Autonomous Driving Competition & Benchmarking of Carmakers, ADAS Supplier and Start-ups

Key questions this report answers:

- 1. What are the most promising opportunities in Autonomy by Market Potential and Readiness?

- 2. Which car market is leading the race to Full-Autonomy? What is the outlook?

- 3. What are the roadmaps of Carmakers in ADAS? What is their Strategy, Technology & Readiness?

- 4. Which suppliers hold the largest market shares and have the best Technology or Strategy?

- 5. Which start-ups attract funding and solve key challenges in the digital transition?

The complete guide to help you discover big opportunities for new revenue pools as Autonomous Driving competition intensifies

This report examines the leaders and followers across carmakers, suppliers and emerging start-ups in the ADAS and Autonomous Driving race.

Competition in ADAS and Autonomous Driving is fierce among carmakers, suppliers and new entrants to:

- monetize the rising sensor content,

- respond to the need for data and compute

- utilize software-defined vehicles

Key questions this report answers:

- 1. What are the most promising opportunities in Autonomy by Market Potential and Readiness?

- 2. Which car market is leading the race to Full-Autonomy? What is the outlook?

- 3. What are the roadmaps of Carmakers in ADAS? What is their Strategy, Technology & Readiness?

- 4. Which suppliers hold the largest market shares and have the best Technology or Strategy?

- 5. Which start-ups attract funding and solve key challenges in the digital transition?

Who is this report for:

- 1. Market Intelligence and Strategy functions in global carmakers and suppliers

- 2. Innovation teams and R&D

- 3. Engineering teams

- 4. Investors and investment professionals

- 5. Software development professionals

- 6. Regulators, policy-makers and other stakeholders

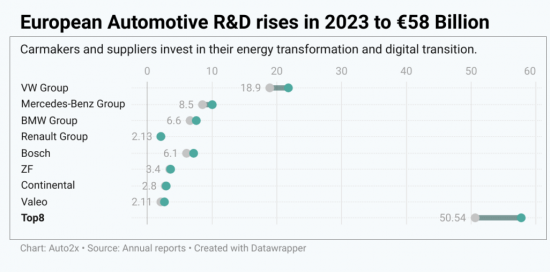

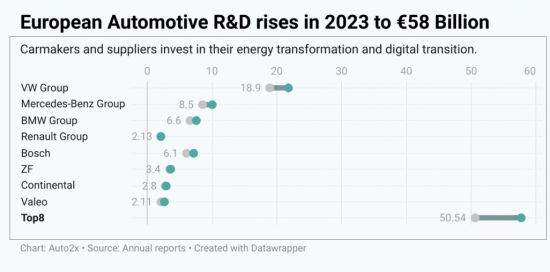

European Automotive R&D is increasing to respond to plans for EV, AD, and Software

Research & Development spending is increasing as carmakers and suppliers invest in their energy transformation and digital transition.

- The four biggest European Automotive Suppliers, Bosch, Continental, Valeo and ZF, increased their R&D cost by 13% in 2023 to Euro 16.3 Billion, from Euro 14.4 in 2022.

- The cumulative R&D spent from the VW Group, BMW Group, Mercedes-Benz and Renault Group rose by 15% in 2023 to Euro 41.5 Billion, from Euro 36.2 Billion in 2022.

New Sensors for Level 3-Level 4 Autonomy, Supercomputers & Autonomous Driving Software are becoming new battlefronts

Automated Driving revenue will grow from Euro 19.3 Billion in 2020 to Euro 35 Billion in 2025, finds Auto2x.

ADAS sensors, such as radar, camera and ultrasonics, and ADAS features account for the majority of Automated Mobility's revenues today for carmakers, suppliers, and other stakeholders.

- By 2030, 67% of vehicles sold globally will have at least Level 2 and 3 autonomous driving capability. We expect only 25% of these vehicles to have Level 4 and under 5% to have Level 5 full automation capabilities.

- ADAS Average Content per Vehicle in 2020 ranged from Euro 489 for Level 2 with 17 sensors per car, to Euro 960-Euro 2.100 for Level 3, depending on the usage of lidar for redundancy.

- Lidar, supercomputers and Automated Driving-Domain Controllers to support Lv.3-4 Automated Driving will also become substantial revenue pools.

Who is leading Computer Vision innovation for Autonomous?

