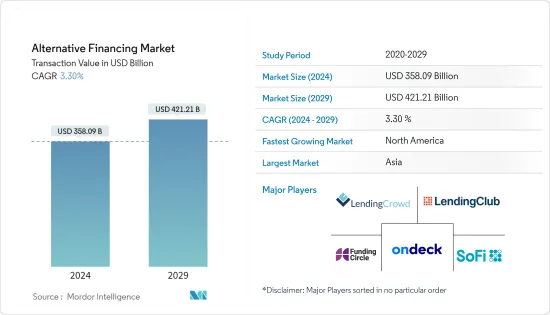

대안 금융 시장 규모(거래액 기준)는 2024년 3,580억 9,000만 달러에서 2029년 4,212억 1,000만 달러로 확대될 것으로 예상되며, 예측 기간(2024-2029년) 동안 3.30%의 CAGR을 기록할 것으로 예상됩니다.

대안 금융 시장(대체 대출 또는 P2P 대출이라고도 함)은 최근 괄목할 만한 성장과 혁신을 거듭하고 있습니다. P2P(Peer-to-Peer) 대출 플랫폼은 가장 인기 있는 대안금융 중 하나입니다. 이러한 플랫폼은 대출자와 대출자를 직접 연결해주기 때문에 전통적인 금융 기관이 필요하지 않습니다.

크라우드펀딩 플랫폼은 개인과 기업이 많은 사람들로부터 자금을 조달하기 위해 인기를 얻고 있습니다. 인보이스 파이낸싱 플랫폼은 기업이 미지급된 인보이스를 투자자에게 할인된 가격으로 판매하여 즉각적인 현금을 확보할 수 있게 해줍니다. 이를 통해 결제 지연 가능성을 낮추고 기업은 현금 흐름을 최적화할 수 있습니다. 마켓플레이스 대출 플랫폼은 대출자와 개인, 금융기관, 은행 등 다양한 대출자를 연결합니다. 이러한 플랫폼은 종종 기술과 데이터 분석을 사용하여 신용도를 평가하고 이자율을 결정합니다.

비즈니스 시장의 확대는 대안 금융 시장의 성장에 있어 중요한 추세입니다. 비즈니스 시장이 확대됨에 따라 더 많은 기업가와 중소기업이 시장에 진입하여 벤처기업에 대한 자금 조달을 모색하고 있습니다. 비즈니스 시장의 성장은 특히 금융 기술(FinTech)의 기술 발전과 함께 이루어지고 있습니다. 이러한 발전은 P2P 대출, 크라우드펀딩, 인보이스 파이낸싱, 가맹점 현금화와 같은 대체 대출 플랫폼의 출현을 촉진하고 있습니다. 비즈니스 시장의 확대는 투자자들의 선호도 변화와도 일치합니다. 기관 및 개인 투자자를 포함한 많은 투자자들이 기존 투자 옵션보다 높은 수익률을 기대할 수 있는 대체 투자 기회를 찾고 있습니다. 그 결과, 마켓플레이스 대출이나 크라우드펀딩 사이트와 같이 투자자가 기업에 직접 자금을 조달하는 대안 금융의 선택지가 증가하고 있습니다.

P2P 대출 플랫폼이 아시아에서 인기를 끌고 있습니다. 이러한 플랫폼은 기술을 활용하여 대출을 촉진하고, 특히 중소기업(SME)을 위해 더 빠르고 쉽게 이용할 수 있는 자금 조달 옵션을 제공하고 있습니다. 아시아에서는 크라우드펀딩 플랫폼이 급증하고 있습니다. 이러한 플랫폼은 스타트업, 창의적인 프로젝트, 사회적 이니셔티브에 대한 자금 조달을 가능하게 하고 있습니다. 중국, 싱가포르, 한국과 같은 국가에서는 크라우드펀딩 활동이 활발하게 진행되고 있습니다. 아시아에서는 벤처 캐피털(VC)과 사모펀드(PE)에 대한 투자가 급증하고 있습니다. 중국, 인도, 동남아시아 국가들은 벤처 캐피털과 사모펀드 투자에 매력적인 투자처가 되고 있으며, 기업가 정신과 혁신을 촉진하고 있습니다.

