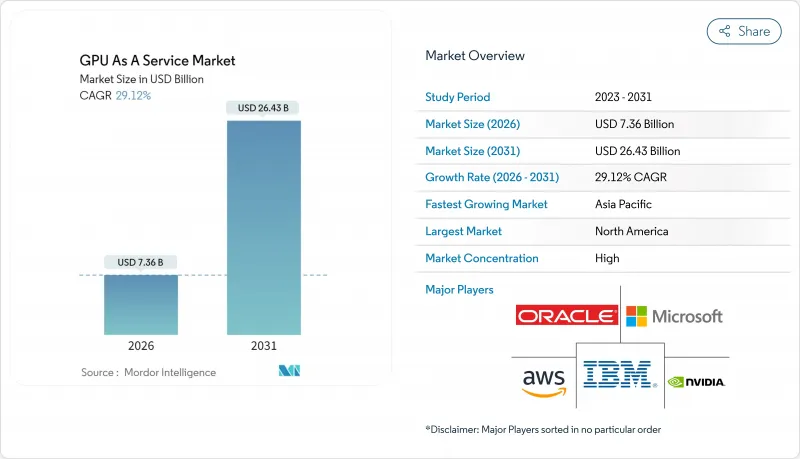

GPUaaS(GPU as a Service) 시장 규모는 2026년에는 73억 6,000만 달러로 추정되고, 2025년 57억 달러에서 성장이 예상됩니다.

2031년까지 264억 3,000만 달러에 달할 것으로 예측되며, 2026-2031년 CAGR 29.12%로 성장할 것으로 전망되고 있습니다.

GPUaaS(GPU as a Service) 시장은 생성형 AI 워크로드, 클라우드 게임 보급, 탄력성이 있는 고밀도 컴퓨팅 능력을 필요로 하는 기업 전체의 디지털 전환 프로젝트가 함께 가세를 하고 있습니다. 종량 과금 모델은 온프레미스 GPU 클러스터에서 클라우드 구독으로의 예산 이동이 계속되는 반면, 액체 냉각 시스템의 리노베이션을 통해 데이터센터 운영자는 랙당 가속기 밀도를 높이면서 전력 효율을 유지할 수 있습니다. 하이퍼스케일러는 세계적인 규모로 점유율을 보호하지만, 전문적인 '네오클라우드'는 가격과 워크로드 특화형 성능으로 적극적으로 경쟁하고 있습니다. 가격은 A100 인스턴스의 시간당 0.66달러부터 프리미엄 H100 구성의 4달러 이상까지 폭넓고, 고객은 성능 계층에 따라 유연하게 선택할 수 있습니다.

트랜스포머 기반의 모델 수요가 전례 없는 GPU 클러스터링을 견인하고 있으며, 단일 프로젝트에서 수천대의 H100 가속기를 몇 주간의 트레이닝 사이클에 투입하는 사례도 발생하고 있습니다. NVIDIA에 따르면 금융기관의 91%가 AI 이용 사례의 운영 또는 평가 단계에 있습니다. BNY 멜론과 같은 금융 서비스 회사는 실시간 사기 분석에서 GPU 수퍼 클러스터의 위력을 입증했습니다(nvidia.com). GPUaaS(GPU as a Service) 시장에 내재된 탄력적인 스케일링을 통해 연구팀은 예측 불가능한 교육 수요가 급증하면서 컴퓨팅 리소스를 유연하게 맞출 수 있습니다. 고대역폭 메모리(HBM)를 탑재한 H100 및 H200 부품은 파라미터 수를 늘릴 때에도 처리량을 유지하기 때문에 특히 선호됩니다. 스타트업 기업도 하이퍼스케일러가 도입하는 동일한 실리콘에 액세스할 수 있게 되어, 혁신의 경쟁 환경이 평준화되었습니다.

초당 90프레임의 포토리얼리틱한 렌더링은 소비자 하드웨어에 부하를 가하기 때문에 개발자는 원격 GPU에서 픽셀 완벽한 프레임을 스트리밍하는 동기부여가 되고 있습니다. NVIDIA의 CloudXR 플랫폼은 GPU 백엔드에 낮은 지연 코덱을 계층화하여 씬 클라이언트에 몰입형 경험을 제공합니다. Arcware와 같은 픽셀 스트리밍 전문 기업은 Unreal Engine as a Service를 제공하여 아키텍처 시각화 팀이 모바일 장치에서 대화형 모델을 제공할 수 있도록 합니다. 제조업에서는 물리 시뮬레이션과 실시간 가시화를 융합한 디지털 트윈 워크플로우를 채용해, 엣지에 있어서의 분산형 GPU 수요가 높아지고 있습니다. 차세대 헤드셋이 등장함에 따라 컨텐츠 스튜디오는 전용 렌더링 팜 구매보다 GPUaaS(GPU as a Service) 시장을 선호하고 이용하고 있습니다. 이것은 자본 비용을 피하고 유연성을 유지할 수 있기 때문입니다.

