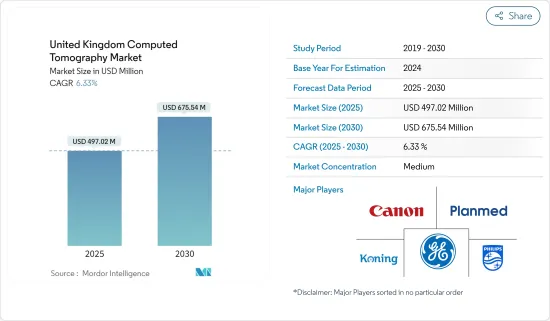

영국의 컴퓨터 단층촬영(CT) 시장 규모는 2025년 4억 9,702만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 6.33%로 확대되어, 2030년에는 6억 7,554만 달러에 달할 것으로 예측됩니다.

COVID 팬데믹은 시장 성장에 부정적인 영향을 미쳤습니다. 팬데믹의 영향을 동찰하기 위해, 다양한 연구조사가 발표되고 있습니다. 예를 들어, 「COVID-19 팬데믹: NHS England PET-CT 서비스에 미치는 영향과 교훈」은 COVID-19의 첫 번째 파도가 잉글랜드의 국민보건서비스(NHS)의 18F-플루오로데옥시글루코스 양전자방사단층촬영(FDG PET-CT) 스캔활동에 어떤 영향을 미쳤는지를 밝히기 위해 실시된 연구의 제목입니다. 이 연구는 2021년 2월 Nuclear Medicine Communication지에 게재되었습니다. 분석에 따르면 2020년 4월과 5월의 2개월간 활동량은 각각 32%와 31% 감소했습니다. PET-CT가 종료한 것에 비해 2019년 동시기에 52,460건의 FDG PET-CT가 종료되었습니다.

영국의 컴퓨터 단층 촬영 시장은 당뇨병과 암 등의 만성 질환에 따른 이환율과 사망률의 상승이 주요 요인입니다. 2020에 따르면 영국에서는 2020년에 457,960명의 신규암 환자가 발생하고, 2040년에는 595,909명의 발생이 예측되고 있습니다. 단기적으로 사용되기 때문에 암 환자 증가가 예상되는 결과, 이 나라에서는 CT 스캐너의 사용이 늘어날 것으로 보입니다. 이 나라의 사망률의 또 다른 중요한 요인은 당뇨병입니다. 당뇨병은 암을 포함한 많은 만성질환의 주요 위험인자이기 때문에 예측기간을 통해 시장 확대에 박차가 걸릴 것으로 예측됩니다. 만성질환 증가나 고령화에 의해 국가 전체에서 CT스캐너의 설치대수가 늘어날 것으로 예상되고 있습니다.

그러나, 상환이 불충분하고, 기기나 CT 스캔의 비용이 고액이기 때문에 영국 시장 확대는 억제될 것으로 예측됩니다.

다양한 유형의 암이 높은 유병률과 국내 시장기업의 존재가 성장을 뒷받침할 것으로 예측됩니다. 암 환자수는 앞으로도 증가할 것으로 예상되며, 컴퓨터 단층 촬영을 필요로 하는 암 치료를 위한 검진 프로그램은 국내에서의 컴퓨터 단층 촬영 장치 수요를 증가시킬 것으로 예측됩니다. 영국에서는 다양한 암의 이환율이 높기 때문에 진단을 위한 컴퓨터 단층 촬영 수요는 증가할 것으로 예측됩니다. 2020년 9월, Canon Medical System UK는 15대의 이동식 CT 스캐너를 전국의 국민보건서비스(NHS) 트러스트에 배포했습니다.

영국의 컴퓨터 단층 촬영 시장은 적당한 경쟁이 있어 여러 대형 기업으로 구성되어 있습니다.

The United Kingdom Computed Tomography Market size is estimated at USD 497.02 million in 2025, and is expected to reach USD 675.54 million by 2030, at a CAGR of 6.33% during the forecast period (2025-2030).

