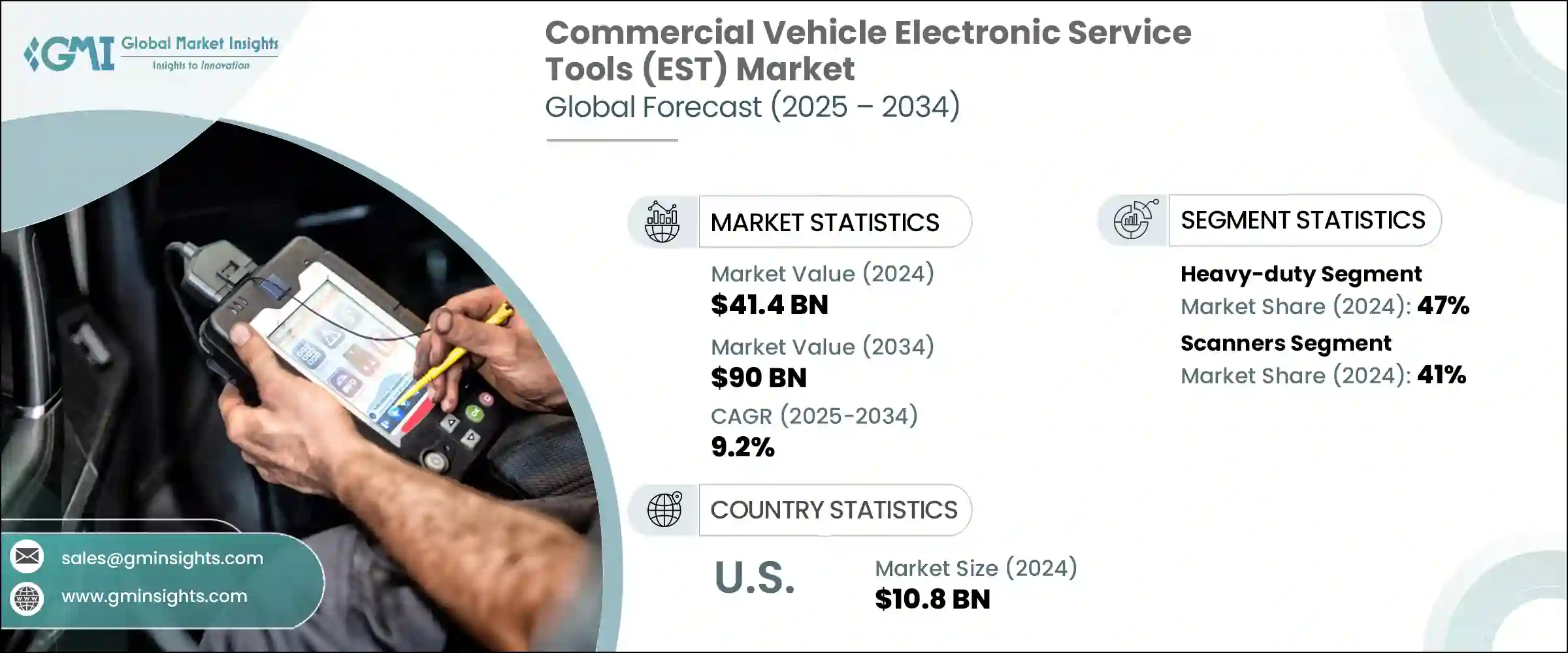

상용차용 EST 시장 규모는 2024년에 414억 달러로 평가되었고, CAGR 9.2%를 나타내 2034년까지는 900억 달러에 이를 것으로 추정됩니다. 엔진 제어 유닛(ECU), 텔레매틱스 시스템, 운전 지원 기술 등 상용차에 첨단 전자 제품의 급속한 통합으로 하이테크 진단 도구 수요가 크게 증가하고 있습니다. 기존의 기계적 서비스로는 충분하지 않기 때문에 함대 운영자와 서비스 센터는 실시간 진단, 소프트웨어 업데이트 및 정확한 고장 감지를 제공하는 고급 전자 도구를 채택합니다. 이러한 도구는 차량의 가동 중지 시간을 줄이고 차량 성능을 최적화하며 유지보수 효율을 높이는 데 도움이 됩니다. 전자상거래, 물류, 공급망 분야의 활세에 힘입어 세계 상용차 보유 대수가 증가함에 따라 정기적인 진단과 유지보수의 필요성이 커지고 있습니다.