공유 액셀러레이터 풀은 새로운 공격 대상 영역을 생성하고 있으며, 조사에 의해 기존의 하이퍼바이저 장벽을 우회하는 GPU 사이드 채널 공격 벡터가 밝혀졌습니다. 기밀 컴퓨팅 확장 기능은 메모리 암호화 및 워크로드 분리를 실현하여 멀티 테넌트 환경이 은행 및 정부 기준을 충족하게 되었습니다. 수출 관리 규제로 컴플라이언스 대응이 복잡해지고 있으며 특정 TOPS 임계값을 초과하는 GPU는 국경을 넘어 전개하기 전에 라이선스가 필요합니다. 주권 클라우드 프레임 워크는 기업을 지역 노드로 유도하고 GPUaaS(GPU as a Service) 시장의 데이터센터 위치 전략에 영향을 미칩니다. 공급자는 지역별 키 관리 시스템과 암호화 서명을 통한 GPU 라이선스 강제로 대응합니다.

인공지능(AI) 이용 사례는 2025년 수익의 46.68%를 차지했으며, GPUaaS(GPU as a Service) 시장에서 가장 큰 점유율을 획득했습니다. 트랜스포머 아키텍처는 현재 1조 파라미터를 넘어서 탄력적인 클라우드 풀만 공급할 수 있는 다중 클러스터 수요를 견인하고 있습니다. 대규모 언어 모델의 추론은 실시간 채팅봇, 코드 생성 어시스턴트, 기업 지식 검색 및 트레이닝 사이클 종료 후에도 이용률을 안정적으로 유지하고 있습니다.

클라우드 게임 및 미디어 렌더링은 30.35%의 연평균 복합 성장률(CAGR)로 가장 빠르게 성장하는 애플리케이션으로, 2031년까지 엔터테인먼트 워크로드를 위한 GPUaaS(GPU as a Service) 시장 규모 확대에 기여합니다. 공급업체는 야간 게임 사용 피크를 수익화하고 주간 유휴 용량을 영화 렌더링 파이프라인에 대여하여 자산 이용률을 높이고 있습니다. 자율 주행 차량 환경을 시뮬레이션하는 하이브리드 워크로드는 포토 리얼 렌더링과 물리 기반 AI를 융합시켜 단일 테넌트 내에서 게임 엔진과 AI 프레임워크를 교차합니다. 이러한 크로스 도메인 워크플로우가 표준화됨에 따라 용도 경계는 모호해지고 증분 프로젝트는 모두 GPUaaS(GPU as a Service) 시장에 부가가치를 가져옵니다.

대기업은 예약 용량 계약과 전임 지원 팀에 의해 2025년 수익의 55.54%를 확보했습니다. 다국적 은행, 자동차 제조업체 및 제약 선두는 예측 가능한 AI 로드맵을 위해 H100 인스턴스를 복수연도 단위로 확보하고 있습니다. 이들은 종종 데이터센터의 코로케이션 계약과 제조업체 직접 판매 공급 보증을 협상하며 공급망 혼란 시에도 연속성을 보장합니다.

중소기업은 28.95%의 연평균 복합 성장률(CAGR)로 성장하고 있으며, 종량 과금제가 GPUaaS(GPU as a Service) 업계에 가져오는 민주화 효과를 뒷받침하고 있습니다. 서버리스 제공으로 DevOps 요원이 필요 없으며 소규모 팀에서도 며칠 만에 비전 모델 및 추천 엔진을 제품에 통합할 수 있습니다. A100의 경쟁력 있는 가격(시간당 0.66달러)은 진입 장벽을 더욱 낮추고 중소기업 참여가 깊어짐에 따라 GPUaaS(GPU as a Service) 시장 전체를 진전시키고 있습니다.