The progress in Automated Driving technology and its wider adoption will unlock new earnings from novel "features". We also expect that Autonomy will attract revenues from 8 new industries.

Focus on reduction of computational complexity, fusion and simulation

NVIDIA, Intel, Magna, Tesla are among the automotive players with the highest number of published patent filings in Computer Vision for Autonomous Driving in the US in 2023. Patents filings grew with 12% CAGR between 2020 and 2022.

New opportunities in Software-Defined Vehicles

What are some key new Software-driven features with high potential?

Software represented around 10% of overall vehicle content in 2018 for a D-segment car ($1,220) & it will grow with CAGR 11% to reach 30% ($5,200) in 2030. Major Tier-1 Suppliers are already monetizing the growth in ADAS Sensor content.

In the 2020s, the vehicle's software value will exceed that of hardware as carmakers shift to more common platforms to achieve cost savings. What's more, the software will be crucial for product differentiation such as new features, content, and new personalized experiences.

The shift of value to software will shape a new Software-based revenue model for Automated Mobility as existing players are forced to shift away from vertically integrated, asset-heavy business models to compete with new entrants. The economics of software are a strong fit for volume OEMs.

Software is the answer to the Digitization of the Automotive Industry but delivery is challenging.

Learn about top innovation clusters across major technological building blocks of SDVs:

- EE Architectures: Assess the roadmaps of leading carmakers and suppliers in the development of centralized architectures and their partnerships;

- CarOS: Learn about the rising adoption of Google's Android Automotive OS and the competitive offerings from MBUX and other players;

- Open-source software development

- Cloud: the emergence of automotive cloud as an enabler for cloud-based ADAS development, development of offerings from carmakers and the role of Microsoft, Amazon among others;

- Over-the-Air-updates and the opportunities for features-on-demand;

- Digital Twin

Cars are becoming increasingly "Connected" with each other, the road infrastructure, our homes, and more, due to the rising penetration of embedded, tethered or integrated connectivity.

By 2030, more than 80% of cars will be Connected, with service value of more than $100 per vehicle.

But the Connected Car Services market is fragmented today, among other inefficiencies.

The integration of new services from providers of vehicle maintenance, parking, insurance, fleet management, analytics or other use cases, is costly and difficult.

What's more, the development of apps for in-vehicle infotainment faces challenges of scalability.

Design: Developers can utilize GenAi for simulation of scenarios and "edge cases", thus improving efficiency and performance. However, the regulatory landscape is not ready to provide clarity and requirements for robustness.

In-vehicle usage: Faraday Future's FF 91 will feature the brand's Generative AI Product Stack. Use cases include entertainment and social media. But, data quality, ethical guidelines and privacy policies are needed to filter out offensive or intrusive content.

Personalized Mobility: by personalizing the passenger's journey or traffic optimization. One of the main concerns is cyber security for these applications related to Intelligent Transportation Systems.

Carmakers have big plans for autonomous driving, but deployment strategies face delays

Fragmented deployment of Level 3 coming to the US and Germany in 2024

- Honda and Nissan launched Lv.3 in Japan only in 2021 leveraging the update of the UNECE regulation. Honda's Legend with L3 system called "Sensing Elite" went for sale in Mar'21 with justicles.

- Changan has L3 in China. Tesla has technical capability of L3+ in the US.

- BMW and Mercedes-Benz are launching Level 3 in 2023 in Germany & US

In this report, we analyse the strategies of global carmakers and provide insights on their technology and market leadership.

- Which models will feature Mercedes-Benz's Level-3 Autonomous Driving in 2024-2030?

- Which are the critical new sensors and technological building blocks to enable autonomy?

- How does Mercedes-Benz's Automated Driving strategy compare to Tesla?

- What should customers expect in terms of system capability and future improvements?

Which suppliers are better prepared for the new era of Autonomous Mobility?

