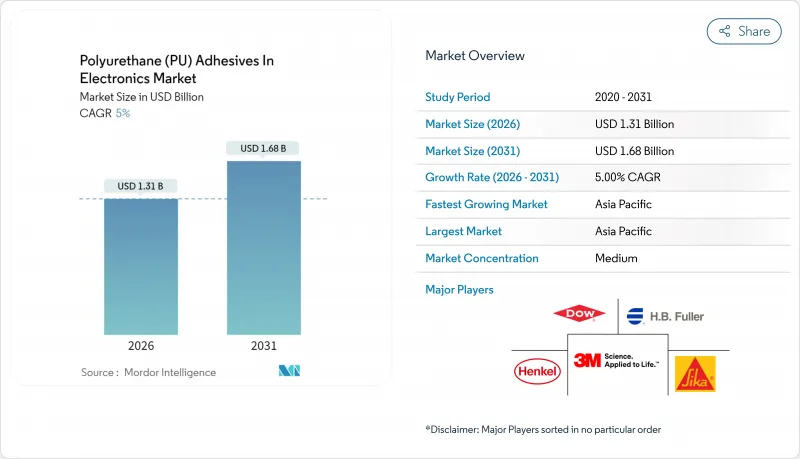

전자제품용 폴리우레탄(PU) 접착제 시장 규모는 2026년에 13억 1,000만 달러로 평가되었습니다.

이는 2025년 12억 5,000만 달러에서 성장한 수치이며, 2031년에는 16억 8,000만 달러에 이를 것으로 예측되고 있습니다. 2026-2031년에 걸쳐 CAGR 5.00%로 성장이 전망됩니다.

이러한 꾸준한 성장은 전기차(EV) 배터리 팩용 고성능 접착 재료의 중요성 증가, 소비자 기기의 지속적인 소형화, 저배출 화학 물질을 선호하는 강화된 안전 규제로 인해 뒷받침됩니다. 공급업체들은 특히 대량 생산이 이루어지는 아시아 공장에서 생산 탭 타임을 단축하는 데 도움이 되는 신속 경화 및 정밀 도포 기술을 우선시하고 있습니다. 설계자들이 파워 모듈과 자동차 인버터에서 더 높은 전력 밀도에 직면함에 따라 열전도성 및 UV 경화 화학 물질에 대한 투자가 가속화되고 있습니다. 폴리올과 디이소시아네이트의 비용 변동성은 여전히 부담 요인으로 작용하지만, 특히 플렉서블 하이브리드 전자 제품의 강력한 다운스트림 수요가 전반적인 성장 모멘텀을 긍정적으로 유지하고 있습니다.

웨어러블, 히어러블, IoT 센서는 계속해서 소형화되어 기계적 패스너를 위한 공간이 거의 남지 않습니다. 따라서 설계자들은 1,000 cPs 미만의 초저점도 폴리우레탄 제형에 의존하며, 이는 150 μm 틈새로 공극 생성 없이 유입됩니다. 이러한 재료는 취약한 칩을 캡슐화하고 진동을 완화하며, Protavic의 PNU-46202 시리즈에서 입증된 바와 같이 -55°C에서 100°C의 열 사이클을 견딥니다. 부품 수의 급격한 감소는 조립 비용을 절감하여 전자 시장 내 폴리우레탄 접착제 전반에 걸쳐 고기능성 포팅 화학 물질에 대한 수요를 강화합니다. 아시아의 아웃소싱 조립 업체들은 일차 합격률을 높이고 재작업량을 줄여주기 때문에 대량으로 신규 등급을 지정하고 있습니다. 중기적으로는 증강 현실 헤드셋의 채택 증가가 긍정적인 연평균 복합 성장률(CAGR) 기여도를 확대할 것입니다.

배터리 팩은 현재 최대 100kWh의 에너지를 저장하므로 열폭주 방지가 설계 최우선 과제입니다. 열전도성 폴리우레탄 접착제는 셀을 전기적으로 절연하면서 열을 방출해 두 가지 핵심 기능을 단일 도포 단계로 결합합니다. 다우의 탄소나노튜브 강화 제형은 0.5% 미만의 수축률로 5W/m*K의 전도도를 달성해 팩 응력을 줄이고 사이클 수명을 연장합니다. 전기차 보급이 가속화되면서 1차 공급업체들은 다년간 공급 계약을 체결하며, 이 촉진요인이 전자기기용 폴리우레탄 접착제 시장에서 가장 높은 증분 성장을 이끌어낼 것임을 보장하고 있습니다.

