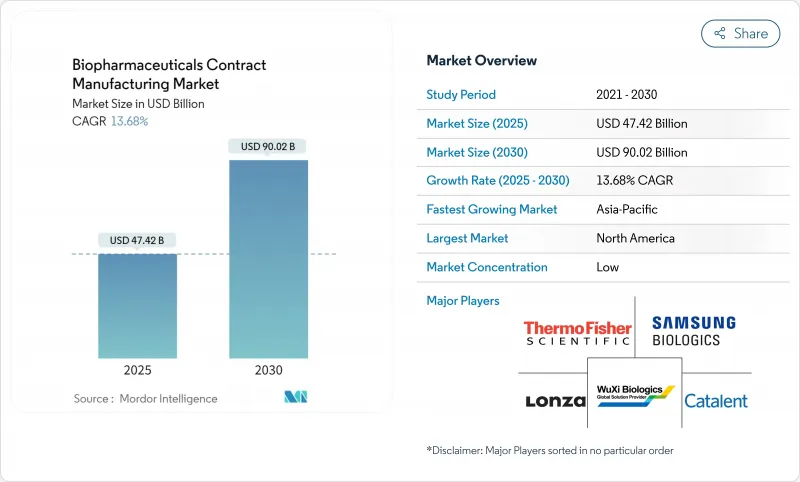

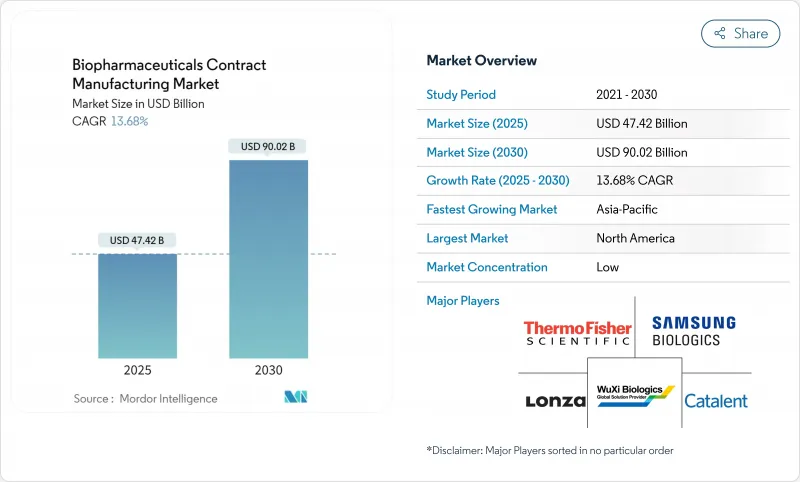

세계의 바이오의약품 수탁제조 시장은 2025년 474억 2,000만 달러에 이르고, 2030년까지 900억 2,000만 달러에 이를 전망입니다.

주요 스폰서가 자본을 절약하고 전문 지식을 활용하기 위해 아웃소싱을 가속화하고 있기 때문입니다. 생물학적 제제 및 바이오시밀러 의약품 파이프라인의 끊임없는 확대, 단일 사용 생산 시스템의 급속한 상업화, 세포 및 유전자 치료용 벡터의 생산 능력 격차의 확대로 성장이 증폭됩니다. 지리적 수요는 광범위하지만, 북미는 견고한 생명공학 클러스터를 보유하고 있으며, 아시아태평양은 다국적 기업들이 중국 플러스 원 소싱 전략을 실행하는 가운데 가장 빠르게 성장하고 있습니다. AI 주도의 예측제어, 연속 바이오프로세스, 모듈러 설비에 대한 기술 투자로 수율이 향상되고 타임라인이 단축되고 디지털 퍼스트 CDMO 경쟁력이 갈라지고 있습니다.

유연성과 자본 효율성을 추구하는 가운데 적어도 하나의 주요 업무를 아웃소싱하는 개발 기업의 비율은 2024년 86.9%로 상승했습니다. 스폰서는 항체 약물 복합체와 자가 세포 요법과 같은 틈새 전문 지식과 엄격한 약사 관리가 필요한 복잡한 치료법에 CDMO를 사용하는 경향이 커지고 있습니다. 아웃소싱은 또한 단일 품질 시스템 하에서 공정 개발, 분석 및 상업용 스케일업을 제공하는 통합 제공업체로 임상 일정을 단축합니다. 다년간의 마스터 서비스 계약에 묶인 용량 예약은 파이프라인 수요가 급증할 때 우선적인 액세스를 확보하기 위한 표준이 되고 있습니다. 이러한 힘이 결합되어 CDMO 파트너십 모델은 기업의 제조 전략에 잘 통합되어 바이오의약품 수탁제조 시장의 성장 궤도를 강화하고 있습니다.

