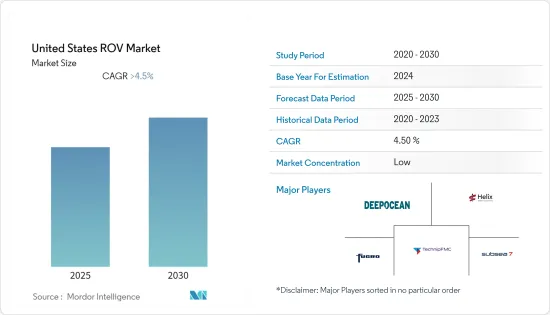

미국의 ROV 시장은 예측 기간 동안 4.5% 이상의 CAGR을 나타낼 것으로 예측되고 있습니다.

장기적으로는 시장의 주요 촉진요인으로서, 석유 및 가스의 해양 발견 증가, 해상 풍력 발전 설비 증가, 석유 및 가스의 폐로 활동 증가 등을 들 수 있습니다. 증가로 인한 환경 파괴 증가로 북미에서 석유 및 가스의 해양탐사가 금지되어 있습니다. 이 때문에 예측기간 중 특히 미국에서는 시장의 성장이 둔화될 것으로 예상됩니다.

석유 및 가스산업에 있어서의 ROV의 가동률은 2014-2017년에 걸쳐 일관되게 하락을 기록했으며, 그 결과 가동일수가 감소하였습니다. 이러한 작업이 필요하고 피할 수 없습니다고 생각되기 때문에 원유 가격의 변동으로부터 보호됩니다. ROV 서비스 시장에 강한 부정적인 영향을 미쳤습니다.

예측 기간 동안 IRM 부문은 특히 미국과 멕시코 만을 포함한 북미의 오프쇼어 인프라 노후화가 주요 요인이되어 큰 성장을 기록할 것으로 예상됩니다. 활동과 함께 더 빈번한 모니터링이 필요합니다.

오프쇼어 부문에서는 심해와 초심해 활동이 원유 가격 하락으로 큰 타격을 입었습니다 그 결과, 총 사업비를 대폭 삭감했습니다. 산업의 운영 효율성 향상으로 이어질 뿐만 아니라 오프쇼어 심해 및 초심해 프로젝트의 손익 분기점 가격 인하로 이어졌습니다. 2022년 8월 시점에서, 동분지에서는 344기의 리그가 가동하고 있어 이어 Eagle Ford가 63기로 되어 있습니다. 양분지는 주로 텍사스주에 위치하고 있습니다. 다시 증가하고 있으며 IRM 부문에서 ROV 수요가 증가하고 있습니다.

오프쇼어 프로젝트 점검, 수리 및 유지 보수(IRM) 서비스에 ROV를 제공하는 기업이 증가하고 있습니다. 예를 들어, Houston Mechatronics. Inc.는 2021년 3월 자사 개발의 AUV/ROV 트랜스포머 「Aquanaut」를 업그레이드했다고 발표했습니다. 이 로봇의 새로운 버전인 Aquanaut Mk-II는 최초의 모델보다 깊은 깊이를 정격으로 하고 있습니다. 비교적 저렴한 비용으로 가능합니다.

따라서 위의 요인에 따라 점검·수리·보수활동은 예측기간 동안 미국에서 큰 성장을 보일 것으로 예상됩니다.

과거 10년간에 에너지 수요가 대폭 증가해, 지구 온난화에 대한 의식도 항상 높아지고 있습니다. 이 때문에 재생 가능 기술에 기회가 퍼지고 있습니다. 해상 기술은 상대적으로 틈새 시장이지만, 에너지 수요 증가는 이러한 에너지를 활용하는 기회를 창출하고 있습니다.

해상 풍력 터빈 및 항해용 수력 발전 장치 등의 해양 재생 가능 에너지 구조물의 설치에는 초기 설치, 케이블 부설, 설치 후 모니터링, 유지보수 작업을 위해 해저를 적절히 조사하기 위한 다양한 시각화 장비와 모니터링 장비가 필요할 것으로 예상됩니다. 따라서 어려운 문제입니다. 또한 시야가 나쁘기 때문에 다이버와 카메라와 같은 기존의 광학 솔루션은 실행할 수 없으며 전방 탐사 소나, 레이저 이미지 또는 유사한 도구가 필요합니다. 따라서 이러한 상황에서는 ROV 시스템이 편리하고 확장 가능한 모듈형 솔루션과 필요한 데이터를 제공합니다.

풍력에너지 산업에서는 해상 풍력 발전소의 설치가 증가하는 경향이 있습니다.

게다가, 2022년 3월, TerraSound는 Vineyard Wind 1 프로젝트와 보다 광범위한 미국 해상 풍력 개발을 지원하는 헌신의 일환으로 매사추세츠 주에 새로운 거점을 투자할 계획을 발표했습니다. 해안의 해상 풍력 발전 산업에 있어서, 현지 조사나 운전·보수 점검을 실시했습니다. 1의 플랜트 밸런스 업무는 동사의 확실한 경험과 실적에 더해, 터빈 기초의 원격 조작차(ROV) 검사, 수출과 어레이 케이블의 해저 조사, 또한 Acteon Group 전체로부터 제공되는 기타 폭넓은 해저 보전· 운영 서비스를 다룹니다. 이러한 해상 풍력에너지 부문의 계획은 예측 기간 동안 미국의 ROV 시장을 견인할 것으로 예상됩니다.

따라서, 상기 요인에 근거하여 해상풍력발전설비 증가는 예측기간 동안 미국의 ROV 시장을 촉진할 것으로 예상됩니다.