GPUaaS(GPU as a Service) 시장은 용도별(인공지능, 고성능 컴퓨팅 등), 기업 규모별(중소기업, 대기업), 최종 사용자 산업별(은행, 금융서비스 및 보험(BFSI), 자동차 및 모빌리티 등), 전개 모드별(퍼블릭 클라우드, 프라이빗 클라우드, 하이브리드 및 멀티클라우드), 서비스 모델별(IaaS, PaaS 등) 및 지역별로 분류됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

북미는 확립된 하이퍼스케일러의 거점, 활기찬 스타트업 에코시스템, 은행, 소매 및 엔터테인먼트 분야에서의 조기 도입을 배경으로 2025년 세계 수익의 30.88%를 차지했습니다. 프로바이더는 레거시 홀을 직접 투 칩 액체 냉각 시스템으로 개조하여 랙 밀도를 120kW 이상으로 높임으로써 시설당 수만 대의 GPU 도입을 실현하고 있습니다. 지역별 수출 규제로 최첨단 실리콘의 전개처가 제한되기 때문에 GPUaaS(GPU as a Service) 시장 내에서는 컴플라이언스 컨설팅이 부가가치 서비스로 제공되고 있습니다.

아시아태평양은 정부 주도의 AI 클라우드와 제조업의 디지털화를 배경으로 29.70%의 연평균 복합 성장률(CAGR)이 전망됩니다. 싱가포르는 국민 1인당 600달러를 NVIDIA 하드웨어에 투자하고 AI 인프라를 위한 세제 우대 조치를 제공함으로써 지역의 컴퓨팅 허브로서의 지위를 확립하고 있습니다. 인도의 국가 프로젝트 '1만 GPU 도입 계획'에서는 NVIDIA가 국내 통신 사업자와 제휴하여 주권 클라우드 구축을 추진하고 있습니다. 일본과 한국에서는 언어 번역 및 로보틱스 워크로드를 위한 H200 클러스터의 조달을 가속화하고 있으며, 지역 예산이 GPUaaS(GPU as a Service) 시장에 유입되는 다양한 요인이 나타났습니다.

유럽에서는 성장 기회와 엄격한 지속가능성 및 데이터 거주 규제의 균형이 잡혀 있습니다. 공급자는 EU의 탄소 배출 상한을 준수하며 100% 재생에너지 공급 및 폐열 재사용에 투자하고 있습니다. 정책면에서의 역풍에도 불구하고 자동차, 제약 및 공공 분야의 AI 애플리케이션 수요에 의해 이용률은 계속 상승하고 있습니다. 남미 및 중동 및 아프리카에서는 절대적인 성장 규모가 지연되고 있지만 광대역 보급률의 향상과 현지 AI 에코시스템의 성숙에 따라 두 자리수의 성장률을 나타내고 있습니다. 신흥지역 전체로서 GPUaaS(GPU as a Service) 시장의 잠재 사용자 기반을 확대하여 수익원의 더욱 다양화를 촉진할 전망입니다.

GPU as a Service market size in 2026 is estimated at USD 7.36 billion, growing from 2025 value of USD 5.70 billion with 2031 projections showing USD 26.43 billion, growing at 29.12% CAGR over 2026-2031.

The GPU as a Service market draws momentum from the collision of generative-AI workloads, cloud-gaming adoption, and companywide digital-transformation projects that require elastic, high-density compute capacity. Pay-per-use models continue to shift budgets away from on-premises GPU clusters toward cloud subscriptions, while liquid-cooling retrofits enable data-center operators to pack more accelerators per rack and maintain power efficiency. Hyperscalers protect share through global scale, yet specialist "neoclouds" compete aggressively on price and workload-specific performance. Pricing ranges from USD 0.66 per hour for A100 instances to USD 4.00 and above for premium H100 configurations, giving customers flexibility across performance tiers.

Demand for transformer-based models drives unprecedented GPU clustering, with single projects consuming thousands of H100 accelerators for training cycles that last weeks. NVIDIA noted that 91% of financial institutions are now in production or evaluation phases for AI use cases.Financial-services firms such as BNY Mellon demonstrated the power of GPU superclusters for real-time fraud analytics nvidia.com. Elastic scaling inherent in the GPU as a Service market allows research teams to match compute supply with unpredictable training bursts. High-bandwidth memory (HBM) equipped H100 and H200 parts are favored because they maintain throughput for expanding parameter counts. The long tail of startups can now access the same silicon that hyperscalers deploy, leveling the innovation playing field.

