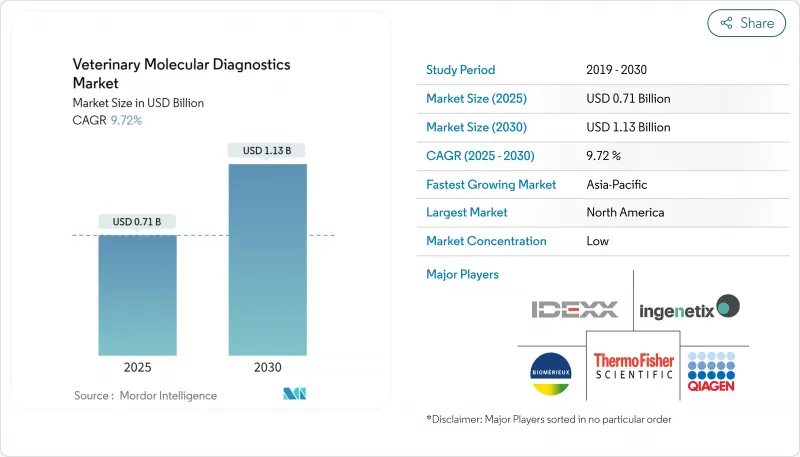

수의 분자진단 시장은 2025년에 16억 7,000만 달러, 2030년에는 25억 5,000만 달러에 이르고, CAGR 8.7%로 성장할 것으로 예측됩니다.

수의사가 더 크고 빈도가 높은 심각한 질병의 발생에 직면하고 정밀의료를 받아들이고 인공지능 도구를 일상 워크 플로우에 통합하면 도입이 가속화됩니다. 휴대용 나노포어 시퀀싱, 신드로믹 멀티플렉스 패널 및 클라우드 기반 분석은 테스트를 참조 실험실에서 포인트 오브 케어로 이동시켜 액세스를 늘리는 동시에 소요 시간을 단축합니다. 북미의 리더십은 계속되고 있지만, 동반 동물의 사육과 집약적인 가축 생산이 확대됨에 따라 아시아태평양은 가장 빠른 성장을 기록하고 있습니다. 경쟁업체 간의 적대관계는 가격보다 기술 폭이 넓고 대기업은 장비, 소모품, 소프트웨어 및 데이터 서비스를 번들로 고객을 둘러싸고 지속적인 수익을 얻고 있습니다.

2024년에 고병원성 조류 인플루엔자 H5N1이 미국의 젖소에 감염되었고, 미네소타 대학과 같은 연구소는 2025년 5월까지 115,000개 이상의 샘플을 처리해야 했습니다. 이러한 급증은 하루에 수백 개의 결과를 내는 높은 처리량 PCR 플랫폼에 대한 수요를 유발하고 바이러스의 진화를 추적하기 위한 전체 유전체 시퀀싱의 채택을 촉진합니다. 소와 관련된 인간의 H5N1 사례가 확인됨으로써, One-Health의 필요성이 높아졌고, 분자진단학은 동물과 인간의 공동발생 대응에 필수적인 인프라가 되었습니다. 따라서 시퀀싱 능력에 대한 투자로 수의 분자진단 시장은 통합적이고 빠르고 확장 가능한 솔루션으로 이동합니다.

아시아태평양에서 고기와 유제품 소비 증가는 생산자에게 바이오 보안 강화와 내병성 유전자의 선택을 촉구합니다. 축산업자는 현재 고해상도 용융 분석을 도입하여 병원체 균주를 확인하고 우수한 사료 전환을 위한 유전자 마커를 적용하여 복지를 지키면서 항생제 사용량을 줄이고 있습니다. 이러한 생산 지향 검사는 단일 워크플로우 내에서 병원체의 검출과 유전자 프로파일링을 결합할 수 있는 멀티플렉스 플랫폼의 장기 매출을 지원합니다.

임상검사기사의 결원률은 인간의 건강분야에서는 35%에서 40%에 달하며, 수의학 분야에서도 비슷한 격차가 있습니다. 지방 수의사는 종종 검사 기사를 겸해야 하지만 대부분의 수의학 커리큘럼에서는 분자 생물학 교육이 제한적입니다. 인력 부족은 첨단 플랫폼의 도입을 늦추고 소규모 클리닉에서 수의 분자진단 시장을 제한하고 있습니다.

