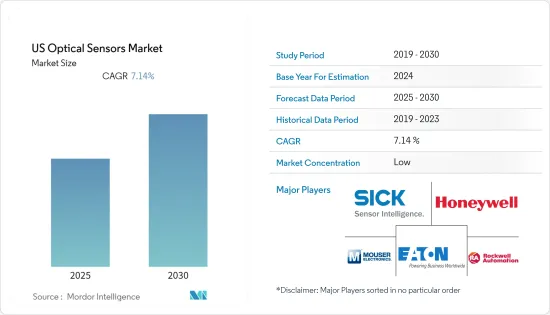

미국의 광학 센서 시장은 예측 기간 동안 연평균 7.14%의 CAGR을 기록할 것으로 예상됩니다.

소비자기술협회(CTA)에 따르면 2021년 소매 판매 예측에 따르면 미국의 소비자 전자제품 소매 판매액은 4,420억 달러에 달했습니다. 스마트폰은 가전제품 부문에서 가장 큰 소매 매출을 차지하는 제품으로 2020년 매출은 790억 달러에 달했습니다.

미국의 스마트폰 가구 보급률은 74%에 달해 미국 내 스마트폰 보급 가능성이 높다는 것을 보여줍니다. 미국 시장은 주로 시장의 최신 제품 혁신에 의해 주도되고 있습니다.

광학 센서는 일반적으로 스마트폰, 스마트 웨어러블, 스마트 워치에 환경 조명 등의 목적으로 내장되어 있습니다. 사물인터넷(IoT), 웨어러블 기술, 건강 및 피트니스 기술이 미국 시장을 변화시키고 있으며, 광학 센서 수요 증가의 주요 요인으로 작용하고 있습니다.

또한 스마트 TV는 높은 다기능성으로 인해 미국에서 높은 성장이 예상되며, comscore에 따르면 2020년 미국 가정에서 가장 인기 있는 스마트 TV 브랜드는 삼성으로 점유율이 32%로 안정적이며, 알카텔/TCL이 14%, Vizio가 13%로 뒤를 이었습니다. 미국에서는 스마트 TV가 모든 가정에 보급될 것으로 예상되며, 향후 더욱 증가하여 시장 성장에 박차를 가할 것으로 보입니다.

미국에서는 광학 센서를 이용한 자율주행차가 증가하고 있으며, Waymo와 같은 기업들이 미국에 진출해 무인자동차의 활용을 촉진하기 위해 사업을 확장하고 있습니다. 캘리포니아 주 등 미국 각 주에서 무인자동차 개발을 지원하기 위해 검사 규정을 확대하고 있어 광학 센서의 판매 증가가 예상됩니다.

광전 센서는 높은 정확도로 물체를 감지하기 때문에 산업 자동화 시장에서 널리 사용되고 있습니다. 이러한 센서는 계수, 모니터링, 컨베이어 메커니즘, 운송 시스템, 공작기계, 조립 라인 등 다양한 자동 기계에 통합되고 있으며, 주로 비접촉식 감지 및 측정을 위해 사용되고 있습니다.

Control Global Magazine에 따르면 이 지역의 주요 자동화 업체로는 Emerson, Rockwell, ABB, Fortive, Schneider Electric, Siemens 등이 있습니다. Emerson의 2020년 매출액은 52억 7,000만 달러, Rockwell Automation의 2020년 매출액은 37억 2,000만 달러입니다.

인더스트리 4.0을 통한 로봇 공학 및 자동화로의 전환이 가속화됨에 따라 작업의 정확성이 더욱 중요해지고 있습니다. 이에 따라 광전 센서에 대한 수요가 증가하고 있습니다. 포장, 자재 취급 및 자동차 산업은 IIoT와 빅데이터의 연계 및 스마트 센서의 데이터에 대한 의존으로 인해 광전 센서의 필요성을 강조하고 있습니다.

포장(자동 창고 증가)에서 제조, 의약품에서 식음료에 이르기까지 이러한 추세의 증가는 예측 기간 동안 시장 성장을 증가시킬 것으로 예상됩니다.

노동통계국에 따르면 미국의 창고 수는 해마다 증가하여 2020년에는 19,190개에 달했습니다. 또한 포브스가 48명의 응답자를 대상으로 실시한 설문조사에 따르면, 응답자의 3분의 1이 향후 1년 이내에 컨베이어 및 자동 분류 장비에 투자할 계획이 있다고 합니다.

