디지털화 및 산업 IoT(IIoT)는 산업 조직에 전례 없는 수준의 생산 효율과 유연성, 공급망 관리, 근로자 안전을 실현함으로써 극적으로 수익성을 높일 수 있게 했습니다. 이러한 목표를 추구하기 위해 산업 조직은 네트워크 인프라를 현대화하고 확장하여 정확하고 관련성이 높고 사용 가능한 데이터에 안전하고 적시에 액세스할 수 있어야합니다. 산업용 네트워킹 솔루션은 오늘날 계속해서 진화하는 연결 요구 사항을 달성하는 데 필수적일 뿐만 아니라 산업 기업 전체의 성능에 매우 중요합니다. 이 보고서는 제품 카테고리, 지역, 채널, 산업별 분류 및 예측을 포함한 산업용 네트워킹 인프라 구성 요소 세계 시장을 다룹니다.

|

|

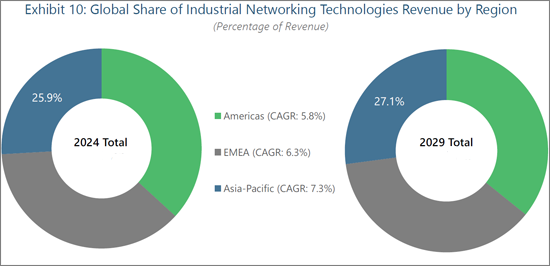

2024년에 산업용 네트워킹 기술에 대한 지출이 가장 컸던 것은 유럽, 중동 및 아프리카이었습니다(Exhibit 10). 이는 주로 EU 특유의 규제인 NIS2 지령의 영향으로 사이버 보안에 대한 관심이 높아져 제조자에게 안전한 네트워크 하드웨어나 소프트웨어에 대한 투자를 명확하게 요구하고 있는 것이 요인입니다. 또한 아시아태평양은 산업용 네트워크 컴포넌트 공급업체에게 최대의 수익 성장을 가져오는 지역이 됩니다. 이는 중국의 "Made in China 2025"와 일본의 "Society 5.0"과 같은 정부 주도의 대처를 비롯해 지역 내의 많은 국가들이 산업 및 제조 분야의 기술 혁신에 널리 임하고 있음을 반영하고 있습니다. 한편, 2024년 산업용 무선기술의 수익의 최대 점유율을 창출한 아메리카는 다른 지역에 비해 관세 관련 경제적 과제의 영향을 더 크게 받을 전망입니다. 또한 브라질, 인도, 세네갈과 같은 산업 경제가 급속히 발전하고있는 국가의 그린 필드 프로젝트는 예측 기간 동안 각 지역에서 충분한 성장 기회를 제공 할 전망입니다.

본 보고서에서는 세계 산업용 네트워킹 기술의 동향을 조사하여 시장 규모 추이와 예측, 유선/무선 산업, 지역별 상세 분석, 시장 영향요인 분석, 경쟁 구도, 주요 벤더프로파일 등을 정리했습니다.

Digitalization and the Industrial Internet of Things (IIoT) have enabled industrial organizations to dramatically increase profitability by realizing unprecedented levels of production efficiency and flexibility, supply chain control, and worker safety. To pursue such objectives, these organizations must modernize and extend their network infrastructure to facilitate secure, timely access to data that is accurate, relevant, and usable. Industrial networking solutions are not only critical to enable today's evolving connectivity requirements but are also vital to the performance of the entire industrial enterprise. This report covers the global market for industrial networking infrastructure components, including segmentations and forecasts by product category, geographic region, channel, and industry.

This report is intended for those making critical decisions regarding product development, partnerships, go-to- market planning, and competitive strategy and tactics. It is written for executives, senior managers, and other decision-makers involved in the development, deployment, marketing, management, or sales of industrial networking infrastructure components, including those in the following roles:

|

|

Digital technologies for operational technology (OT) organizations require timely and accurate data from industrial assets to be effective. As the volume of connected industrial assets increases and analytics-driven strategies such as predictive maintenance gain momentum, industrial organizations have continued to modernize and expand their network infrastructures to keep pace. Demand for infrastructure components such as gateways, routers, and switches has risen steadily as industrial organizations continue scaling their OT networks to accommodate additional connected endpoints and interconnected enterprise systems.

Though macroeconomic uncertainty may dampen short-term growth, when total revenue will approach $58B. The continued proliferation of wireless industrial sensors coupled with the rise of industrial 5G networks will allow growth within the wireless segment to outstrip that of the wireline market, while increasing demand for customized configurations and robust network performance management capabilities will bolster demand for non-bundled network management software solutions.

The semiconductor industry will be the fastest growing vertical market sector through the end of the forecast period in 2029. Among the primary drivers spurring growth within this market are the unique requirements of the "cleanroom" environments needed to prevent wafer contamination during the manufacturing process. Continued deployments of high-resolution cameras and machine vision systems will drive further growth as manufacturers upgrade their networks to accommodate the intensive data processing requirements inherent in such systems.

The competitive landscape for industrial networking technologies comprises a diverse mix of networking companies, global automation suppliers, and niche competitors that offer a narrow range of networking technologies or serve select geographies, industries, or use cases.

In 2024, industrial networking technology spending was greatest in EMEA [See Exhibit 10], driven in large part by the increasing focus on cybersecurity due to EU-specific regulations such as the NIS2 Directive, which specifically calls for manufacturers to invest in secure networking hardware and software. The Asia-Pacific region will provide the greatest revenue growth for industrial networking component vendors, with government-led initiatives such as "Made in China 2025" and "Society 5.0" in Japan underscoring the widespread commitment to the technological advancement of the industrial and manufacturing sectors by many countries in the region. The Americas, which generated the largest share of industrial wireless technology revenue in 2024, will be more significantly impacted by tariff-related economic challenges than the other regions. Greenfield projects in countries with quickly evolving industrial economies such as Brazil, India, and Senegal will provide ample growth opportunities across each region for the duration of the forecast period.

A significant portion of the revenue generated within the market for industrial networking components can be attributed to operators in major industrialized nations such as Germany, Japan, and the United States, among others. While such nations will continue to account for most market revenue, some of the most compelling growth opportunities will be generated within countries where economic growth is occurring at a much steeper trajectory. As countries such as Brazil, Egypt, India, Senegal, and others continue their economic and industrial progressions, resources from both the public and private sectors will be earmarked for projects such as improving transportation or utilities infrastructures and modernizing operations at local factories. Such initiatives will undoubtedly leverage connected OT networks to facilitate smart manufacturing and other advanced automation techniques, creating opportunities for industrial networking vendors. Suppliers with local ties will be best positioned to capitalize on the growth opportunities within these growing economies, though vendors with strong global brands will also perform well.

An Excel workbook containing more than 65 exhibits is provided alongside this report. The following exhibits are presented here: