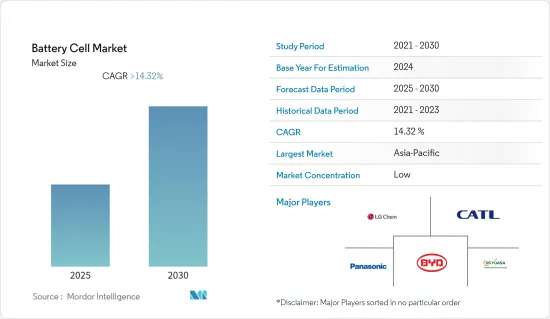

배터리 셀 시장은 예측 기간 동안 14.32% 이상의 CAGR로 성장할 것으로 예측됩니다.

2020년에 COVID-19 팬데믹의 영향을 받았지만, 회복되어 팬데믹 이전 수준에 도달했습니다. 배터리 셀에 대한 수요 증가는 예측 기간 동안 시장의 성장을 촉진할 것으로 예상됩니다. 리튬 이온 배터리의 가격 하락으로 인한 전기자동차의 급속한 채택도 연구 대상 시장의 성장을 견인할 것으로 예상됩니다.

아시아태평양이 시장을 독점하고 있으며 예측 기간 동안 가장 높은 CAGR이 예상됩니다.

프리즘 셀은 1990년대 초에 도입된 배터리 산업의 배터리 셀 유형입니다. 최신 프리즘 셀는 더 얇은 크기에 대한 수요를 충족하며 츄잉껌 상자나 작은 초콜릿 바처럼 고급스러운 포장로 포장되어 제공됩니다. 프리즘 셀은 레이어드 방식을 사용하여 공간을 최적으로 활용합니다. 다른 디자인은 프리즘형 젤리 롤을 감아 납작하게 만든 유사 프리즘형입니다. 이러한 셀은 주로 800mAh에서 4,000mAh에 이르는 휴대폰, 태블릿 및 로우 프로파일 노트북에 사용됩니다.

프리즘 셀는 용접된 알루미늄 하우징에 포장된 대형 포맷으로도 제공되며 20-50Ah의 용량을 제공합니다. 이러한 전지는 주로 에너지 저장 시스템과 하이브리드 및 전기자동차의 전기 파워트레인에 사용됩니다. 따라서 프리즘 셀의 크기가 클수록 전기 자전거나 휴대폰과 같은 소형 기기에는 적합하지 않습니다. 리튬 각형 셀은 부피 단위당 전력과 에너지의 비율이 가장 우수하기 때문에 자재 운반 장비(MHE)에 선호되는 기술입니다. 따라서 이러한 배터리 셀 유형은 에너지 집약적인 용도에 더 적합합니다.

이 배터리 셀 유형은 대용량과 프리즘 모양으로 인기를 얻고 있으며, 4개의 셀을 연결하여 12V 배터리 팩을 쉽게 만들 수 있어 공간 활용도가 향상되고 유연한 설계가 가능합니다. 다른 셀보다 가장 높은 Ah 공칭 용량과 kWh 에너지를 제공하며 전체 배터리 에너지 밀도가 높습니다. 이 배터리 셀은 부풀어 오르는 현상이 발생하지 않습니다. 다른 배터리 셀 유형에 비해 이러한 장점으로 인해 최종 사용자가 선호합니다. 그러나 제조 비용이 더 비싸고 열 관리 효율이 떨어지며 원통형 디자인보다 수명이 짧을 수 있습니다.

2022년 1월, 한국의 주요 배터리 업체인 LG 에너지 솔루션은 리튬 이온 배터리 라인업에 각형 셀 유형을 추가할 계획입니다. 이 회사는 고객 기반을 넓히기 위해 프리즘 형태를 포트폴리오에 추가 할 수 있다고 밝혔다. 최고의 전기차 제조업체인 테슬라와 폭스바겐이 2021년 초에 프리즘형을 채택함에 따라 삼성SDI와 SK 온과 같은 국내 경쟁사들은 현재 중국 CATL이 주도하고 있는 리튬-철-인산염(LFP) 프리즘형 셀로 이동하고 있습니다.

Volkswagen이 2030년까지 전기자동차의 최대 80%에 프리즘 셀를 사용하기로 결정한 후 삼성SDI와 SK 온 등 국내 업체들은 직사각형 포장에 주목했습니다. 2022년 7월, 폭스바겐 그룹은 독일 잘츠기터에 첫 번째 배터리 셀 공장을 설립한다고 발표했습니다. 프리즘형 통합 셀이 자사 모델의 최대 80%에 사용될 것이라고 발표했습니다.

따라서 위에서 언급 한 요인으로 인해 프리즘 셀 부문은 예측 기간 동안 상당한 성장을 보일 것으로 예상됩니다.

아시아태평양은 대규모 생산 능력으로 인해 주로 중국이 지배하는 최대 가전 제품 제조업체 및 수출국입니다.

중국은 폭넓은 용도로 배터리를 제조하고 활용하는 세계 최고의 국가 중 하나입니다. 2020년 중국은 전 세계 리튬 이온 배터리의 76%, 전 세계 전기자동차의 44%를 제조했습니다. 중국은 전자 부문의 허브로서 2021년 전체 휴대폰 수출의 약 48.4%가 중국에서 이루어질 정도로 배터리 셀 산업에서 중요한 시장 플레이어입니다.

