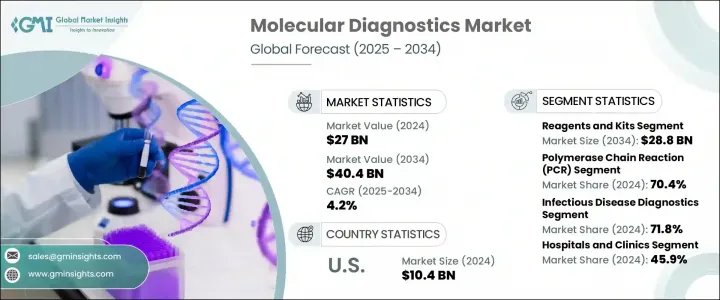

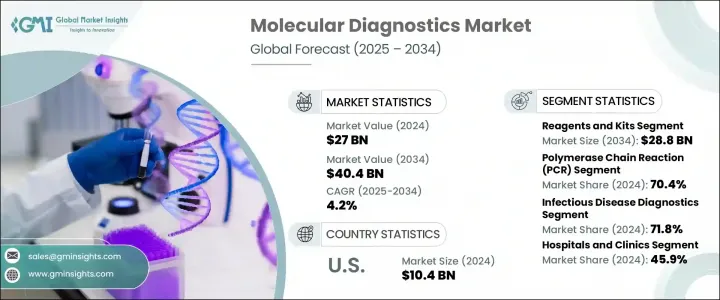

세계의 분자진단 시장 규모는 2024년에 270억 달러로 평가되었고, CAGR 4.2%를 나타내, 2034년에는 404억 달러에 이를 것으로 추정됩니다.

이러한 꾸준한 성장의 배경은 전염병 환자 증가, 분자진단 기술의 지속적인 혁신, 질병의 조기 발견에 대한 의식 증가, 포인트 오브 케어(POC) 진단에 대한 요구 급증, 세계 노인 인구의 급속한 확대 등 여러 요인을 집약하고 있습니다.

분자진단은 DNA, RNA, 단백질을 포함한 유전체과 프로테옴에서 생물학적 마커를 분석하여 질병을 확인하고 모니터링하는 데 필수적인 기술입니다. 보다 빠르고 정확한 진단 솔루션을 제공할 수 있는 건강 관리 시스템에서 이 기술은 현대 임상에서 점점 더 중심적인 역할을 하고 있습니다. Thermo Fisher Scientific, Hologic, Sysmex Corporation, Danaher Corporation 및 Qiagen과 같은 이 시장의 주요 기업은 진화하는 세계의 의료 요구를 충족시키기 위해 제품 라인업을 지속적으로 확대하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 270억 달러 |

| 예측 금액 | 404억 달러 |

| CAGR | 4.2% |

분자진단은 유전자 질환, 암, 감염증 등 폭넓은 질환의 식별에 필수적인 고감도로 정확한 검사를 포함합니다. 이 정밀도의 높이가 선진국 시장과 신흥국 시장의 양쪽에서 채용의 원동력이 되고 있습니다. 사용된 기술 중에서 중합효소 연쇄반응(PCR)은 2024년 점유율 70.4%로 시장을 선도했습니다. RNA와 DNA를 정확하게 증폭하고 미량의 유전 물질도 검출할 수 있는 PCR은 특히 감염증 스크리닝이나 유전자 검사에 있어서 조기 발견에 필수적인 툴이 되고 있습니다.

종양 검사 분야는 2024년에 21억 달러로 평가되었고, 2034년에는 32억 달러에 이를 것으로 전망됩니다. 세계에서 암 이환율이 증가하고 있는 것 외에 조기 진단에 대한 수요가 높아지고 있는 것이 종양학에 있어서의 고도의 분자 검사 툴의 도입을 촉진하고 있습니다. 헬스케어 시스템은 높은 감도와 특이성을 가능하게 하는 분자 기반 장비, 키트, 시약에 투자하고 환자의 결과를 개선하고 암 관리 프로토콜을 진행하고 있습니다.

2024년 미국의 분자진단 시장 규모는 104억 달러로 평가되었습니다. 미국과 캐나다 시장은 전염병의 지속적인 증가와 차세대 진단 기술의 개발과 상업화에 대한 강력한 지원으로 큰 기세를 보이고 있습니다. 엄격한 규제 기준이 수립되었음에도 불구하고 혁신적인 진단 장비 및 키트 배포가 현저하게 장려되고 있습니다. 기술의 진보와 정교한 분자 검사 플랫폼의 광범위한 채용이 북미 시장의 추가 견인 역할을 하고 있습니다.

