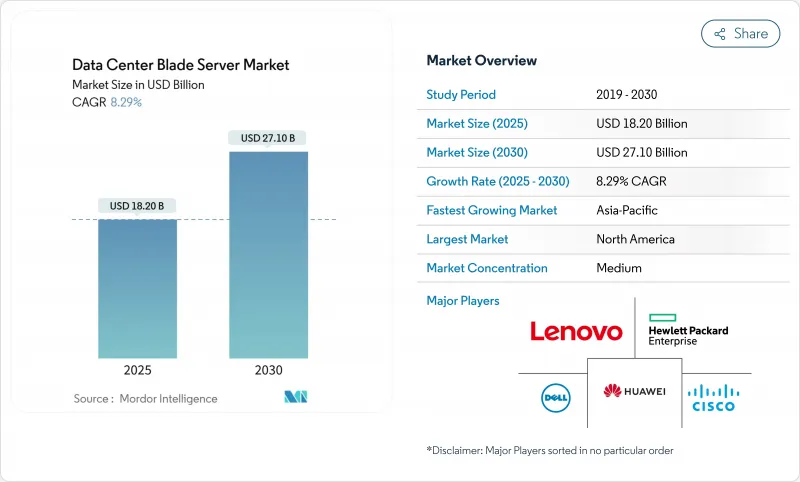

데이터센터 블레이드 서버 시장의 2025년 시장 규모는 182억 달러로, 2030년에는 271억 달러에 이르고, CAGR 8.29%를 나타낼 것으로 예측됩니다.

AI 및 머신러닝 워크로드의 도입이 증가하고 컴퓨팅 밀도 요구 사항이 변화함에 따라 벤더는 컴퓨팅, 스토리지 및 네트워킹 리소스를 분리하는 컴포저블한 분리형 블레이드 설계를 향하고 있습니다. 이 아키텍처의 전환은 활용도를 높이고 작업 부하를 신속하게 재배치할 수 있는 반면, 직접 액체 냉각, 실리콘 포토닉스 백플레인 및 고급 섀시 관리 소프트웨어는 30kW를 초과하는 랙의 전력 엔벨로프를 관리하는 데 도움이 됩니다. 북미는 규모의 리더를 유지하고 있지만 아시아태평양은 인도, 중국, 싱가포르에서 대규모 그린필드 건설로 성장이 가속화되고 있습니다. 코로케이션 시설이 가장 큰 고객 그룹이라는 것은 아니지만, 하이퍼스케일러는 보다 높은 랙 수준의 효율성을 제공하는 전용 AI 블레이드 시스템으로 전환하여 기술적 과제를 설정하고 있습니다.

AI 추론 및 트레이닝 클러스터는 현재 랙 엔벨로프를 10-15kW에서 30-50kW로 밀어 올리고 있습니다. Open Compute Project의 OSAI 사양은 250kW에서 1MW의 랙 아키텍처를 목표로 하며, 블레이드 벤더는 고효율 전압 조정기와 직접 액체 냉각을 통합하도록 권장합니다. Dell의 PowerEdge XE9680L은 섀시 레벨 공기 흐름, 콜드 플레이트 루프 및 AI 전용 가속기가 열 조절 없이 공존할 수 있음을 입증합니다. 국제에너지기구(IEA)는 AI에 특화된 데이터센터가 2030년까지 945TWh를 소모할 것으로 예측하고 있으며, 전력 효율적인 블레이드 설계가 사업자 전략의 중심에 자리잡고 있습니다.

5G 배포 및 초저지연 서비스는 컴퓨팅을 네트워크 에지에 밀어넣어 배선 및 냉각된 마이크로모듈 데이터센터에 대한 수요를 창출합니다. Google의 모듈식 에지 설비에 관한 특허는 전원과 열교환이 통합된 안전한 멀티 테넌트 랙 어셈블리의 중요성을 뒷받침합니다. 통신 사업자는 6,000억 달러의 CAPEX 계획의 상당 부분을 이러한 에지 사이트에 할당하고 있으며, 블레이드 벤더에게 제한된 실적에 맞는 1/4 높이의 노드를 공급할 기회를 제공합니다.

포토닉 집적 회로와 800GbE 패브릭으로 전환하면 대기 시간과 대역폭을 향상시킬 수 있지만 새로운 섀시, 미드플레인 커넥터 및 리타이머 카드가 필요합니다. 국가기관은 효율성 향상이 인정되고 있는 것, 특히 중견기업에 있어서는 초기 도입에 상당한 자본비용이 소요된다는 점에 주의를 촉구하고 있습니다. CXL의 메모리 분할에 관한 조사는 투자 회수에 수년이 걸릴 것이라는 것을 제안하고 있으며, 사업자는 업그레이드 시기를 어긋나게 해야 합니다.

Tier 3 시설은 N1 중복 프로파일이 주류 기업의 SLA와 일치하기 때문에 2024년 데이터센터 블레이드 서버 시장의 42.21%를 차지했습니다. 티어 4 시설은 수가 적고 AI 트레이닝 클러스터로부터의 내결함성 요구에 따라 CAGR 12.2%를 나타낼 것으로 예측됩니다. 이 기세로 Tier 4는 100% 액냉 섀시와 실리콘 포토닉스 상호 접속의 실증 실험장으로 자리매김하고 있습니다.