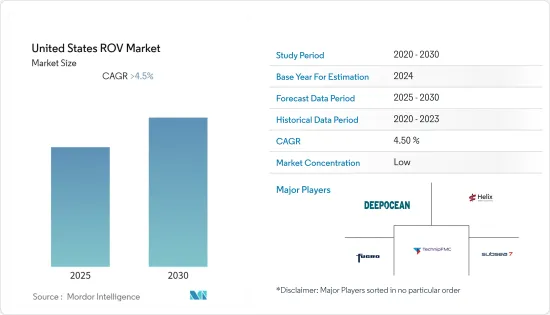

미국의 ROV 시장은 부문화되어 있습니다. 이 시장의 주요 기업(순부동)은 Subsea 7 SA, TechnipFMC PLC, DeepOcean AS, Helix Energy Solutions Group, Fugro NV 등이 있습니다.

The United States ROV Market is expected to register a CAGR of greater than 4.5% during the forecast period.

Over the long term, the major driving factors of the market include increasing offshore oil and gas discoveries, growing offshore wind energy installations, and rising oil and gas decommissioning activities. On the flip side, increasing environmental damage due to the increasing use of fossil fuels has led to the banning of offshore exploration of oil and gas in the North American region. This is expected to slow down the market, especially in the United States, during the forecast period. Nevertheless, technological advancements in the US ROV market are expected to create enormous opportunities for the United States ROV deployment.

The utilization rates for ROV in the oil and gas industry registered a consistent decline during 2014-2017, resulting in declining day rates. Generally, the inspection, repair, and maintenance (IRM) segment is protected from volatility in oil prices, as these operations are considered necessary and unavoidable. However, the combination of a substantial decline in offshore operations and delays in some of the activities had a strong negative impact on the IRM ROV services market.

During the forecast period, the IRM segment is expected to register significant growth, mainly driven by aging offshore infrastructure, particularly in the North American region, which includes the United States and the Gulf of Mexico. These aging infrastructures require more frequent monitoring, along with frequent repair and maintenance activities.

In the offshore sector, deepwater and ultra-deepwater activities were hit harder by the decline in oil prices. During the period of downturn, the industry adopted a lower price scenario and responded with project re-engineering, efficiency gains, and better expense management, which resulted in a significant reduction of the total operating cost. All such steps have not only resulted in improving the operational efficiency in the industry but have also reduced the breakeven price of offshore deepwater and ultra-deepwater projects. Moreover, the Permian basin is the region with the largest number of oil rigs in the United States. As of August 2022, there were 344 active rigs in the basin, followed by Eagle Ford, with 63 rigs. Both basins are mainly located in Texas. The number of operational oil and gas rigs in the United States has increased again from a pandemic-induced slump on the back of tighter fuel supplies due to the Russia-Ukraine war, thus, increasing the demand for ROV in the IRM segment.

A growing number of companies are offering ROV for inspection, repair, and maintenance (IRM) services for offshore projects. Some of the major services being offered by the companies include driverless inspection, pipeline maintenance, subsea structure monitoring, and subsea engineering services. For instance, in March 2021, Houston Mechatronics Inc. announced that it had upgraded its self-developed AUV/ROV transformer, Aquanaut, a multi-purpose subsea robot that can transform an AUV into a tetherless ROV, eliminating the need for large vessels and umbilicals. The new version of this robot, Aquanaut Mk-II, has a deeper depth rating than the first model. It enables the collection of data as well as the remote operation of maintenance and repair tasks at a comparatively lower cost.

Therefore, based on the above-mentioned factors, inspection, repair, and maintenance activity is expected to witness significant growth in the United States during the forecast period.

There has been a significant increase in energy demand over the past decade and a constant rise in awareness about global warming. This has been opening opportunities for renewable technologies. Though offshore technologies, such as offshore wind power, tidal energy, and hydrokinetic turbines or device,s are relatively niche markets, the increasing energy demand has created opportunities for harnessing these energies.

The installation of marine renewable energy structures, such as offshore wind turbines and navigational hydrokinetic devices, is expected to require a variety of visualization and monitoring equipment to appropriately survey the seafloor for initial installation, cable lay, post-installation monitoring, and maintenance tasks. Such activities can be challenging due to unstable conditions such as high tides or high ocean currents where these installations are located. In addition, the visibility is such that traditional optical solutions such as divers or cameras are not feasible, necessitating forward-looking sonars, laser imaging, or similar tools. Therefore, ROV systems come in handy in such situations and offer scalable, modular solutions and the necessary data required.

The wind energy industry is witnessing an increasing trend toward offshore wind farm installations. The new offshore wind power in the United States accounted for more than 13 MW capacity in 2021.

Moreover, in March 2022, TerraSound announced plans to invest in a new base in Massachusetts as part of its commitment to support the Vineyard Wind 1 project and wider US offshore wind developments. TerraSond is already committed to the US East Coast offshore wind industry through its site investigation surveys and operating and maintenance inspections. The Vineyard Wind 1 balance of plant work, which will add to the company's solid experience and track record, covers turbine foundation remotely operated vehicle (ROV) inspections and export and array cable seabed surveys alongside a range of other subsea integrity and operational services from across the Acteon group. Such plans for the offshore wind energy sector are expected to drive the US ROV market during the forecast period.

Therefore, based on the above-mentioned factors, the increase in offshore wind power installations is expected to drive the US ROV market during the forecast period.

The US ROV market is fragmented. Some of the major players in the market (in no particular order) are Subsea 7 SA, TechnipFMC PLC, DeepOcean AS, Helix Energy Solutions Group, and Fugro NV.