키트 및 시약은 2024년 매출의 59.1%를 차지하며 공급업체의 현금 흐름을 안정화시키는 경상 비즈니스 모델을 지원합니다. 그러나 소프트웨어 및 서비스는 클라우드 분석, AI 해석 모듈, 구독 데이터 포털이 실험실 업무에 필수적이 됨에 따라 CAGR 11.9%로 확대되고 있습니다. 주요 공급업체는 소모품, 장비 및 애널리틱스를 번들하여 스위칭 장벽을 강화합니다. 소모품으로 인한 수의 분자진단제 시장 규모는 2030년까지 지배적일 것으로 예상되지만 차별화를 위해 소프트웨어의 전략적 중요성이 높아집니다. 휴대형 나노포어 시퀀서의 가격이 기존의 벤치탑형 시스템의 몇 분의 1인 것으로 대표되는 바와 같이, 장치의 소형화와 오픈 플랫폼 설계에 의해 진입 장벽이 저하되어 장치의 마진이 축소합니다. 그 결과, 제조업체 각 사는 하드웨어와 디지털 해석 및 라이프타임 키트의 수익을 결합한 통합 에코시스템으로 전환하고 있습니다.

감염증 감시는 2024년 매출의 69.7%를 차지하며, 새 독감, 아프리카 돼지 콜레라 열, 개 파르보바이러스를 관리하는 검사실이 여전히 수의 분자진단 시장의 핵심입니다. 신드로믹 패널은 감별 진단을 단축하고 경험적 항생제 사용을 줄입니다. 유전학 애플리케이션은 CAGR 10.4%로 발전하고 있으며, 반려동물 주인이 유전성 스크리닝을 원하고 브리더가 유전체 선별에 중점을 두고 있음을 반영합니다. 종양학을 위한 리퀴드 바이옵시는 임상 채택이 더욱 넓어지고 있습니다. 유전학 수의 분자진단제 시장 규모는 시퀀싱 비용이 저하되고 질병 소인과 성능 형질 모두에 대해 일상적인 스크리닝이 가능해짐에 따라 가속될 것으로 예측됩니다.

북미는 2024년 매출액의 41.6%를 차지했으며, 이는 광범위한 수의학 인프라, 관대한 반려동물 관리 지출, 2025년 동물 건강 진단에 대한 6,442만 9,000달러의 미국 농무부의 자금 지원에 지원되고 있습니다. 새로운 분석에 대한 연방 정부의 빠른 패스웨이가 혁신을 가속화하고 있지만, 지방 기술 부족은 병목 현상이 되었습니다.

유럽은 엄격한 항균제 스튜어드십 규칙 덕분에 상당한 점유율을 유지하고 있습니다. 규칙(EU) 2019/6은 동물 의약품 모니터링을 현대화하고 신속한 내성 검사에 대한 수요를 높입니다. 2018년부터 2022년 사이에 이 지역은 식용 동물에서 항균제 사용을 28.3% 줄이고, 농장이 컴플라이언스 도구로 분자 감시를 채택하도록 촉구하고 있습니다.

아시아태평양은 CAGR 11.1%에서 가장 빠르게 성장하는 지역입니다. 중간층 반려동물 사육, 대규모 낙농장 확대, ASEAN 의료기기 지침 등의 지원 정책이 보급에 박차를 가하고 있습니다. 라틴아메리카와 중동 및 아프리카는 환율 변동과 제한된 실험실 네트워크가 성장을 억제하는 것, 꾸준한 보급을 기록하고 있습니다. 다양한 생물종과 기후에 맞는 휴대용 진단 키트는 이러한 지역에서의 보급을 가속화할 수 있습니다.

The veterinary molecular diagnostics market is valued at USD 1.67 billion in 2025 and is forecast to reach USD 2.55 billion by 2030, advancing at an 8.7% CAGR.

Adoption accelerates as veterinarians confront larger and more frequent outbreaks of high-consequence diseases, embrace precision medicine, and integrate artificial-intelligence tools into daily workflows. Portable nanopore sequencing, syndromic multiplex panels, and cloud-based analytics are shifting testing from reference laboratories toward point-of-care settings, widening access while shortening turnaround times. North American leadership continues, yet Asia Pacific records the fastest growth as companion-animal ownership and intensive livestock production expand. Competitive rivalry centers on technology breadth rather than price, with leading firms bundling instruments, consumables, software, and data services to lock in customers and capture recurring revenue.

