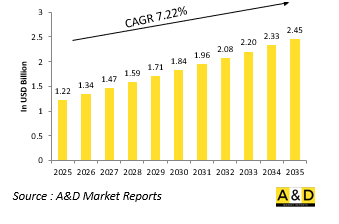

세계 해군 수상함 시뮬레이션 시장 규모는 2025년에 12억 2,000만 달러, 2035년에는 24억 5,000만 달러에 달할 것으로 예상되며, 예측 기간인 2025-2035년 7.22%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다.

해군 수상함 시뮬레이션은 현대 해상 훈련 및 작전 준비의 핵심 요소입니다. 이 시뮬레이션은 해상 안보, 전력 투사, 대지 및 대공전, 호위 작전, 인도적 지원 등 광범위한 작전을 포괄하는 수상함대의 복잡한 작전을 재현하도록 설계되었습니다. 갈수록 다양해지는 해군 위협과 현대 수상함의 다면적인 역할로 인해 기존 훈련을 넘어서는 훈련 환경이 요구되고 있습니다. 시뮬레이션은 승조원들이 현실적인 조건에서 항해 및 지휘 의사결정, 전술적 조정을 개선할 수 있는 고도로 통제되고 비용 효율적이며 반복 가능한 환경을 제공합니다. 전 세계적으로 해군 역량 강화를 추진하는 가운데, 시뮬레이션은 함대 육성과 전투태세 유지에 있어 필수적인 요소로 자리 잡았습니다. 해군은 시뮬레이션을 개별 승조원 교육뿐만 아니라 통합된 태스크 그룹 훈련에도 활용하고 있으며, 여러 함정 및 지역에서 동기화된 작전을 수행할 수 있도록 지원하고 있습니다. 시뮬레이션을 통해 장병들은 고위험 시나리오에 안전하게 대비하고, 기술 업그레이드에 적응하며, 장기 배치 중에도 원활하게 행동할 수 있도록 돕습니다. 해상 작전에서 항공, 수상, 수중 플랫폼의 협력이 점점 더 중요해지고 있기 때문에 시뮬레이션은 평시부터 분쟁 시까지 해군의 모든 작전을 가정한 훈련과 리허설을 위한 통합된 프레임워크를 제공합니다.

기술 혁신은 해군의 수상함 운영 시뮬레이션의 범위와 현실성을 재정의하고 있습니다. 최신 플랫폼은 해상 상황, 시야 문제, 환경적 위험 등 해상 조건을 정확하게 재현하는 고해상도 가상 환경을 활용하고 있습니다. 통합된 함교 시뮬레이터는 선박 제어, 레이더 해석, 혼잡한 수로 및 분쟁 중인 수로에서의 항해를 사실적으로 표현합니다. 첨단 AI를 사용하여 적함의 기동, 미사일 궤도, 전자전 상황 등 역동적인 위협을 모델링할 수 있습니다. 시뮬레이션 시스템에는 해군 위협의 하이브리드적 성격을 반영하기 위해 사이버 침투, 전자적 대응책 등의 요소를 통합할 수 있도록 하고 있습니다. 선상 정비 훈련, 손상 제어 훈련, 화재 진압 시뮬레이션을 강화하기 위해 AR/MR 도구가 채택되고 있으며, 승조원을 위험에 빠뜨리지 않고 실제와 같은 경험을 제공할 수 있게 되었습니다. 네트워크화된 시뮬레이터는 여러 함정 유닛 간의 실시간 협업을 가능하게 하여, 연계된 함대 훈련, 통합 작전 부대 훈련, 다중 영역 리허설을 지원합니다. 또한, 모듈식 소프트웨어 아키텍처를 통해 새로운 함정급, 무기체계, 작전 절차가 도입되더라도 시뮬레이션 프로그램을 쉽게 업데이트할 수 있습니다. 이러한 기술적 진보는 훈련 성과를 향상시킬 뿐만 아니라 지휘관에게 전투 및 비전투 해상 시나리오에서 작전 계획, 시스템 테스트, 작전 보고에 사용할 수 있는 귀중한 도구를 제공합니다.

해양 안보, 해군 현대화, 다중 도메인 작전에 대한 전 세계적인 관심으로 인해 해군 수상함의 시뮬레이션 채택이 가속화되고 있습니다. 해상 교전부터 연안 작전까지 수상함의 역할이 점점 더 복잡해짐에 따라, 훈련은 다양한 위협과 상황에 대응할 수 있도록 진화해야 합니다. 시뮬레이션은 실제 함정을 훈련에 파견하는 데 따르는 비용과 물류 문제 없이 충실도 높은 훈련을 수행할 수 있는 능력을 제공합니다.

세계의 해군 수상함 시뮬레이션 시장에 대해 조사 분석했으며, 성장 촉진요인, 향후 10년간의 전망, 지역별 동향 등의 정보를 전해드립니다.

지역별

유형별

용도별

컴포넌트별

북미

성장 촉진요인, 억제요인, 과제

PEST

주요 기업

공급업체 Tier 상황

기업 벤치마킹

유럽

중동

아시아태평양

남미

미국

방위 프로그램

최신 뉴스

특허

캐나다

이탈리아

프랑스

독일

네덜란드

벨기에

스페인

스웨덴

그리스

호주

남아프리카공화국

인도

중국

러시아

한국

일본

말레이시아

싱가포르

브라질

The Global Naval Surface Vessels Simulation market is estimated at USD 1.22 billion in 2025, projected to grow to USD 2.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.22% over the forecast period 2025-2035.