세계의 분자진단 시장에서 사업을 전개하는 주요 기업으로는 F. Hoffmann-La Roche, Qiagen, Agilent Technologies, Biocartis, Thermo Fisher Scientific, Siemens Healthineers, Abbott Laboratories, Quidel Ortho Corporation, Bio-Rad Laboratories, Illumina, Becton, Dickinson Lifesciences, Biomerieux, Danaher Corporation, Hologic 등이 있습니다. 경쟁이 심한 분자진단 영역에서의 지위를 굳히기 위해 각사는 전략적 제휴, 합병, 인수를 적극적으로 진행하고 있습니다. 또한 높은 처리량, 자동화, 멀티플렉스 검사 플랫폼을 혁신하기 위한 R&D 투자에도 주력하고 있습니다. 제품 포트폴리오 확대, 규제 당국의 승인 취득, 새로운 지역 시장 진입은 기업이 세계 발자국을 확대하는 데 도움이 됩니다. 또한 AI와 디지털 플랫폼의 통합은 진단 정확도와 속도를 향상시키고 기술적 이점을 제공합니다.

The Global Molecular Diagnostics Market was valued at USD 27 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 40.4 billion by 2034. This steady growth is being fueled by multiple converging factors such as rising cases of infectious diseases, continuous innovation in molecular diagnostic technologies, growing awareness of early disease detection, the surging need for point-of-care (POC) diagnostics, and the rapid expansion of the global elderly population.

Molecular diagnostics serves as a vital technique in identifying and monitoring diseases by analyzing biological markers in the genome and proteome, including DNA, RNA, and proteins. With healthcare systems under pressure to deliver faster and more accurate diagnostic solutions, this technique is playing an increasingly central role in modern clinical practice. Major players in the market-such as Thermo Fisher Scientific, Hologic, Sysmex Corporation, Danaher Corporation, and Qiagen-continue to expand their offerings to meet evolving global health needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27 Billion |

| Forecast Value | $40.4 Billion |

| CAGR | 4.2% |

Molecular diagnostics involves highly sensitive and accurate tests that are critical for identifying a wide array of conditions, including genetic disorders, cancers, and infectious diseases. This accuracy is driving its adoption across both developed and emerging markets. Among the technologies used, polymerase chain reaction (PCR) led the market in 2024 with a 70.4% share. Its precise amplification of RNA and DNA and ability to detect even the smallest quantities of genetic material make PCR an essential tool for early detection, especially for infectious disease screening and genetic testing.

The oncology testing segment was valued at USD 2.1 billion in 2024 and is projected to reach USD 3.2 billion by 2034. Increasing cancer incidence across the globe, along with a rising demand for early diagnosis, is driving the uptake of advanced molecular testing tools in oncology. Healthcare systems are investing in molecular-based instruments, kits, and reagents that enable high sensitivity and specificity, improving patient outcomes and advancing cancer management protocols.

United States Molecular Diagnostics Market generated 10.4 billion in 2024. The U.S. and Canadian markets are witnessing significant momentum due to the continued rise of infectious diseases and strong support for the development and commercialization of next-generation diagnostic technologies. Even with strict regulatory standards in place, there is notable encouragement for the rollout of innovative diagnostic instruments and kits. Technological advancement and widespread adoption of sophisticated molecular testing platforms are helping to drive the market further in North America.

Leading companies operating in the Global Molecular Diagnostics Market include F. Hoffmann-La Roche, Qiagen, Agilent Technologies, Biocartis, Thermo Fisher Scientific, Siemens Healthineers, Abbott Laboratories, QuidelOrtho Corporation, Bio-Rad Laboratories, Illumina, Becton, Dickinson and Company, Sysmex Corporation, Huwel Lifesciences, Biomerieux, Danaher Corporation, and Hologic. To solidify their positions in the competitive molecular diagnostics space, companies are actively pursuing strategic alliances, mergers, and acquisitions. They are also focused on investing in R&D to innovate high-throughput, automated, and multiplex testing platforms. Expanding product portfolios, obtaining regulatory approvals, and entering new regional markets are helping players scale their global footprint. Additionally, integration of AI and digital platforms is enhancing diagnostic accuracy and speed, providing a technological edge.