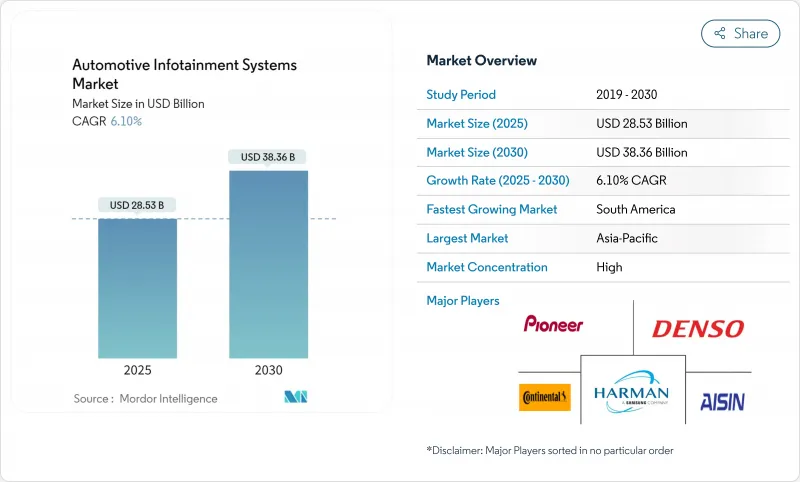

세계의 자동차 인포테인먼트 시스템 시장은 2025년에 285억 3,000만 달러에 이르고, 2030년에는 383억 6,000만 달러로 확대될 것으로 예상되며, 예측 기간 동안 연평균 CAGR은 6.10%를 나타낼 전망입니다.

이 성장 궤도는 인포테인먼트 시스템이 운전자와 복잡해지는 차량 아키텍처 간의 주요 인터페이스 역할을 하는 소프트웨어 정의 차량으로의 자동차 산업의 기본적인 변화를 반영합니다. 시장 확대는 특히 EU의 일반 안전 규칙 II(2024년 7월 발효)와 같은 강제적인 안전 규제에 의해 지원되고 있으며, 컨티넨탈 오토모티브와 같은 인포테인먼트 플랫폼과 ADAS(첨단 운전자 보조 시스템)의 통합이 요구되고 있습니다. 시장 발전는 인포테인먼트 시스템이 엔터테인먼트 중심 플랫폼에서 미션 크리티컬한 차량 운영 인터페이스로 이동하는 보다 광범위한 변화를 반영합니다. NITI Aayog는 자동차 1대당 반도체 비용이 2030년까지 2배의 1,200달러에 달할 것으로 예상하고 있으며, 자동차가 인공지능, 머신러닝, 클라우드 네이티브 아키텍처를 통합함에 따라 인포테인먼트 시스템이 이러한 증가의 상당 부분을 차지하게 됩니다.

ADAS(첨단 운전자 보조 시스템)와 휴먼 머신 인터페이스의 융합은 기존의 안전 용도에 그치지 않고 통합된 차량 제어 아키텍처를 구축하는 패러다임 변화를 의미합니다. 콘티넨탈 스마트 조종실 고성능 컴퓨터는 최대 3대의 디스플레이와 5대의 카메라를 지원하는 반면, 직관적인 음성 대화를 위해 Google Cloud의 제네라티브 AI를 통합하여 대화형 내비게이션과 원활한 차내 제어를 가능하게 합니다. HARMAN과 HL Klemove의 협업은 ADAS 통합이 자동차 제조업체에 통합 솔루션을 만드는 방법을 보여줍니다. 이 통합은 시스템의 복잡성을 줄이는 동시에 자동차 제조업체가 하드웨어 확산이 아닌 소프트웨어 정의 경험을 통해 차별화할 수 있도록 합니다. EU에서는 2024년 7월부터 지능형 속도 보조 및 운전자의 졸음 경고를 실시해야 하며 이 융합이 가속화됩니다. 보쉬의 조종석 통합 플랫폼은 단일 차량 조종석 아키텍처 내에서 다양한 기능의 원활한 통합을 가능하게 함으로써 이러한 경향을 구현합니다.

