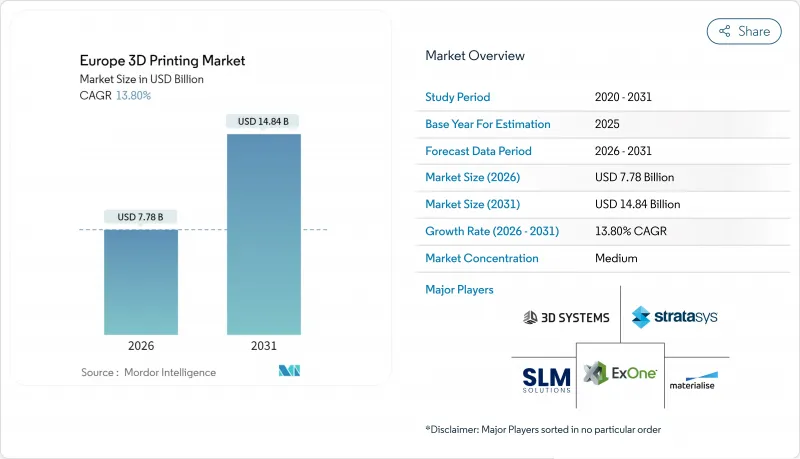

유럽의 3D 프린팅 시장은 2025년 68억 4,000만 달러로 평가되었고, 2026년에는 77억 8,000만 달러, 2026년부터 2031년에 걸쳐 CAGR 13.8%로 성장하고 2031년까지 148억 4,000만 달러에 이를 전망입니다.

이 확장은 지역 전체 제조업체가 분산형 생산 전략을 가속화하고 있기 때문입니다. 이를 통해 리드 타임의 단축, 공급망의 혼란에 대비하고, 현지 생산을 장려하는 탄소 국경 조정 조치의 요건을 충족시킬 수 있습니다. 신속한 혁신 사이클, 금속 3D 프린터 비용 절감, 인공지능을 통한 공정 제어 통합은 자동차, 의료 및 해사 산업에서 생산 등급의 이용 사례 확대를 지원합니다. 하드웨어 판매가 여전히 수익의 대부분을 차지하는 반면, 서비스 지향의 "제조 서비스(MaaS)"모델은 급속히 확대되고 있으며, 대규모 자본 지출을 수반하지 않는 유연한 생산 능력을 요구하는 사용자의 의향을 반영하고 있습니다. 국가별 동향에는 편차가 보입니다. 독일은 특허 깊이와 자동화 전문 지식을 활용하여 주도적 입장을 지키고 있으며, 네덜란드는 세계 수준의 물류와 해사 클러스터를 전개하여 최고의 성장 속도를 기록하고 있습니다. 기존 기업이 수직통합을 진행하고 신규 참가자가 신소재를 추진하고 유럽연합이 기술기준을 조화시켜 국경을 넘은 사업 운영을 용이하게 하는 가운데 경쟁 격화가 진행되고 있습니다.

유럽 각국 정부는 적층 조형 기술의 보급 촉진을 위한 상당한 자금을 투입하고 있습니다. 프랑스의 540억 유로 규모의 '프랑스 2030' 계획은 첨단 제조 플랫폼에 대한 자금을 할당하고 있습니다. 또한 「호라이즌 유럽」은 국경을 넘은 설비를 클라우드 관리형 생산 라인에 통합하는 「서비스로서의 제조」파일럿 사업을 한층 더 지원하고 있습니다. 독일에서는 적층조형기업이 매출액의 30.6%를 조사에 투자하고 있으며, 국가 및 EU의 조성금에 의해 더욱 강화되어 금속시스템 분야에서의 리더십을 확고히 하고 있습니다. 이 공동 자금 모델은 연구소에서 현장으로의 기술 이전을 촉진하고 공통 기술 기준에 따라 공급업체의 기반을 구축합니다. 그 결과 유럽의 3D 프린팅 시장은 규모의 경제를 확보하고 중견 기업에 대한 진입 장벽을 줄이고 있습니다.