한국은 가전제품, 가정용품, 전기차 배터리에 주로 사용되는 원통형 및 각형 셀의 주요 소비국입니다

2022년 7월 GODI는 2만 1,700개의 원통형 NMC811 3.65V-4.5Ah 리튬 이온 셀의 인도 표준국(BIS) 인증을 인도에서 처음으로 취득했습니다. 새로 인증받은 셀은 인도의 전기차 및 ESS 부문의 수요를 충족시킬 수 있을 것으로 보입니다. 따라서 이러한 향후 투자는 예측 기간 동안 인도에서 배터리 셀 시장의 성장을 주도 할 것으로 예상됩니다.

따라서 위의 요인으로 인해 아시아태평양 부문은 예측 기간 동안 큰 성장을 보일 것으로 예측됩니다.

세계의 배터리 셀 시장은 셀 시장은 세분화되어 있습니다. 이 시장의 일부 주요 업체(특별한 순서 없음)에는 LG Chem Ltd, Contemporary Amperex Technology Co. Limited, BYD Company Limited, GS Yuasa Corporation, and Panasonic Corporation 등이 있습니다.

The Battery Cell Market is expected to register a CAGR of greater than 14.32% during the forecast period.

Although the market studied was affected by the COVID-19 pandemic in 2020, it recovered and reached pre-pandemic levels. The growing demand for battery cells is expected to boost the market's growth during the forecast period. The rapid adoption of electric vehicles, mainly fostered by the declining price of lithium-ion batteries, is also expected to drive the growth of the market studied. However, the lack of direct access to battery metals is restraining the market's growth. With technological advancements, the price of smart gadgets is expected to decline, making them more affordable to the public, which is expected to provide growth opportunities during the forecast period.

Asia-Pacific dominates the market and is expected to witness the highest CAGR during the forecast period. The majority of the demand comes from countries like China and India.

Prismatic cells are a type of battery cell in the battery industry that were introduced in the early 1990s. The modern prismatic cell fulfills the demand for thinner sizes and comes wrapped in elegant packages like a box of chewing gum or a small chocolate bar. The prismatic cells make optimal use of space by using the layered approach. Other designs are wound and flattened into a pseudo-prismatic jelly roll. These cells are mostly found in cell phones, tablets, and low-profile laptops ranging from 800 mAh to 4,000 mAh.

Prismatic cells are also available in large formats packaged in welded aluminum housings and deliver capacities of 20-50 Ah. These are primarily used in energy storage systems and for electric powertrains in hybrid and electric vehicles. Hence, the larger size of the prismatic cells makes them bad candidates for smaller devices like e-bikes and cellphones. Lithium prismatic cells are the preferred technology for material handling equipment (MHE), as the technology provides the best ratio of power and energy per volume unit. Therefore, these battery cell types are better suited for energy-intensive applications.

These battery cell types have gained popularity due to their large capacity and prismatic shape, making it easy to connect four cells and create a 12V battery pack, providing improved space utilization and allowing flexible design. It has the highest Ah nominal capacity and kWh energy and a higher overall battery energy density than other cells. These battery cells are not subject to swelling. Such advantages over other battery cell types make it preferable to the end users. However, it can be more expensive to manufacture, less efficient in thermal management, and have a shorter cycle life than the cylindrical design.

In January 2022, South Korean battery major LG Energy Solution Ltd planned to add a prismatic cell type to its lithium-ion battery lineup. The company revealed that it could add the prismatic form to its portfolio to broaden its customer base. The company's local competitors like Samsung SDI and SK On are moving onto prismatic cells with lithium-iron-phosphate (LFP), currently led by China's CATL, as top EV makers Tesla and Volkswagen adopted prismatic type earlier in 2021.

Korean players, both Samsung SDI and SK On, turned attention to rectangular packaging after Volkswagen decided that up to 80% of its electric vehicles would use prismatic batteries by 2030. In July 2022, Volkswagen Group announced the setup of its first battery cell factory in Salzgitter, Germany. It unveiled the prismatic unified cell would be used in up to 80% of its models. The plant is expected to start production by 2025, and the new cell plant, nicknamed SalzGiga, is expected to reach an annual capacity of 40 GWh, enough for about 500,000 electric vehicles.

Hence, due to the above-mentioned factors, the prismatic cell segment is expected to witness significant growth during the forecast period.

Asia-Pacific is the biggest manufacturer and exporter of consumer electronics, mainly dominated by China due to its large production capabilities. The region is expected to dominate the consumer electronics manufacturing sector during the forecast period. Hence, the Asia-Pacific battery market is expected to benefit from the growth of the consumer electronics sector.

China is one of the leading countries in the world that manufacture and utilizes batteries in a wide range of applications. In 2020, China manufactured 76% of the global lithium-ion battery and 44% of the global electric vehicles. The country is a hub of the electronic sector, i.e., nearly 48.4% of the total mobile phone export was from China in 2021, making China a significant market player in the battery cell industry.

South Korea is a major consumer of cylindrical and prismatic cells, primarily used in consumer electronics, household items, and electric vehicle batteries. Amid concerns about an anticipated slowdown in South Korean semiconductor exports in recent years, batteries for electric vehicles are emerging as a new pillar, which is expected to propel the country's economy in the coming years.

In July 2022, GODI became the first company in India to receive Bureau of Indian Standard (BIS) certification for its 21700 cylindrical NMC811 3.65V-4.5Ah lithium-ion cells. The company aims to set up a lithium-ion cell manufacturing factory by 2024. The newly certified cells are likely to cater to the needs of the EV and ESS sectors in India. Thus, such upcoming investments are expected to drive the battery cell market's growth in India during the forecast period.

Hence, due to the above-mentioned factors, the Asia-Pacific segment is expected to witness significant growth during the forecast period.

The global battery cell market is fragmented. Some key players in this market (in no particular order) include LG Chem Ltd, Contemporary Amperex Technology Co. Limited, BYD Company Limited, GS Yuasa Corporation, and Panasonic Corporation.