중국 본토의 반도체 산업은 최근 몇 년 동안 괄목할 만한 성장과 변혁을 이루며 세계 무대에서 중요한 위치를 차지하고 있습니다. 세계 최대 반도체 소비국이자 중요한 전자기기 생산국인 중국의 반도체 시장은 투자자, 업계 이해관계자 및 정책 입안자들이 주목하는 대상입니다. 중국 본토의 반도체 및 장비 시장의 역동성, 동향 및 제조 능력을 이해하는 것은 빠르게 진화하는 이 복잡한 상황을 헤쳐나가는 데 필수적입니다.

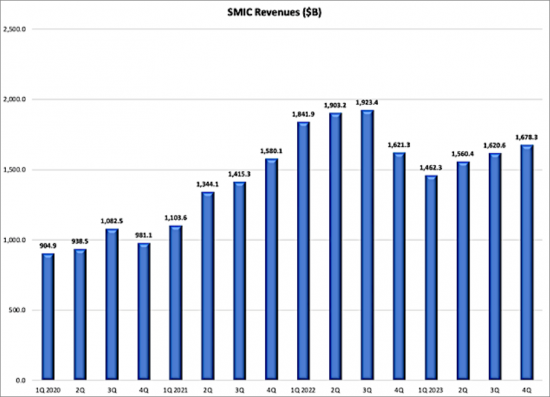

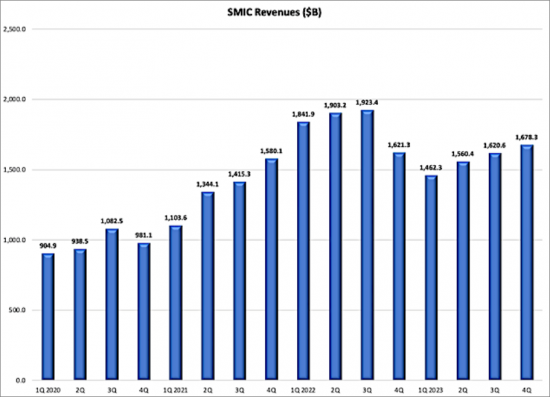

중국 본토 반도체 산업에서 가장 주목해야 할 동향 중 하나는 국내 반도체 기업의 부상으로, SMIC(Semiconductor Manufacturing International Corporation), Huawei의 HiSilicon, YMTC(Yangtze Memory Technologies Corporation) 등의 기업들이 세계 반도체 시장의 주요 진입자로 부상하며 기존 기업들에게 도전장을 내밀고 경쟁을 촉진하고 있습니다.

또 다른 중요한 추세는 첨단 제조 기술과 제조 능력에 대한 관심이 높아지고 있다는 점입니다. 중국 본토는 첨단 제조 공정, 패키징 기술 및 장비 제조 개발에 많은 투자를 하고 있습니다. 국가집적회로산업투자기금(일명 빅펀드)과 메이드 인 차이나 2025 전략과 같은 이니셔티브는 FinFET 트랜지스터, 3D 패키징, 첨단 리소그래피와 같은 첨단 반도체 제조 기술의 채택을 가속화하는 데 도움이 되고 있습니다.

이 보고서는 중국 본토의 반도체 및 장비 시장을 심층적으로 분석하여 주요 제조 동향, 기술 발전, 시장 역학 및 경쟁 상황에 대한 자세한 분석과 인사이트를 제공합니다. 제조 공정, 패키징 기술, 장비 혁신 등 반도체 제조의 최신 동향을 조사하여 중국 본토 반도체 산업의 성장을 촉진하고 미래를 형성하는 요인을 조명합니다. 또한, 중국 본토의 반도체 산업을 이끄는 전략적 이니셔티브, 투자 및 정책을 조사하여 시장 기회, 도전 과제 및 경쟁 전략에 대한 귀중한 관점을 제공합니다.