일반적으로 에지 어그리게이션 및 브랜치 워크로드에 서비스를 제공하는 Tier 1 및 Tier 2 시설 운영자는 자동화를 진행하면서 비용 규율을 유지하기 위해 표준화된 블레이드를 채택합니다. Infrastructure Masons의 보고서에 따르면, 현재 전력 증가의 90%는 AI 모델의 훈련으로 인한 것이며, 그 부하는 보다 높은 전력 소비와 랙 밀도에 대응해야 하는 겸손한 사이트에까지 파급하고 있습니다. 결과적으로, 공급업체는 저층 방에 격납 통로와 후방 도어 열교환기를 개장하는 키트를 포장하여 더 넓은 데이터센터 블레이드 서버 시장의 기세를 유지하고 있습니다.

하프 높이 블레이드는 듀얼 소켓 CPU, 충분한 DIMM 슬롯 및 PCIe 확장을 지원하며 대부분의 가상화 및 데이터베이스 작업을 지원합니다. 하프 하이트 블레이드는 기업의 코로케이션 랙의 주요 제품입니다. 전체 높이 모델은 쿼드 소켓 및 메모리 내 분석과 같은 메모리 바인딩 워크로드를 계속 지원합니다.

쿼터 높이 및 마이크로 블레이드 노드는 10U 선반 당 16-32개의 컴퓨팅 스레드를 지원하며 제한된 에지 실적에 이상적이므로 CAGR 14.12%로 가장 빠르게 성장하는 슬라이스입니다. 공급업체는 현재 이러한 소형 스레즈에 GPU 가속기를 통합하여 셀 타워 사이트에서 실시간 추론을 가능하게 합니다. Open Rack v3 사양과의 호환성을 통해 동일한 캐비닛 내에서 혼합 배포가 가능하며 데이터센터 블레이드 서버 시장의 에지 확장 이야기를 지원합니다.

데이터센터 블레이드 서버 시장 보고서는 업계를 유형(Tier 1, Tier 2, 기타), 폼 팩터(하프 높이 블레이드, 전체 높이 블레이드 등), 최종 사용자 업계별(은행, 금융서비스 및 보험(BFSI), 제조, 기타), 데이터센터 유형(하이퍼스케일러/클라우드 서비스 공급자 등), 지역(아시아태평양, 유럽 등)으로 분류합니다. 시장 예측은 금액(달러)으로 제공됩니다.

북미는 2024년 데이터센터 블레이드 서버 시장의 42.23%를 차지했으며 버지니아 북부, 텍사스, 실리콘 밸리의 하이퍼스케일 캠퍼스가 그 원동력이 되었습니다. 로렌스 버클리 국립 연구소는 2023년 미국 데이터센터의 전력 사용량을 176TWh로 계산하여 시설의 PUE를 줄이는 액체 냉각 블레이드의 긴급성을 높였습니다. 캐나다와 멕시코는 지역 주권 클라우드와 재해 부흥 구역을 통해 더 많은 수요를 늘립니다.

아시아태평양은 2025-2030년 CAGR이 12.54%로 가장 급성장하는 지역입니다. 중국에서는 대규모 AI 클라우드 클러스터가 도입되고 인도에서는 디지털 이코노미의 목표를 따라잡기 위해 2030년까지 설치 용량을 135만kW에서 5만kW로 확대해야 합니다. 싱가포르의 정책 프레임워크는 고밀도 블레이드와 열회수형 냉각기를 포함한 설계에 우선적으로 용량 라이선스를 부여합니다. 일본과 호주는 해저 케이블 육상 국을 따라 에지 풋 프린트를 확장하고 컨텐츠 캐싱을 위해 1/4 높이의 블레이드를 통합합니다.

유럽은 엄격한 효율성과 데이터 주권에 관한 규칙에 따라 꾸준한 확장을 보여줍니다. Ecodesign 2019/424개정은 35°C 이상의 온수 냉각을 지원하는 블레이드 섀시를 장려하여 지역 열 루프와의 통합을 용이하게 합니다. 중동 및 아프리카에서는 핀테크와 게임 고객에게 서비스를 제공하는 클라우드 온 램프에 대한 투자가 모여 있습니다. 남미에서는 브라질의 인터넷 교환 허브를 중심으로 설치가 진행되고 있으며, 사업자는 계절적인 트래픽의 피크에 대응하기 위해 컴포저블 블레이드를 도입하고 있습니다. 이러한 지역 역학은 데이터센터 블레이드 서버 시장의 세계 관련성을 높이고 있습니다.

The Data Center Blade Server market is valued at USD 18.2 billion in 2025 and is forecast to reach USD 27.10 billion by 2030, expanding at an 8.29% CAGR.

