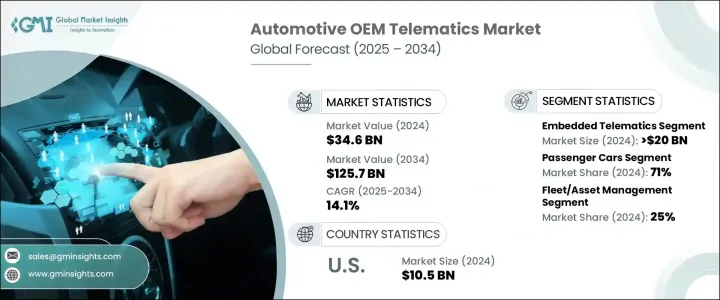

세계의 자동차 OEM 텔레매틱스 시장 규모는 2024년에 346억 달러로 평가되었고, 2034년에는 1,257억 달러에 이를 것으로 추정되며, CAGR 14.1%로 성장할 전망입니다.

이러한 성장은 차량 내 연결성, 편의성 및 스마트 기능에 대한 소비자의 기대가 높아짐에 따라 촉진되고 있습니다. 소비자들은 차량에 통합 내비게이션, 인포테인먼트, 실시간 진단, 음성 명령, 원격 액세스 기능 등을 요구하고 있습니다. 자동차 제조사들은 이러한 요구를 충족시키기 위해 차량에 고급 텔레매틱스 시스템을 직접 내장해 디지털 연결 플랫폼으로 변모시키고 있습니다. IoT 기술과 스마트폰의 통합으로 차량은 빠르게 상호 작용이 가능한 소프트웨어 기반의 허브로 변모하고 있습니다. 스마트 모빌리티가 추진력을 얻으면서 OEM 업체들은 내장형 텔레매틱스를 활용하여 운전 경험을 개선하고 차량 구매 순간부터 즉각적인 연결성을 제공하고 있습니다. 이러한 변화로 인해 내장형 텔레매틱스는 단순한 부가가치 기능이 아닌 신차 설계의 핵심 구성 요소가 되었습니다.

전 세계 정부는 엄격한 안전 및 추적 규정을 시행하여 OEM이 공장에서 텔레매틱스 시스템을 설치하도록 촉진하고 있습니다. 다양한 의무 규정은 모든 신차에 긴급 경보 및 자동 충돌 알림 기능을 지원하도록 요구하고 있습니다. 인도, 브라질, 러시아, EU 국가 등 여러 국가에서 이러한 법안들이 통과됨에 따라 커넥티드 안전 기술이 전 세계 표준으로 자리잡게 되어 제조업체들이 텔레매틱스 통합을 우선 과제로 삼게 되었습니다. 이로 인해 이러한 정부 조치들은 공공 안전을 강화하는 동시에 소비자 인식과 수용도를 확대하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 346억 달러 |

| 예측 금액 | 1,257억 달러 |

| CAGR | 14.1% |

내장형 텔레매틱스 부문은 개조형 대안에 비해 원활하고 안전하며 고성능의 솔루션을 제공하여 2024년에 200억 달러의 매출을 달성했습니다. 차량의 아키텍처에 직접 내장된 이 시스템은 지속적인 모니터링, OTA 업데이트, 원격 진단 및 실시간 데이터 수집을 지원합니다. 자동차 제조업체들은 차량 데이터에 대한 더 엄격한 제어, 더 나은 시스템 호환성, 독점적인 차량 기술과의 통합을 이유로 이러한 내장형 플랫폼을 선호합니다. 더 많은 차량이 소프트웨어 중심이 되면서, 소비자들이 차량을 구입한 첫날부터 즉각적인 연결성과 스마트 기능을 선호하는 경향이 촉진되어 기본으로 설치된 텔레매틱스에 대한 수요가 계속 증가하고 있습니다.

2024년에는 승용차 부문이 71%의 점유율을 차지할 것으로 예상됩니다. 연결성은 더 이상 고급 차량에만 국한되지 않으며, 소형차, SUV 및 세단에도 공장에서 통합 텔레매틱스가 점점 더 많이 장착되고 있습니다. 엔트리급 모델에도 실시간 성능 추적, OTA 소프트웨어 기능 및 원격 서비스 기능이 포함될 것으로 예상됩니다. OEM은 일상적인 주행에서 생성된 데이터를 활용하여 맞춤형 인포테인먼트 서비스, 예측 유지보수 및 행동 기반 인사이트를 제공하여 고도로 맞춤화된 소유 경험을 제공하는 동시에 반복적인 수익원을 확보하고 있습니다.

미국의 자동차 OEM 텔레매틱스 시장은 2024년에 105억 달러를 창출하여 88%의 점유율을 차지했습니다. 주요 미국 OEM들은 내부 개발과 전략적 기술 제휴를 통해 텔레매틱스 역량을 강화하고 있습니다. 이러한 노력은 진단, 실시간 업데이트, 차량 건강 모니터링, 운전 보조 기능 등 연결된 서비스 제공을 지원합니다. 구독 모델이 점점 더 보편화됨에 따라 자동차 제조업체들은 텔레매틱스 데이터를 신뢰할 수 있는 수익 채널로 전환하여 통합 디지털 시스템의 전략적 가치를 강화하고 있습니다.

