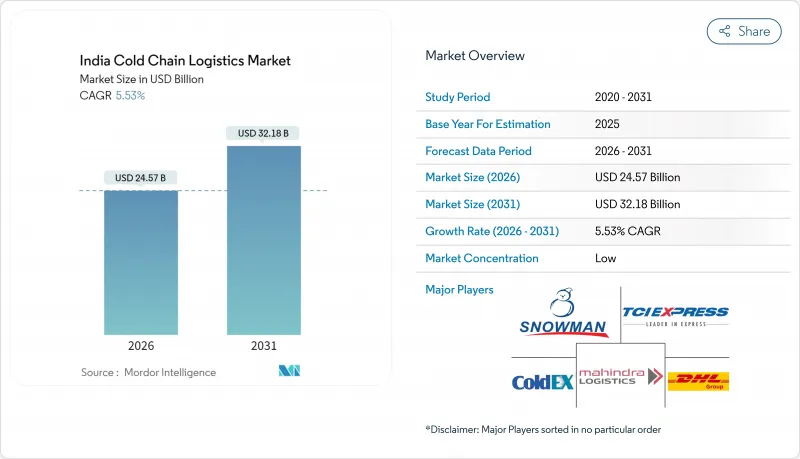

인도의 콜드체인 물류 시장 규모는 2026년 245억 7,000만 달러로 추정되며, 2025년 232억 8,000만 달러에서 성장할 것으로 전망됩니다. 2031년에는 321억 8,000만 달러에 달하고, 2026년부터 2031년까지 CAGR 5.53%로 확대될 전망입니다.

도시의 외식산업 급성장, 창고시설에 대한 공적 보조금, 생물학적 제제를 다용하는 의약품 파이프라인이 더해져, 기존의 분산형 벌크 저장에서 통합형 엔드 투 엔드 온도 관리 솔루션으로의 결정적인 이행을 추진하고 있습니다. India Cooling Action Plan은 에너지 절약 자산을 추진하고, 국가 물류 정책은 효율성 향상을 보여주는 물류 대 GDP 비율을 목표로 하고 있으며, 사업자의 차량 갱신 및 AI 기반 경로 계획 도입을 촉진하고 있습니다. LNG 대응 고속도로, 전자식료품 배송 허브, eVIN 대응 백신 감시 시스템은 신뢰할 수 있는 초저온 유통 수요를 강화하고 있습니다. 한편, 고효율 압축기로의 수입 관세 장벽과 만성 냉동차 운전자 부족이 단기적인 기세를 억제하는 한편, 규모의 우위성을 가진 통합형 사업자에게 유리한 진입 장벽을 높이고 있습니다. 태양광 하이브리드 저장소와 녹색 에너지 냉동차 플릿에 대한 민간 투자는 탄소 중립을 따라 성장 궤도를 모색하는 기업의 차별화를 더욱 추진하고 있습니다.

전국적인 파이프라인 정비로 2030년까지 천연가스 보급률은 70%에 이를 전망입니다. 이에 따라 1,000개소의 LNG 급유 거점이 정비되어 냉장 차량은 디젤 연료에 비해 약 20%의 연료비 삭감, 장거리 수송에서는 약 25%의 이산화탄소 배출량 감축이 가능합니다. 구자라트주와 라자스탄주에서는 이미 수출량이 많은 루트에 LNG 회랑이 정비되어 있어, 마하라슈트라주의 포도 및 양파 수출업체는 운송중의 온도 관리가 안정화됨으로써 혜택을 받고 있습니다. 인도석유공사가 2025년까지 50개소의 LNG 소매 거점을 설치하는 목표는 급유간격 단축과 냉동차 전환 프로그램의 가속화로 이어집니다. 더 깨끗한 연소로 유지 보수 비용을 줄이면 플릿 소유자에게 라이프 사이클 비용을 30-40% 줄이고 인도의 콜드체인 물류 시장에서 채용 곡선에 추가 추풍을 가져옵니다.

총리 Kisan Sampada Yojana 아래 394건의 인가 프로젝트가 표준화된 허브 건설로 과일 및 채소 수확 후 손실 25-30% 억제를 목표로 하고 있습니다. 국립 콜드체인 개발 센터는 포장 하우스와 운송 사양을 통합하는 엔지니어링 템플릿을 제공하여 인도의 콜드체인 물류 시장 전반에 걸쳐 상호 운용성을 향상시킵니다. 보조금은 소규모 농업주의 자금 부족을 보완하지만, 실시에는 지역의 전력망의 신뢰성과 오퍼레이터 연수가 불가결하며, 태양광 백업 설비의 개수를 위한 관민 연계가 촉진되고 있습니다.

대도시 지역 밖의 냉장 창고에서는 빈번한 정전이 발생하여 디젤 발전기에 의존하고 있습니다. 이로 인해 에너지 비용이 18-22% 증가하여 온도 변동의 위험이 높아지면 신선 식품의 가치가 손상될 우려가 있습니다. 아쌈의 태양광 발전 프로토타입은 4-10℃를 30시간 유지할 수 있지만, 높은 초기 비용이 소규모 생산자의 도입을 방해하고 있습니다. 농촌 지역의 콜드체인 지속가능성을 위해서는 장기적인 송전망의 현대화가 여전히 필수적입니다.