2025년에는 700개가 넘는 유전자 기반 치료제와 450개가 넘는 바이오시밀러 분자가 세계 개발 프로그램을 통해 발전하고 있습니다. 중소규모의 혁신자들이 산업적 규모의 능력을 갖는 것은 드물기 때문에 세포 배양 노하우, 세계 약사 실적, 각 지역의 신청간에 민첩한 대응을 가져오는 외부 제조업체에 의존하고 있습니다. 미국, 유럽 및 아시아태평양의 주요 관할 구역에서 통일된 가이드라인은 다국적 거점 네트워크가 있는 CDMO를 더욱 우월합니다. 생물 제제의 복잡성이 증가함에 따라 차별화된 정제, 제제화 및 전달 기술이 중요한 가치 드라이버가 되어 제품 수명주기에 걸쳐 CDMO를 통합하는 깊은 협력과 기술 이전의 틀을 촉구하고 있습니다.

EU GMP 부속서 1의 구현은 무균 제조 요건을 강화하고 광범위한 오염 관리 및 품질 모니터링 업그레이드를 강요합니다. 2024년 FDA 경고장은 거버넌스 부족과 소프트웨어 검증 격차를 강조하여 규제 당국이 ALCOA 데이터 원칙에 초점을 맞추도록 했습니다. 소규모 CDMO는 전자 배치 기록 시스템, 트럭 및 추적 플랫폼 및 고급 환경 모니터링을 도입할 때 불균형한 재정적 압력에 직면하고 있습니다. 컴플라이언스에 대한 부담은 시설의 사용을 늦추고 장기적인 품질 기준을 업계 전반에서 끌어올려도 단기 수익 성장을 억제할 수 있습니다.

항체 부문은 2024년에 38.2% 시장 점유율을 획득하여 암 영역과 자가면역 질환 영역에서 중심적인 모달리티로서의 역할을 굳혔습니다. 지속적인 임상 활동으로 높은 배치 양이 유지되는 반면, 프로세스 강화로 역가와 경제성이 향상되었습니다. 이와 병행하여, 바이오시밀러 단일클론항체는 라틴아메리카, 동유럽, 아시아의 일부 비용에 민감한 의료 시스템에서의 수요를 자극합니다.

세포 및 유전자 치료용 벡터는 GMP 벡터 생산능력 부족, 특주 분석, 엄격한 규제 감독에 의해 CAGR 18.4%로 확대되어 이들이 함께 전문 CDMO에 고수익의 기회를 창출하고 있습니다. 차세대 AAV 혈청형 및 비바이러스 전달 대체품을 포함한 바이러스 벡터의 혁신은 서비스 범위를 확대하고 바이오의약품 수탁제조 시장에서 개발 및 제조 기술 세트의 융합을 가속화합니다.

CHO 세포를 중심으로 한 포유류 발현 플랫폼은 세포주 공학, 벡터 설계, 배지 최적화의 진보에 의해 특이적 생산성이 향상되고, 당쇄 수식 단백질 및 복합형 mAbs에서의 이 플랫폼의 우위성이 강화되었기 때문에 2024년 시장 점유율의 63.4%를 차지했습니다.

박테리아와 효모 시스템은 단순한 재조합 단백질과 효소에서 여전히 비용 효율적이며, 특히 가격 압력이 강한 신흥 국가에서는 그 경향이 두드러집니다. 식물과 곤충의 세포 기술은 틈새 용도 분야에서 유망하지만 규제에 익숙하기 때문에 보다 광범위한 채용에는 한계가 있습니다. 공급자는 시설 이용률을 극대화하면서 고객의 요구를 충족시키기 위해 시스템 간 포트폴리오의 균형을 맞추고 있습니다. 이는 일회용 스위트가 플랫폼 간 유연한 전환을 가능하게 함에 따라 점점 더 중요해지고 있습니다.