EPA 및 REACH 규정은 실내 포름알데히드 농도를 0.062 mg/m³로 제한하고, 디이소시아네이트 취급 시 작업자 교육을 의무화합니다. 소규모 EMS 기업들은 연기 배출 및 인증을 위한 25만 달러 이상의 규정 준수 투자 부담으로 대체 화학 물질로 전환하고 있습니다. 관할 구역별 별도 SKU는 재고 비용을 증가시켜 신제품 출시를 지연시킵니다. 주요 공급업체들이 저모노머 등급을 출시하고 있지만, 인증 주기가 6-9개월로 길어져 전자기기용 폴리우레탄 접착제 시장의 단기 주문이 위축되고 있습니다.

표면 플래시 경화형 폴리우레탄 제형은 2025년 매출의 63.73%를 차지했으며, 2031년까지 연평균 5.30% 성장률로 이 위치를 더욱 공고히 할 전망입니다. 이러한 선도적 지위는 전자제품 시장의 폴리우레탄 접착제가 조립 라인의 체류 시간을 분 단위에서 초 단위로 단축할 때 얼마나 큰 이점을 제공하는지 보여줍니다. 많은 계약 제조업체들은 현재 50μm 접합선을 2초 미만으로 경화시키는 인라인 UV 터널을 운영하여 사이클 시간을 약 30% 단축하고 있습니다. 이 급속 경화 기능은 또한 고정 장치를 최소화하여 고밀도 기판의 자동 디스펜싱을 단순화합니다.

전기전도성 및 열전도성 제품이 제품 라인을 보완합니다. 비록 생산량은 뒤처지지만, LED 어레이의 열 확산이나 카메라 모듈의 접지 경로와 같은 핵심 과제를 해결함으로써 평균 이상의 마진을 확보합니다. UV 개시와 2차 수분 경화를 결합한 하이브리드 이중 경화 화학 기술은 그림자가 지는 접합부를 해결하여 전자 시장 내 폴리우레탄 접착제의 적용 범위를 확대합니다. 신흥 열 활성화 제품은 틈새 시장이지만, 높은 피크 조도를 견딜 수 없는 폴더블 디스플레이 분야에서 관심을 끌고 있습니다.

「전자제품용 폴리우레탄(PU) 접착제 보고서」는 제품 유형(전기전도성 PU 접착제, 열전도성 PU 접착제 등), 용도(표면 실장, 컨포멀 코팅, 와이어 택, 포팅, 밀봉, 기타 용도), 지역(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)별로 분석되고 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

아시아태평양 지역은 중국의 독보적인 PCB, 스마트폰, 전기차 배터리 생산량에 힘입어 2025년 매출 점유율 72.60%로 시장을 주도했습니다. 선전과 상하이의 공장 클러스터는 컨베이어 벨트형 UV LED 아래에서 3초 이내에 경화되는 고처리량 UV 등급을 소비하며 지역적 규모의 경제 효과를 강화하고 있습니다. 한국의 반도체 팹은 450W 칩 열유속 밀도를 견디는 열전도성 폴리우레탄 인터페이스 소비를 주도합니다.

북미에서는 미시간주, 테네시주, 온타리오주에서 EV 배터리 생산이 2W/mK의 갭 필러 수요를 주도하는 한편, 워싱턴주와 텍사스주의 항공우주 주요 업체는 위성 제어 기판의 경량화를 실현하는 저밀도 신택틱 폴리우레탄 포팅 컴파운드를 지정하고 있습니다. 규제의 엄격화, EPA의 휘발성 유기 화합물(VOC) 규제, OSHA가 정하는 노출 임계치에 의해 수성 분산액의 인기가 높아지고 있으며, 조기에 전환을 도모한 현지의 배합 제조업체가, 전자제품용 폴리우레탄(PU) 접착제 시장의 점유율 확대의 기회를 얻고 있습니다.

유럽은 자동차 전기화 목표와 연계된 균형적 성장을 보입니다. 독일 프리미엄 자동차 부문은 배터리 케이스의 내충격성을 제공하는 폴리우레탄 구조재 사용을 점차 확대하고 있습니다. 한편, REACH 부속서 XVII의 자유 모노머 디이소시아네이트 제한으로 OEM 업체들은 새로운 초저배출 화학 기술로 전환하고 있습니다. 아시아 EMS 업체들이 공급하는 폴란드와 헝가리의 신흥 클러스터는 2030년까지 동유럽 소비량을 증가시킬 전망입니다. 중동·아프리카 및 남미 시장은 아직 초기 단계이지만, 베트남 지원 아프리카 합작기업의 휴대폰 조립 증가가 장기적 성장 가능성을 시사합니다.

Polyurethane Adhesives In Electronics market size in 2026 is estimated at USD 1.31 billion, growing from 2025 value of USD 1.25 billion with 2031 projections showing USD 1.68 billion, growing at 5.00% CAGR over 2026-2031.