자동차 업계의 5G 배포는 단순한 연결 업그레이드에 그치지 않고 실시간 데이터 수익화 및 엣지 컴퓨팅 용도를 중심으로 근본적으로 새로운 비즈니스 모델을 실현하기 위해 가속화되고 있습니다. 리어 코퍼레이션은 인포테인먼트 시스템을 종합적인 이동성 플랫폼으로 전환하는 Vehicle-to-Everything 통신 기능을 통해 자동차 5G 시장은 2025년 20억 달러에서 2030년 50억 달러로 성장할 것으로 예측했습니다. HARMAN의 5G 지원 TBOT 기술은 스트리밍 및 게임 용도 연결 요구 사항을 예측하면서 다양한 연결 영역에서 데이터 사용량을 최적화하여 지능형 소프트웨어가 5G 잠재력을 극대화할 수 있음을 보여줍니다. 2030년까지 판매되는 자동차의 90% 이상이 커넥티비티 기능을 탑재할 것으로 추정되고 있으며, 특히 배터리 전기자동차 부문에서는 소비자는 뛰어난 커넥티비티 체험을 위해 브랜드를 변경하고자 합니다. 5G와 인공지능의 융합은 예지보전과 개인화된 컨텐츠 전달을 가능하게 하며 차량 1대당 연간 1,600달러를 창출할 수 있는 구독 수익 기회를 창출합니다. 미국에서 제조되는 자동차 전체에 5G를 전개하기 위한 제너럴 모터스와 AT&T의 파트너십은 기존의 자동차 제조업체가 커넥티비티를 옵션 기능이 아니라 차별화의 핵심으로 자리매김하고 있음을 보여줍니다.

엔트리 레벨 자동차 부문에서는 가격 경쟁력을 유지하면서 고급 인포테인먼트 기능을 통합해야 한다는 압박이 커지고 있으며, 소비자의 기대와 제조 경제성 사이에 근본적인 긴장 관계가 발생하고 있습니다. i.MX6UL 프로세서와 TDF8541 파워 앰프를 포함한 NXP 세미컨덕터스의 엔트리 인포테인먼트 포트폴리오는 기본적인 연결성과 오디오 기능을 최소한의 비용으로 제공해야 하는 비용 중심 용도를 목표로 하고 있습니다. 자동차 1대당 반도체 비용은 2030년까지 2배의 1,200달러에 달할 것으로 예상되고 있으며, 인포테인먼트 시스템은 이러한 증가의 상당 부분을 차지하고 있기 때문에 과제는 점점 심각해지고 있습니다. 인도 시장 역학이 이 긴장을 이야기하고 있으며, 특정 부문에서는 프리미엄 변종이 판매 대수의 40%를 차지하고 있습니다. 그러나 기본 인포테인먼트 기능을 비용 제약과 신중하게 균형을 맞추어야 하는 대량 판매 부문에서는 가격에 대한 감도가 여전히 가장 중요합니다. BYD의 스마트 드라이빙 기술에 대한 1,000억 위안 규모의 투자는 특히 엔트리 모델의 접근성을 목표로 하며 경쟁력 있는 가격을 유지하면서 고급 기능을 민주화하는 것을 목표로 하고 있습니다. 이러한 비용 압력은 OEM이 기능의 풍부함과 합리적인 가격 사이에 전략적 절충을 촉구하고 가격에 민감한 부문에서 시장 침투를 제한할 수 있습니다.