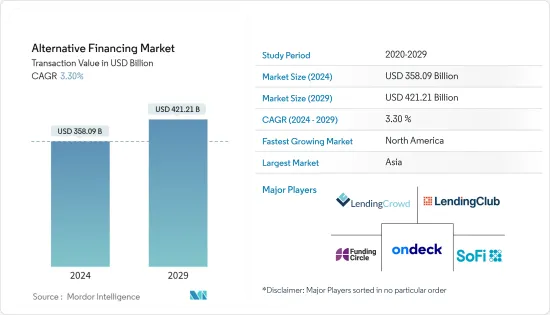

대안 금융 시장은 적당히 통합되어 있습니다. 세계 주요 시장 기업으로는 Lending Club, Funding Circle, Kabbage, SoFi, OnDeck 등이 있습니다. 조사 기간 동안 시장 기업들은 시장에서의 입지를 확대하는 데 초점을 맞춘 인수합병(M&A)과 제휴에 참여하기도 했습니다. 이 시장은 예측 기간 동안 성장 잠재력을 가지고 있으며, 이는 시장 경쟁을 더욱 치열하게 만들 것으로 보입니다. 그러나 중소기업들은 새로운 계약을 체결하고 새로운 시장을 개척함으로써 기술 발전과 제품 혁신을 통해 시장에서의 입지를 강화하고 있습니다.

The Alternative Financing Market size in terms of transaction value is expected to grow from USD 358.09 billion in 2024 to USD 421.21 billion by 2029, at a CAGR of 3.30% during the forecast period (2024-2029).

The alternative financing market, also known as alternative lending or peer-to-peer lending, has been experiencing significant growth and innovation. Platforms for peer-to-peer (P2P) lending are among the most popular types of alternative finance. These platforms match borrowers and lenders directly, eliminating the need for a traditional financial institution.

Crowdfunding platforms have gained popularity for individuals and businesses to raise funds from many people. Invoice financing platforms allow companies to obtain immediate cash by selling their outstanding invoices to investors at a discount. This lowers the possibility of late payments and helps firms optimize their cash flow. Marketplace lending platforms connect borrowers with various lenders, including individuals, institutions, or banks. These platforms often use technology and data analytics to assess creditworthiness and determine interest rates.

The increasing business market is a significant trend for the growth of the alternative financing market. As the business market expands, more entrepreneurs and small businesses are entering the market, seeking capital to finance their ventures. The growth of the business market has been accompanied by technological advancements, particularly in financial technology (FinTech). These advancements have facilitated the emergence of alternative financing platforms, such as peer-to-peer lending, crowdfunding, invoice financing, and merchant cash advances. The expansion of the business market has coincided with a shift in investor preferences. Many investors, including institutional and retail investors, are now looking for alternative investment opportunities that offer potentially higher returns than traditional investment options. As a result, there has been an increase in alternative financing options that let investors directly fund firms, like marketplace lending and crowdfunding websites.

P2P lending platforms have gained popularity in Asia. These platforms leverage technology to facilitate lending and offer quicker and more accessible funding options, particularly for small and medium-sized enterprises (SMEs). Asia has witnessed a surge in crowdfunding platforms. These platforms allow capital access to startups, creative projects, and social initiatives. Countries like China, Singapore, and South Korea have seen a rise in crowdfunding activities. Asia has witnessed a surge in venture capital (VC) and private equity (PE) investments. Countries such as China, India, and Southeast Asian nations have become attractive destinations for venture capital and private equity investments, fostering entrepreneurship and innovation.

The alternative financing market is moderately consolidated. Some major global market players include Lending Club, Funding Circle, Kabbage, SoFi, and OnDeck, among others. In the study period, market players were also involved in mergers and acquisitions, and partnerships focused on expanding their presence in the market. The market has the potential to grow during the forecast period, and this is likely to further fuel competition. However, by securing new contracts and tapping new markets, small- to medium-sized enterprises are increasing their presence on the market with technological progress and product innovation.