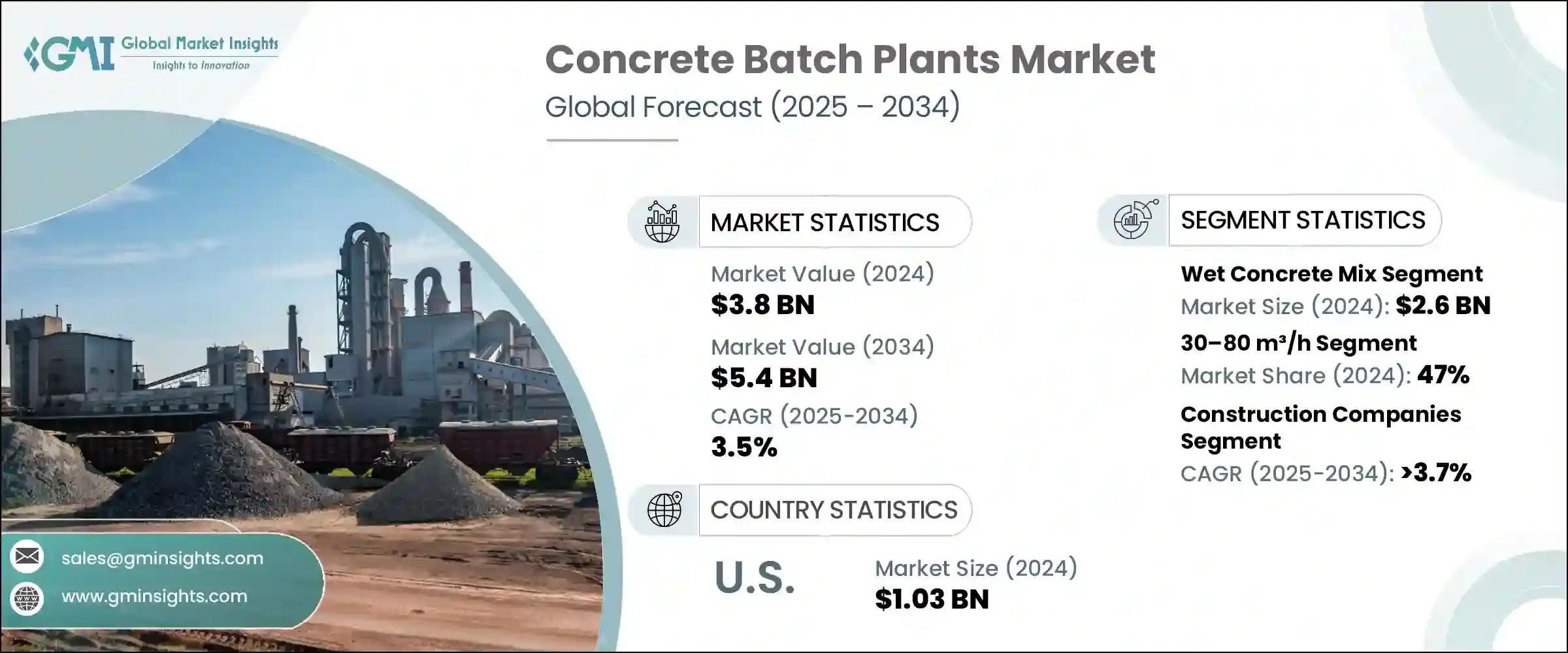

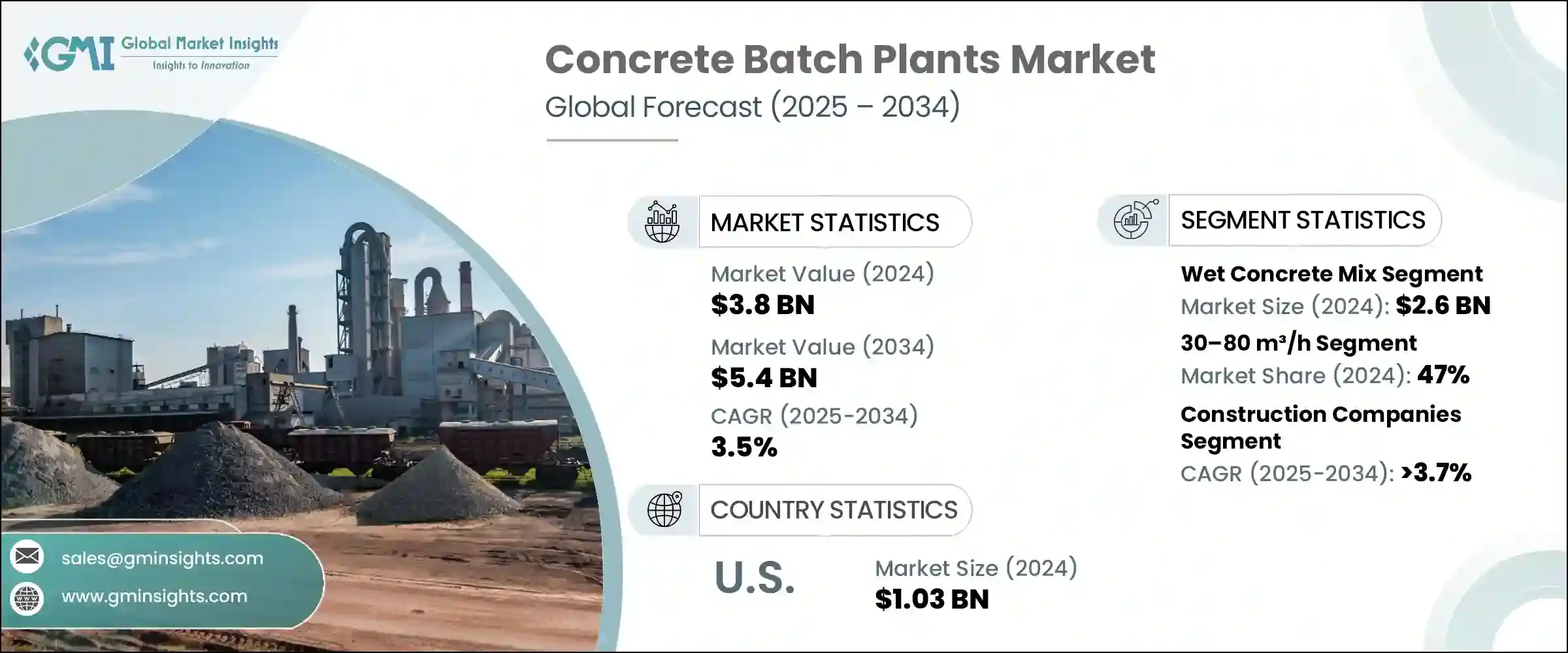

세계의 콘크리트 배치 플랜트 시장은 2024년 38억 달러로 평가되었으며 CAGR 3.5%를 나타내 2034년까지 54억 달러에 이를 것으로 추정됩니다.

이 증가 추세는 인프라 개발 확대, 도시 급속한 확대, 효율적이고 고품질의 콘크리트 제조 방법에 대한 수요 증가로 지원됩니다. 상업 허브, 주택 개발, 에너지 관련 인프라에 대한 투자를 계속하고 있습니다. 이 프로젝트는 모두 일관된 고성능 콘크리트에 크게 의존하고 있으며, 이는 고급 배치 플랜트의 필요성을 부추기고 있습니다.

이동식 배치 플랜트는 운송에 대한 의존성을 줄이고 프로젝트의 타임라인을 가속화하는 현장에서의 혼합 능력으로 주목할만한 인기를 모으고 있습니다. 뿐만 아니라 전기 구동의 이동식 플랜트를 검토하도록 촉구하고 있습니다. 휴대용 기능을 갖춘 컴팩트한 모듈식 플랜트는 이전의 용이성과 셋업의 유연성으로부터 점점 채용되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 38억 달러 |

| 예측 금액 | 54억 달러 |

| CAGR | 3.5% |

습식 콘크리트 믹스 부문은 2024년에 26억 달러를 생산했고 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 3.7%를 나타낼 것으로 예측됩니다. 물을 포함한 모든 필수 재료를 현장에서 충분히 혼합할 수 있기 때문에 보다 선호되게 되어 왔습니다. 운송 중 혼합을 위해 미리 계량된 재료를 전달하는 드라이버 배치 플랜트와 비교하여, 습식 믹스 시스템은 특히 높은 강도 사양이 필요한 대규모 프로젝트에 보다 큰 제어와 균일성을 제공합니다. 건식 혼합 솔루션은 고속으로 이동하는 원격지 건설 작업에 유용하지만 습식 배치는 탁월한 결과와 생산 정확도로 인해 여전히 지배적입니다.

생산 능력이 30-80m3/h인 플랜트는 2024년에 47%의 점유율을 차지했고, 2025년부터 2034년의 CAGR은 3.9%를 나타낼 것으로 예측됩니다. 적당한 처리 능력으로 계약자는 상업 개발, 지자체 프로젝트, 도로 포장 작업 등 폭넓은 용도로 도입할 수 있습니다.