High-pathogenicity avian influenza H5N1 infected U.S. dairy cattle in 2024, pushing laboratories such as the University of Minnesota to process more than 115,000 samples by May 2025. Such surges spur demand for high-throughput PCR platforms that deliver hundreds of results per day and drive adoption of whole-genome sequencing to track viral evolution. Confirmed human H5N1 cases linked to cattle reinforce the One-Health imperative, making molecular diagnostics essential infrastructure for joint animal-human outbreak response. Investments in sequencing capacity therefore shift the veterinary molecular diagnostics market toward integrated, rapid and scalable solutions.

Rising meat and dairy consumption in Asia Pacific is pushing producers to intensify biosecurity and select disease-resistant genetics. Livestock operators now deploy high-resolution melting assays to distinguish pathogen strains and apply genetic markers for superior feed conversion, cutting antibiotic usage while protecting welfare. This production-oriented testing sustains long-term sales of multiplex platforms capable of combining pathogen detection with genetic profiling inside a single workflow.

Vacancy rates for laboratory technologists have reached 35%-40% in human health, with parallel gaps in veterinary practice. Rural veterinarians must often double as lab technicians, yet most veterinary curricula provide limited molecular-biology training. Staffing shortages slow installation of advanced platforms and limit the veterinary molecular diagnostics market in smaller clinics.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Kits and reagents produced 59.1% of 2024 revenues, anchoring a recurring business model that stabilizes cash flow for suppliers. Software and services, however, are expanding at an 11.9% CAGR as cloud analytics, AI interpretive modules, and subscription data portals become integral to laboratory operations. Leading vendors bundle consumables, instruments, and analytics, reinforcing switching barriers. The veterinary molecular diagnostics market size attributable to consumables is forecast to remain dominant through 2030, yet software will command increasing strategic importance for differentiation. Instrument margins tighten as miniaturization and open-platform designs lower entry barriers, illustrated by portable nanopore sequencers costing a fraction of legacy bench-top systems. As a result, manufacturers pivot toward integrated ecosystems that pair hardware with digital interpretation and lifetime kit revenue.

Infectious disease surveillance generated 69.7% of 2024 sales and remains the core of the veterinary molecular diagnostics market as laboratories manage avian influenza, African swine fever, and canine parvovirus. Syndromic panels shorten differential diagnosis and reduce empirical antibiotic use. Genetics applications, advancing at a 10.4% CAGR, reflect pet owners' desire for hereditary screening and breeders' focus on genomic selection. Liquid biopsies for oncology further widen clinical adoption. The veterinary molecular diagnostics market size for genetics is projected to accelerate as sequencing costs fall, enabling routine screening for both disease predisposition and performance traits.

The Veterinary Molecular Diagnostics Market is Segmented by Products (Instruments, Kits, and More), Applications (Infectious Diseases, Genetics, and More), Technology (PCR, Microarray, and More), Animal Type (Companion Animals and Livestock), End User (Veterinary Hospitals & Clinics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

North America captured 41.6% revenue in 2024, underpinned by extensive veterinary infrastructure, generous pet-care spending, and USDA funding of USD 64.429 million for animal-health diagnostics in 2025. Federal fast-track pathways for new assays accelerate innovation, though rural skills shortages remain a bottleneck.

Europe maintains a substantial share thanks to strict antimicrobial stewardship rules. Regulation (EU) 2019/6 modernizes veterinary medicinal oversight and boosts demand for rapid resistance testing. Between 2018 and 2022, the region cut antimicrobial use in food animals by 28.3%, prompting farms to adopt molecular surveillance as a compliance tool.

Asia Pacific is the fastest-growing territory at an 11.1% CAGR. Middle-class pet ownership, mega-dairy expansion, and supportive policies such as the ASEAN Medical Device Directive spur uptake. Latin America and the Middle East & Africa record steady adoption, although currency volatility and limited laboratory networks temper growth. Portable diagnostic kits tailored for diverse species and climates show promise for accelerating penetration in these regions.