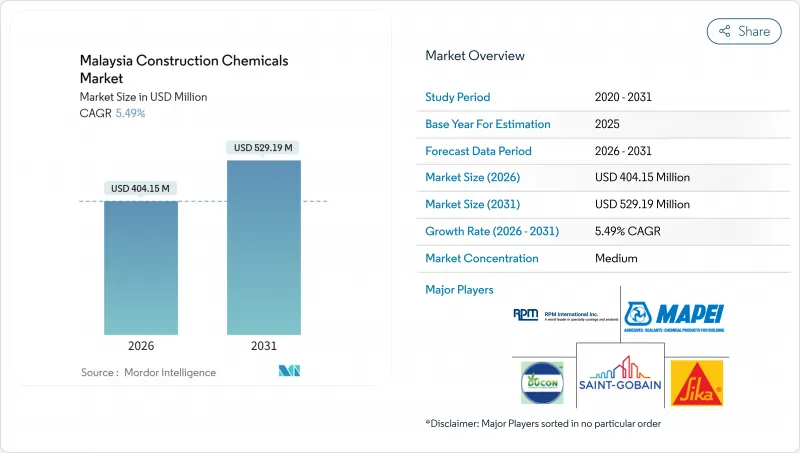

말레이시아의 건설용 화학제품 시장은 2025년 3억 8,312만 달러로 평가되었고, 2026년에는 4억 415만 달러로 성장할 전망입니다. 2026-2031년에 걸쳐 CAGR은 5.49%를 나타내고, 2031년까지 5억 2,919만 달러에 달할 것으로 예측되고 있습니다.

2024년 1월부터 11월까지 발주된 1,837억 위안 규모의 프로젝트를 포함한 지속적인 인프라 투자의 기세는 개발자가 고성능 혼화제, 방수 시트 및 보호 코팅을 지정함에 따라 꾸준한 수량 성장을 지원하고 있습니다. 2025년 1월 조인된 조호르 싱가포르 특별 경제구와 같은 메가 프로젝트는 해양 환경과 고습도 환경에 적합한 내구성 화학제품 수요를 가속할 것으로 예측됩니다. 말레이시아의 건설용 화학제품 시장은 유틸리티에 있어서의 BIM 도입율 90%라고 하는 정부의 의무화도 추풍이 되고 있습니다. 이는 자동화된 건설 워크플로우와 원활하게 통합되는 정밀 설계 제품을 유리하게 만듭니다. 동시에 그린빌딩 인증 기세는 낮은 VOC(휘발성 유기화합물)와 재활용 가능한 배합의 채택을 촉진하고, 제조업체가 지속가능성을 중시한 기회를 포착하면서 프리미엄 가격을 설정하는 것을 가능하게 하고 있습니다.

말레이시아의 견고한 인프라 정비 계획(2024년 계약액 : 1,837억 위안)은 교량, 터널, 도시 철도 시스템용 특수 방수 시트, 폴리머 개질 그라우트, 부식 코팅의 성장을 지원합니다. 조호르 싱가포르 특별 경제구만으로도 5년 이내에 50개의 경계 프로젝트를 목표로 하고, 기수 환경에도 견디는 해양용 실란트나 탄산염 방지 혼화제 수요를 확대하고 있습니다. Tesla와 인텔 등의 제조 대기업을 포함한 관민 연계에 의해 성능 기준이 더욱 높아져 정전기 소산성 바닥용 수지나 내약품성 벽용 도료의 사양 개발이 촉진되고 있습니다. 개선된 도로, 항만, 디지털 채널은 2차 상업 프로젝트를 불러들여 말레이시아 건설용 화학제품 시장 전체에서 제품 수요의 선순환을 강화하고 있습니다.

국가 주택 시책에 의한 보조 주택의 가속적인 전개는 레디믹스트 콘크리트나 조립식 벽 패널의 사용을 표준화해, 혼화제의 사용량을 확대하는 것과 동시에 품질 허용차를 엄격화하고 있습니다. 저소득자를 위한 주택개발업자는 자발적으로 그린빌딩 기준을 채택하여 그린빌딩 지수가 정하는 탄소 삭감 목표에 따른 수성 아크릴계 실란트나 낮은 VOC 타일 접착제 수요를 환기하고 있습니다. 이포와 쿠칭 등의 지방도시에의 시책 확대에 따라 유통망이 확대되고, 공급업체는 소용량 포장 제품 및 이동식 기술 서비스 팀의 도입을 촉진하고 있습니다. 비용 중심 프로젝트는 고내구성이면서 가격 경쟁 화학제품을 채택하여 현지 제조업체는 배치 품질의 안정화를 도모하기 위해 자동화 생산 라인의 규모 확대를 추진하고 있습니다.

수입 폴리머, 특수 용제, 고성능 첨가제는 고급 배합에 있어서 원료 비용의 최대 60%를 차지하고 있어, 제조업체는 환율 변동이나 원유 가격 급등의 영향을 받기 쉬워지고 있습니다. 페트로나스사는 2026년까지 선물공급계약을 체결했지만 중소규모 기업은 스팟거래에서 구매하고 있기 때문에 원료비용이 상승하면 EBITDA 마진이 압박됩니다. 2025년 중반부터 건설 중인 펜겔란 거점 35억 달러 규모의 석유화학 콤플렉스는 현지 공급 통합을 강화하지만, 2028년 이전에 설계 생산 능력에 도달할 전망은 없습니다. 그때까지 자본이 부족한 기업이 통합형 다국적 기업에 점유율을 부여함으로써 변동성이 산업 재편을 가속화할 수 있습니다.