북미는 2024년 바이오의약품 수탁제조 시장 점유율 36.7%로 계속해서 최대의 지역 공헌국이며, 풍부한 벤처 자금, 선진적인 규제 에코시스템, 보스턴 케임브리지 및 샌프란시스코 베이 지역의 인재 밀집지에 의해 지원되고 있습니다. Fujifilm Diosynth의 32억 달러를 투자한 노스캐롤라이나 캠퍼스와 WuXi Biologics의 매사추세츠 사이트 등의 능력 확장에 의해 서비스의 폭이 넓어지고, 이 지역은 후기 단계 및 상업 프로젝트의 최전선에 계속되고 있습니다. BIOSECURE 법이 제정될 가능성이 있고, 국내 및 관련 공급자가 유리하게 됨으로써 벤더 선정이 재편될 가능성이 있지만, 왕성한 수요와 다양한 파이프라인에 의해 모달리티에 관계없이 견조한 전망이 유지되고 있습니다.

아시아태평양은 가장 빠르게 성장하는 지역으로, 2030년까지 연평균 복합 성장률(CAGR)은 11.6%로 예상됩니다. 중국의 규제 개혁과 인프라 정비는 지정 긴장이 이중 조달 관습에 영향을 미치지만, 초기 단계의 제조 옵션으로서의 지위를 높이고 있습니다. 한국의 Samsung Biologics는 2025년까지 누계 78만 4,000L의 생산능력으로 세계적인 주목을 받고 이 지역의 대두를 강조하고 있습니다. 인도는 비용면의 우위성과 영어 능력을 무기로, 싱가포르는 엄격한 품질 감독과 정부의 인센티브를 무기로 첨단 치료 프로젝트를 획득하고 있습니다.

유럽은 Lonza, Boehringer Ingelheim, Catalent 등 기존 기업이 스위스, 독일, 오스트리아에서 10억 달러 규모의 투자를 실시해 지역 생태계를 강화하고 있습니다. Vacaville 인수는 Lonza 네트워크에 330,000L의 생산 능력을 추가하여 브렉시트 관련 공급망의 복잡성에도 불구하고 지속적인 헌신을 강조합니다. EMA의 조화로운 심사 패스웨이와 견고한 IP 보호는 규제 다양화를 요구하는 미국과 아시아의 고객을 끌어들입니다. 성숙한 인프라, 자동화 개념, 녹색 제조 인센티브를 종합하면 유럽은 바이오의약품 수탁제조 시장을 평가하는 다국적 스폰서의 전략 계획에 확고하게 자리를 잡고 있습니다.

The biopharmaceuticals contract manufacturing market stands at USD 47.42 billion in 2025 and is on track to reach USD 90.02 billion in 2030, reflecting a 13.68% CAGR over the period.

This advancement outpaces the wider pharmaceutical sector because large sponsors are accelerating outsourcing to conserve capital and tap specialized expertise. Growth is amplified by the unrelenting expansion of biologic and biosimilar pipelines, rapid commercial uptake of single-use production systems, and widening capacity gaps for cell and gene therapy vectors. Geographic demand is broad-based, yet North America holds sway through its entrenched biotech clusters, while Asia Pacific posts the quickest gains as multinationals execute China-plus-one sourcing strategies. Technology investments in AI-driven predictive control, continuous bioprocessing, and modular facilities lift yields and compress timelines, sharpening the competitive edge of digital-first CDMOs.

The proportion of developers outsourcing at least one major activity rose to 86.9% in 2024 as firms sought flexibility and capital efficiency. Sponsors increasingly turn to CDMOs for complex modalities such as antibody-drug conjugates and autologous cell therapies that require niche expertise and rigorous regulatory stewardship. Outsourcing also shortens clinical timelines, with integrated providers offering process development, analytics, and commercial scale-up under a single quality system. Capacity reservations tied to multi-year master service agreements have become the norm, ensuring priority access as pipeline demand surges. Together, these forces embed the CDMO partnership model firmly within corporate manufacturing strategies, reinforcing the growth trajectory of the biopharmaceuticals contract manufacturing market.

