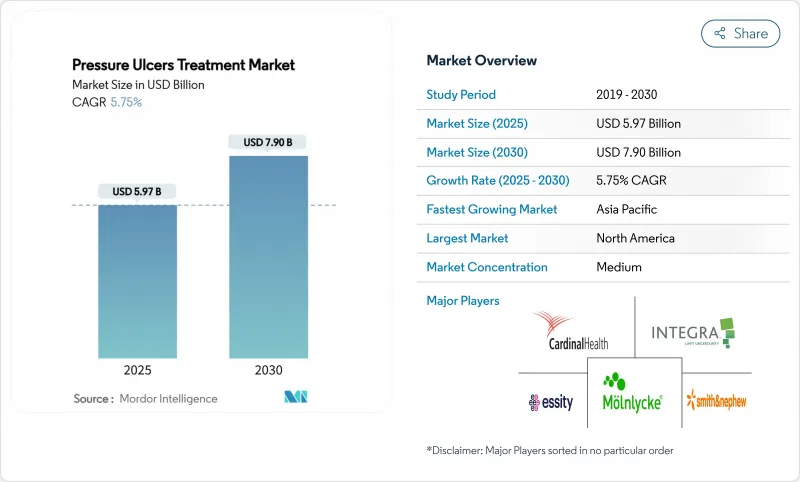

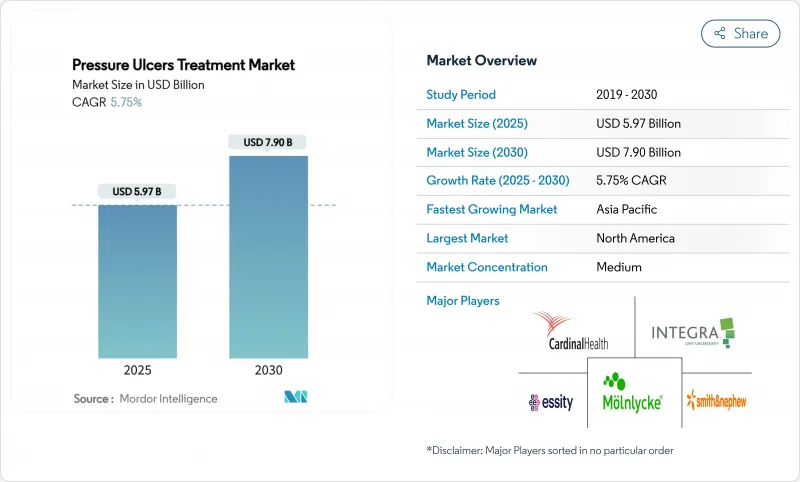

욕창 치료 시장 규모는 2025년 59억 7,000만 달러로 추정되고, 2030년에는 79억 달러에 이를 전망이며, CAGR 5.75%로 성장할 것으로 예측됩니다.

성장을 지지하는 것은 가속하는 인구동태의 고령화, 만성질환의 급증, 예방에 보답하는 한편, 원내 손상에는 페널티를 부과하는 가치 기반의 상환 정책입니다. 실시간 AI 압력 매핑 베드는 현재 환자의 신체 위치 검출에서 94.2%의 정확도를 달성하고, 적극적인 신체 위치 변환을 가능하게 하며, 반응적 케어로부터 예측적 예방으로의 구조적 축족을 추진합니다. 음압상처치료(NPWT) 시스템은 휴대성과 비용 효율성을 향상시키고 외래 환자 및 재택 관리에서의 사용을 지원하는 동시에 대응 가능한 환자층을 확장합니다. 이러한 요인들이 함께 의료 제공업체의 경제 상황은 크게 변화하고 있으며 의사 결정자는 치료 시간 단축, 재입원 최소화, 총 의료비 절감을 실현하는 기술로 방향타를 끊고 있습니다.

세계적인 평균 수명이 연장됨에 따라 압박 손상을 받기 쉬운 움직이지 않는 합병증 환자 집단이 증가하고 있습니다. 전 세계적으로 2024년에 수술 후보자의 당뇨병 유병률이 15.3%에 달했고, 조직 복구의 복잡성이 증가하고 있습니다. 따라서 병원은 만성 상처의 재상피화를 촉진하는 것으로 나타나는 상피성장 인자를 투여하는 생물학적으로 활성인 드레싱 재료에 대한 투자를 확대하고 있습니다. 성숙한 의료 제도에서는 진료 보상 규정이 이미 성장인자 요법을 폭넓게 커버하고 있으며, 치유 시간을 단축하는 프리미엄 제품의 채용을 임상의에게 촉구하고 있습니다. 한편, 신흥 시장에서는 같은 인구동태의 압력을 다루기 위해 간편하고 저비용의 생물활성 솔루션을 채용하고 있습니다. 채택의 틀이 다르기 때문에 현지 생산 능력에 따라 가격과 제품의 복잡성을 바꿀 수 있는 공급업체에게는 세계적으로 단계적인 비즈니스 기회가 탄생하고 있습니다.

