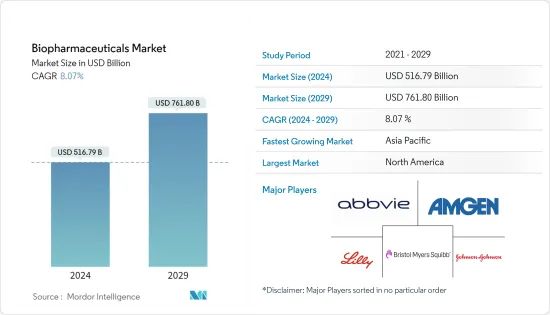

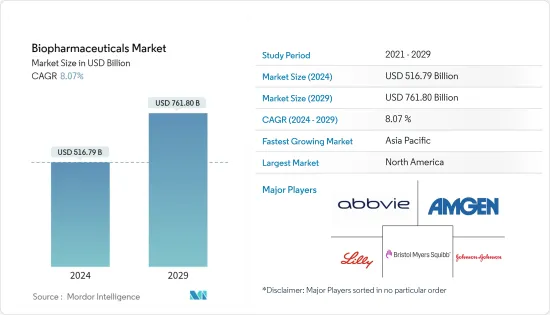

바이오의약품 시장 규모는 2024년 5,167억 9,000만 달러로 추정되며, 2029년까지 7,618억 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 8.07%의 CAGR로 성장할 것으로 예상됩니다.

COVID-19의 팬데믹은 바이오 제약 산업에 큰 영향을 미쳤습니다. 대부분의 바이오제약 기업들은 SARS-CoV-2 백신 개발에 많은 노력을 기울이고 있습니다. 예를 들어, 2021년 4월 인도 정부는 인도 고유의 신종 코로나 바이러스 백신 개발 및 생산을 가속화하기 위한 미션 COVID Suraksha를 발표했고, 생명공학부가 이를 실행에 옮겼습니다.

코박신의 생산 능력은 2021년 4월 10억 회분에서 2021년 7-8월에는월 60억-70억 회분으로 증가했습니다. 또한 2021년 9월에는월 100억 회 분량의 백신 생산량을 달성할 예정입니다. 2022년 6월, 화이자는 미시간주 칼라마주(Kalamazoo) 시설에 미화 1억 2천만 달러를 투자하여 COVID-19 경구용 치료제인 팍스로비드(닐마트렐레비르[PF-07321332] 정제와 리토나비어 정제의 미국 내 생산이 가능해졌다고 발표했습니다. 을 가능하게 합니다.

이번 투자는 미국에서 중요한 바이오의약품의 생산량을 확대하려는 화이자의 노력에 있어 또 하나의 중요한 진전을 의미하며, 미국 및 전 세계 환자들에게 치료제와 의약품을 생산하고 공급할 수 있는 능력을 강화할 것입니다. 마찬가지로 2021년 8월 캐나다 정부는 COVID-19 백신 개발 업체인 모델나(Modelna)와 캐나다에 mRNA 백신 시설을 건설하기로 합의했다고 발표했습니다. 최근 발표된 바이오 제조 및 생명과학 전략의 목표는 캐나다에 mRNA 백신 제조 시설을 건설하고자 하는 모더나의 열망과 일치했습니다. 이 조치는 캐나다의 전반적인 산업 역량을 향상시키고, 인재 확보 및 유지에서 임상시험 능력 향상에 이르기까지 바이오 제조 및 생명과학 산업의 전체 밸류체인을 강화할 것이며, COVID-19 백신 생산에 대한 관심이 높아짐에 따라 바이오의약품 시장의 성장을 크게 촉진했습니다. 크게 촉진되었습니다.

바이오의약품의 수용 증가와 거대한 시장 수요, 이전에 치료할 수 없었던 질병을 치료할 수 있는 바이오의약품의 능력과 같은 요인이 시장 성장을 주도하고 있습니다. 알츠하이머병 협회의 2021년 보고서에 따르면 미국 식품의약국(FDA)은 알츠하이머병 치료제 5종을 승인했습니다. 그들은 리바스티그민, 갈란타민, 도네페질, 메만틴, 메만틴 및 도네페질과 결합 된 메만틴입니다. 같은 소식통에 따르면 알츠하이머병에 걸리는 사람의 대다수는 65세 이상입니다. 이를 후발성 알츠하이머 병이라고합니다.

