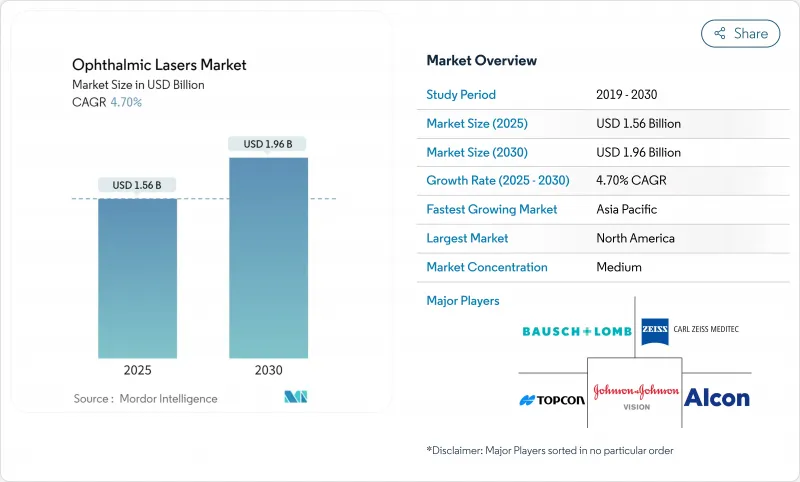

안과용 레이저 시장은 2025년에 15억 6,000만 달러, 2030년에는 19억 6,000만 달러에 이르고, CAGR 4.7%로 성장할 것으로 예측됩니다.

성장은 물량 확대보다는 정밀공학적 업그레이드에서 더 큰 동력을 얻고 있으며, 펨토초 플랫폼은 조직 정밀도를 유지한 채 새로운 속도 기준을 제시합니다. 북미는 높은 수술 건수와 조기 규제 승인으로 수요를 지지하고 있지만 아시아태평양은 근시율 상승과 인구동태 고령화가 수렴함에 따라 가장 가파른 성장 곡선을 그리고 있습니다. 외래수술센터(ASC)와 사무실 기반 수술실로의 지속적인 이동은 휴대용 통합 플랫폼에 자본 시설의 선호도를 재구성합니다. 경쟁은 현재 치료 시간의 단축, 치료 결과의 예측 가능성의 향상, 임상 워크플로우의 합리화를 실현하고, 비용 억제 압력 하에서도 비싼 가격 설정을 가능하게 하는 AI 대응 시스템에 축족을 두고 있습니다.

백내장은 이미 2,050만 명이 넘는 미국인이 앓고 있으며, 증가의 길을 따라가고 있습니다. 아시아태평양에서는 시력 장애의 유병률이 1990년에서 2015년에 걸쳐 17.9% 상승했기 때문에 추가적인 압력이 가해지고 있습니다. 이것은 주로 도시 지역의 근시와 당뇨병과 관련된 망막증 때문입니다. 이러한 중복 병태는 한 번의 세션에서 광응고, 코팅 절개, 해면체 형성이 가능한 다목적 레이저 플랫폼을 필요로 하는 경우가 많으며, 공급자는 광범위한 스펙트럼 시스템을 구입하도록 촉구하고 있습니다. 인구동태의 물결은 서비스계약 수입도 지원하고 있으며, 기기의 이용률이 높으면 예측 가능한 유지보수가 필요합니다. 따라서 백내장, 굴절 교정 및 망막의 각 적응증에 걸친 복합적인 수요를 캡처하기 위해서는 완벽한 포트폴리오를 가진 제조업체가 유리한 입장에 있습니다.

규제 당국이 진정한 혁신을 받아들여 시장 출시까지의 시간이 단축되었습니다. FDA는 2024년 보슐롬의 Teneo 엑시머 플랫폼을 승인했지만, 이는 20년 만입니다. 루미세라의 Valeda 시스템은 건식 AMD에 대한 최초의 광 바이오 모듈레이션 요법으로 승인되었으며 치료 프론티어가 확산되었습니다. 유럽에서는 ViaLase가 펨토초 녹내장 치료로 CE 마크를 받았고, Espansione Group은 광 바이오 모듈레이션 장치의 승인을 받았습니다. 각각의 승인 취득은 대응 가능한 환자층을 확대하고 임상적 선례를 확립하여 향후 승인 신청을 용이하게 하고 차별화된 제품의 건전한 파이프라인을 지원합니다.