의료 제공업체의 지불 개혁은 현재 보상 및 입원 기간의 지표를 연결하고 있으며 결과를 손상시키지 않고 상처를 신속하게 폐쇄하는 데 업무에 중점을 두도록 촉구하고 있습니다. 전기 붕대의 프로토타입은 기존 접근법에 비해 30% 치유가 빠르다는 것을 입증했으며 원격 모니터링이 가능한 에너지 기반 치료법의 상업적 가능성을 보여줍니다. 살아있는 세포를 함침시킨 생물학적 드레싱 재료는 육아 조직의 형성을 더욱 촉진하여 특정 욕창 환자의 일주일 이내에 퇴원을 가능하게 합니다. 마이크로센서가 장착된 스마트 붕대는 수분과 pH 데이터를 임상의에게 전송하여 불필요한 붕대 교환과 간호사의 부담을 줄여줍니다. 이러한 진보는 입원 환자의 자원을 고도 급성기 의료에 돌리려는 지불측의 목표와 일치합니다. 결과적으로 비용 효율적인 소모품에 실시간 분석을 통합한 장비 제조업체는 통합 의료 제공 네트워크를 통해 신속한 처방에 액세스할 수 있는 위치에 있습니다.

세포 조직 제품은 한 번의 사용으로 1,500달러를 초과할 수 있으며 고정 지불 제도 하에서 운영되는 병원의 경우 장애물입니다. Medicare & Medicaid Service Center(CMS)는 2025년에 대상으로 하는 대체 피부 목록을 17개 제품으로 줄였습니다. 자본 집약적인 NPWT 콘솔도 마찬가지로 여러 해에 걸친 가치 분석을 통한 정당화가 요구되어 자금에 제약이 있는 시설에서의 채용을 늦추고 있습니다. 공급업체는 구독 기반의 가격 설정과 1회당 지출을 줄이는 재패키징된 일회용 키트를 도입함으로써 대응하고 있습니다. 그럼에도 불구하고, 저자원 환경에서의 급속한 보급에는 경제적 장애물이 여전히 큰 발판이 되고 있습니다.

활성 상처 치료제는 2024년 욕창 치료 시장 규모의 21.51%를 차지했는데, 이는 염증을 조절하고 조직 재생을 자극하는 생물학적으로 활성인 솔루션에 대한 강한 임상적 취향을 반영하고 있습니다. 성장 인자, 다혈소판 혈장, 세포 배양 매트릭스가 이 범주의 필두이며, 종합적인 딜리버리 네트워크를 통해 비싼 가격 설정이 이루어지고 있습니다. 제조업체 각사는 상용화까지의 기간을 단축하는 규제 당국의 패스트 트랙을 활용하여 동종 세포 요법의 생산을 확대하고 있습니다. 음압상처 치료는 외래 환자 및 재택 관리 환경에서의 신속한 전개를 가능하게 하는 일회용 플랫폼에 힘입어 CAGR 8.25%에서 다른 모든 치료법을 능가하고 있습니다. 한편, 종래의 폼 드레싱재와 하이드로겔 드레싱재는 비용 효율적인 보조요법으로서의 관련성을 유지하기 위해 수분응답성 폴리머나 항균 나노입자 등의 개량이 반복되고 있습니다. 예측 기간 동안 활성 생물 제제 및 센서를 활용한 전달 시스템을 결합한 공급업체는 병원 지출 증가를 얻는 데 가장 유리한 입장에 있습니다.