인 대시 구성은 2024년 출하 대수의 72.32%를 차지해 자동차 인포테인먼트 시스템 시장을 장악한 것을 알 수 있습니다. BMW의 최근 출시 예정인 Panoramic iDrive는 48인치 곡면 OLED와 3D 헤드업 오버레이를 융합시켜 중앙 디스플레이가 별도의 버튼을 사용하지 않고 에어컨, 내비게이션, 엔터테인먼트를 오케스트레이션한다는 것을 보여줍니다. 테슬라 모델 Y의 단일 화면 조종석은 물리적 노브 대신 소프트웨어 메뉴가 하드웨어 미니멀리즘을 보여주는 또 다른 예입니다. 한편, 리어 시트 엔터테인먼트의 카테고리는 자율주행 기능에 의해 승무원이 액티브한 운전으로부터 해방되기 때문에 CAGR이 11.81%를 나타낼 것으로 예측되고 있습니다. 럭셔리 브랜드는 4K 컨텐츠를 스트리밍하는 멀티 디스플레이 천장 마운트 및 시트백 어레이를 도입하여 구독 수입을 위한 포로가 되는 플랫폼을 만들고 있습니다. HARMAN의 SeatSonic은 시트 프레임을 통해 오디오를 전송하여 캐빈의 데시벨 레벨을 올리지 않고 몰입감을 높입니다. 증가하는 라이드 헤일링 플릿은 추가 수요를 추가합니다. 승객은 통근 중에 비디오 온 디맨드를 기대하게 되고 있으며, 오퍼레이터는 중급 세단조차도 엔터테인먼트 스크린을 개설해야 합니다.

승객 중심의 상호 작용은 인터페이스의 논리를 재구성합니다. 햅틱 피드백, 컨텍스트 라이팅, 카메라 기반 제스처 컨트롤이 대시보드의 스택에 집계되어 엔터테인먼트 이외의 차량 영역의 커맨드 센터로 변모하고 있습니다. 뒷좌석 모듈은 현재 클라우드 프로파일에 직접 연결되어 모든 사용자가 여행 중에 재생목록 및 동영상 진행을 재개할 수 있습니다. 구독 계층을 실험하는 자동차 제조업체는 운전석 화면에 기능을 푸시하기 전에 소비자의 의욕을 테스트하기 위해 후면 디스플레이에서 월별 게임 번들을 데뷔하는 경우가 많습니다. 또한 드라이버의 주의 산만에 관한 새로운 규제 이야기도 터치 스크린보다 헤드업 프로젝션을 선호하도록 디자인을 기울일 수 있습니다. 이러한 역학은 UX 디자인과 수익화 전략이 교차하는 놀이터로서 시장 역학을 강화합니다.

2024년 세계 매출의 79.34%는 승용차가 차지했고, 구매자는 차내를 디지털 라이프 스타일의 연장이라고 여겼습니다. 전동 파워트레인은 항속 거리를 최적화하는 라우팅 및 배터리 분석의 필요성을 강화하고 BEV 인포테인먼트 도입을 촉진합니다. 소형 상용차는 2030년까지 연평균 복합 성장률(CAGR) 11.34%로 확대해 오랫동안 텔레매틱스가 주류가 될 것으로 예측되지만, 현재는 피로 모니터링, 디지털 타코그래프, 운반 기록용 인포테인먼트 앱이 레이어화되고 있습니다. 예를 들어, Ford Pro는 대시보드를 엔터프라이즈 SaaS의 엔드포인트로 바꾸고 미국 함대 전체에서 약 60만 개의 유료 소프트웨어 구독을 기록합니다. 함대 운영자는 가동 시간과 저장소에 대한 방문을 피하는 간단한 무선 패치를 높이 평가합니다. 그 결과, 상용차의 자동차 인포테인먼트 시스템 시장 규모는 2030년까지 64억 달러에 달할 것으로 예상되어, 가격 감응도에 의해 차폐되고 있던 새로운 수익을 획득하고 있습니다.

라이드 쉐어링과 마지막 마일 물류는 대응 가능한 범위를 더욱 확장합니다. 운송장 및 배달 증명 사진을 자동으로 입력하는 대시보드는 관리 오버헤드를 줄입니다. 인포테인먼트에 통합된 카메라 대응 ADAS는 충돌감지를 제공하고 보험료를 인하함으로써 보험사를 지원합니다. 반면 프리미엄 세단은 멀티채널 오디오, 몰입형 앰비언트 조명, 화면에서 직접 예약할 수 있는 컨시어지 서비스로 차별화됩니다. 소프트웨어의 성숙도가 높아짐에 따라 차종의 구별은 모호해집니다. 고급 승용차용으로 작성된 코드 모듈은 최소한의 변경으로 경트럭용으로 재패키징됩니다. 이러한 재사용의 사고방식은 기능의 보급을 가속시켜 자동차 인포테인먼트 시스템 시장의 스케일 메리트를 높입니다.

헤드 유닛과 도메인 컨트롤러는 2024년 41.33%의 매출을 확보했습니다. 이는 백 카메라의 스티칭부터 음성 AI까지 모든 기능이 계산 능력에 의존하기 때문입니다. 운영체제와 앱 매출은 15.92%의 연평균 복합 성장률(CAGR)을 나타낼 전망이며, 업계가 철강에서 코드로 축발을 옮기는 것을 뒷받침하고 있습니다. Qualcomm의 Snapdragon Cockpit Gen 4는 8 TOPS 온다이 NPU를 통합하여 추가 칩 없이 캐빈의 개인화 및 드라이버 상태 분석을 가능하게 합니다. 텍사스 기기의 AM275x-Q1 마이크로컨트롤러는 DSP 처리량을 4배 향상시켜 비용에 중점을 둔 OEM은 하이엔드 SoC를 사용하지 않고 공간 오디오를 추가할 수 있습니다. 디스플레이도 동시에 진화하고 있습니다. 마이크로 LED 패널은 낮은 전력 소비로 더 나은 휘도를 제공하여 슬림한 도어 장착형 터치스크린을 가능하게 합니다. 안테나 모듈은 다이버 시티 4G에서 매시브 MIMO 5G 어레이로의 전환에 직면하여 차량 당 부품 비용이 상승합니다. 이러한 변화를 종합하면 소프트웨어가 승수로 강화되고 자동차 인포테인먼트 시스템 시장은 OS와 용도 계층에서 가치가 증가하는 레이어 스택으로 변합니다.

공급자의 전략은 이 현실을 반영합니다. 콘티넨탈은 현재 Telechips 기반 보드에 안드로이드를 번들로 출하하며 베어 메탈이 아닌 턴키 유연성을 판매하고 있습니다. Tier-2의 펌웨어 하우스는 무선 진단 및 스토어 프론트 SDK를 제공하여 자동차 제조업체가 최초 판매부터 오랫동안 유료 기능 애드온을 시작할 수 있도록 합니다. 투자자들에게는 경상적인 소프트웨어 마진이 일회성 하드웨어 마크업보다 중요합니다. 결국 하드웨어가 여전히 시스템 비용을 지원하고 있음에도 불구하고 순수한 소프트웨어 공급업체 시장 점유율이 상승하고 있습니다.

BYD는 2025년까지 550만대의 EV 판매를 지원하기 위해 ADAS와 인포테인먼트의 연구개발에 1,000억 위안을 투입하고 있습니다. 일본의 자동차 제조업체(토요타, 닛산, 혼다)는 제네레이티브 AI와 자사제 반도체를 위해서 자원을 풀하고 있어, 장래의 콕피트 플랫폼에 대한 공급의 탄력성을 확보하고 있습니다. 인도의 프리미엄 트림 점유율은 40%로 상승하고 HARMAN India와 같은 공급업체는 음성 어시스턴트 및 지역 언어 UX의 현지화를 위해 벵갈루루에서 연구 개발을 확대합니다.

북미는 「커넥티드 퍼스트」의 생각을 채용. 미국에서는 AT&T와 GM의 협력에 의해 5G 탑재 모델이 급증하고, 갱신 시간이 단축되어, 지속적인 수익을 낳는 단계적인 데이터 플랜을 이용할 수 있게 되었습니다. 반면에 초당파 Right-to-Repair 법안은 OEM에 진단 API 공개를 강제할 수 있으며 인포테인먼트 보안 키가 독립 기업과 어떻게 공유되는지에 영향을 미칩니다. 유럽에서는 데이터 거버넌스가 중요합니다. 2025년에 EU 데이터 법이 시행되어 자동차 데이터의 사용자 관리가 의무화되고, 자동차 제조업체는 타사 서비스에 대한 액세스를 허가할 의무가 있습니다. 4G/5G로의 eCall 이행과 2024년의 Right-to-Repair 지령도 보수성과 후방 호환성을 위한 조종석 설계를 형성했습니다.