첨단 레이저 장비는 50만 달러에서 150만 달러 사이이며, 연간 서비스 계약은 8-12%를 흡수하기 때문에 소규모 클리닉에 스트레스가 됩니다. 신흥국은 25-40%의 수입 마크업과 통화 관련 변동에 직면하여 투자 회수 기간이 장기화합니다. 임대 및 공유 유스 모델은 현금 흐름의 장벽을 줄이는 것이며, 대부분의 경우 월간 주사 및 치료에 상한선이 있기 때문에 수익의 편차가 제한됩니다. 그 결과, 그룹 구매 및 여러 시설의 의료 네트워크에서는 예측 가능한 요금으로 함대 전체 서비스를 번들하는 공급업체가 선호되고 시장은 소규모 규모의 효율적인 공급업체로 향하고 있습니다.

광응고 시스템은 2024년 안과용 레이저 시장 점유율에서 38.3%를 차지했는데, 이는 망막의료에 있어서의 역할이 정착되어 있다는 증거입니다. 그러나 펨토초 플랫폼은 2030년까지 연평균 복합 성장률(CAGR) 8.8%로 성장하여 초고속 펄스 속도가 시술 시간을 단축하고 환자 불편을 줄입니다. VisuMax 800의 2,000kHz 속도는 처리량을 향상시킬 뿐만 아니라 각막 바이오메카닉을 유지하는 SMILE 처리를 지원합니다. 대조적으로, 엑시머 장치는 Teneo의 1,740Hz 아이트래킹과 같은 점진적인 이득에 의존하며, 표면 절제에서의 지위를 강화하고 있습니다. Nd:YAG 디스랩터는 계속해서 코팅 절개와 유리체 용해를 지원하고 선택적 레이저 해면체 성형술(SLT) 시스템은 녹내장 치료 옵션을 넓히고 있습니다. 광응고와 펨토초 또는 Nd:YAG 모듈을 통합한 다목적 콘솔은 자본 효율성 측면에서 점점 더 지지되고 있습니다.

펨토초의 급증은 열에서 빛에 의한 파괴적인 정확도로의 전환을 명확하게 보여줍니다. AI 주도 계획과 인체공학적 개선을 통합한 벤더는 프리미엄 게재위치를 획득했습니다. 그 결과 크로스 플랫폼 생태계에 투자하는 부문 기업은 특히 올인원 장비를 요구하는 대량 생산 ASC에서 틈새 전문가를 능가합니다. 금액 기준으로, 펨토초 장비 시장 규모는 2030년까지 5억 9,000만 달러를 획득할 것으로 예상되며, 이는 조기 채용자들 사이의 지속적인 교체 수요를 반영합니다.

백내장용 레이저는 2024년에 34.1%의 점유율을 확보했지만, 굴절 이상 교정은 2030년까지의 CAGR이 9.4%로 가장 빠른 인상이 기대되고 있습니다. 펨토초 어시스트 LASIK와 SMILE은 현재 광학 구역의 안정성과 안구건조증 발병률의 저하로 경쟁하고 있으며, 소절개 렌티클 삽입술에서는 87%의 시력 유지율이 보고되고 있습니다.

Subthreshold Micropulse Modality는 2차 손상을 제한하여 망막 질환 관리를 진보시키고 Alcon의 Voyager DSLT와 같은 SLT 혁신은 고니오 렌즈의 취급을 없애고 녹내장 워크플로우를 간소화합니다. 굴절 교정 응용 분야의 안과용 레이저 시장 규모는 2025년 4억 6,000만 달러에서 2030년에는 7억 1,000만 달러로 확대될 것으로 예측됩니다. 백내장 파쇄술, 각막 재성형술, 트라베큘로플라스티를 전환할 수 있는 통합 콘솔은 혼합 사례에 어필하며 기존의 단일 적응증 경계를 더욱 모호하게 합니다.

북미는 2024년 매출 37.4%로 안과용 레이저 시장을 선도해 2030년까지 한자리대 중반의 성장이 전망됩니다. 장비의 보급률의 높이, 유리한 상환 제도, FDA의 조기 인가가 이 지역의 우위를 유지하고 있지만, 외과의 부족의 문제가 상향으로 톱니를 걸고 있습니다. 예측은 2035년까지 안과 의사가 30% 부족하여 지방에 대한 접근이 가장 낮습니다. ASC로의 전환과 가치 기반 지불은 합병증을 줄이는 레이저에 보상을 주지만, 자본 비용이 증가함에 따라 일부 클리닉은 임대 컨소시엄 및 공유 서비스 모델로 전환하고 있습니다.