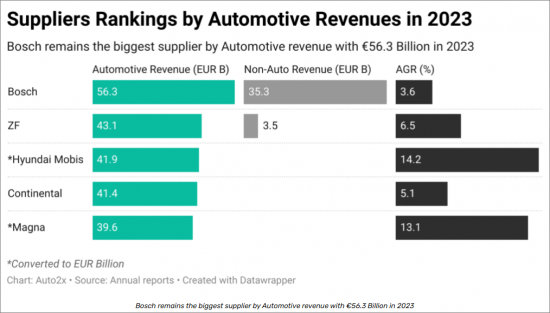

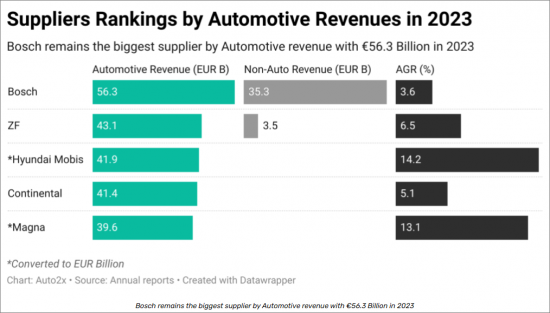

Which Automotive suppliers are leading the race to Autonomous Driving? Let's start with the basics, the ranking by Automotive Revenue.

Auto2x examined the revenues of the 15 biggest Automotive suppliers to derive the rankings by revenue. We excluded Non-Automotive revenue which includes Industrial, Consumer Goods, Energy and Building business units and more. We also focused on those suppliers with offerings in ADAS and Autonomous Driving.

The Top-15 Suppliers recorded Euro 360 Billion in Automotive revenue in 2023, found Auto2x.

Bosch remains 1st supplier with Euro 56 Billion, followed by ZF. Hyundai Mobis capitalized on its growth and the slowdown of Denso and Continental.

Out of the 15 Suppliers examined, 13 increased their Automotive Revenues in 2023, except for Denso and Panasonic.

Mitsubishi Electric recorded the strongest growth followed by Hyundai Mobis, APTIV and Forvia with 14% y-y.

The Top-4 Automotive Suppliers of ADAS are all European, Bosch, Valeo, ZF and Continental, according to Global ADAS Ranking by Revenues.

To assess the readiness of suppliers we quantify their technological competitiveness, their strategy execution and their market positioning.

We assessed the Top-20 ADAS Tier-1s, including Aptiv, Bosch, Continental, Denso, Mobileye, Valeo, ZF, in addition to Baidu, Alibaba, Amazon and others.

New ADAS Ranking unveils that ZF and Continental are among the suppliers who broke the Euro 2 Billion mark in ADAS revenues in 2023, but challenges remain.

The growth in automotive production and the higher sensor fitment for Level 2-3 systems benefited their ADAS sales and Order Books.

- ZF reported Euro 2.7 Billion revenue in Electronics & ADAS and Mobileye $2.1 Billion in 2023.

- ZF achieved 33% growth in ADAS revenues in 2022 to Euro 2.4 Billion, from Euro 1.8B in 2021. ZF ranked 3rd in the Global ADAS Ranking by Revenues in 2021 from Auto2x with an 11% market share.

- Continental saw 23% growth in ADAS sales to Euro 2.1 Billion in 2022, from Euro 1.7B in 2021. ADAS accounted for 11% of Continental's Automotive revenues.

Auto2x expects that the ADAS revenues from the Top-12 ADAS Suppliers will amount to Euro 35 Billion in 2025, demonstrating the growth potential of hardware and software business models.

But major automotive suppliers face further transformation to develop capabilities in AI and software, expand into software business models and face new competition

Could new entrants disrupt major ADAS Suppliers?

Traditional ADAS suppliers still maintain the lion's share in automotive. But they face competition from US, Chinese and other Tech giants who are capitalizing on their expertise in AI, Cloud and Software transforming automotive.

We have identified a number of opportunities for Tech Companies to enter or disrupt the existing supply chain.

- Next-gen Perception Hardware for Autonomous Driving:

- Computing, e.g. for Peta-ops chips for Autonomous Driving

- AI: AI for Autonomy and HMI such as in-car AI assistants

- Data-based Mobility Business models such as in-car e-commerce

- 5G-6G, Connected Infrastructure and Smart Cities

- Autonomous Shared Mobility: AMoD, autonomous deliveries

Baidu and INTEL lead the overall competitiveness, followed by Amazon.

- INTEL's Mobileye spearheads its Autonomous Driving strategy and has captured a large share in ADAS helping INTEL score higher than Baidu in Strategy Execution;

- Baidu offers competitive technology offering today due to Apollo's strengths

How regulation, innovation and consumer demand affect adoption?

Auto2x assesses that China will take over global leadership in Level 2-Autonomous Driving in 2025 with 1.70 million cars equipped with Traffic Jam Assist and Cruise Assist, ahead of Europe and the USA.