남미는 현재 절대 시장 규모는 작지만 CAGR은 가장 높습니다. 브라질의 'Mover' 프로그램은 세제 우대 조치와 현지 컨텐츠 규제를 연결하여 OEM에 인포테인먼트 ECU의 국내 조달을 촉구하고 있습니다. 오디오 비주얼에 대한 투자는 50억 달러를 넘어서 자동차 수요에 대응할 수 있는 디스플레이와 사운드 프로세싱공급 체인을 제공합니다. 소비자의 기대는 스마트폰의 보급을 반영하고 연결성, 앱 스토어, 비접촉식 결제는 이제 기본 수준의 기능으로 간주됩니다. 그러나 외환 변동과 수입 관세의 상승으로 인해 SoC 통합을 통해 달성되는 많은 비용 절감 엔지니어링이 필요합니다. 이러한 힘은 자동차 인포테인먼트 시스템 시장의 지리적 다양성을 유지하는 동시에 유연성이 높고 소프트웨어 중심 공급업체에게 큰 상승을 의미합니다.

The global automotive infotainment systems market reached USD 28.53 billion in 2025 and is projected to expand to USD 38.36 billion by 2030, registering a compound annual CAGR of 6.10% during the forecast period.

This growth trajectory reflects the automotive industry's fundamental shift toward software-defined vehicles, where infotainment systems serve as the primary interface between drivers and increasingly complex vehicle architectures. The market's expansion is underpinned by mandatory safety regulations, particularly the EU's General Safety Regulation II, effective July 2024, which requires advanced driver assistance systems integration with infotainment platforms, such as Continental Automotive. The market's evolution reflects a broader transformation where infotainment systems transition from entertainment-centric platforms to mission-critical vehicle operating interfaces. NITI Aayog projects semiconductor costs per vehicle will double to USD 1,200 by 2030, with infotainment systems accounting for a substantial portion of this increase as vehicles integrate artificial intelligence, machine learning, and cloud-native architectures.

The convergence of Advanced Driver Assistance Systems with human-machine interfaces represents a paradigm shift that extends beyond traditional safety applications to create unified vehicle control architectures. Continental's Smart Cockpit High-Performance Computer supports up to 3 displays and five cameras while integrating Google Cloud's generative AI for intuitive voice interaction, enabling conversational navigation and seamless in-car control. HARMAN's collaboration with HL Klemove demonstrates how ADAS integration creates unified solutions for automakers, where driver monitoring systems and collision avoidance features share processing resources with entertainment functions. This integration reduces system complexity while enabling automakers to differentiate through software-defined experiences rather than hardware proliferation. The EU's mandatory implementation of intelligent speed assistance and driver drowsiness warnings from July 2024 accelerates this convergence. OEMs seek cost-effective solutions that combine regulatory compliance with enhanced user experiences.Bosch's cockpit integration platform exemplifies this trend by enabling seamless integration of various functionalities within a single vehicle cockpit architecture.

The automotive industry's 5G deployment accelerates beyond mere connectivity upgrades to enable fundamentally new business models centered on real-time data monetization and edge computing applications. Lear Corporation estimates the automotive 5G market will grow from USD 2 billion in 2025 to USD 5 billion by 2030, driven by vehicle-to-everything communication capabilities that transform infotainment systems into comprehensive mobility platforms. HARMAN's 5G-enabled TBOT technology anticipates connectivity needs for streaming and gaming applications while optimizing data usage across varying connectivity zones, demonstrating how intelligent software can maximize 5G's potential. It has been estimated that over 90% of vehicles sold by 2030 will feature connectivity capabilities, with consumers willing to switch brands for superior connected experiences, particularly in battery-electric vehicle segments. The convergence of 5G with artificial intelligence enables predictive maintenance and personalized content delivery, creating subscription revenue opportunities that could generate USD 1,600 per vehicle annually. General Motors' partnership with AT&T for 5G deployment across U.S.-built vehicles exemplifies how traditional automakers position connectivity as a core differentiator rather than an optional feature.