아시아태평양은 CAGR 6.3%로 가장 빠르게 성장하는 지역입니다. 근시 진행은 도시 지역의 청년층에서 80%를 넘어 노화와 함께 백내장과 굴절 교정 작업량이 증가하고 있습니다. 그러나 외과 의사의 편재와 가격에 민감한 조달은 유지 보수의 번거로움을 줄인 설계를지지합니다. 중국의 수량 기준 조달은 금리를 압박하고 제조업체에게 가치 등급 SKU를 제공하도록 촉구하는 반면 인도와 동남아시아에서는 아웃리치 캠프에 적합한 휴대용 핸드헬드 유닛이 유용합니다. 근본적인 질병의 확산을 지속 가능한 장비 도입으로 바꾸기 위해서는 견고한 임상 교육 제휴와 자선 프로그램이 매우 중요합니다.

유럽은 CE 마크의 무결성과 보편적인 보험 적용으로 꾸준한 확대를 보여줍니다. 펨토초 녹내장 치료기와 광 바이오 모듈레이션 치료기의 CE 승인은 2024 년이며 규제 당국의 민첩성을 보여줍니다. 그러나 국가 수준의 상환 뉘앙스는 시장 분단을 야기하고 공급업체는 지불자별로 가치 제출 서류를 조정해야 합니다. 서유럽에서는 임상 결과 데이터가 중시되는 한편, 동유럽에서는 어포더빌리티가 중시되어 동대륙 내에서 수요의 흐름이 이분되고 있습니다. 중동, 아프리카 및 남미에서는 채워지지 않은 수술 요구가 크지만 공급망의 격차와 환율 위험에 시달리고 있습니다. 기부 프로그램, 이동 수술 캐러밴, 정부의 자기 부담 계획은 잠재적 가능성이 점차 개화할 수 있지만 단기 성장은 여전히 완만합니다.

The ophthalmic lasers market is valued at USD 1.56 billion in 2025 and is forecast to touch USD 1.96 billion by 2030, advancing at a 4.7% CAGR.

Momentum derives more from precision-engineering upgrades than volume expansion, with femtosecond platforms setting new speed benchmarks while retaining tissue accuracy. North America anchors demand through high procedural volumes and early regulatory approvals, yet Asia-Pacific supplies the steepest growth curve as rising myopia and aging demographics converge. The sustained shift toward ambulatory surgery centers (ASCs) and office-based suites is reshaping capital-equipment preferences toward portable, integrated platforms. Competition now pivots on AI-ready systems that compress treatment times, improve outcome predictability, and streamline clinical workflows, allowing premium pricing even under cost-containment pressure.

Cataract cases already affect over 20.5 million Americans and continue to climb, guaranteeing a steady patient pool for laser-assisted surgeries. Asia-Pacific adds additional pressure as visual-impairment prevalence rose 17.9% from 1990 to 2015, mainly because of urban myopia and diabetes-linked retinopathy.These overlapping pathologies often require multipurpose laser platforms capable of photocoagulation, capsulotomy, and trabeculoplasty in a single session, encouraging providers to purchase broad-spectrum systems. The demographic wave also underpins service-contract revenue, as high device utilization necessitates predictable maintenance. Manufacturers with complete portfolios are therefore better positioned to capture the compounding demand across cataract, refractive, and retinal indications.

Regulators have become more receptive to genuine innovations, shortening time-to-market. The FDA cleared Bausch + Lomb's Teneo excimer platform in 2024, the first such approval in two decades. LumiThera's Valeda system secured authorization as the inaugural photobiomodulation therapy for dry AMD, widening therapeutic frontiers. Parallel activity in Europe saw ViaLase win a CE mark for femtosecond glaucoma therapy and Espansione Group gain approval for photobiomodulation devices. Each clearance enlarges the addressable patient pool and sets clinical precedent, easing future submissions and supporting a healthy pipeline of differentiated offerings.

