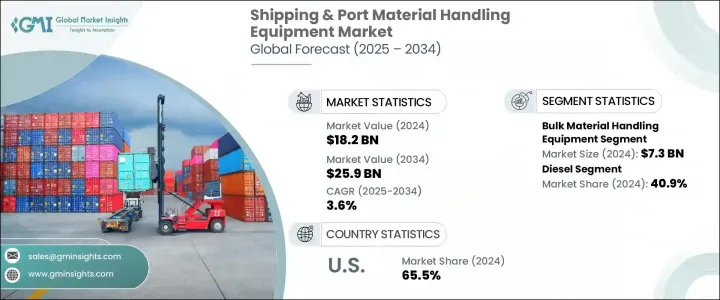

세계의 해운 및 항만 자재 취급 장비 시장은 2024년에 182억 달러로 평가되었고 CAGR 3.6%로 성장할 전망이며 2034년에는 259억 달러에 이를 것으로 추정됩니다.

시장 성장은 효율적인 화물 관리에 대한 수요 증가와 글로벌 무역의 복잡성 증대에 의해 촉진되고 있습니다. 항만 자재 취급 장비는 터미널 내외로 화물을 이동시키는 데 중요한 역할을 수행함으로써 항만 운영에 핵심적입니다. 신뢰할 수 있는 기계가 없다면 항만은 지연, 병목 현상 및 높은 물류 비용의 위험에 직면합니다. 이러한 시스템은 대량 화물의 처리량 지원, 공급망 유동성 유지, 선박 회전 시간 최적화에 필수적입니다. 항만이 대용량 무역 허브로 진화함에 따라 중장비 및 기술적 발전 장비에 대한 의존도는 더욱 두드러지고 있습니다.

전 세계 화물 운송 규모 확대와 항만 체류 시간 최소화 필요성은 신뢰할 수 있는 취급 시스템의 중요성을 더욱 부각시키고 있습니다. 지속가능성과 운영 효율성에 대한 관심이 증가함에 따라 제조사들은 생산성 향상뿐만 아니라 배출량 감축 및 변화하는 환경 기준 충족을 위한 고급 솔루션을 개발하고 있습니다. 해당 시장은 야드 트럭, 갠트리 크레인, 스트래들 캐리어, 터미널 트랙터, 탑/사이드 핸들러, 리치 스태커, 지게차 등 다양한 장비 유형을 포괄합니다. 크레인과 로더는 철강, 목재, 시멘트, 소금과 같은 벌크 상품 관리에 필수적이며 선박, 열차, 트럭에서의 신속한 적재 및 하역을 보장합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 182억 달러 |

| 예측 금액 | 259억 달러 |

| CAGR | 3.6% |

2024년 벌크 자재 취급 장비 부문은 73억 달러의 매출을 기록했습니다. 이 범주에는 컨베이어, 호퍼, 사일로, 회수기, 선박 적재기 및 하역기, 벌크 작업에 특화된 다양한 크레인이 포함됩니다. 국제 무역량 증가와 산업 인프라의 지속적인 발전이 효율적인 시스템에 대한 수요를 촉진하고 있습니다.

디젤엔진 장비 분야는 2024년 40.9%의 점유율을 차지하며 75억 달러를 창출했습니다. 디젤 엔진은 낮은 RPM에서도 우수한 토크 성능을 발휘하며, 까다로운 조건에서도 완전 적재 컨테이너 및 대규모 화물량을 처리하는 엔진의 검증된 능력 덕분에 대용량 작업 부문에서 여전히 선호되는 선택지입니다. 항만은 확립된 연료 공급 인프라와 지속적인 가동 능력 덕분에 중장비 항만 용도에 필수적인 요소로 자리매김했습니다.

유럽의 해운 및 항만 자재 취급 장비 시장은 2024년 27%의 점유율을 기록했습니다. 이 지역은 세계에서 가장 분주한 항만 다수를 보유하고 있으며 운영 효율성 제고를 위한 혁신적 관행 도입에서 선도적 위치를 유지하고 있습니다. 이 지역의 업계는 터미널 장비 최근화, 디지털 도구 도입, 물류 최적화를 위한 자동화 및 IoT 기반 솔루션 전개에 막대한 투자를 하고 있습니다. 이러한 기술적 개선은 인적 오류를 줄이고 화물 처리량을 증가시키며, 배출량 감축을 위한 친환경 항만 이니셔티브와 부합합니다.