음압상처 치료는 혁신 파이프라인을 선도하고 있으며 차세대 시스템은 주입 사이클과 이온 은 메쉬를 결합하여 대기압 이하의 압력을 유지하면서 바이오 필름 형성을 억제합니다. FDA가 2025년에 승인한 필 앤 플레이스 드레이프는 설치 시간을 5분 미만으로 단축하고 간호의 보급을 넓혔습니다. 필름 드레싱 재료 및 콜라겐 패드는 조기 궤양과 표재성 궤양에서 틈새 역할을 하며 비용 의식이 높은 의료 제공업체에게 임상적으로 효과적인 선택을 제공합니다. 가격 압력이 강해지는 가운데, 벤더는 치유 시간의 단축을 문서화한 것에 상환을 연동시키는 아웃컴 베이스의 계약에 의해 차별화를 도모해, 보다 광범위한 욕창 치료 시장 동향을 반영해 나갈 것으로 예측됩니다.

북미는 2024년 매출액 점유율이 45.52%였으며, 욕창 치료 시장을 선도해 견고한 상환제도, AI를 활용한 예방 기술의 높은 채용률, 유리한 규제 경로에 뒷받침되고 있습니다. 미국 병원은 원내 욕창과 관련된 268억 달러의 벌금 부담을 받고 스마트 지원 서피스에 대한 설비 투자를 가속화했습니다. 캐나다에서는 재택 간호 프로그램의 NPWT 키트에 주 수준의 자금이 할당되어 환자 액세스가 더욱 확대되었습니다.

유럽에서는 예산 편성의 틀이 비용 효과적인 서류를 요구하고 있으며 공급업체는 자원 조정 후 이익을 입증하는 실용적 시험의 스폰서가 되도록 동기 부여되고 있습니다. 독일과 네덜란드와 같은 국가에서는 현재 DRG를 지불하여 NPWT를 상환하고 있으며, 영국 NICE는 2024년에 수술 부위에 대한 일회용 NPWT를 승인했습니다. 이 지역에서는 증거 기반 조달이 받아들여지고 있으며, 보급 수준은 성숙했음에도 불구하고 완만한 성장을 유지하고 있습니다.

아시아태평양은 CAGR 8.61%로 가장 급성장하는 지역으로, 중국과 인도의 의료보험 확대, 정형외과 및 심혈관 외과 수술 건수 증가 등이 그 요인입니다. 지역 부처는 감염 대책 및 신속한 동원을 선호하는 상처 관리 지침을 발표하고 있으며, 은 함침 양식 및 휴대용 NPWT 시스템의 수입을 자극하고 있습니다. 현지 수탁 제조업체는 다국적 공급업체와 라이선스 계약을 체결하여 최종 제품 비용을 낮추고 보급을 촉진하고 있습니다. 중동 및 아프리카와 남미를 합친 점유율은 작지만 미충족 요구는 높습니다. 다자간 개발 프로그램은 3차 병원에서 AI 대응 체압 매핑 및 침대의 시험적 전개에 자금을 제공하고 있어 2027년까지 광범위한 전개에 대한 수요를 환기할 가능성이 있습니다.

The pressure ulcer treatment market size stands at USD 5.97 billion in 2025 and is projected to reach USD 7.90 billion by 2030, advancing at a 5.75% CAGR.

Growth is underpinned by accelerating demographic aging, surging chronic-disease prevalence, and value-based reimbursement policies that reward prevention while penalizing hospital-acquired injuries. Real-time AI pressure-mapping beds now achieve 94.2% accuracy in patient-position detection, enabling proactive repositioning and driving a structural pivot from reactive care to predictive prevention. Negative pressure wound therapy (NPWT) systems have become more portable and cost-efficient, supporting outpatient and home-care use while broadening the addressable patient base. Collectively, these factors are reshaping provider economics, pushing decision-makers toward technologies that shorten healing time, minimize readmissions, and reduce total cost of care.

Global life expectancy gains are producing a larger cohort of immobile, comorbid patients who remain susceptible to pressure injuries. World-wide, diabetes prevalence among surgical candidates reached 15.3% in 2024, intensifying tissue-repair complexity. Hospitals are therefore scaling investment in biologically active dressings that deliver epidermal growth factor, a modality shown to accelerate re-epithelialization in chronic wounds. In mature health systems, reimbursement codes already cover a spectrum of growth-factor therapies, encouraging clinicians to adopt premium products that shorten healing time. Emerging markets, meanwhile, are adopting simplified, lower-cost bioactive solutions to manage the same demographic pressures. The differential adoption framing is creating a tiered global opportunity for suppliers able to flex pricing and product complexity according to local capacity.