미국에서는 65-74세 인구의 약 5.3%, 75-84세 인구의 13.8%, 85세 이상 인구의 34.6%가 알츠하이머 치매를 앓고 있습니다. 또한, 2021년에는 65세 이상 미국인 620만 명이 알츠하이머병을 앓고 있으며, 2050년에는 1,350만 명에 달할 것으로 예측됩니다. 이러한 질병 유병률의 증가는 향후 몇 년 동안 환자 집단에서 API에 대한 수요를 증가시킬 것입니다.

바이오의약품이 이전에는 치료할 수 없었던 증상을 치료할 수 있는 능력은 혁신적인 의약품을 시장에 출시할 수 있는 길을 열어주었습니다. 예를 들어, 2022년 9월 블루버드 바이오(Bluebird Bio)의 스카이소나(SKYSONA, 에리바도제네 오토템셀)는 CBER로부터 4-17세의 조기 활동성 뇌부신백질 이영양증(CALD)을 앓고 있는 4-17세 남자아이들의 신경 기능 부전 진행을 늦추기 위한 승인을 받았습니다. 또한, 2022년 6월 CBER는 GSK plc가 생산하는 홍역, 볼거리, 풍진 생백신 프리오릭스(PRIORIX)를 승인했습니다.

또한, 2022년 2월 존슨앤드존슨과 중국 중심의 파트너사 레전드 바이오텍(Legend Biotech)은 미국 식품의약국(FDA)의 승인을 받은 백혈구암 치료제를 개발했습니다. 종양 질환 치료에 도움이 되는 새로운 치료법은 예측 기간 동안 시장 성장을 더욱 가속화할 것입니다.

그러나 고급 제조와 복잡하고 까다로운 규제 요건은 예측 기간 동안 시장 성장을 저해할 것입니다.

단클론항체(moAb 또는 mAb라고도 함)는 우리 시스템에서 항체와 유사하게 작용하는 실험실에서 만들어진 단백질입니다. 치료에서 단클론 항체 및 항체 유도체의 성공적인 사용은 이 연구 분야의 급속한 성장의 주요 원동력입니다. 단클론항체의 치료 용도에는 암, 류마티스 관절염, 다발성 경화증, 심혈관 질환 등이 있습니다.

승인 건수 증가, 임상시험 및 연구비 지출 증가는 이 부문의 성장에 중요한 요소입니다. 2022년 10월, 이중 특이성 항 델타 유사 리간드 3(DLL3)/항분화 클러스터 47(CD47) 항체인 PT217이 Phanes Therapeutics, Inc. Phanes Therapeutics는 종양학에 초점을 맞춘 임상 단계의 생명공학 기업입니다. 소세포폐암(SCLC) 및 기타 신경내분비암 환자. 미국 식품의약국(FDA)으로부터 1상 승인을 받았습니다. 또한 FDA의 승인 증가와 다양한 적응증에 대한 신제품 출시가 이 분야를 견인할 것으로 보입니다. 예를 들어, 2022년 2월 미국 식품의약국(FDA)은 오미클론 변종에 대한 활성을 유지하는 COVID-19 치료용 신규 단클론 항체에 대한 긴급사용승인(EUA)을 발급했습니다. 베브테로비맙의 EUA는 COVID-19 검사에서 양성 판정을 받은 성인 및 소아 환자의 경증에서 중등도의 COVID-19를 치료하기 위한 것으로, 입원 및 사망을 포함한 중증으로 진행될 위험이 높은 환자들을 대상으로 합니다. 또한, FDA가 승인 또는 허가한 다른 COVID-19 치료 옵션을 사용할 수 없거나 임상적으로 적절하지 않은 환자도 대상입니다.

따라서, 단클론항체 부문은 위의 요인으로 인해 예측 기간 동안 상당한 성장을 이룰 것으로 예상됩니다.

미국의 만성질환 부담 증가와 연구개발 활동에 대한 투자 증가가 북미 바이오의약품 시장을 견인하는 주요 요인으로 작용하고 있습니다. 미국의 바이오의약품 시장은 만성 질환 발생률 증가, 기존 바이오 제약 기업의 존재감, 바이오 기술 기업의 증가로 인해 성장할 것으로 예상됩니다. 국내 노인 인구의 증가와 연구 개발의 증가도 시장 성장을 촉진할 것입니다.