광학 센서는 차선 유지 보조 시스템, 주차 보조 시스템, 긴급 제동 보조 시스템 등 운전 보조 시스템에 점점 더 많이 사용되고 있으며, LED와 적외선 레이저를 기반으로 한 센서는 운전자의 부담을 점차 줄여주는 ADAS(첨단 운전자 보조 시스템)의 핵심 기술 중 하나입니다. 주요 기술 중 하나입니다.

미국 경제 분석국(BEA)에 따르면 2020년 미국에서 약 220만 대의 자동차가 생산되었는데, 이는 COVID-19 전염병으로 인해 크게 감소했습니다. 그러나 이 수치는 예측 기간 동안 증가할 것으로 예상되어 시장 성장을 촉진할 수 있으며, OICA(Organisation Internationale des Constructeurs d'Automobiles)에 따르면 2020년에는 북미에서 약 1,340만 대의 자동차가 생산되었습니다.

적외선 레이저를 기반으로 한 센서도 컨베이어 시스템, 이송 시스템, 조립 라인 모니터링 등 비접촉식 감지를 위해 다양한 자동 기계에 점점 더 많이 통합되고 있습니다. 자동차 산업에서 광학 센서의 적용은 특히 기술 발전으로 인해 이미지 센서의 사용이 크게 증가하고 있습니다. 자동차 산업에서 이미지 센서의 성장은 자동차 부문의 광범위한 이미지 애플리케이션으로 인해 빠르게 성장할 것으로 예상됩니다.

2020년 1월, 세계 센서 솔루션 공급업체인 ams AG는 근적외선(NIR) 이미지 센서인 CMOS 세계 셔터 센서(CGSS) 근적외선(NIR) 이미지 센서인 CGSS130을 출시하였습니다. %의 높은 양자 효율을 가지고 있습니다. 센서 제조에 사용되는 적층 BSI 공정은 3.8mm*4.2mm의 작은 풋프린트를 제공합니다.

이 센서는 최대 120 프레임/초의 프레임 속도로 1080H X 1280V의 유효 픽셀 배열로 흑백 이미지를 생성합니다. 또한 100dB 이상의 HDR(High Dynamic Range) 모드를 지원하며, CGSS130은 NIR 파장에 대해 4배 더 민감하여 3D 센싱 시스템에서 매우 낮은 출력의 IR 이미터로부터의 반사를 확실하게 감지합니다. 이 센서는 액티브 스테레오 비전, Time-of-flight, Structured Light와 같은 3D 센싱 기술에 사용됩니다.

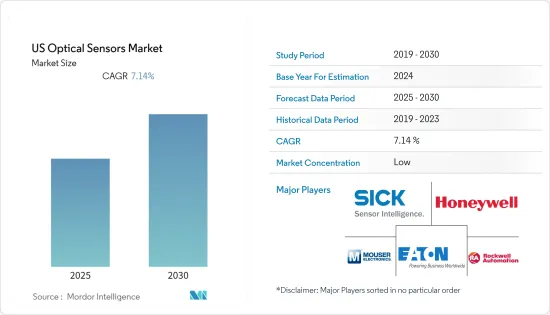

미국의 광학 센서 시장은 국제적인 전통 브랜드, 국내 브랜드, 신규 진입 기업 등 소수의 주요 기업들로 세분화되어 경쟁 구도를 형성하고 있습니다. 주요 진입 기업 중 일부는 다양한 전략적 인수합병, 기술 혁신, R&D 투자 증가를 통해 시장 확대를 위한 움직임을 강화하고 있습니다.

The US Optical Sensors Market is expected to register a CAGR of 7.14% during the forecast period.

According to the Consumer Technology Association (CTA), based on the projected retail sales for 2021, consumer electronics retail sales in the United States reached USD 442 billion. Smartphones were the products accounting for the largest retail revenue within the consumer electronics sector, comprising USD 79 billion in revenue in 2020.

The smartphone household penetration stands at 74% in the United States, which indicates a high potential for household penetration in the country. The United States market is primarily driven by the latest product innovations in the market.

Optical sensors are typically embedded in smartphones, smart wearable, and smartwatches for ambient light and other purposes. Internet of Things (IoT), wearable technology, and health and fitness technology have transformed the United States market and have been primary drivers for increasing the demand for optical sensors.