Provider payment reforms now link compensation to length-of-stay metrics, prompting an operational focus on closing wounds quickly without compromising outcomes. Electric bandage prototypes have demonstrated 30% faster healing versus conventional approaches, signalling commercial potential for energy-based therapies that can be monitored remotely. Biologic dressings impregnated with viable cells further boost granulation tissue formation, enabling same-week discharge for selected pressure-ulcer patients. Smart bandages equipped with micro-sensors transmit moisture and pH data to clinicians, cutting unnecessary dressing changes and nurse workload. These advances dovetail with payer objectives to reallocate inpatient resources toward high-acuity care. Consequently, device makers that integrate real-time analytics into cost-effective consumables stand to gain rapid formulary access across integrated delivery networks.

Cellular tissue products can exceed USD 1,500 per application, a hurdle for hospitals operating under fixed-payment bundles. The Centers for Medicare & Medicaid Services (CMS) pruned its covered-skin-substitute list to 17 products in 2025, narrowing the reimbursable field and forcing clinicians to ration premium therapies. Capital-intensive NPWT consoles likewise demand justification through multi-year value analyses, delaying adoption in cash-constrained facilities. Suppliers are countering by introducing subscription-based pricing and repackaged single-use kits that lower per-episode spending. Nonetheless, the economic hurdle remains a significant dampener on rapid penetration in low-resource settings.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Active wound-care therapies accounted for 21.51% of the pressure ulcer treatment market size in 2024, reflecting strong clinical preference for biologically active solutions that modulate inflammation and stimulate tissue regrowth. Growth factors, platelet-rich plasma, and cell-seeded matrices headline this category and command premium pricing across integrated delivery networks. Manufacturers are scaling production of allogeneic cell therapies, leveraging regulatory fast tracks that shorten commercialization timelines. Negative pressure wound therapy continues to outpace all other modalities at an 8.25% CAGR, buoyed by single-use platforms that allow rapid deployment in outpatient and home-care environments. Meanwhile, conventional foam and hydrogel dressings undergo iterative improvements-such as moisture-responding polymers and antimicrobial nanoparticles-to sustain relevance as cost-effective adjuncts. Over the forecast horizon, suppliers that pair active biologics with sensor-enabled delivery systems stand best positioned to capture incremental hospital spend.

Negative pressure wound therapy leads innovation pipelines, with next-generation systems combining instillation cycles and ionic-silver meshes to suppress biofilm formation while maintaining sub-atmospheric pressure. The FDA's 2025 clearance of a peel-and-place drape reduced setup time to under five minutes, widening nursing adoption. Film dressings and collagen pads retain niche roles in early-stage or superficial ulcers, providing cost-conscious providers with clinically validated options. As pricing pressure intensifies, vendors will differentiate through outcomes-based contracts that tie reimbursement to documented reductions in healing time, mirroring trends in the broader pressure ulcer treatment market.

The Pressure Ulcers Treatment Market Report is Segmented by Product Type (Wound Care Dressings, Active Wound Care Therapies, Negative Pressure Wound Therapy, Growth Factors & Biologics, and More), Ulcer Stage (Stage I Stage II, and More), End User (Hospitals & Clinics, Long-Term Care Facilities, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

North America led the pressure ulcer treatment market with 45.52% revenue share in 2024, supported by robust reimbursement schemes, high adoption of AI-enabled preventive technologies, and favorable regulatory pathways. Hospitals in the United States accelerated capital outlays for smart support surfaces following a USD 26.8 billion penalty burden tied to hospital-acquired pressure injuries. Canada followed with province-level funding earmarked for NPWT kits in home-care programs, further broadening patient access.

In Europe, budgeting frameworks require cost-effectiveness dossiers, motivating suppliers to sponsor pragmatic trials that demonstrate resource-adjusted benefits. Countries such as Germany and the Netherlands now reimburse NPWT under DRG add-on payments, while the United Kingdom's NICE validated single-use NPWT for surgical sites in 2024. The region's embrace of evidence-based procurement sustains moderate growth despite mature penetration levels.

Asia-Pacific is the fastest-growing territory, projected at an 8.61% CAGR, fueled by health-insurance expansion in China and India and rising orthopedic and cardiovascular surgery volumes. Regional ministries are launching wound-management guidelines that prioritize infection control and rapid mobilization, stimulating imports of silver-impregnated foam and portable NPWT systems. Local contract manufacturers are entering licensing deals with multinational suppliers, lowering final-product costs and facilitating wider adoption. The Middle East & Africa and South America collectively account for a smaller share but present high unmet need; multilateral development programs are funding pilot deployments of AI-enabled pressure-mapping beds in tertiary hospitals, potentially seeding demand for broader rollouts by 2027.