This steady expansion rests on the growing importance of high-performance bonding materials for electric-vehicle (EV) battery packs, the continuing miniaturization of consumer devices, and stricter safety regulations that favor low-emission chemistries. Vendors are prioritizing rapid-cure, precision-dispense technologies that help shrink production tact times, especially in high-volume Asian factories. Investments in thermally conductive and UV-curing chemistries are accelerating as designers confront higher power densities in power modules and automotive inverters. Cost volatility for polyols and diisocyanates remains a headwind, yet strong downstream demand, particularly from flexible-hybrid electronics, keeps overall momentum positive.

Wearables, hearables, and IoT sensors continue to shrink, leaving little room for mechanical fasteners. Designers therefore rely on ultra-low-viscosity polyurethane formulations, often below 1,000 cPs, that flow into 150 µm gaps without void creation. These materials encapsulate fragile chips, mitigate vibration, and survive -55 °C to 100 °C thermal cycles, as demonstrated by Protavic's PNU-46202 series. Sharp reductions in part counts cut assembly costs, which reinforces demand for high-function potting chemistries across the polyurethane adhesives in the electronics market. Asian outsourced-assembly providers are specifying the new grades in volume because they enhance first-pass yields and reduce rework. Over the medium term, growing adoption in augmented-reality headsets will magnify the positive CAGR contribution.

Battery packs now carry up to 100 kWh of energy, making thermal runaway avoidance a design priority. Thermally conductive polyurethane adhesives dissipate heat while electrically insulating cells, combining two critical functions in a single dispense step. Dow's carbon-nanotube-enhanced formulations achieve 5 W/m*K conductivity with sub-0.5% shrinkage, reducing pack stresses and extending cycle life. As EV adoption accelerates, tier-one suppliers are locking in multiyear supply contracts, ensuring that this driver delivers the highest incremental growth within the polyurethane adhesives in electronics market.

EPA and REACH frameworks now cap indoor formaldehyde at 0.062 mg/m3 and mandate operator training for diisocyanate handling. Smaller EMS companies face compliance investments topping USD 250,000 for fume extraction and certification, pushing them toward alternative chemistries. Separate SKUs for different jurisdictions raise inventory costs, slowing new-product introductions. Although major suppliers are unveiling low-monomer grades, qualification cycles stretch six to nine months, dampening near-term orders in the polyurethane adhesives in the electronics market.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Surface-flash curing polyurethane formulations commanded 63.73% revenue in 2025, a position they are set to strengthen by expanding at 5.30% CAGR to 2031. This leadership underscores how the polyurethane adhesives in the electronics market benefit when assembly lines slash dwell times from minutes to seconds. Many contract manufacturers now operate inline UV tunnels that cure 50 µm bond lines in under two seconds, delivering cycle-time savings near 30%. The rapid-cure feature also minimizes fixturing, which simplifies automated dispensing on densely populated boards.

Electrically conductive and thermally conductive variants round out the portfolio. Although they trail in volume, they capture above-average margins by solving mission-critical challenges such as thermal spreading in LED arrays or grounding paths in camera modules. Hybrid dual-cure chemistries that combine UV initiation with secondary moisture curing address shadowed joints, broadening the reachable share of the polyurethane adhesives in the electronics market. Emerging heat-activated products remain niche but draw interest in foldable displays that cannot tolerate high peak irradiance.

The Polyurethane Adhesives in Electronics Report is Segmented by Product Type (Electrically Conductive PU Adhesive, Thermally Conductive PU Adhesive, and More), Application (Surface Mounting, Conformal Coatings, Wire Tacking, Potting, Encapsulation, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Asia-Pacific dominated with 72.60% revenue share in 2025 on the back of China's unmatched PCB, smartphone, and EV-battery output. Factory clusters in Shenzhen and Shanghai consume high-throughput UV grades that cure under conveyor-belt UV LEDs in less than three seconds, reinforcing regional scale advantages. South Korea's semiconductor fabs drive consumption of thermally conductive polyurethane interfaces that cope with 450 W chip heat-flux densities.

North America is buoyed by EV battery production in Michigan, Tennessee, and Ontario, which is fueling orders for 2 W/m*K gap fillers, while aerospace primes in Washington and Texas specify low-density syntactic polyurethane potting compounds that shave grams from satellite control boards. Regulatory rigor, EPA VOC limits, and OSHA-dictated exposure thresholds make water-borne dispersions more popular, positioning local formulators that pivot early for share gains in the polyurethane adhesives in electronics market.

Europe shows balanced growth tied to automotive electrification targets. The German premium-car segment increasingly specifies polyurethane structurals that provide impact resistance for battery enclosures. Meanwhile, REACH Annex XVII limits on free monomer diisocyanates push OEMs to new micro-emission chemistries. Emerging clusters in Poland and Hungary, supplied by Asian EMS players, are likely to raise Eastern European consumption through 2030. Middle-East and Africa, and South America remain nascent, but rising handset assembly in Vietnam-backed African ventures hints at longer-term upside.