세계의 자동차 OEM 텔레매틱스 산업을 적극적으로 형성하고 있는 주요 기업으로는 Tesla, Continental, Mercedes-Benz Group, Robert Bosch, Toyota Motor, Hyundai Motor Company, BMW Group, Ford Motor Company, General Motors, and Volkswagen Group 등이 있습니다. 자동차 OEM 텔레매틱스 시장에서 기업들은 경쟁력을 강화하고 시장 입지를 확대하기 위해 다양한 전략을 채택하고 있습니다. 주요 접근 방식 중 하나는 텔레매틱스를 차량 플랫폼에 직접 통합하여 사용자 경험을 향상시키고 첫날부터 원활한 연결을 보장하는 공장 설치형 솔루션을 제공하는 것입니다. 자동차 제조업체들은 또한 무선 업데이트, 진단 및 데이터 기반 서비스를 지원하는 독점 소프트웨어 생태계에 투자하고 있습니다. 기술 기업 및 클라우드 서비스 제공업체와의 전략적 협력을 통해 확장 가능하고 안전한 텔레매틱스 인프라를 구축할 수 있습니다.

The Global Automotive OEM Telematics Market was valued at USD 34.6 billion in 2024 and is estimated to grow at a CAGR of 14.1% to reach USD 125.7 billion by 2034. This growth is fueled by increasing consumer expectations for in-vehicle connectivity, convenience, and smart features. Buyers now demand integrated navigation, infotainment, real-time diagnostics, voice commands, and remote access capabilities in their vehicles. Automakers are meeting this demand by embedding advanced telematics systems directly into their vehicles, transforming them into digitally connected platforms. The integration of IoT technology and smartphones is rapidly reshaping vehicles into interactive, software-driven hubs. As smart mobility gains momentum, OEMs are leveraging embedded telematics to enhance the driving experience and deliver instant connectivity from the moment a vehicle is purchased. This shift has made built-in telematics not just a value-add but a key component of new vehicle design.

Governments worldwide are driving OEMs toward factory-installed telematics systems by enforcing strict safety and tracking regulations. Various mandates require all new vehicles to be equipped with features that support emergency alerts and automatic crash notifications. These legislative moves across countries such as India, Brazil, Russia, and EU nations are establishing connected safety technologies as a global standard, encouraging manufacturers to make telematics integration a priority. As a result, these government actions are not only enhancing public safety but also broadening consumer awareness and acceptance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.6 Billion |

| Forecast Value | $125.7 Billion |

| CAGR | 14.1% |

The embedded telematics segment generated USD 20 billion in 2024, by offering a seamless, secure, and high-performance solution compared to retrofit alternatives. Built directly into the vehicle's architecture, these systems support continuous monitoring, OTA updates, remote diagnostics, and data gathering in real-time. Automakers prefer these embedded platforms due to their tighter control over vehicle data, better system compatibility, and integration with proprietary vehicle technology. As more vehicles become software-oriented, the demand for natively installed telematics continues to increase, driven by consumer preferences for instant connectivity and smart features from day one.

The passenger vehicles segment accounted for 71% share in 2024. Connectivity is no longer limited to luxury vehicles-compact cars, SUVs, and sedans are increasingly outfitted with integrated telematics from the factory. Even entry-level models are expected to include real-time performance tracking, OTA software capabilities, and remote service features. OEMs are tapping into data generated from daily driving to craft tailored infotainment services, predictive maintenance, and behavior-based insights, allowing for highly customized ownership experiences while unlocking recurring revenue streams.

United States Automotive OEM Telematics Market generated USD 10.5 billion in 2024, which held an 88% share. Leading American OEMs are enhancing their telematics capabilities through both in-house development and strategic technology alliances. These initiatives support the delivery of connected services, including diagnostics, real-time updates, vehicle health monitoring, and driver assistance features. With subscription models increasingly prevalent, automakers are transforming telematics data into dependable income channels, reinforcing the strategic value of integrated digital systems.

Key players actively shaping the Global Automotive OEM Telematics Industry include Tesla, Continental, Mercedes-Benz Group, Robert Bosch, Toyota Motor, Hyundai Motor Company, BMW Group, Ford Motor Company, General Motors, and Volkswagen Group. In the automotive OEM telematics market, companies are adopting multiple strategies to reinforce their competitive positioning and expand market presence. A key approach involves integrating telematics directly into vehicle platforms to deliver factory-installed solutions that enhance user experience and ensure seamless connectivity from day one. Automakers are also investing in proprietary software ecosystems that support over-the-air updates, diagnostics, and data-driven services. Strategic collaborations with tech firms and cloud service providers enable scalable and secure telematics infrastructure.