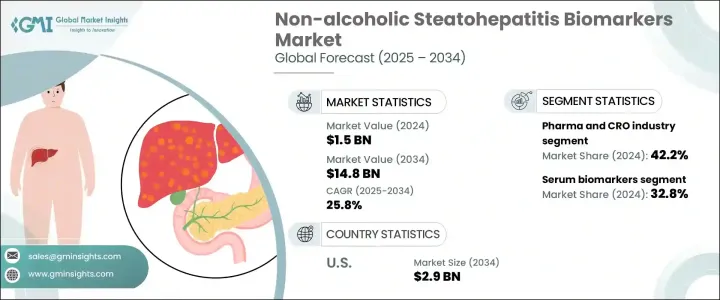

세계의 비알코올성 지방간염 바이오마커 시장은 2024년에 15억 달러로 평가되었으며 CAGR 25.8%로 성장하여 2034년에는 148억 달러에 이를 것으로 추정됩니다.

NASH 바이오마커는 비알코올성 지방 간 질환(NAFLD)에서 진화하는 심각한 간 질환인 NASH의 존재와 진행을 평가하는 데 도움이 되는 생물학적 지표입니다. 의료 제공자들은 조기 발견과 적극적인 개입을 점점 우선시하고 있으며, 이러한 바이오마커 수요는 상당히 높아지고 있습니다. 적극적인 간질환 스크리닝의 추진은 위험한 집단을 대상으로 한 임상적 권고의 진화에 의해 더욱 강화되고 있습니다. 여기에는 NASH를 발병하기 쉬운 비만이나 2형 당뇨병과 같은 대사 이상이 있는 사람이 포함됩니다.

간 관련 합병증에 대한 인식이 증가함에 따라 건강 관리 시스템은 환자 결과를 개선하기 위해 바이오 마커 기반 진단 전략을 통합하고 있습니다. 이러한 도구는 질병의 진행을 모니터링하고, 치료 효과를 평가하고, 새로운 치료법의 혜택을 받기 쉬운 환자를 확인할 수 있는 가능성을 제공합니다. 맞춤형 의료에서 바이오마커의 역할은 간질환의 진단·관리 방법에 큰 변화를 가져오고 있습니다. 낮은 침습적 방법이 선호되고 임상 연구에서 정밀 진단의 채택이 증가함에 따라 현대 건강 관리에서 NASH 바이오 마커의 중요성이 더욱 커지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 15억 달러 |

| 예측 금액 | 148억 달러 |

| CAGR | 25.8% |

시장은 바이오 마커유형별로 산화 스트레스 바이오 마커, 간 섬유증 바이오 마커, 혈청 바이오 마커, 아폽토시스 바이오 마커 등으로 구분됩니다. 덧붙여 혈청 바이오마커가 2024년에 32.8%를 차지했고, 매출에서 최대의 점유율을 차지했습니다. 이 부문의 우위성은 주로, 혈액 샘플링의 간편성, 비침습적인 순서, 진단, 모니터링, 예후에 자주 사용되는 것입니다. 혈청 기반 바이오마커는 간세포 독성과 질병 진행과 관련된 다른 세포 반응을 감지하여 간 건강 상태에 대한 중요한 통찰력을 제공하는 것으로 인식되고 있습니다.

최종 용도의 관점에서 시장은 제약 및 CRO(의약품 개발 업무 수탁 기관) 업계, 병원, 진단 실험실, 학술 연구 기관으로 나눌 수 있습니다. 제약 및 CRO 업계는 2024년에는 전체 매출의 42.2%를 창출해 주도적인 지위를 차지하고 있습니다. 이러한 이점은 업계가 신약, 임상시험의 층별화, 치료 모니터링을 위한 효과적인 바이오마커에 강하게 의존한다는 것을 반영합니다. 의약품 개발기업이 치료제 후보의 개발기간 단축과 정밀도 향상을 목표로 하는 가운데, 바이오마커는 개발 사이클 전반에 걸쳐 유효성과 안전성을 평가하는데 있어서 필수적이 되고 있습니다. 한편 CRO는 바이오마커의 검증 및 시험을 위한 기술적, 규제적 전문지식을 제공함으로써 이러한 노력을 지원하고 있습니다. CRO의 참여는 바이오마커의 발견에서 임상적 응용으로의 전환을 효율화하고 표적 치료의 개발을 강화하고 시장의 급성장에 기여하고 있습니다.