냉장 창고는 2025년 시점에서 인도의 콜드체인 물류 시장의 40.62%를 차지하고 있습니다. 이것은 역사적으로 농업 상품에 대한 투자가 분단되고 있었기 때문에 현재도 용량 증강에 대해 PM Kisan Sampada 보조금(농업 지원 보조금)이 적용되고 있습니다. 냉장 수송 루트의 80%는 도로 수송이 담당하고 있지만, 전용화물 회랑(DFC)의 정비에 의해 운송 모드의 전환이 진행되어 체류 시간의 단축이 기대되고 있습니다. 바코드 라벨 부착에서 키트화에 이르는 부가가치 서비스는 옴니채널 소매업체가 원스톱 솔루션을 요구하는 가운데 2031년까지 연평균 복합 성장률(CAGR) 5.22%로 시장을 견인할 것으로 예측됩니다. Snowman Logistics와 같은 사업자는 품질 보증 감사 및 팔레트 재수송을 다루는 통합 데스크에 인접한 멀티 클라이언트용 냉장실을 설치하여 크로스 독 처리 속도를 향상시키고 있습니다.

종합적인 서비스 수요 증가는 공공 및 민간 복합 저장소 모델의 창출로 이어지고 있습니다. 이 모델에서는 시설 투자와 3PL 관리 계약을 분리하여 중소규모의 생산자도 초기 투자 없이 개선 시설을 사용할 수 있습니다. CONCOR의 철도 대응 냉동 컨테이너는 동부의 어업 거점까지 도달하여 신선도 열화를 억제합니다. 이에 따라 인도의 해운 수출을 위한 콜드체인 물류 시장 규모가 확대되고 있습니다. 항공화물 회랑은 틈새 시장이며 취급량의 2% 미만을 차지할 뿐입니다. 소매업체가 WMS 플랫폼을 창고 온도 기록에 직접 연계하는 동안 서비스 제공업체는 SKU 회전을 최적화하고 에너지 피크를 줄이는 데이터 분석 대시보드의 수익화를 추진하고 있습니다.

The India Cold Chain Logistics Market size in 2026 is estimated at USD 24.57 billion, growing from 2025 value of USD 23.28 billion with 2031 projections showing USD 32.18 billion, growing at 5.53% CAGR over 2026-2031.

Rapid urban food-service growth, public subsidies for warehousing, and biologics-heavy pharma pipelines collectively steer a decisive move from isolated bulk storage toward integrated end-to-end temperature-controlled solutions. The India Cooling Action Plan promotes energy-efficient assets, while the National Logistics Policy targets a logistics-to-GDP ratio that signifies enhanced efficiency, encouraging operators to upgrade fleets and adopt AI-based routing. LNG-ready highways, e-grocery fulfillment hubs, and eVIN-enabled vaccine monitoring strengthen demand for reliable sub-zero distribution. Meanwhile, import duty barriers on high-efficiency compressors and a chronic reefer-driver shortfall temper near-term momentum but also raise entry thresholds that favor integrated operators with scale advantages. Private investments in solar-hybrid depots and green-energy reefer fleets further differentiate players seeking carbon-aligned growth trajectories.

Nationwide pipeline roll-outs are slated to lift natural-gas coverage to 70% by 2030, underpinning 1,000 LNG fueling points that offer refrigerated fleets fuel cost savings near 20% against diesel and carbon cuts near 25% for long hauls. Gujarat and Rajasthan already deploy LNG corridors on export-heavy routes, while Maharashtra's grape and onion exporters gain from steadier line-haul temperatures. Indian Oil's target of 50 LNG retail sites by 2025 shortens refueling gaps and accelerates reefer conversion programs. Lower maintenance expenses from cleaner combustion add 30-40% life-cycle savings for fleet owners, supplying further tailwinds to the India cold chain logistics market adoption curves.

Under the PM Kisan Sampada Yojana, 394 sanctioned projects aim to curb the 25-30% post-harvest losses in fruit and vegetables by building standardized hubs. The National Centre for Cold-chain Development provides engineering templates that unify pack-house and transport specs, improving interoperability across the India cold chain logistics market. Subsidies close funding gaps in smaller agri-states, but execution rests on local grid reliability and operator training, prompting public-private tie-ups for solar-backup retrofits.

Cold stores outside metro hubs confront frequent outages that trigger diesel genset reliance, lifting energy spends by 18-22% and risking temperature excursions that jeopardize perishable value. Solar-powered prototypes in Assam sustain 4-10 °C for 30 hours, but upfront costs deter adoption among smallholders. Long-term grid modernization remains pivotal to rural cold chain viability.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Refrigerated storage retains 40.62% India cold chain logistics market share in 2025, owing to historically siloed investments in bulk agri commodities, and it still attracts PM Kisan Sampada grants for capacity additions. Road haulage underpins 80% of refrigerated transportation lanes, but Dedicated Freight Corridors promise modal shifts that can curb dwell times. Value-added services, from barcoded labeling to kitting, are forecast to outperform at a 5.22% CAGR through 2031 as omnichannel retailers seek single-window solutions. Operators such as Snowman Logistics now position multi-client chambers adjacent to integration desks that handle QA audits and pallet reconsolidation, bolstering cross-dock velocity.

Demand for comprehensive offerings also sparks hybrid public-private depot models that split shell investment from 3PL management contracts, letting smaller farmers tap upgraded facilities without upfront capital. Rail-enabled reefer containers by CONCOR reach eastern fishery hubs, shrinking spoilage and expanding the reach of the India cold chain logistics market size for marine exports. Air-cargo corridors stay niche, accounting for less than 2% of volumes, yet remain indispensable for high-value biologics dispatches to Europe and North America. As retailers link WMS platforms directly to warehouse temperature logs, service providers monetize data analytics dashboards that optimize SKU rotation and cut energy peaks.

The India Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, and Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, and Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, and More), Region (North India, South India, and More). The Market Forecasts are Provided in Terms of Value (USD).