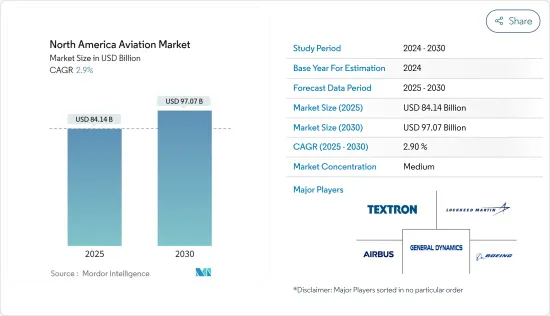

북미의 항공 시장 규모는 2025년 841억 4,000만 달러로 추정되고, 시장 추정 및 예측 기간(2025-2030년) 중 CAGR 2.9%로 성장할 전망이며, 2030년에는 970억 7,000만 달러에 달할 것으로 예측됩니다.

저렴한 항공사(LCC)와 초저가 항공사(ULCC) 증가는 기존 항공사의 비즈니스 모델을 파괴해 왔습니다. 이 항공사들은 경쟁 운임을 제공함으로써 고객층을 늘리고, 더 많은 사람들에게 항공 여행의 편의성을 확대하고 있습니다.

다양한 항공기 제조업체의 존재는 북미 전체 항공 산업의 성숙으로 이어졌습니다. 방위 산업은 또한 헬리콥터와 전투기를 위한 첨단 방위 솔루션과 연구 개발 능력을 도입하기 위한 정부 투자로부터 혜택을 누리고 있습니다. 첨단 전투기, 수송기, 연습기, 헬리콥터를 지역 진출 기업으로부터 조달하는 것도 시장 성장에 크게 기여하고 있습니다. 연료 가격이 상승함에 따라 기업은 운항 비용이 증가할 것으로 예상됩니다. 연료 요금은 항공기 유형 및 연료 가격의 변동에 따라 시간당 600달러에서 1,000달러 이상 가산됩니다. 이 때문에 기업은 비용을 소비자에게 전가해야 하며, 여행 비용 증가와 이익률의 저하로 이어집니다. 이러한 요인은 시장 성장을 방해합니다.

또한, 이 지역의 일반항공 시장의 성장은 예측 기간 동안 민간공항 인프라 개선에 대한 주목 증가 및 유리한 규제 변경에 의해 지원될 것으로 예상됩니다.

예측 기간 동안 북미의 항공 시장에서는 민간항공기 부문이 큰 성장을 이룰 전망입니다. 여객기의 요구는 주로 국내 여행이 계속 증가하고 있기 때문에 이러한 증가를 뒷받침하고 있습니다.

항공사의 기체 확대, 연비가 좋은 비행기에 대한 요망 증가, 항공 여행 증가, 제로 에미션 2050년 목표를 향한 산업의 시프트가 민간항공기 수요를 촉진하고 있습니다. 2023년 8월까지 이 지역에서는 Boeing 1,474대, Airbus 986대가 납품될 예정입니다. 미국은 인도 대기 항공기 2,405대의 유일한 소유자입니다. 따라서 예측 기간 동안 이 나라는 큰 성장을 이룰 것으로 예상됩니다.

American Airlines, Delta Air Lines, United Airline과 같은 주요 기업은 2024년에 대폭적인 항공기 납품을 예정하고 있으며, Air Canada와 같은 화물 회사는 빠르게 성장하고 항공기를 업데이트하고 있습니다. 2024년 1월 Delta Air Lines는 A350-1,000을 20대 발주함으로써 연비가 좋은 신형 와이드 바디기의 요건을 충족시키기 위해 Airbus를 선택했습니다. Delta Air Lines는 450대 이상의 Airbus기를 운항하고 있으며 200대 이상을 발주 중입니다. 이러한 진보는 예측 기간 동안 민간항공기 산업의 확대를 촉진할 것으로 예측됩니다.

미국은 세계 최대의 항공 시장 중 하나이기 때문에 향후 몇 년간 현저한 확대가 전망될 예정입니다. 항공 여행의 요구가 높아짐에 따라 미국의 여러 항공사가 기자재를 강화하고 기술적으로 선진적인 항공기를 취득하고 있습니다. 2023년 6월, United Parcel Service는 향후 2년 이내에 55대의 항공기를 도입하고 기자재를 증강할 의향을 발표했습니다. 대부분은 도급업체가 운항하는 소형 피더기로, 이 회사는 2023-2025년 사이 B777F 기종을 8대 추가 도입하는 것도 목표로 하고 있습니다.

민간항공 외에도 미국은 자금의 대부분을 군사비에 충당하고 있습니다. SIPRI에 따르면 미국의 군사비는 2023년에 약 2.3% 증가하여 총 9,160억 달러가 되었으며, 세계 국방비의 37%를 차지하는 세계 1위의 지위를 확고히 했습니다. 미국은 향후 10년간 방위 산업에서 일관된 성장을 할 것으로 예측되고 있으며, 이는 구식 전투기를 보다 선진적인 버전으로 업그레이드하려는 의도 때문입니다. 미국 해병대는 AV-8B 해리어 II와 구식 F/A-18 호넷의 후계기로서 F-35B를 약 340대, F-35C를 약 80대 취득할 계획입니다.

2024년 4월 미국은 MiG-31 요격기, MiG-27 전투 폭격기, MiG-29 전투기, Su-24 폭격기 등 117대의 군용기를 경매로 낙찰한 카자흐스탄에서 81대의 소련 시대의 전투기와 폭격기를 구입했습니다. 결론적으로 예측 기간을 통해 시장을 확대시킬 것으로 예상됩니다.