자동차 제조업체는 초기 프로토타이핑을 넘은 적층 조형을 추구하고 있습니다. EU 기금을 통한 Multi-FUN 프로젝트는 배선과 센서를 경량 구조에 통합하는 복합재료 조형을 드러냈습니다. 독일 공급업체는 소량 생산 공구를 조형하고 높은 비용의 재고 보관 없이 차종 고유 부품을 관리합니다. 용접 및 볼트를 줄이는 단일 조립 조립체를 활용함으로써 기업은 경량화와 생산 사이클 단축을 실현하고 유럽 자동차 산업의 주요 지역에서 3D 프린팅 시장의 기세를 유지하고 있습니다.

산업용 프린터는 여섯 자리 가격대이며 사용자는 분말 처리 장치, 후 처리 장치 및 품질 보증 장치를 추가로 도입해야합니다. 하드웨어 가격이 하락했음에도 불구하고 중소기업은 구매를 앞당기는 사례가 적습니다. EU 의료기기규칙에 준거하려면 엄격한 문서화와 시판후 조사가 요구되어 의료분야 도입 기업에 있어서 간접비를 끌어 올리고 있습니다. 철도, 항공우주, 에너지 분야에서의 인증제도의 분단은 시험예산을 증대시키고, 렌탈과 서비스 모델이 위험을 상쇄할 때까지 유럽 3D 프린팅 시장의 잠재 고객 기반을 좁히고 있습니다.

서비스 제공업체는 기업이 유연성을 우선시하면서 수익 공유를 확대하고 있습니다. 2025년 시점에서 유럽 3D 프린팅 시장의 67.62%를 하드웨어가 차지하고 있습니다만, 설계 최적화, 빌드 준비 및 후처리를 외부 위탁하는 기업이 증가하는 가운데, 서비스 지향 모델은 CAGR15.97%로 확대하고 있습니다. K3D나 FKM 등의 수탁 제조 기업은 여러 프린터를 운용하는 팜을 전개하여 고객이 설비에 자본을 고정하지 않고 저스트 인 타임으로 부품을 입수할 수 있도록 하고 있습니다. 이 전환은 실험 비용을 줄이고 다양한 고객 파이프라인에 위험을 분산시킵니다.

병행하여 하드웨어 공급업체는 소프트웨어, 유지보수 및 교육 구독을 번들링하여 장비 판매와 지속적인 서비스의 경계를 모호하게 만듭니다. 클라우드 대시보드는 모든 함대 데이터를 통합하여 예측 보전 및 소모품 보충을 가능하게 합니다. 이러한 통합 제공은 도입을 촉진하고 유럽 3D 프린팅 시장을 성과 기반 조달 규범으로 이끌고 있습니다.

FDM은 성숙한 재료, 낮은 운영 비용, 폭넓은 사용자 인지도로 2025년에도 29.12%로 최대 점유율을 유지했습니다. 한편 DLP는 치과 교정 장치, 보청기, 조직 비계 연구에 적합한 50 미크론 미만의 미세 가공 능력을 배경으로 14.42%라는 눈부신 CAGR을 기록하고 있습니다. 식물 유래 포토폴리머의 진보는 지속가능성의 신뢰성을 강화하는 동시에 생체적합성의 폭을 넓히고 있습니다. SLA와 SLS는 항공우주 및 자동차 분야의 내열 부품 요구에 대응하는 반면, 전자빔 용융법은 정형외과 임플란트용 티타늄 격자 구조의 주요 기술로 계속되고 있습니다.

기술의 차별화는 현재 자동화 및 폐루프 제어에 의존합니다. AI 구동의 복셀 레벨 보정은 서포트재의 질량을 삭감해, 탈분체화를 용이하게 하는 것으로, 유럽 3D 프린팅 시장 전체에서의 가동률을 향상시키고 있습니다. 분말 바닥 시스템의 멀티 레이저 협조는 생산성과 표면 마감의 균형을 실현하고 제조업체가 부품을 대량 생산 인증 할 수있는 자신감을 제공합니다.

The Europe 3D printing market is expected to grow from USD 6.84 billion in 2025 to USD 7.78 billion in 2026 and is forecast to reach USD 14.84 billion by 2031 at 13.8% CAGR over 2026-2031.