유럽의 콘크리트 배치 플랜트 시장은 2024년에 8억 달러로 평가되었고 2025년부터 2034년에 걸쳐 CAGR 3.1%를 나타낼 것으로 예측됩니다. 수량 감소의 규제 압력과 지속 가능한 건축 관행에 대한 수요가 증가함에 따라 형성됩니다. 대규모 공공 투자와 민간 투자로 시장이 급속히 확대되고 있습니다.

시장을 선도하는 주요 제조업체는 Sany, Elkon, Vince Hagan, Putzmeister, XCMG, Cemco, Meka, JEL Concrete Plants, Schwing Stetter, Semix, Stephens Mfg, Ammann, AIMIX Group, Liebherr, Astec 등이 있습니다. 콘크리트 배치 플랜트 시장 주요 기업은 경쟁력을 강화하고 시장 점유율을 확대하기 위해 여러 가지 중점 전략을 전개하고 있습니다. 지속가능성의 동향에 맞추어 에너지 효율이 높은 모델을 도입하여 배출규제를 충족하고 있습니다.

The Global Concrete Batch Plants Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 5.4 billion by 2034. This upward trend is supported by growing infrastructure development, rapid urban expansion, and the rising demand for efficient, high-quality concrete production methods. Governments and private entities across both developed and developing economies are continuing to invest in robust transportation systems, commercial hubs, housing developments, and energy-related infrastructure. These projects all rely heavily on consistent and high-performance concrete, which is fueling the need for advanced batch plants.

Mobile batching plants are gaining notable traction due to their on-site mixing capability, which reduces the reliance on transportation and speeds up project timelines. This demand spans across various sectors, including utilities, industrial development, and road construction. Evolving environmental policies and growing emphasis on sustainable construction are prompting contractors to consider electric-powered mobile plants over diesel-based alternatives, particularly in dense urban areas. Compact modular plants with portable features are increasingly being adopted for their ease of relocation and set-up flexibility. Furthermore, innovations like IoT integration, automation, and smart control panels are transforming plant operations, making real-time monitoring and minimal manual input possible.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 3.5% |

The wet concrete mix segment generated USD 2.6 billion in 2024 and is expected to grow at a CAGR of 3.7% from 2025 to 2034. Wet mix plants are gaining more preference as they allow all essential materials-including water-to be thoroughly mixed at the site before the concrete is loaded for delivery. This results in a more even mix and superior concrete quality, which appeals to construction professionals seeking consistency and reliability. Compared to dry batch plants that deliver pre-weighed materials for mixing in transit, wet mix systems offer greater control and uniformity, especially in larger projects requiring higher strength specifications. While dry mix solutions are useful for fast-moving, remote construction tasks, wet batching remains dominant for its better results and production precision.

Plants with a production capacity ranging from 30 to 80 m3/h segment accounted for 47% share in 2024 and are projected to register a CAGR of 3.9% during 2025-2034. These batch plants are ideally suited for medium-scale infrastructure developments and urban projects, balancing capacity with flexibility. Their moderate throughput enables contractors to deploy them for a wide range of applications such as commercial developments, municipal projects, and road paving operations. They strike a good balance between output efficiency and mobility, allowing users to adapt quickly to different project requirements.

Europe Concrete Batch Plants Market was valued at USD 800 million in 2024 and is anticipated to grow at a CAGR of 3.1% from 2025 to 2034. This regional growth is being shaped by regulatory pressure to cut construction emissions and the rising demand for sustainable building practices. Contractors throughout Europe are adopting mobile batch plants to reduce the environmental footprint of transporting concrete and to better align with eco-focused infrastructure initiatives. Western Europe sees steady demand supported by refurbishment and maintenance activities, while in Eastern Europe, the market is expanding rapidly due to public and private investment in infrastructure growth and emerging construction demands. Countries across the region are making sustainability central to development strategies, pushing the adoption of newer-generation concrete batching systems.

Key manufacturers leading the market include Sany, Elkon, Vince Hagan, Putzmeister, XCMG, Cemco, Meka, JEL Concrete Plants, SCHWING Stetter, Semix, Stephens Mfg, Ammann, AIMIX Group, Liebherr, and Astec. Top players in the concrete batch plants market are deploying several focused strategies to strengthen their competitive edge and enhance market share. Companies prioritize product innovation with a strong emphasis on automation and digital integration to deliver smart batching solutions with real-time control features. They are introducing energy-efficient models to align with sustainability trends and meet emission norms. Regional expansion through partnerships and localized manufacturing is helping firms improve market responsiveness and reduce logistics costs. Modular and portable plant designs are being emphasized to serve remote projects and fast-paced construction sites.