More than 700 gene-based therapies and 450 biosimilar molecules are advancing through global development programs in 2025. Small and mid-sized innovators rarely possess industrial-scale capability, so they depend on external manufacturers that bring cell-culture know-how, global regulatory track records, and agility to pivot among regional filings. Harmonized guidelines across the United States, Europe, and key Asia Pacific jurisdictions further reward CDMOs with multinational site networks. As biologics complexity rises, differentiated purification, formulation, and delivery technologies become critical value drivers, prompting deep collaboration and technology-transfer frameworks that embed CDMOs across the product life cycle.

Implementation of EU GMP Annex 1 heightens sterile-manufacturing requirements, compelling extensive contamination-control and quality monitoring upgrades. FDA warning letters in 2024 spotlighted governance lapses and software validation gaps, reinforcing regulators' focus on ALCOA+ data principles. Smaller CDMOs face disproportionate financial pressure when deploying electronic batch-record systems, track-and-trace platforms, and advanced environmental monitoring. The compliance load can delay facility utilization, tempering short-term revenue growth even as it lifts long-term quality standards across the biopharmaceuticals contract manufacturing industry.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

The antibodies segment generated 38.2% market share in 2024, cementing its role as the anchor modality for oncology and autoimmune indications. Continued clinical activity sustains high batch volumes, while process intensification lifts titers and economics. In parallel, biosimilar monoclonal antibodies stimulate incremental demand from cost-sensitive health systems in Latin America, Eastern Europe, and parts of Asia.

Cell and gene therapy vectors are expanding at an 18.4% CAGR due to the scarcity of GMP vector capacity, bespoke analytics, and stringent regulatory oversight, which combine to create high-margin opportunities for specialized CDMOs. Viral vector innovation, including next-generation AAV serotypes and non-viral delivery alternatives, deepens the service scope and accelerates convergence between development and manufacturing skill sets in the biopharmaceuticals contract manufacturing market.

Mammalian expression platforms, chiefly CHO cells, held 63.4% of market share in 2024 as advances in cell-line engineering, vector design, and media optimization boost specific productivity, reinforcing this platform's dominance for glycosylated proteins and complex mAbs.

Bacterial and yeast systems remain cost-efficient for simple recombinant proteins and enzymes, especially in emerging economies where pricing pressure is acute. Plant and insect cell technologies show promise for niche applications, yet regulatory familiarity limits broader adoption. Providers balance portfolios across systems to meet client needs while maximizing facility utilization, an increasingly important lever as single-use suites enable flexible switching between platforms.

The Biopharmaceutical Contract Manufacturing Market is Segmented by Product Type (Peptides/Proteins, Antibodies, Vaccines, and More), Service Type (Process Development, CGMP Drug Substance Manufacturing, and More), by Development Phase (Pre-Clinical, Phase I, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

North America remained the largest regional contributor with a 36.7% biopharmaceuticals contract manufacturing market share in 2024, sustained by deep venture funding, advanced regulatory ecosystems, and dense talent pools in Boston-Cambridge and the San Francisco Bay Area. Capacity expansions such as Fujifilm Diosynth's USD 3.2 billion North Carolina campus and WuXi Biologics' Massachusetts site broaden service breadth and keep the region at the forefront of late-stage and commercial projects. Potential enactment of the BIOSECURE Act could reshape vendor selection by favoring domestic and allied suppliers, yet strong demand and diversified pipelines maintain robust outlooks across modalities.

Asia Pacific is the fastest-growing territory, advancing at an 11.6% CAGR to 2030. China's regulatory reforms and infrastructure build-out elevate its status as a manufacturing option for early-stage runs, although geopolitical tensions influence dual-sourcing habits. South Korea's Samsung Biologics commands global attention with a cumulative capacity of 784,000 L by 2025, underscoring the region's ascent. India leverages cost advantages and English-language talent, while Singapore markets its stringent quality oversight and government incentives to capture advanced-therapy projects.

Europe sustains its position through incumbents such as Lonza, Boehringer Ingelheim, and Catalent, each reinforcing local ecosystems with billion-dollar investments in Switzerland, Germany, and Austria. The Vacaville acquisition adds 330,000 L of capacity to Lonza's network, highlighting continued commitment despite Brexit-related supply chain complexity. EMA's harmonized review pathways and robust IP protections entice U.S. and Asian clients seeking regulatory diversification. Collectively, mature infrastructure, automation initiatives, and green-manufacturing incentives place Europe firmly in the strategic plans of multinational sponsors evaluating the biopharmaceuticals contract manufacturing market.