Rising deployment of AI and machine-learning workloads is reshaping compute density requirements, pushing vendors toward composable, disaggregated blade designs that separate compute, storage and networking resources. This architectural shift enables higher utilization and rapid workload re-allocation, while direct liquid cooling, silicon-photonics backplanes and advanced chassis management software help operators manage rack power envelopes that now exceed 30 kW. North America retains scale leadership, yet Asia-Pacific is growing faster on the back of large greenfield builds in India, China and Singapore. Colocation facilities remain the largest customer group, but hyperscalers are setting the technical agenda as they move to purpose-built AI blade systems that deliver higher rack-level efficiency.

AI inference and training clusters now push rack envelopes from 10-15 kW toward 30-50 kW. The Open Compute Project's OSAI specification targets 250 kW to 1 MW rack architectures, encouraging blade vendors to integrate high-efficiency voltage regulators and direct liquid cooling. Dell's PowerEdge XE9680L demonstrates how chassis-level airflow, cold-plate loops, and AI-specific accelerators can coexist without thermal throttling. The International Energy Agency projects that AI-focused data centers could consume 945 TWh by 2030, which keeps power-efficient blade design at the center of operator strategies

5G rollouts and ultra-low-latency services push compute to the network edge, spawning demand for micro-modular data centers that can ship pre-wired and pre-cooled. Google's patent for modular edge facilities confirms the importance of secure, multitenant rack assemblies with integrated power and heat exchange. Telecom operators are allocating a sizeable share of their USD 600 billion CAPEX plan to such edge sites, giving blade vendors an opening to supply quarter-height nodes tailored for constrained footprints

Switching to photonic integrated circuits and 800 GbE fabrics unlocks latency and bandwidth gains but demands new chassis, mid-plane connectors and retimer cards. National agencies acknowledge the efficiency upside yet caution that early deployments bear heavy capital costs, particularly for mid-sized enterprises. Research into memory disaggregation over CXL suggests a multi-year payback, forcing operators to stagger upgrades

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Tier 3 facilities owned 42.21% of the Data Center Blade Server market in 2024, as their N+1 redundancy profile aligns with mainstream enterprise SLAs. Tier 4 sites, though smaller in count, are forecast to grow at 12.2% CAGR thanks to fault-tolerance demands from AI training clusters. This momentum positions Tier 4 as the proving ground for 100% liquid-cooled chassis and silicon-photonics interconnects.

Operators of Tier 1 and Tier 2 facilities, typically serving edge aggregation or branch workloads, adopt standardized blades to maintain cost discipline while gaining better automation. The Infrastructure Masons report links 90% of current power growth to AI model training, a load now propagating into even modest sites that must accommodate higher power draw and rack density. As a result, vendors are packaging kits that retrofit lower-tier rooms with containment aisles and rear-door heat exchangers, preserving momentum for the wider Data Center Blade Server market.

Half-height blades delivered 48.41% revenue in 2024, supporting dual-socket CPUs, ample DIMM slots and PCIe expansion for most virtualization and database tasks. They remain the workhorse of enterprise colocation racks. Full-height models continue to serve quad-socket, memory-bound workloads such as in-memory analytics.

Quarter-height and micro-blade nodes are the fastest-growing slice at 14.12% CAGR because they fit 16-32 compute sleds per 10U shelf, ideal for limited edge footprints. Vendors now integrate GPU accelerators into these compact sleds, enabling real-time inference at cell-tower sites. Compatibility with Open Rack v3 specifications allows mixed deployment inside the same cabinet, sustaining the Data Center Blade Server market's edge expansion narrative.

Data Center Blade Server Market Report Segments the Industry Into Type (Tier 1, Tier 2, and More), Form Factor(Half-Height Blades, Full-Height Blades, and More), End-User Verticals (BFSI, Manufacturing, and More), Data Center Type(Hyperscalers/Cloud Service Provider, and More) and Geography (Asia-Pacific, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

North America controlled 42.23% of the Data Center Blade Server market in 2024, fueled by hyperscale campuses in Northern Virginia, Texas and Silicon Valley. The Lawrence Berkeley National Laboratory calculated 176 TWh of US data-center electricity use in 2023, raising urgency for liquid-cooled blades that cut facility PUEs. Canada and Mexico add incremental demand through regional sovereign-cloud and disaster-recovery zones.

Asia-Pacific is the fastest-growing theater at 12.54% CAGR from 2025-2030. China deploys massive AI cloud clusters, while India needs to expand installed capacity from 1.35 GW to 5 GW by 2030 to keep pace with digital-economy targets. Policy frameworks in Singapore award capacity licenses preferentially to designs that include high-density blades and heat-recovery chillers. Japan and Australia extend the edge footprint along subsea cable landing stations, embedding quarter-height blades for content caching.

Europe shows steady expansion under strict efficiency and data-sovereignty rules. Ecodesign 2019/424 revisions encourage blade chassis that support warm-water cooling above 35 °C, easing integration with district-heat loops. The Middle East and Africa attract investment for cloud on-ramps serving fintech and gaming customers. South America's installations cluster around Brazil's internet exchange hubs, where operators deploy composable blades to meet seasonal traffic peaks. These regional dynamics reinforce the global relevance of the Data Center Blade Server market.