The COVID pandemic had an adverse effect on market growth. Various research studies have been published to provide insight into the effects of the pandemic. For instance, the COVID-19 pandemic: impact on NHS England PET-CT services and lessons learned is the title of a study that was conducted to determine how the first wave of COVID-19 affected the National Health Service's (NHS) 18F-fluorodeoxyglucose positron emission tomography-computed tomography (FDG PET-CT) scanning activity in England. The study was published in Nuclear Medicine Communication in February 2021. The analysis found that for the two months of April and May 2020, there was a 32 percent and a 31 percent decline in activity, respectively. Comparing cancer FDG PET-CT cases to non-cancer CT cases, a greater decline was seen. Between January 2020 and June 2020, 50,879 FDG PET-CTs were finished, compared to 52,460 FDG PET-CTs finished during the same time in 2019. Along with its negative effects, COVID-19 has given players the chance to build their presence by releasing new products or advancing clinical research in this area. Due to which, the studied market is expected to recover in future years.

The UK computed tomography market is majorly driven by higher incidences and mortality rates associated with chronic diseases, such as diabetes and cancer. The country's market is also driven by the growing geriatric population, increasing research and development procedures, rising investments, and increasing product launches. According to Globocan 2020, there were 457,960 new cases of cancer in the UK in 2020, and 595,909 instances are anticipated by 2040. The country will employ more CT scanners as a result of the anticipated rise in cancer cases because CT scanners are used to diagnose a variety of cancers. As a result, it is anticipated that the market under study will expand significantly during the next years. Another significant contributing factor to mortality in the nation is diabetes. The country has 5.6 percent prevalence of diabetes, with 2,680,500 people living with the disease, according to the International Diabetes Federation. Due to the fact that diabetes is the primary risk factor for many chronic illnesses, including cancer, this is anticipated to spur market expansion throughout the forecasted period. According to figures provided by the Organization for Economic Co-operation and Development, there were 9 CT scanners per 1,000,000 people in hospitals in the United Kingdom. Due to the growing burden of chronic diseases and the ageing population, more CT scanners are anticipated to be installed across the nation. This is anticipated to stimulate market expansion. Additionally, the National Research Facility (NRF) in Lab-based X-ray Computed Tomography was established in November 2020 with the help of the current facilities from the Universities of Manchester, Southampton, University College London (UCL), University of Warwick, and Diamond Light Source to offer the United Kingdom a special and varied shared capability. The Engineering and Physical Sciences Research Council (EPSRC) provided 10 million euros over 5 years to NRF to build this facility. Therefore, it is anticipated that rising product launches and rising investments in the relevant industry will fuel market expansion.

However, it is anticipated that the market expansion in the United Kindgom will be constrained by the inadequate reimbursement and the high cost of equipment and CT scan procedures.

Growth is anticipated to be boosted by the high prevalence of various cancer kinds and the existence of market players in the nation. Growing initiatives by big companies that could help the market develop in the future are another factor contributing to the expansion of this category. The number of cancer cases is expected to increase, and screening programs for cancer procedures that need computed tomography imaging are expected to increase the demand for computed tomography devices in the nation. For instance, the GLOBOCAN 2020 report was released by the International Agency for Research on Cancer. The analysis estimates that there will be 53,889 new cases of breast cancer in the United Kingdom in 2020. The research also said that 56,780 instances of prostate cancer were anticipated to be diagnosed in 2020. 13,168 men lost their lives to prostate cancer. The demand for computed tomography for diagnosis is anticipated to increase as a result of the high prevalence of various cancer conditions in the United Kingdom. To address the National Health Service (NHS) care backlog in England, the government promised to invest EUR 350 million in the creation of 40 new "one-stop-shops for inspections, scans, and tests" in October 2021. By March 2022, the centers would be completely operational after providing services over the following six months. Such government activities are projected to increase the use of computed tomography scanners to scan for cancer cases, which will fuel the market under study's expansion. In September 2020, Canon Medical System UK distributed 15 mobile CT scanners to National Health Service (NHS) trusts all around the nation. The aforementioned elements and study findings are also anticipated to enhance market expansion in this sector.

The United Kingdom computed tomography market is moderately competitive and consists of several major players. Some of the companies that are currently dominating the market are Canon Medical Systems, Koning Corporation, GE Healthcare, Planmeca Group (Planmed OY), and Koninklijke Philips NV among others.