세계의 해운 및 항만 자재 취급 장비 시장을 형성하는 주요 기업으로는 Konecranes, TIL Limited, Toyota Material Handling, Liebherr Group 등이 있습니다. 주요 업체들은 항만 기계의 성능, 안전성 및 신뢰성 향상을 위해 자동화, AI, IoT 통합에 막대한 투자를 진행 중입니다. 최근 항만 레이아웃에 유연한 솔루션을 제공하면서 환경적 영향을 줄이기 위해 모듈식 및 전동식 장비 개발에 주력하고 있습니다. 물류 공급업체 및 항만 당국과의 전략적 제휴는 제조업체들이 장기 계약을 확보하고 전 세계 입지를 확대되다는데 기여하고 있습니다. 기업들은 또한 예측 유지보수를 제공하고 가동 중지 시간을 줄이기 위해 텔레매틱스 및 원격 진단을 통해 기존 장비 라인을 업그레이드하고 있습니다.

The Global Shipping & Port Material Handling Equipment Market was valued at USD 18.2 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 25.9 billion by 2034. The market growth is driven by the rising need for efficient cargo management and the increasing complexity of global trade. Material handling equipment plays a critical role in port operations by facilitating the movement of goods in and out of terminals. Without reliable machinery, ports risk delays, bottlenecks, and higher logistics costs. These systems are essential in supporting the throughput of high-volume cargo, keeping supply chains fluid, and optimizing vessel turnaround times. As ports evolve into high-capacity trade hubs, the reliance on heavy-duty and technologically advanced equipment becomes more pronounced.

The increasing scale of global shipments and the need to minimize dwell time at ports are placing greater emphasis on reliable handling systems. With growing attention to sustainability and operational efficiency, manufacturers are developing advanced solutions that not only boost productivity but also reduce emissions and meet changing environmental standards. The market covers a variety of equipment types, including yard trucks, gantry cranes, straddle carriers, terminal tractors, top and side handlers, reach stackers, and forklifts. Cranes and loaders are essential for managing bulk commodities such as steel, lumber, cement, and salt, ensuring swift loading and unloading from ships, trains, and trucks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.2 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 3.6% |

In 2024, the bulk material handling equipment segment generated USD 7.3 billion. This category includes conveyors, hoppers, silos, reclaimers, ship loaders and unloaders, and various types of cranes tailored to bulk operations. The growing volume of international trade and the continued development of industrial infrastructure are fueling the demand for efficient systems.

The diesel-powered equipment segment held a 40.9% share in 2024, generating USD 7.5 billion. Diesel engines remain the preferred choice for high-capacity operations due to their superior torque performance at lower RPMs and robust design. Ports continue to rely on diesel-powered machinery because of their established fueling infrastructure and the engines' proven capability in managing fully loaded containers and massive cargo volumes under demanding conditions. Their ability to operate continuously makes them an integral part of heavy-duty port applications.

Europe Shipping and Port Material Handling Equipment Market held a 27% share in 2024. This region hosts several of the world's busiest ports and remains a leader in adopting innovative practices aimed at boosting operational efficiency. The industry here is heavily investing in modernizing terminal equipment, adopting digital tools, and deploying automation and IoT-enabled solutions to optimize logistics. These technological enhancements help reduce human error, increase cargo throughput, and align with green port initiatives to cut emissions.

Key players shaping the Global Shipping and Port Material Handling Equipment Market include Konecranes, TIL Limited, Toyota Material Handling, Liebherr Group, and others. Major players are investing heavily in automation, AI, and IoT integration to enhance the performance, safety, and reliability of port machinery. They are focusing on developing modular and electric-powered equipment to reduce environmental impact while offering flexible solutions for modern port layouts. Strategic alliances with logistics providers and port authorities are helping manufacturers secure long-term contracts and expand their global footprint. Companies are also upgrading existing equipment lines with telematics and remote diagnostics to offer predictive maintenance and lower downtime.