또한 2022년 7월에 업데이트된 질병통제예방센터(CDC)의 데이터에 따르면 관상동맥성 심장병은 가장 흔한 유형의 심장병으로 미국에서 20세 이상 성인 약 2,010만 명이 이 질병을 앓고 있다고 합니다. 또한 CDC 데이터에 따르면 40초마다 누군가가 심장마비를 앓고 있으며, 미국에서는 매년 805,000명 정도가 심장마비를 앓고 있습니다. 따라서 심혈관 질환의 부담이 커서 치료용 첨단 약물의 사용이 요구되고 있습니다.

2022년 5월, 일라이 릴리 앤 컴퍼니는 미국 인디애나 주에 21억 달러를 투자해 생산기지를 확장할 것이라고 발표했습니다. 마찬가지로 2022년 5월 롯데는 뉴욕주 이스트시라큐스에 위치한 브리스톨마이어스스퀴브의 제조시설을 매입했습니다. 이스트 시러큐스 시설은 미국 내 롯데의 새로운 바이오의약품 위탁개발생산(CDMO) 사업인 롯데의 북미 사업 센터 역할을 하게 됩니다.

따라서 위의 요인을 고려할 때, 조사 대상 시장은 예측 기간 동안 북미에서 크게 성장할 것으로 예상됩니다.

바이오의약품 시장은 여러 기업이 사업을 전개하고 있기 때문에 본질적으로 세분화되어 있습니다. 경쟁 상황에는 시장 점유율을 보유하고 유명한 여러 국제 및 국내 기업들에 대한 분석이 포함됩니다.

바이오엔텍(BioNTech SE)은 2022년 3월, 진행성 비소세포폐암(NSCLC)에서 PD-1 억제제인 Libtayo(세미프리맙)와의 병용투여를 통해 자사의 FixVac 후보물질 BNT116을 개발하기 위해 Regeneron과 전략적 제휴를 확대했다고 발표했습니다. 계약 조건에 따라 양사는 다양한 진행성 비소세포폐암 환자군을 대상으로 병용투여를 평가하기 위한 임상시험을 공동으로 진행할 예정입니다.

The Biopharmaceuticals Market size is estimated at USD 516.79 billion in 2024, and is expected to reach USD 761.80 billion by 2029, growing at a CAGR of 8.07% during the forecast period (2024-2029).

The COVID-19 pandemic had a significant impact on the biopharmaceutical industry. Most biopharmaceutical companies strived extensively to develop vaccines against the SARS-CoV-2 virus. For example, in April 2021, Mission COVID Suraksha was announced by the Government of India to accelerate the development and production of indigenous COVID vaccines, which the Department of Biotechnology implemented.

The production capacity of Covaxin increased from 1 crore vaccine doses in April 2021 to 6-7 crore vaccine doses per month between July/August 2021. Also, it will reach nearly ten crore doses per month during September 2021. On the other hand, in June 2022, Pfizer announced its commitment to US manufacturing with a USD 120 million investment at its Kalamazoo (Michigan) facility, enabling United States-based production for its COVID-19 oral treatment, PAXLOVID (nirmatrelvir [PF-07321332] tablets and ritonavir tablets).

The investment represents yet another significant step in Pfizer's initiative to expand the amount of critical biopharmaceutical manufacturing in the US, enhancing Pfizer's capacity to manufacture and provide treatments and medications for patients in the US and around the world. Similarly, in August 2021, the Government of Canada announced an agreement with leading COVID-19 vaccine developer Moderna, Inc. to build an mRNA vaccine facility in Canada. The goals of the recently unveiled biomanufacturing and life science strategy were in line with Moderna's aspirations to build an mRNA vaccine manufacturing facility in Canada. The action will improve Canada's overall industrial competence and boost the whole value chain of the biomanufacturing and life sciences industry, from talent acquisition and retention to greater clinical trial capacity. The increased interest in manufacturing COVID-19 vaccines has significantly added to the growth of the biopharmaceutical market during the COVID-19 pandemic.

Factors like increasing acceptance of and huge market demand for biopharmaceuticals and the biopharmaceuticals' ability to treat previously untreatable diseases are driving the market's growth. According to the Alzheimer's Association 2021 report, the US Food and Drug Administration (FDA) approved five drugs for treating Alzheimer's. They are rivastigmine, galantamine, donepezil, memantine, and memantine, combined with donepezil. As per the same source, the vast majority of people who develop Alzheimer's dementia are 65 years and above. It is called late-onset Alzheimer's.

In the US, nearly 5.3% of people aged 65 to 74 years, 13.8% of people aged 75 to 84 years, and 34.6% of people aged 85 years or above have Alzheimer's dementia. Additionally, 6.2 million Americans aged 65 years and above are living with Alzheimer's dementia in 2021 and projected to reach 13.5 million by 2050. Such a higher disease prevalence will bolster the demand for API among the patient population over the coming years.