This expansion occurs as manufacturers across the region accelerate distributed-production strategies to cut lead times, hedge against supply-chain shocks and meet carbon-border adjustment requirements that reward localized output. Fast innovation cycles, falling metal-printer costs and the integration of artificial-intelligence process control underpin a widening set of production-grade use cases across automotive, healthcare and maritime industries. Hardware sales still dominate revenue, yet service-oriented "manufacturing as a service" models are scaling quickly, reflecting user preference for flexible capacity without large capital outlays. Country-level momentum is uneven: Germany leverages patent depth and automation expertise to safeguard its leadership position, while the Netherlands deploys world-class logistics and maritime clusters to register the highest growth pace. Competitive intensity rises as incumbents integrate vertically, newer entrants push novel materials and the European Union harmonizes technical standards to ease cross-border operations.

European governments deploy sizeable capital to speed additive-manufacturing adoption. France's EUR 54 billion "France 2030" program earmarks funds for advanced manufacturing platforms. Horizon Europe further backs "manufacturing as a service" pilots that network equipment across borders into cloud-managed production lines. In Germany, additive-manufacturing firms invest 30.6% of turnover in research, amplified by national and EU grants, cementing leadership in metal systems. The shared funding model drives technology transfer from laboratories to shop floors and builds a cadre of suppliers aligned to common technical standards. As a result, the Europe 3D printing market secures economies of scale that lower entry barriers for mid-sized enterprises.

Automotive manufacturers now pursue additive-manufacturing beyond early prototyping. The EU-funded Multi-FUN project reveals multi-material builds that embed wiring and sensors into lightweight structures. German suppliers print low-volume production tooling to manage model-specific parts without storing costly inventory. By exploiting single-build assemblies that cut welds and bolts, companies save weight and shorten production cycles, sustaining momentum for the Europe 3D printing market in core automotive corridors.

Industrial-grade printers carry six-figure price tags, and users must add powder-handling, post-processing, and quality-assurance gear. Small and medium-sized enterprises often defer purchases even as hardware prices decline. Compliance with the EU Medical Device Regulation imposes rigorous documentation and post-market surveillance, inflating overhead for healthcare adopters. Fragmented certification regimes for rail, aerospace, and energy sectors multiply testing budgets, narrowing the addressable base of the Europe 3D printing market until rental or service models offset risk.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Service providers captured a growing slice of revenue as enterprises prioritize flexibility. Although hardware still anchored 67.62% of the Europe 3D printing market in 2025, service-oriented models are scaling at 15.97% CAGR as firms outsource design optimization, build preparation and post-processing. Contract manufacturers such as K3D and FKM deploy multi-printer farms, giving customers just-in-time parts without locking capital into machines. This transition lowers the cost of experimentation and spreads risk across diverse client pipelines.

In parallel, hardware vendors bundle software, maintenance, and training subscriptions, blurring lines between equipment sales and recurring services. Cloud dashboards aggregate fleet-wide data, enabling predictive maintenance and consumable replenishment. These integrated offers reinforce adoption, propelling the Europe 3D printing market toward outcome-based procurement norms.

FDM maintained the largest share in 2025 at 29.12% thanks to mature materials, low operating costs, and broad user familiarity. Yet DLP is registering an impressive 14.42% CAGR, propelled by sub-50-micron feature capability that suits dental aligners, hearing aids, and tissue-scaffold research. Advances in plant-based photopolymers reinforce sustainability credentials while widening the bio-compatibility palette. SLA and SLS cater to aerospace and automotive requirements for heat-resistant components, whereas electron-beam melting remains the go-to for titanium lattice structures in orthopedic implants.

Technology differentiation now hinges on automation and closed-loop control. AI-driven voxel-level correction trims support mass and eases depowdering, elevating utilization rates across the Europe 3D printing market. Multi-laser coordination in powder-bed systems balances productivity and surface finish, giving manufacturers confidence to qualify parts for serial production.

The Europe 3D Printing Market Report is Segmented by Component (Hardware and Services), Technology (Stereolithography, Fused Deposition Modeling, and More), Material (Polymers, Metals and Alloys, and More), End-User Industry (Automotive, Aerospace and Defense, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).