방수 솔루션은 쿠알라룸푸르와 조호르 바루에서 고층 개발 프로젝트의 옥상 및 포디움 데크에 대한 의무 사양을 배경으로 2025년 말레이시아 건설용 화학제품 시장 점유율의 48.42%를 차지했습니다. 양판면에서는 아스팔트 개질 방수 시트가 선두를 유지하는 한편, 폴리머 시멘트계 하이브리드 제품은 지하 공사에 있어서의 속경화 특성으로부터 지지를 모으고 있습니다. 방수 부문의 말레이시아 건설용 화학제품 시장 규모는 습윤 환경 하에서의 장수명이 요구되는 교통 지향형 개발, 항만, 데이터센터 지하 시설과 보조를 맞추어 확대가 전망됩니다.

표면 처리 화학물질은 프리캐스트 외벽 패널에 최적화된 고급 경화제와 이형 에멀젼으로 2031년까지 연평균 복합 성장률(CAGR) 6.78%라는 가장 높은 성장을 보여줄 전망입니다. 낙서방지 실러와 소수성 실란겔은 유지관리 비용 절감을 목표로 하는 지자체 인프라 사업에서의 수요 증가가 전망됩니다. 혁신은 VOC 수준을 증가시키지 않고 내마모성을 높이는 나노 엔지니어링 입자로 전환하고 있으며, 그린 빌딩 인증 기준에도 적합합니다.

The Malaysia Construction Chemicals Market is expected to grow from USD 383.12 million in 2025 to USD 404.15 million in 2026 and is forecast to reach USD 529.19 million by 2031 at 5.49% CAGR over 2026-2031.

Sustained infrastructure momentum, including RMB 183.7 billion in projects awarded during the first 11 months of 2024, underpins steady volume growth as developers specify higher-performance admixtures, waterproofing membranes, and protective coatings. Mega-projects, such as the Johor-Singapore Special Economic Zone, signed in January 2025, are expected to accelerate demand for durable chemistries suited to marine and high-humidity environments. The Malaysia construction chemicals market also benefits from the government's 90% BIM adoption mandate for public works, which favors precision-engineered products that integrate seamlessly with automated construction workflows. In parallel, the momentum for green-building certification stimulates the uptake of low-VOC and recyclable formulations, enabling manufacturers to command premium price points while capturing sustainability-driven opportunities.

Malaysia's robust infrastructure pipeline, valued at RMB 183.7 billion in contracts awarded during 2024, sustains growth for specialty waterproofing membranes, polymer-modified grouts, and corrosion-inhibiting coatings used in bridges, tunnels, and urban rail systems. The Johor-Singapore Special Economic Zone alone aims to target 50 cross-border projects within five years, thereby amplifying demand for marine-grade sealants and anti-carbonate admixtures that can withstand brackish conditions. Public-private partnerships that include manufacturing giants such as Tesla and Intel further elevate performance benchmarks, driving the development of specifications for electrostatic-dissipative flooring resins and chemical-resistant wall coatings. Upgraded roads, ports, and digital pathways attract secondary commercial projects, reinforcing a virtuous cycle of product demand across the Malaysian construction chemicals market.

The National Housing Policy's accelerated rollout of subsidized units standardizes the use of ready-mix concrete and prefabricated wall panels, expanding admixture volumes while tightening quality tolerances. Developers engaged in low-income housing voluntarily adopt green building criteria, fueling demand for water-based acrylic sealants and low-VOC tile adhesives that align with carbon reduction goals outlined by the Green Building Index. The policy's geographic spread into secondary cities, such as Ipoh and Kuching, enlarges distribution networks, prompting suppliers to introduce small-pack formulations and mobile technical service teams. Cost-sensitive projects rely on high-durability yet price-competitive chemistries, incentivizing local manufacturers to scale automated production lines for consistent batch quality.

Imported polymers, specialty solvents, and performance additives account for up to 60% of the raw material cost in premium formulations, exposing manufacturers to currency fluctuations and crude oil price spikes. PETRONAS has locked in forward supply contracts through 2026, but small and mid-sized players purchase on spot terms, eroding EBITDA margins when feedstock costs rise. The Pengerang-based USD 3.5 billion petrochemical complex, under construction since mid-2025, will enhance local supply integration but is not expected to reach nameplate output before 2028. Until then, volatility may accelerate consolidation as under-capitalized firms cede share to integrated multinationals.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Waterproofing solutions captured 48.42% of the Malaysian construction chemicals market share in 2025, driven by mandatory rooftop and podium deck specifications in high-rise developments across Kuala Lumpur and Johor Bahru. Bitumen-modified membranes retain their leadership in volume, while polymer-cementitious hybrids gain favor for their rapid-setting underground applications. The Malaysian construction chemicals market size for waterproofing is projected to expand in lockstep with transit-oriented developments, ports, and data center basements that require a long service life in humid conditions.

Surface-treatment chemicals are expected to register the fastest 6.78% CAGR through 2031, driven by advanced curing agents and mold-release emulsions optimized for precast facade panels. Anti-graffiti sealers and hydrophobic silane gels enjoy rising demand from municipal infrastructure programs aimed at reducing maintenance costs. Innovation is pivoting toward nano-engineered particles that enhance abrasion resistance without increasing VOC levels, aligning with green-building credits.

The Malaysia Construction Chemicals Market Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, Sealants, Surface-Treatment Chemicals, and Waterproofing Solutions) and End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, Residential). The Market Forecasts are Provided in Terms of Value (USD).