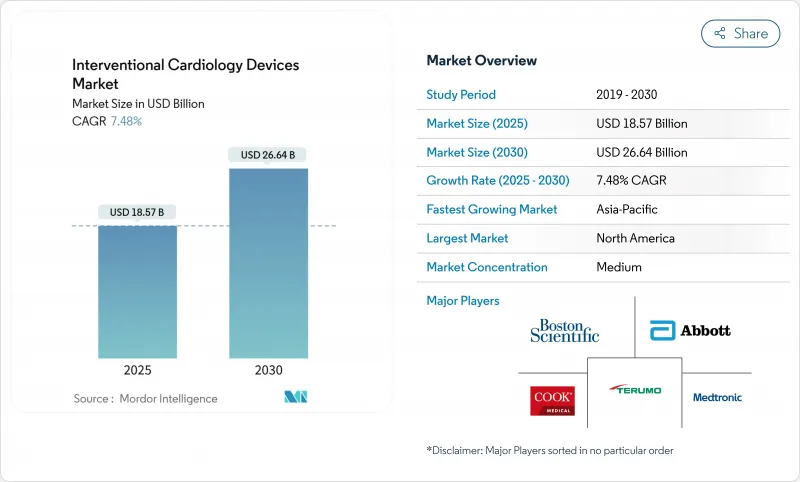

심혈관 중재시술 기기 시장은 2025년에 185억 7,000만 달러로 추정되고, 2030년에는 266억 4,000만 달러에 이를 것으로 예측되며, CAGR 7.48%로 성장할 전망입니다.

현재의 성장은 약물 용출 스텐트, 혈관 내 결석 파쇄(IVL) 시스템, AI 강화 이미징에 의존하는 저침습 절차의 활발한 흡수에 의해 지원됩니다. 관상동맥질환(CAD)의 세계 부담 확대는 당일 퇴원 패스웨이 및 외래수술센터(ASC)의 채용과 함께 대응 가능한 환자 풀을 계속 확대하고 있습니다. 규제 당국과 의료 제공업체가 장기적인 안전과 지속가능성을 중시하게 되어 제품 파이프라인은 보다 얇은 스트럿, 생체 흡수성 플랫폼으로 이동하고 있습니다. 대기업이 차별화 기술의 추가나 공급망의 강화를 목적으로 한 인수를 진행하는 중, 경쟁의 격렬함은 증가하고 있습니다. 규제 당국에 의한 감시 강화, 노동력 부족, 재료에 관한 법규제가 역풍이 되고 있지만, 시장의 상승 궤도를 벗어나지 못하고 있습니다.

CAD는 여전히 세계적인 사망 원인의 최상위이며 미국에서만 2,000만 명 이상의 성인이 앓고 있습니다. 고령화, 비만, 앉기 쉬운 라이프스타일로 인해 특히 IVL 요법이 효과적인 다지 병변과 복잡한 석회화 병변에 대한 PCI 수요가 증가하고 있습니다. 아시아태평양 시장은 도시화에 따라 식생활 및 활동 패턴이 변화하고 있기 때문에 가장 급증하고 있습니다. CAD는 만성 질환으로 관리되기 때문에 재수술이 수술 건수의 대부분을 차지하게 되어, 단발적인 치료를 넘어 기기의 이용이 지속되고 있습니다.

병원과 지불자는 입원 기간을 단축하고 합병증을 줄이는 경피적 접근법을 선호합니다. COVID-19의 대유행은 이러한 기호를 강하게 하고, 약제 용출성 풍선이나 생체 흡수성 스캐폴드의 채용을 촉진했습니다. 인공지능 지원 이미지는 정확도를 높이고, 조영제 부담을 줄이며, 과거 개복 수술의 위험이 높다고 판단된 노인과 합병증이 있는 환자에 대한 적응을 확대합니다.