Entry-level vehicle segments face mounting pressure to integrate advanced infotainment capabilities while maintaining price competitiveness, creating a fundamental tension between consumer expectations and manufacturing economics. NXP Semiconductors' entry infotainment portfolio, including i.MX6UL processors and TDF8541 power amplifiers, specifically targets cost-conscious applications where basic connectivity and audio functionality must be delivered at minimal expense. The challenge intensifies as semiconductor costs per vehicle are projected to double to USD 1,200 by 2030, with infotainment systems representing a significant portion of this increase. Indian market dynamics illustrate this tension, where premium variants account for 40% of sales in certain segments. Yet, price sensitivity remains paramount for volume segments where basic infotainment features must be carefully balanced against cost constraints. BYD's CNY 100 billion investments in smart driving technology specifically target entry-level model accessibility, aiming to democratize advanced features while maintaining competitive pricing. This cost pressure forces OEMs to make strategic trade-offs between feature richness and affordability, potentially limiting market penetration in price-sensitive segments.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

In-dash configurations held 72.32% of 2024 shipments, illustrating their grip on the automotive infotainment systems market. BMW's forthcoming Panoramic iDrive melds a 48-inch curved OLED with 3D head-up overlays, demonstrating how central displays now orchestrate HVAC, navigation, and entertainment without discrete buttons. Tesla's single-screen Model Y cockpit offers another illustration of hardware minimalism where software menus replace physical knobs. The rear-seat entertainment category, meanwhile, is projected to register an 11.81% CAGR as autonomous features free passengers from active driving. Luxury brands deploy multi-display ceiling mounts and seat-back arrays that stream 4K content, creating a captive platform for subscription revenue. HARMAN's SeatSonic transduces audio through seat frames, enhancing immersion without raising cabin decibel levels. Growing ride-hailing fleets add further demand: passengers increasingly expect video-on-demand during commutes, pushing operators to retrofit entertainment screens even in mid-tier sedans.

Passenger-centric interactions are reshaping interface logic. Haptic feedback, contextual lighting, and camera-based gesture control converge on the in-dash stack, turning it into a command center for vehicle domains beyond entertainment. Rear-seat modules now link directly to cloud profiles so every user can resume playlists or video progress across trips. Automakers experimenting with subscription tiers often debut pay-per-month gaming bundles on rear displays to test consumer appetite before pushing features to the driver's screen. Emerging regulatory talk on driver distraction could also tilt design, favoring heads-up projection over touchscreens. These dynamics reinforce the automotive infotainment systems market as a playground where UX design and monetization strategy intersect.

Passenger cars owned 79.34% of global revenue in 2024 as buyers consider the cabin an extension of their digital lifestyle. Electric powertrains intensify the need for range-optimized routing and battery analytics, driving BEV infotainment installations. Light commercial vehicle is expanding at 11.34% CAGR by 2030, long dominated by telematics, now layer infotainment apps for fatigue monitoring, digital tachographs, and haul documentation. Ford Pro, for instance, logs around 600,000 paid software subscriptions across its U.S. fleet, turning dashboards into enterprise SaaS endpoints. Fleet operators prize uptime and simple over-the-air patches that avoid depot visits. Consequently, the market size of commercial vehicles' automotive infotainment systems is projected to reach USD 6.4 billion by 2030, capturing fresh revenue otherwise shielded by price sensitivity.