The semiconductor industry in Mainland China has undergone remarkable growth and transformation in recent years, positioning itself as a key player on the global stage. As the world's largest consumer of semiconductors and a significant producer of electronic devices, China's semiconductor market is a focal point for investors, industry stakeholders, and policymakers alike. Understanding the dynamics, trends, and manufacturing capabilities within Mainland China's semiconductor and equipment markets is essential for navigating the complexities of this rapidly evolving landscape.

This comprehensive report offers a deep dive into Mainland China's semiconductor and equipment markets, providing in-depth analysis and insights into key manufacturing trends, technological advancements, market dynamics, and competitive landscapes. By examining the latest developments in semiconductor manufacturing, including fabrication processes, packaging technologies, and equipment innovations, the report sheds light on the factors driving growth and shaping the future of the industry in Mainland China.

Furthermore, the report explores the strategic initiatives, investments, and policies driving Mainland China's semiconductor industry, offering valuable perspectives on market opportunities, challenges, and competitive strategies. From the rise of domestic semiconductor companies to the impact of global trade dynamics and technological disruptions, this report provides a holistic view of Mainland China's semiconductor ecosystem and its implications for global stakeholders.

Whether you're a semiconductor manufacturer, equipment supplier, investor, or policymaker, this report serves as an indispensable resource for understanding the dynamics of Mainland China's semiconductor and equipment markets, identifying growth opportunities, and making informed strategic decisions in an increasingly interconnected and dynamic industry landscape.

One of the most notable trends in Mainland China's semiconductor industry is the rise of domestic semiconductor companies. Fueled by government support, strategic investments, and technological innovation, Chinese semiconductor firms have been making significant strides in various segments of the industry, from design and manufacturing to packaging and testing. Companies such as SMIC (Semiconductor Manufacturing International Corporation), Huawei's HiSilicon, and Yangtze Memory Technologies Corporation (YMTC) have emerged as major players in the global semiconductor market, challenging established incumbents and driving competition.

Another key trend is the increasing focus on advanced manufacturing technologies and capabilities. Mainland China has been investing heavily in the development of cutting-edge fabrication processes, packaging technologies, and equipment manufacturing. Initiatives such as the National Integrated Circuit Industry Investment Fund (also known as the Big Fund) and the Made in China 2025 strategy have been instrumental in accelerating the adoption of advanced semiconductor manufacturing techniques, including FinFET transistors, 3D packaging, and advanced lithography.

Additionally, Mainland China's semiconductor industry has been actively pursuing collaborations and partnerships with international players to bolster its technological capabilities and expand its market reach. Joint ventures, technology licensing agreements, and strategic alliances with leading semiconductor companies from countries such as the United States, South Korea, and Taiwan have become increasingly common, facilitating knowledge transfer, technology exchange, and access to global markets.

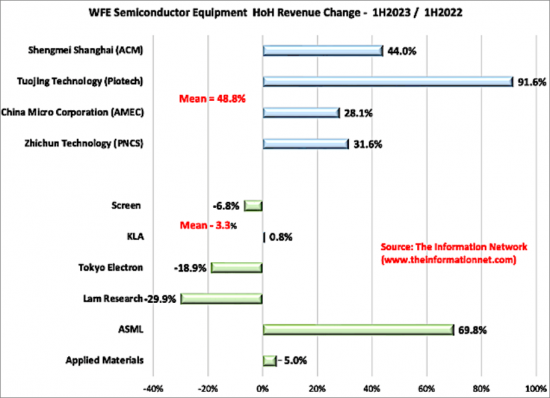

In recent years, Mainland China's semiconductor and equipment markets have faced significant challenges due to escalating trade tensions and U.S. sanctions. These developments have reshaped the landscape of the semiconductor industry in China, prompting the country to accelerate efforts to achieve self-sufficiency and reduce its reliance on foreign technologies. Against this backdrop, analyzing the trends in Mainland China's semiconductor and equipment markets becomes crucial for understanding the impact of these sanctions and identifying opportunities and challenges for industry stakeholders.