EU의 의료기기 규제는 보다 엄격한 임상 데이터와 시판 후 서베이런스를 요구하고, 시장 투입까지의 시간과 컴플라이언스 비용을 증대시키고 있습니다. 동시에 미국에서는 몇 가지 클래스 i 이벤트를 받았으며 리콜 모니터링이 강화되었습니다. 지역에 따라 요구사항이 다르기 때문에 제조업체는 병렬 승인 프로그램을 실행해야 하며 중소형 혁신자에게 부담을 주고 있습니다.

관상동맥 스텐트는 경피적 인터벤션의 지속적인 수요에 힘입어 2024년 심혈관 중재시술 기기 시장의 41.35%를 차지했으며, 최대 매출을 창출했습니다. IVL 플랫폼은 아직 시작되었지만 2030년까지 연평균 복합 성장률(CAGR)은 11.25%로 예측됩니다. IVL 기술의 심혈관 중재시술 기기 시장 규모는 심각하게 석회화된 병변의 경피적 치료가 더 자주 수행됨에 따라 현저하게 확대될 것으로 예측됩니다. 극세 스트럿의 약물 용출 스텐트와 차세대 생체 흡수성 스캐폴드는 재협착을 감소시켜 혈관의 생리적 치유를 촉진합니다. 베어 메탈 스텐트는 현재 항혈소판 이중 요법을 필요로 하지 않는 환자에게만 사용됩니다. PTCA 풍선과 가이드와이어는 안정적인 수량 성장을 유지하고 약물 코팅 풍선은 2024년 FDA에서 Agent 플랫폼이 승인된 후 스텐트 내 재협착 관리용으로 주목받게 됩니다.

IVUS 카테터 및 OCT 카테터 등의 수술 보조기구는 병변의 평가를 정밀화하고 기구의 사이징을 최적화하는 AI 오버레이의 혜택을 받습니다. 즉각적인 보행이 가능한 지혈 장치는 당일 퇴원 프로토콜에 필수적입니다. 이러한 혁신은 전반적으로 절차의 효율성을 높이고 PCI의 임상 범위를 확장합니다.

북미는 광범위한 보험 적용, 견고한 임상 연구 네트워크, AI 가이드 하 영상 진단의 급속한 보급을 배경으로 2024년 매출에서 41.82%를 차지했으며, 심혈관 중재시술 기기 시장을 선도했습니다. 이 지역은 또한 FDA의 리콜에 대한 경계와 카테라보의 인력 부족이 성장을 억제하고 있는 것, ASC의 채용이나 복잡한 PCI에 대한 당일 퇴원의 선구가 되고 있습니다. 유럽은 성숙하면서도 기술 혁신 친화적인 지역이며 지속가능성에 대한 노력이 생체흡수성 발판과 저탄소 공급망을 뒷받침하고 있습니다. MDR의 컴플라이언스 비용은 소규모 제조업체들에게 무거워지지만, 독일과 프랑스에서는 차세대 의료기기의 조기 인체 사용이 시험적으로 계속되고 있습니다.

아시아태평양은 현저한 성장 엔진이며 예측 CAGR은 12.61%로 전망됩니다. 중국의 공공 보험 확대와 병원 건설 붐이 PCI 생산량을 확대하고 인도의 가격 억제 환경이 현지 생산에 뒷받침되는 비용 효율적인 DES 플랫폼을 뒷받침하고 있습니다. 일본은 승인 프로세스가 엄격하기 때문에 도입이 지연되지만, 승인을 얻으면 고가격으로 판매됩니다. 한국과 호주는 높은 절차 품질과 조기 AI 통합을 보여 주며 이차 혁신의 거점으로 자리매김하고 있습니다. 이러한 추세는 지역 경쟁력을 재구성하고 심혈관 중재시술 기기 시장에서 미래의 수익 풀을 재분배할 것입니다.

The interventional cardiology devices market generated USD 18.57 billion in 2025 and is forecast to reach USD 26.64 billion by 2030, registering a 7.48% CAGR.