북미의 항공 시장은 Boeing, AirbusSE, Lockheed Martin, Textron Inc., General Dynamics 기업과 같은 주요 기업이 포함되어 있습니다. 이러한 대형 항공기 제조업체의 존재로 인해 시장은 매우 경쟁이 치열해지고 있습니다. 게다가 전 세계 항공기 생산의 대부분이 이 지역에 있고, 제조, 판매, 지원의 거점이 있기 때문에, 이 지역은 국제적인 항공 우주 공급 업체에 있어서의 초점이 되고 있습니다.

이 지역의 항공 시장을 장악하기 위해 각 회사는 새로운 접근 방식 도입, 제공 제품 확대, 노동 효율 개선, 공급망 파트너 획득, 타사 합병, 신시장 진입, 경쟁 가격 제공 등 다양한 협력과 제휴는 북미 항공우주 제조업체가 채용하는 매우 중요한 성장 전술을 구사하고 있습니다. 협력과 제휴는 북미의 항공 우주 업체가 채택하는 매우 중요한 성장 전술입니다. 그 대부분은, 국제적인 기업과 협력해, 새로운 기술이나 제품을 만들어내기 위한 지식이나 기술을 교환하고 있습니다.

The North America Aviation Market size is estimated at USD 84.14 billion in 2025, and is expected to reach USD 97.07 billion by 2030, at a CAGR of 2.9% during the forecast period (2025-2030).

An increase in low-cost carriers (LCCs) and ultra-low-cost carriers (ULCCs) has disrupted the traditional airline business model. These carriers offer competitive fares, enticing a larger customer base and expanding air travel accessibility to more people.

The presence of various aircraft manufacturers has led to the maturation of the aviation industry across North America. The defense industry has also benefited from government investments in introducing advanced defense solutions and research and development capabilities for helicopters and fighter jets. Procuring advanced fighter jets, transport and trainer aircraft, and helicopters from regional players has also contributed significantly to market growth. With fuel prices increasing, companies are expected to experience increased operating costs. Fuel surcharges add USD 600 to over USD 1,000 per hour, depending on aircraft types and fuel price changes. Due to this, companies have to transfer the costs to the consumers, which increases trip costs or cuts their profit margin. Such factors hamper the market's growth.

Moreover, the growth of the general aviation market in the region is anticipated to be supported by the growing focus on improving private airport infrastructure and favorable regulatory changes during the forecast period.

The commercial aircraft segment is expected to witness significant growth in the North American aviation market during the forecast period. The need for passenger planes mainly fuels this increase as domestic trips continue to rise.

Expansion of airline fleets, rising desire for fuel-efficient planes, growth in air travel, and the industry's shift toward the zero-emission 2050 target are driving the demand for commercial aircraft. By August 2023, 1,474 Boeing and 986 Airbus aircraft were expected to be delivered in the region. The United States is the sole owner of 2,405 aircraft awaiting delivery. Therefore, the country is anticipated to experience significant growth over the forecast period.

Leading airlines like American Airlines, Delta Air Lines, and United Airlines have significant aircraft deliveries scheduled for 2024, and cargo companies like Air Canada are rapidly growing and updating their fleets. In January 2024, Delta Air Lines selected Airbus to fulfill its requirements for new, fuel-efficient widebody aircraft by ordering 20 A350-1000 planes. Delta Air Lines has over 450 Airbus aircraft in operation and more than 200 on order. These advancements are projected to fuel expansion in the commercial aircraft industry over the forecast period.

The United States is anticipated to experience notable expansion in the coming years, as it ranks among the biggest aviation markets globally. In response to the growing need for air travel, multiple US airlines are enhancing their fleets and acquiring technologically advanced aircraft. In June 2023, United Parcel Service announced its intention to increase its fleet by incorporating 55 aircraft within the next two years. Most of these will be small feeder planes operated by contractors, and the company also aims to introduce an additional eight B777F aircraft between 2023 and 2025.

In addition to civil aviation, the United States allocates most of its funds to its military. As per the SIPRI, the US military spending rose by around 2.3% in 2023, totaling USD 916 billion, solidifying its position as the top defense spender globally, accounting for 37% of worldwide expenditure. The United States is projected to experience consistent growth in the defense industry in the next ten years, as it intends to upgrade its outdated fighter jets with more advanced versions. The US Marine Corps plans to acquire approximately 340 F-35B and 80 F-35C models to replace the AV-8B Harrier II and old F/A-18 Hornet jets.

In April 2024, the United States bought 81 Soviet-era fighter and bomber planes from Kazakhstan, which sold 117 military aircraft in an auction, including MiG-31 interceptors, MiG-27 fighter bombers, MiG-29 fighters, and Su-24 bombers. In conclusion, these developments are expected to expand the market throughout the forecast period.

The aviation market in North America includes major companies like The Boeing Company, Airbus SE, Lockheed Martin Corporation, Textron Inc., and General Dynamics Corporation. Due to the existence of these large aircraft manufacturers, the market has become very competitive. Moreover, this area is a focal point for international aerospace suppliers because most of the aircraft production across the world is located here, where they have manufacturing, sales, and support establishments.

To control the aviation market in the region, the companies use various growth tactics, including implementing new approaches, expanding offerings, improving workforce efficiency, acquiring supply chain partners, merging with other companies, entering new markets, and offering competitive prices. Cooperation and alliances are crucial growth tactics that aerospace manufacturers in North America embrace. Many of them work with international companies to exchange knowledge and skills to create new technologies and products.