The biopharmaceutical products' capability to address previously untreatable conditions has paved the way for introducing innovative drugs in the market. For instance, in September 2022, bluebird bio, Inc.'s SKYSONA (elivaldogene autotemcel) slows the progression of neurologic dysfunction in boys 4-17 years of age with early, active cerebral adrenoleukodystrophy (CALD), was approved by CBER. Similarly, in June 2022, CBER approved PRIORIX, a live vaccine for measles, mumps, and rubella, manufactured by GSK plc.

Also, in February 2022, Johnson and Johnson and its China-focused partner company Legend Biotech Corp developed a therapy to treat white blood cell cancer type approved by the US Food and Drug Administration (FDA). New therapies that aid in treating oncologic disorders will add to the market growth over the forecast period.

However, high-end manufacturing and complicated and cumbersome regulatory requirements will hinder market growth over the forecast period.

Monoclonal antibodies (also called moAbs or mAbs) are proteins made in laboratories that behave like the antibodies in our systems. The successful use of monoclonal antibodies and antibody derivatives in therapeutics is the primary driver for the rapid growth of the studied segment. The therapeutic applications of monoclonal antibodies include cancer, rheumatoid arthritis, multiple sclerosis, and cardiovascular diseases.

Growing approvals, clinical trials, and increasing research expenditure are critical factors in this segment's growth. In October 2022, PT217, a bispecific anti-Delta-like ligand 3 (DLL3)/anti-Cluster of Differentiation 47 (CD47) antibody, was developed by Phanes Therapeutics, Inc. It is a clinical-stage biotech company focused on oncology for patients with small cell lung cancer (SCLC) and other neuroendocrine cancers. It received Phase 1 clearance from the US Food and Drug Administration (FDA). Additionally, the growing FDA approvals and new product launches for various indications will drive the segment. For instance, in February 2022, the US Food and Drug Administration issued an Emergency Use Authorization (EUA) for a new monoclonal antibody to treat COVID-19 that retains activity against the omicron variant. The EUA for bebtelovimab treats mild to moderate COVID-19 among adults and pediatric patients with a positive COVID-19 test who are at high risk for progression to severe COVID-19, including hospitalization or death. It is also for those for whom alternative COVID-19 treatment options approved or authorized by the FDA are not accessible or clinically appropriate.

Thus, the monoclonal antibodies segment will witness significant growth over the forecast period due to the abovementioned factors.

The growing burden of chronic diseases and increasing investments in research and development activities in the US are the major factors driving the biopharmaceuticals market in North America. The US market for biopharmaceuticals will grow due to increasing chronic disease incidences, well-established biopharmaceutical companies' presence, and an increase in biotech companies. The rising geriatric population and increased research and developments in the country also drive market growth.

In addition, the Centers for Disease Control and Prevention's (CDC) data updated in July 2022 shows that coronary heart disease is the most common type of heart disease, and approximately 20.1 million adults of age 20 and older suffer from the ailment in the US. Additionally, per the CDC data, every 40 seconds, someone suffers from a heart attack, and nearly 805,000 people in the US have a heart attack annually. Thus, the high burden of cardiovascular diseases demands the availability of advanced drugs for treatment.

In May 2022, Eli Lilly and Company announced an investment of USD 2.1 billion to expand its manufacturing footprint in Indiana, US. Similarly, in May 2022, LOTTE purchased Bristol Myers Squibb's manufacturing facility in East Syracuse, New York. The East Syracuse site will serve as the LOTTE Center for North America Operations for LOTTE's new biologics contract development and manufacturing organization (CDMO) business in the US.

Thus, given the factors mentioned above, the studied market is expected to grow significantly in North America over the forecast period.

The biopharmaceuticals market is fragmented in nature due to the presence of several companies operating. The competitive landscape includes analyzing a few well-known international and local companies that hold market shares and are famous, including Amgen Inc., Eli Lily and Company, Johnson and Johnson, Sanofi SA, AstraZeneca PLC, and Pfizer Inc., among others.

In March 2022, BioNTech SE reported the expansion of its strategic collaboration with Regeneron to advance the Company's FixVac candidate BNT116 in combination with Libtayo (cemiplimab), a PD-1 inhibitor, in advanced non-small cell lung cancer (NSCLC). Under the terms of the agreement, the companies plan to jointly conduct clinical trials to evaluate their combination in different patient populations with advanced NSCLC.