Current growth is anchored by brisk uptake of minimally invasive procedures that rely on drug-eluting stents, intravascular lithotripsy (IVL) systems and AI-enhanced imaging. The expanding global burden of coronary artery disease (CAD), together with same-day discharge pathways and ambulatory surgical center (ASC) adoption, continues to enlarge the addressable patient pool. Product pipelines are shifting toward thinner-strut, bio-resorbable platforms as regulators and providers place greater emphasis on long-term safety and sustainability. Competitive intensity is rising as large manufacturers pursue acquisitions that add differentiated technologies and shore up supply chains. Escalating regulatory scrutiny, workforce shortages and material legislation present headwinds but have not derailed the market's upward trajectory.

CAD remains the leading global cause of mortality, affecting more than 20 million adults in the United States alone. Aging populations, obesity and sedentary lifestyles are increasing procedural demand, particularly for multivessel disease and complex calcified lesions that benefit from IVL therapy. Asia-Pacific markets show the steepest rise as urbanization alters dietary and activity patterns. Re-interventions now constitute a larger portion of procedural volume because CAD is managed as a chronic condition, sustaining device utilization beyond single-episode care.

Hospitals and payers favor percutaneous approaches that shorten admissions and reduce complications. The COVID-19 pandemic reinforced this preference and catalyzed adoption of drug-eluting balloons and bio-resorbable scaffolds. AI-assisted imaging enhances precision, lowers contrast load and expands eligibility for elderly or comorbid patients once deemed high risk for open surgery.

EU Medical Device Regulation demands more rigorous clinical data and post-market surveillance, increasing time-to-market and compliance costs. Concurrently, the United States has heightened recall oversight after several Class I events. Divergent regional requirements force manufacturers to run parallel approval programs, straining smaller innovators.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Coronary stents generated the largest revenue, holding 41.35% of the interventional cardiology devices market in 2024, supported by durable demand for percutaneous interventions. IVL platforms, although nascent, are forecast to advance at 11.25% CAGR through 2030. The interventional cardiology devices market size for IVL technology is expected to expand markedly as heavily calcified lesions become more frequently treated percutaneously. Ultra-thin-strut drug-eluting stents and next-generation bio-absorbable scaffolds reduce restenosis and facilitate physiologic vessel healing. Bare-metal stents are now reserved for patients requiring abbreviated dual antiplatelet therapy. PTCA balloons and guidewires maintain steady volume growth, with drug-coated balloons gaining attention for in-stent restenosis management following FDA approval of the Agent platform in 2024.

Procedural adjuncts such as IVUS and OCT catheters benefit from AI overlays that refine lesion assessment and optimize device sizing. Hemostasis devices that enable immediate ambulation are integral to same-day discharge protocols. Collectively, these innovations bolster procedural efficiency and extend the clinical reach of PCI.

The Interventional Cardiology Devices Market Report is Segmented by Product Type (Coronary Stents [Bare-Metal Stents, and More], Catheters [Angiography Catheters, and More], PTCA Balloons, Guide Wires, and More), End-User (Hospitals, Ambulatory Surgical Centers, and More), Material (Cobalt-Chromium Alloy, Nitinol, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

North America led the interventional cardiology devices market with 41.82% revenue in 2024 on the back of broad insurance coverage, robust clinical research networks and rapid uptake of AI-guided imaging. The region is also pioneering ASC adoption and same-day discharge for complex PCI, although FDA recall vigilance and cath-lab staffing gaps temper growth. Europe follows as a mature yet innovation-friendly arena where sustainability initiatives encourage bio-resorbable scaffolds and lower-carbon supply chains. MDR compliance costs weigh on small manufacturers, but Germany and France continue to pilot early human use of next-generation devices.

Asia-Pacific is the standout growth engine with a 12.61% forecast CAGR. China's public insurance expansion and hospital construction boom are scaling PCI volumes, while India's price-capped environment favors cost-effective DES platforms anchored by local production. Japan's stringent approval process slows rollouts but commands premium pricing once clearance is secured. South Korea and Australia showcase high procedural quality and early AI integration, positioning them as secondary innovation hubs. Together these trends are set to re-shape regional competitive dynamics and redistribute future revenue pools within the interventional cardiology devices market.