Ride-sharing and last-mile logistics further widen the addressable scope. Dashboards that auto-populate waybills or proof-of-delivery photos cut administrative overhead. Camera-enabled ADAS integrated into infotainment helps insurers by providing crash forensics and lowering premiums. Meanwhile, premium sedans are differentiated through multichannel audio, immersive ambient lighting, and concierge services that are bookable straight from the screen. As software maturity grows, vehicle type distinctions blur: code modules written for premium passenger cars get repackaged for light trucks with minimal change. That reuse philosophy accelerates feature spread and enhances economies of scale for the automotive infotainment systems market.

Head units and domain controllers secured 41.33% revenue in 2024 because every feature-from rear-view camera stitching to voice AI-relies on computational horsepower. Yet the software tier is scaling faster: operating-system and app revenue is slated for a 15.92% CAGR, underscoring the industry pivot from steel to code. Qualcomm's Snapdragon Cockpit Gen 4 integrates an on-die NPU capable of 8 TOPS, allowing cabin personalization and driver-state analytics without extra chips. Texas Instruments' AM275x-Q1 microcontrollers quadruple DSP throughput so cost-conscious OEMs can add spatial audio without high-end SoCs. Displays are simultaneously evolving-micro-LED panels deliver better luminance with lower power draw, enabling slim door-mounted touchscreens. Antenna modules face a switch from diversity 4G to massive-MIMO 5G arrays, lifting the bill-of-materials value per vehicle. Altogether, these shifts reinforce software as the multiplier, transforming the automotive infotainment systems market into a layered stack where value accretes at the OS and application tier.

Supplier strategies mirror that reality. Continental now ships Telechips-based boards bundled with Android distribution, selling turnkey flexibility rather than bare metal. Tier-2 firmware houses offer over-the-air diagnostics and storefront SDKs, enabling carmakers to launch paid feature add-ons long after the initial sale. For investors, recurring software margin beats once-off hardware markup, a critical pivot as raw-material prices stay volatile. Ultimately, the automotive infotainment systems market share of pure-play software vendors is rising, even though hardware still anchors system cost.

The Automotive Infotainment Systems Market Report is Segmented by Installation Type (In-Dash Infotainment and More), Vehicle Type (Passenger Cars, Lcvs, and More), Component (Display Modules, and More), Propulsion Type (ICE, Hevs, and More), Connectivity (4G LTE, 5G, and More), Operating System (Linux-Based, and More), Sales Channel (OEM and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Asia-Pacific's 39% foothold owes much to China's aggressive smart-cockpit race, with BYD earmarking CNY 100 billion for ADAS and infotainment R&D to support 5.5 million EV sales by 2025. Japanese automakers-Toyota, Nissan, Honda-are pooling resources for generative AI and in-house semiconductors, ensuring supply resilience for future cockpit platforms. India's share of premium trims has climbed to 40%, pushing suppliers like HARMAN India to expand Bengaluru R&D for localization of voice assistants and regional language UX.

North America adopts a "connected-first" mindset. The U.S. surge of 5 G-equipped models, spurred by AT&T-GM collaboration, cuts update time and unlocks tiered data plans that generate recurring revenue. Meanwhile, bipartisan Right-to-Repair bills could compel OEMs to publish diagnostic APIs, influencing how infotainment security keys are shared with independents. Europe focuses on data governance: the EU Data Act in 2025 mandates user control of in-vehicle data and obliges carmakers to allow third-party service access. eCall migration to 4G/5G and the 2024 Right-to-Repair Directive also shape cockpit design for maintainability and backward compatibility.

South America currently represents a smaller absolute market but the highest CAGR. Brazil's 'Mover' program links tax incentives to local-content rules, pushing OEMs to source infotainment ECUs domestically. Audiovisual investment exceeding USD 5 billion provides display and sound-processing supply chains that can serve automotive demand. Consumer expectations mirror smartphone penetration: connectivity, app stores, and contactless payments are now considered base-level features. However, currency volatility and high import duties require cost-down engineering, often achieved through SoC consolidation. These forces collectively maintain geographic diversity in the automotive infotainment systems market while signaling strong upside for flexible, software-centric suppliers.