Smart TVs are also expected to witness high growth in the United States, owing to high multi-functionality. According to comscore, In 2020, Samsung remained the most popular smart TV brand among US households, with a steady share of 32%, followed by Alcatel/TCL and Vizio with 14% and 13% market share, respectively. It is expected that smart TVs will be a part of all households in the United States, which is expected to further increase further, thereby fueling the growth of the market.

Autonomous vehicles, which use optical sensors, have been on the rise in the United States. Companies, such as Waymo, are stationed in the country and have been expanding operations to drive the use of driverless cars. Various states in the country, such as California, have been expanding testing rules to aid the development of driverless cars, which is expected to increase the sales of optical sensors.

These sensors have been recognized for their robust use in the industrial automation marketplace, owing to their high precision in detecting objects. These sensors have found a rising integration into a wide range of automated machinery, mainly for non-contact detections and measurements, including counting, monitoring, conveyor mechanisms, transport systems, machine tools, and across assembly lines.

According to Control Global Magazine, some of the leading automation vendors in the region include Emerson, Rockwell, ABB, Fortive, Schneider Electric, Siemens, etc. Emerson had a sales revenue of USD 5.27 Billion in the year 2020, followed by Rockwell Automation with a sales revenue of USD 3.72 Billion in 2020.

With a greater inclination toward employing robotics and automation through Industry 4.0, there is a pressing need for precision in operations. Thus, driving the need for photoelectric sensors. The packaging, material handling, and automotive industries have emphasized the need for photoelectric sensors, owing to their collaboration of IIoT with Big Data and the reliance on data from smart sensors.

This rising trend in sectors, ranging from packaging (the growth of automated warehouses) to manufacturing, and pharmaceuticals to food and beverages, is set to augment the growth of the market over the forecast period.

According to the Bureau of Labor Statistics, the number of warehouses in the United States has been growing at an increasing rate every year, reaching 19,190 in 2020. Forbes survey with 48 respondents also showed that one-third of respondents plan to invest in conveyors or automatic sortation facilities in the next 12 months.

Optical sensors are increasingly used in driver assistance systems for lane-keeping assistants, parking assistants, and emergency brake assistant systems. The sensors, based on LEDs and infrared lasers, are one of the primary technologies for advanced driver assistance systems to reduce the burden on the driver gradually.

According to the U.S. Bureau of Economic Analysis (BEA), In 2020, approximately 2.2 million automobiles were produced in the United States, which has decreased a lot due to the covid-19 pandemic. However, this number is expected to increase in the forecasted period, which can fuel the growth of the market. Organisation Internationale des Constructeurs d'Automobiles (OICA), almost 13.4 million motor vehicles were produced in North America in 2020.

Sensors based on infrared lasers are also witnessing a rising integration into a wide range of automated machinery primarily for non-contact detection, such as monitoring conveyor systems, transport systems, and assembly lines. The application of optical sensors in the automotive industry is considerably growing, especially with the usage of image sensors due to the advancement of technology. The image sensors growth in the automotive industry is estimated to grow rapidly due to its extensive image applications in the automotive sector.

In January 2020, ams AG, a worldwide supplier of sensor solutions, launched the CMOS Global Shutter Sensor (CGSS) Near Infrared (NIR) image sensor, CGSS130, that enables 3D optical sensing applications such as face recognition, payment authentication, among others. The CGSS130 sensor has high quantum efficiency at NIR wavelength up to 40% at 940nm and 50% at 850nm. The stacked BSI process used to fabricate the sensors offer a small footprint of 3.8mm*4.2mm.

The sensor produces monochrome images with an effective pixel array of 1080H X 1280V at a maximum frame rate of 120 frames/s. In addition, it offers a high dynamic range (HDR) mode of more than 100dB. The CGSS130 is 4times more sensitive to NIR wavelengths and reliably detects reflections from very low-power IR emitters in 3D sensing systems. The sensor is used for 3D sensing technologies such as Active Stereo Vision, Time-of-flight, and Structured Ligh.

The United States Optical Sensors Market is fragmented with few major players, which are various established international brands, domestic brands, as well as new entrants that form a competitive landscape. Some of the major players are increasingly seeking market expansion through various strategic mergers and acquisitions, innovation, increasing investments in research and development.