China benefits from the fast go-to-market strategy for advancements in Automated Driving technology, strong digital infrastructure, favourable regulation and positive consumer sentiment.

How is investment in Mobility start-ups progressing to solve key challenges in Autonomous Driving?

Early-stage funding in Automotive Start-ups, which includes Pre-Seed, Seed, A and B Series, amounted to $24 Billion between 2021 & Q1 2023.

Electric vehicles ($12B), Mobility business models ($6B) and autonomous vehicles ($6B) accounted for most of the funding. Funding in Web3, which supports the decentralization, privacy and transparency, rose from $29M in 2021 to $36M in 2022.

The 10 most notable funding rounds in Autonomous Driving came from the following entities:

- 1. Deeproute ($300M, L4 Autonomous Driving for Robotaxis and Trucks),

- 2. Didi Woya ($300M, L4 Autonomous Driving Robotaxis)

- 3. WeRide (300M, L4 Autonomous Driving Robotaxis

China leads funding with $12.9 Billion raised from 120 start-ups. European start-ups raised $3.2B, of which $1.0B went to Electric Vehicles and $0.7B for Autonomous Vehicles.

Listen to the interviews with buzzing start-ups Recogni and Actify

We sat down with R K Anand, Founder & Chief Product Officer, Recogni to discuss:

- Why computing is a key enabler for safer ADAS, as well as higher autonomy;

- Recogni's advantages in high performance, low-power consumption computational platforms for perception processing;

- How product fit and customer acquisition matter for Recogni's growth strategy

- Recogni's success story, milestones and growth velocity

Dave Opsahl, CEO Actify

- The need for digitalization of Program Management in the automotive industry to support the complexity and scalability of vehicle and parts manufacturing

- How Actify's software management & UX can help to overcome the resource constraints & support the fast transition to electrified mobility & networked driving

- Actify's go-to-market strategy, product-fit benefits and availability of solutions

Table of Contents

1. Opportunity Compass in Autonomous Driving

- Top Opportunities Radar in Autonomous Driving

- Rising ADAS Sensor Content

- Need for compute

- Opportunities from Software-Defined Vehicles

- AI-based Digital Products & New features

2. Deployment

3. Top 30 Carmakers in ADAS and Autonomous Driving

- 1. Audi

- 2. BAIC Motor

- 3. Bentley

- 4. BMW Group

- 5. BYD

- 6. CHANGAN

- 7. Chery

- 8. Mercedes-Benz

- 9. Dongfeng

- 10. Focus on Alfa Romeo, Fiat, Maserati & Jeep

- 11. FAW

- 12. Ford

- 13. Geely

- 14. General Motors: Cadillac and Chevy-Cruise

- 15. Great Wall

- 16. GUANGZHOU AUTOMOBILE GROUP (GAC)

- 17. Honda

- 18. Hyundai, KIA and Genesis

- 19. Jaguar Land Rover

- 20. Porsche

- 21. PSA

- 22. Renault-Nissan-Mitsubishi Alliance

- 23. Nissan & Infiniti

- 24. Renault

- 25. SAIC

- 26. Subaru

- 27. Tesla Motors

- 28. Toyota Motors: Lexus and Toyota

- 29. Volvo

- 30. VW & VW Group

4. Leading ADAS suppliers: analysis, portfolio & key figures

- 1. Aptiv (ex-Delphi Automotive)

- 2. Bosch

- 3. Continental

- 4. Denso

- 5. Hella

- 6. Hitachi

- 7. Magna

- 8. Mobileye

- 9. Valeo

- 10. Veoneer (ex-Autoliv's Electronics Segment)

- 11. Zenuity

- 12. ZF

- 13. ADAS Suppliers' Ranking in 2020 & ADAS Sensor outlook

- ADAS suppliers' revenue

- ADAS-to-Automotive Revenue for major Suppliers in 2020 and ranking for major suppliers.

- ADAS & Automated Driving adoption outlook up to 2025

- OEM & Supplier Consortiums for L3-5 platforms, AMoD and HD maps

- Outlook for ADAS radar, camera, Lidar, and ultrasonic components

- Overview of the ADAS component supplier ecosystem: Tier-1s, 2s and their portfolio

5. Emerging Start-ups

- Trends in Automotive Start-up Funding

- Start-up Ranking

- Interview with Founder & CPO, Recogni

- Interview with CEO, Actify