Advanced laser units range between USD 500,000 and USD 1.5 million, while annual service contracts absorb 8-12% of that figure, stressing smaller practices. Emerging economies face 25-40% import mark-ups and currency-related volatility that prolong payback periods. Although leasing and shared-usage models alleviate cash flow barriers, they often cap monthly shots or procedures, limiting revenue upside. Consequently, group purchasing and multi-site health networks favor vendors that bundle fleet-wide service at predictable rates, nudging the market toward a few scale-efficient suppliers.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Photocoagulation systems retained 38.3% of the ophthalmic lasers market share in 2024, a testament to their entrenched role in retinal care. However, femtosecond platforms are on an 8.8% CAGR trajectory through 2030, propelled by ultrafast pulse rates that slash chair time and discomfort. The VisuMax 800's 2,000 kHz speed not only enhances throughput but also supports SMILE procedures that preserve corneal biomechanics. In contrast, excimer devices rely on incremental gains such as Teneo's 1,740 Hz eye-tracking, reinforcing their place in surface ablation. Nd:YAG disruptors continue to anchor capsulotomy and vitreolysis, while selective laser trabeculoplasty (SLT) systems broaden glaucoma therapy options. Multipurpose consoles that merge photocoagulation with femtosecond or Nd:YAG modules are increasingly favored for capital efficiency.

The femtosecond surge underscores a transition from thermal to photo-disruptive precision. Vendors integrating AI-driven planning and ergonomic improvements command premium placements. As a result, segment players investing in cross-platform ecosystems are set to outpace niche specialists, especially in high-volume ASCs seeking all-in-one devices. In value terms, the ophthalmic lasers market size for femtosecond equipment is projected to capture USD 0.59 billion by 2030, reflecting sustained replacement demand among early adopters.

Cataract-oriented lasers safeguarded a 34.1% stake in 2024, yet refractive error corrections promise the quickest lift at 9.4% CAGR to 2030, fuelled by consumer willingness to finance vision-enhancement electives. Femtosecond-assisted LASIK and SMILE now compete on optical-zone stability and reduced dry-eye incidence, with small-incision lenticule implantation reporting 87% visual-acuity maintenance.

Sub-threshold micropulse modalities advance retinal-disease management by limiting collateral damage, while SLT innovations like Alcon's Voyager DSLT remove gonio-lens handling, simplifying glaucoma workflows. The ophthalmic lasers market size for refractive applications is forecast to expand from USD 0.46 billion in 2025 to USD 0.71 billion by 2030 as elective procedure volumes climb. Integrated consoles capable of toggling between cataract fragmentation, corneal reshaping, and trabeculoplasty appeal to mixed-case sites, further blurring historical single-indication boundaries.

The Ophthalmic Lasers Market is Segmented by Product (Femtosecond Lasers, Excimer Lasers, and More), Application (Cataract Surgery, Refractive Error Correction, and More), End User (Hospitals, Specialist Eye Clinics & Chains, and More), Technology Integration (Stand-Alone Laser Systems and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

North America led the ophthalmic lasers market with 37.4% revenue in 2024 and is expected to post mid-single-digit growth through 2030. High equipment penetration, favorable reimbursement, and early FDA clearances keep the region ahead, yet looming surgeon shortages cap upside. Projections show a 30% ophthalmologist deficit by 2035, with rural access dipping lowest. Migration to ASCs and value-based payment rewards lasers that cut complications, but rising capital costs nudge some practices toward leasing consortia and shared-service models.

Asia-Pacific is the fastest-advancing territory at 6.3% CAGR. Escalating myopia-now exceeding 80% in certain urban young-adult cohorts-combines with aging populations to swell cataract and refractive workloads. Yet uneven surgeon distribution and price-sensitive procurement favor stripped-down, low-maintenance designs. China's volume-based procurement squeezes margins, pushing manufacturers to offer value-tier SKUs, while India and Southeast Asia reward portable handheld units suited to outreach camps. Robust clinical-training alliances and philanthropic programs will be pivotal in converting underlying disease prevalence into sustainable device adoption.

Europe exhibits steady expansion courtesy of CE-mark alignment and universal insurance coverage. CE approvals in 2024 for femtosecond glaucoma and photobiomodulation devices demonstrate regulatory agility. Country-level reimbursement nuances, however, generate market fragmentation, requiring vendors to tailor value-submission dossiers by payer. Western Europe champions clinical-outcome data while Eastern markets lean on affordability, creating bifurcated demand streams within the continent. Middle East & Africa and South America house significant unmet surgical need but grapple with supply-chain gaps and currency risk. Donation programs, mobile surgery caravans, and government co-payment schemes could gradually unlock latent potential, though short-term growth remains modest.