지역적으로 미국은 NASH 바이오마커 분야의 주요 성장 엔진으로 부상하고 있습니다. 미국 시장만으로도 2024년에는 3억880만 달러로 평가되었고, 2034년에는 약 29억 달러로 급증할 것으로 예측되고 있습니다. 간 질환의 부담이 증가하고 있는 것, 고도의 진단 기술을 서포트할 수 있는 견고한 헬스 케어 인프라가 정비되고 있는 것 등, 몇개의 요인이 이 큰 궤도의 요인이 되고 있습니다. 노인은 만성 간 질환의 위험이 높고 적시에 진단 개입이 필요하기 때문입니다. 비침습적인 솔루션에 대한 주목과 함께, 건강 관리에서 진단에 대한 투자가 증가하고 있는 것도 바이오마커 기술 수요를 더욱 끌어올리고 있습니다. 정확하고 조기 발견 도구에 대한 요구는 전례 없이 높아지고 있으며, 미국은 급속한 기술 진보와 차세대 검사 프로토콜의 통합으로 이 수요에 부응하는 최전선에 있습니다.

NASH 바이오마커 시장 경쟁 구도는 여전히 합리적으로 단편화되고 있습니다. 이 분야를 전진시키고 있습니다. 다중화 플랫폼과 AI 통합 분석 등의 혁신은 임상과 연구의 두 장면에서 바이오마커 데이터를 수집, 해석, 적용하는 방법을 변화시키고 있습니다.

The Global Non-alcoholic Steatohepatitis Biomarkers Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 25.8% to reach USD 14.8 billion by 2034. NASH biomarkers are biological indicators that help evaluate the presence and progression of NASH, a severe liver condition that evolves from non-alcoholic fatty liver disease (NAFLD). As healthcare providers increasingly prioritize early detection and targeted interventions, the demand for such biomarkers has grown considerably. The push for proactive liver disease screening is further reinforced by evolving clinical recommendations targeting at-risk populations. This includes individuals with metabolic disorders such as obesity and type 2 diabetes, who are more likely to develop NASH.

As awareness of liver-related complications continues, healthcare systems are integrating biomarker-based diagnostic strategies to improve patient outcomes. These tools offer the potential to monitor disease progression, assess treatment efficacy, and identify patients most likely to benefit from emerging therapies. Their growing role in personalized medicine drives a significant shift in how liver diseases are diagnosed and managed. Increasing preference for minimally invasive methods and growing adoption of precision diagnostics in clinical research have further cemented the importance of NASH biomarkers in modern healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $14.8 Billion |

| CAGR | 25.8% |

The market is segmented by biomarker type into oxidative stress biomarkers, hepatic fibrosis biomarkers, serum biomarkers, apoptosis biomarkers, and others. Among these, serum biomarkers accounted for the largest share of revenue, contributing 32.8% in 2024. This segment's dominance is primarily due to the convenience of blood sampling, non-invasive procedures, and their frequent use in diagnosis, monitoring, and prognosis. Serum-based biomarkers are recognized for offering vital insights into liver health by detecting hepatocyte injury and other cellular responses linked to disease progression. Their application across both clinical settings and research environments adds to their widespread utility and market traction.

In terms of end use, the market is divided into the pharmaceutical and contract research organization (CRO) industry, hospitals, diagnostic laboratories, and academic research institutes. The pharmaceutical and CRO industry held the leading position in 2024, generating 42.2% of the overall revenue. This dominance reflects the industry's strong reliance on validated biomarkers for drug discovery, clinical trial stratification, and treatment monitoring. As drug developers seek to accelerate timelines and increase the precision of their therapeutic candidates, biomarkers have become essential in assessing efficacy and safety throughout the development cycle. CROs, on the other hand, support these efforts by offering technical and regulatory expertise for biomarker validation and testing. Their involvement has streamlined the transition from biomarker discovery to clinical application, bolstering the development of targeted treatments and contributing to faster market growth.

Geographically, the United States has emerged as a key growth engine within the NASH biomarkers space. The US market alone was valued at USD 308.8 million in 2024 and is anticipated to surge to approximately USD 2.9 billion by 2034. Several factors contribute to this significant trajectory, including a rising burden of liver-related conditions and a robust healthcare infrastructure capable of supporting advanced diagnostic technologies. The growing aging population is also a major driver, as older individuals face a higher risk of chronic liver diseases and require timely diagnostic interventions. Increasing healthcare investments in diagnostics, coupled with a focus on non-invasive solutions, are further driving demand for biomarker technologies. The need for accurate and early detection tools has never been greater, and the US is at the forefront of meeting this demand with rapid technological advancements and integration of next-generation testing protocols.

The competitive landscape of the NASH biomarkers market remains moderately fragmented. A mix of specialized biomarker firms and diagnostic solution providers is actively shaping the space, with leading players collectively capturing around 40% of the total market share. These companies are advancing the field by incorporating novel technologies and forming partnerships aimed at enhancing precision medicine capabilities. Innovations such as multiplexed platforms and AI-integrated analytics are transforming how biomarker data is collected, interpreted, and applied in both clinical and research settings. As the market continues to evolve, technological upgrades and cross-industry collaborations are expected to accelerate the adoption of more efficient, scalable, and patient-centered biomarker solutions.