Photorealistic rendering at 90 frames per second strains consumer hardware, motivating developers to stream pixel-perfect frames from remote GPUs. NVIDIA's CloudXR platform layers low-latency codecs onto GPU back-ends to deliver immersive experiences to thin clients. Pixel-streaming specialists such as Arcware offer Unreal-Engine-as-a-Service so that architectural-visualization teams can present interactive models on mobile devices. Manufacturing firms adopt digital-twin workflows that mix physics simulation with real-time visualization, pushing demand for distributed GPUs at the edge. As next-generation headsets arrive, content studios prefer the GPU as a Service market over purchasing bespoke render farms because they avoid capital costs and maintain flexibility.

Shared accelerator pools create fresh attack surfaces, with research highlighting GPU side-channel vectors that bypass traditional hypervisor barriers.Confidential-computing extensions now encrypt memory and isolate workloads so that multi-tenant environments meet bank and government standards. Export-control regimes add compliance complexity because GPUs above certain TOPS thresholds require licensing before cross-border deployment. Sovereign-cloud frameworks push enterprises toward regional nodes, influencing data-center location strategies inside the GPU as a Service market. Providers respond with per-region key-management systems and cryptographically signed GPU-license enforcement.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Artificial-intelligence use cases represented 46.68% of 2025 revenue, giving this segment the largest slice of the GPU as a Service market. Transformer architectures now exceed 1 trillion parameters, driving multi-cluster demands that only elastic cloud pools can supply. Large-language-model inference spans real-time chatbots, code-generation assistants, and enterprise knowledge retrieval, keeping utilization steady after training cycles complete.

Cloud Gaming and Media Rendering is the fastest-rising application group at a 30.35% CAGR, helping expand the GPU as a Service market size for entertainment workloads through 2031. Providers monetize evening gaming peaks and rent idle daytime capacity to film-render pipelines, elevating asset utilization. Hybrid workloads that simulate autonomous-vehicle environments blend photoreal rendering with physics-based AI, bridging gaming engines and AI frameworks in a single tenancy. As these cross-domain workflows normalize, application boundaries blur and every incremental project funnels additional value into the GPU as a Service market.

Large Enterprises secured 55.54% of 2025 revenue thanks to reserved-capacity contracts and dedicated support teams. Multinational banks, automakers, and pharmaceutical giants lock in multi-year blocks of H100 instances for predictable AI roadmaps. They often negotiate data-center colocation arrangements or direct-to-manufacturer supply guarantees, ensuring continuity during supply-chain shocks.

Small and Medium Enterprises are growing at a 28.95% CAGR, underscoring the democratization effect that consumption billing brings to the GPU as a Service industry. Serverless offerings remove the need for DevOps headcount, allowing lean teams to integrate vision models or recommendation engines into products within days. Competitive pricing at USD 0.66 per hour for A100s further lowers entry barriers, propelling the overall GPU as a Service market forward as SME participation deepens.

GPU As A Service Market is Segmented by Application (Artificial Intelligence, High-Performance Computing, and More), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Automotive and Mobility, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid / Multi-Cloud), Service Model (IaaS, Paas, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

North America contributed 30.88% of global revenue in 2025 on the back of established hyperscaler footprints, vibrant startup ecosystems, and early adoption across banking, retail, and entertainment. Providers retrofit legacy halls with direct-to-chip liquid-cooling to achieve rack densities above 120 kW, enabling tens of thousands of GPUs per facility. Regional export controls shape where the most advanced silicon can be deployed, adding compliance consulting as a value-added service inside the GPU as a Service market.

Asia-Pacific is projected to post a 29.70% CAGR, reflecting government-funded AI clouds and manufacturing digitization. Singapore spends USD 600 per capita on NVIDIA hardware and offers tax incentives for AI infrastructure, positioning itself as a regional compute hub. India's national mission to install 10,000 GPUs partners NVIDIA with domestic telcos for sovereign-cloud builds. Japan and South Korea accelerate procurement of H200 clusters for language-translation and robotics workloads, illustrating diverse catalysts that funnel regional budgets into the GPU as a Service market.

Europe balances growth opportunities with stringent sustainability and data-residency regulations. Providers invest in 100% renewable energy supplies and waste-heat re-use, aligning with EU carbon caps. Demand across automotive, pharma, and public-sector AI applications keeps utilization rising despite policy headwinds. Growth in South America and the Middle East & Africa lags in absolute terms but posts double-digit gains as broadband penetration improves and local AI ecosystems mature. Collectively, emerging regions will expand the addressable user base and further diversify revenue streams for the GPU as a Service market.