Naval surface vessels simulation has become a core element of modern maritime training and operational readiness. These simulations are designed to replicate the complexities of surface fleet operations, which encompass a wide range of missions including maritime security, power projection, anti-surface and anti-air warfare, escort duties, and humanitarian support. The increasing diversity of naval threats, combined with the multifaceted roles of modern surface vessels, demands training environments that go beyond conventional drills. Simulation offers a highly controlled, cost-efficient, and repeatable setting in which crews can refine navigation, command decision-making, and tactical coordination under realistic conditions. The global push for enhanced naval capabilities has made simulation essential for both fleet development and maintenance of combat readiness. Naval forces are leveraging simulation not only for individual crew instruction but also for integrated task group training, allowing for synchronized operations across multiple ships and domains. Simulation ensures that personnel can safely prepare for high-risk scenarios, adapt to technological upgrades, and maintain procedural fluency during extended deployments. As maritime operations increasingly involve coordination across air, surface, and underwater platforms, simulation provides the connective framework to train and rehearse for the full spectrum of naval engagements in peacetime and conflict.

Technological innovation is redefining the scope and realism of simulation in naval surface vessel operations. Modern platforms now utilize high-resolution virtual environments that accurately replicate maritime conditions, including sea states, visibility challenges, and environmental hazards. Integrated bridge simulators provide realistic representations of ship control, radar interpretation, and navigation in busy or contested waterways. The use of advanced artificial intelligence allows for dynamic threat modeling, including enemy ship maneuvers, missile trajectories, and electronic warfare scenarios. Simulation systems can now incorporate elements such as cyber intrusions and electronic countermeasures to reflect the hybrid nature of naval threats. Augmented and mixed reality tools are increasingly being adopted to enhance onboard maintenance training, damage control drills, and fire-fighting simulations, offering hands-on experience without putting crews at risk. Networked simulators enable real-time collaboration between multiple ship units, supporting coordinated fleet training, joint task force exercises, and multi-domain rehearsals. Modular software architectures also allow simulation programs to be easily updated as new ship classes, weapons systems, or operational procedures are introduced. These technological advancements not only improve training outcomes but also provide commanders with valuable tools for mission planning, system testing, and operational debriefing in both combat and non-combat maritime scenarios.

The global focus on maritime security, naval modernization, and multi-domain operations is accelerating the adoption of simulation for naval surface vessels. As the roles of surface ships become increasingly complex-ranging from open-sea engagements to littoral missions-training must evolve to address a wide spectrum of threats and scenarios. Simulation offers the ability to conduct high-fidelity training without the cost and logistical challenges of deploying actual ships for exercises. It also addresses the growing need for training standardization across multinational forces, especially in regions where joint naval operations and coalition deployments are frequent. The rising tempo of naval operations and shorter crew rotations mean there is less time for traditional onboard training, pushing simulation to the forefront of readiness strategies. Another key factor is the integration of new technologies and weapon systems into naval fleets, requiring crews to familiarize themselves with advanced platforms without disrupting active missions. Simulation ensures smooth transitions by offering risk-free environments for procedural practice and mission rehearsals. Additionally, simulation plays a vital role in supporting strategic deterrence, enabling fleet commanders to test naval strategies and response plans against a range of emerging threats, from surface engagements to cyber and electronic warfare.

Regional approaches to naval surface vessels simulation reflect a diverse set of priorities and operational realities. In North America, simulation is a mature capability embedded into naval doctrine, supporting everything from ship handling and damage control to battle group coordination and multi-threat scenario planning. Emphasis is placed on replicating high-threat environments to ensure rapid adaptability and tactical superiority. European nations focus on interoperability and joint mission planning, using simulation to reinforce coordination among allies and standardize response procedures in shared maritime zones. This regional trend also supports rapid integration of new naval assets into existing fleets. In the Asia-Pacific, the focus is on expanding naval presence and securing vast maritime domains, leading to significant investments in simulation to train crews for blue-water operations, anti-piracy missions, and high-stakes regional disputes. Middle Eastern navies prioritize simulation for patrol vessel operations, coastal defense, and maritime interdiction, often in collaboration with international partners. In Latin America and Africa, simulation is increasingly seen as a force multiplier, enabling training scalability and preparedness even with limited access to live assets. Through partnerships and technology transfers, these regions are gradually building their simulation capabilities to support both national defense and cooperative maritime security efforts.

GE Aerospace has been awarded a contract to supply equipment for the Republic of Korea Navy's (ROKN) PKX-B Batch-II patrol boat program. Under the agreement, the U.S.-based company will provide eight additional LM500 marine gas turbine engines. These engines will be produced at GE's facility in Lynn, Massachusetts, and then delivered to Hanwha Aerospace for final assembly and testing before being installed on the patrol vessels. Hanwha Aerospace plays a key role in the program, not only assembling the engines but also co-manufacturing components and offering long-term support, including spare parts and maintenance services throughout the vessels' operational life. The PKX-B Batch-II patrol boats are designed to strengthen the ROKN's coastal defense capabilities, offering enhanced speed, agility, and firepower for operations in littoral and near-shore environments.

By Region

By Type

By Application

By Component

The 10-year Global Naval Surface Vessels Simulation Market in defense analysis would give a detailed overview of Global Naval Surface Vessels Simulation Market in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

The 10-year Global Naval Surface Vessels Simulation Market in defense forecast of this market is covered in detailed across the segments which are mentioned above.

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Hear from our experts their opinion of the possible analysis for this market.