One prominent trend in Mainland China's semiconductor market is the rapid growth of domestic semiconductor companies. Faced with restrictions on access to key technologies and components from foreign suppliers, Chinese semiconductor firms have ramped up efforts to develop indigenous capabilities in chip design, fabrication, and packaging. This has led to the emergence of a robust ecosystem of domestic semiconductor companies, supported by government policies and investments. These companies are increasingly focused on developing advanced semiconductor products tailored to the needs of domestic and global markets.

Furthermore, Mainland China's semiconductor industry is witnessing increased investment in research and development (R&D) to drive innovation and technological advancements. With the goal of achieving technological parity with global leaders, Chinese semiconductor companies are investing heavily in areas such as artificial intelligence (AI), 5G, Internet of Things (IoT), and high-performance computing. These investments are aimed at developing cuttingedge semiconductor technologies and products that can compete on a global scale and reduce the country's dependence on foreign suppliers.

Moreover, the sanctions imposed by the United States have prompted Mainland China to accelerate efforts to enhance its semiconductor manufacturing capabilities. This includes investments in advanced manufacturing facilities and equipment, as well as the development of domestic supply chains for critical semiconductor materials and components. Additionally, Mainland China is exploring collaborations with other countries and regions to access advanced semiconductor technologies and expertise.

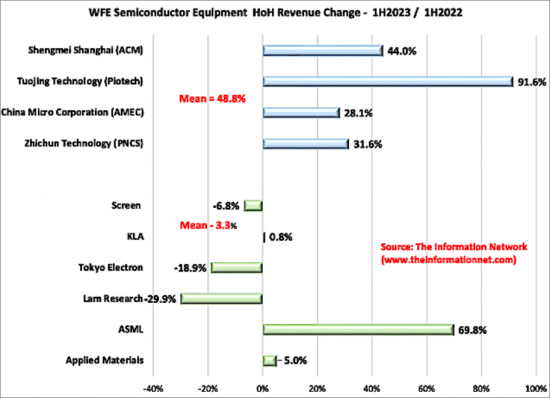

In the semiconductor equipment market, Mainland China is investing in the development and deployment of advanced manufacturing equipment to support its growing semiconductor industry. This includes investments in lithography machines, etching systems, deposition tools, and inspection equipment to enable the production of advanced semiconductor products. Domestic equipment manufacturers are also emerging as key players, supported by government subsidies and incentives to enhance their competitiveness in the global market.

Overall, Mainland China's semiconductor and equipment markets are undergoing rapid transformation in response to U.S. sanctions and the drive for self-sufficiency. While these developments present challenges, they also create opportunities for domestic companies to innovate, grow, and compete on a global scale.

The Mainland China's Semiconductor and Equipment Markets: Analysis and Manufacturing report delves into the intricate dynamics of one of the most rapidly evolving sectors in the global economy. It meticulously analyzes various facets of the semiconductor industry within mainland China, providing readers with invaluable insights to navigate this dynamic landscape, including:

Market Overview: This section offers a panoramic view of the semiconductor market in mainland China, encompassing its size, growth trajectory, and the primary factors propelling or inhibiting its expansion. It delves into historical data and current trends to provide a comprehensive understanding of the market dynamics.

Competitive Landscape: An in-depth analysis of the key players operating in mainland China's semiconductor industry is crucial for understanding market dynamics and competitive strategies. This segment evaluates the market share, growth strategies, R&D initiatives, and recent developments of major semiconductor companies in the region.

Manufacturing Trends: Manufacturing trends are pivotal indicators of the industry's health and trajectory. This section examines capacity expansions, investment patterns, technological advancements in fabrication facilities, and shifts in manufacturing strategies adopted by semiconductor manufacturers in mainland China.

Market Segmentation: The semiconductor market in mainland China is multifaceted, catering to diverse product types, applications, and end-user industries. This segment dissects the market into various segments, providing insights into their growth trajectories, market size, and key drivers.