함대 관리자는 가동 중지 시간을 최소화하고 자원 배분을 개선하기 위해 전자 서비스 도구를 활용한 예지 보전 솔루션에 대한 의존도를 높이고 있습니다. 이러한 차량의 지속적인 운전은 부품에 추가적인 부담을 주어 빈번한 유지보수와 시기 적절한 진단의 필요성을 가속화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 414억 달러 |

| 예측 금액 | 900억 달러 |

| CAGR | 9.2% |

2024년 대형차 부문의 점유율은 47%에 달했습니다. 이 성장의 원동력이 되고 있는 것은 세계 물류에 있어서 대형차의 사용 증가이며, 리얼타임 데이터와 원격 진단은 업무 효율, 규제 준수, 신속한 문제 해결을 확보하는데 필수적입니다. 특수한 EST 수요가 급증하고 있습니다. 이러한 툴은 연료 소비량, 엔진 성능, 드라이버의 행동 등, 차량의 주요 파라미터의 감시에 도움이 되기 때문에 특히 국경을 넘은 운송에 있어서, 차량 운행의 강화, 다운타임의 최소화, 규제 기준의 유지가 가능하게 됩니다.

스캐너 분야는 2024년에 41%의 점유율을 차지했으며, 2034년까지의 CAGR은 11.1%를 나타낼 것으로 예상되고 있습니다. 현재는 ECU 프로그래밍, 시스템 테스트, 양방향 제어 등 보다 많은 기능성이 제공되어 기술자의 생산성과 서비스 정밀도가 향상되어 더욱 보급되고 있습니다.

미국의 상용차용 EST 시장은 83%의 점유율을 차지했으며, 2024년에는 108억 달러를 창출하였습니다. 독립 정비 공장, OEM 공인 서비스 센터, 플리트 유지 보수 시설의 광범위한 네트워크를 포함하여, 이 나라의 자동차 애프터마켓 인프라는 잘 확립되어 있으며, 전자 서비스 도구의 성장에 견고한 기반을 제공합니다.

상용차용 EST 시장 주요 기업은 Bendix, Bosch, Continental AG, Cummins, Daimler Trucks, Knorr-Bremse, Navistar, PACCAR, Snap-on, Volvo 등입니다. 각 회사가 시장에서의 지위를 강화하기 위해 채택한 주요 전략에는 최신 차량 기술과 원활하게 통합되는 고급 진단 도구의 지속적인 개발이 포함됩니다. 각 회사는 또한 대형 트럭에서 소형 지자체 차량에 이르기까지 폭넓은 차종에 대응하는 제품 라인업의 확충에도 주력하고 있습니다. 또한 새로운 차량 모델과의 툴 호환성을 확보하기 위해 OEM 및 플릿 오퍼레이터와의 제휴가 진행되고 있으며, 예측 진단을 위한 인공지능과 머신러닝을 도입하는 등 툴의 기능을 강화하기 위한 연구개발에 대한 투자도 우선되고 있습니다. 게다가 많은 기업들은 성장하는 함대와 물류 부문을 활용하기 때문에 특히 신흥 시장에서의 세계 존재 확대에 주력하고 있습니다.

The Global Commercial Vehicle Electronic Service Tools Market was valued at USD 41.4 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 90 billion by 2034. The rapid integration of advanced electronics into commercial vehicles, including engine control units (ECUs), telematics systems, and driver-assistance technologies, has significantly increased the demand for high-tech diagnostic tools. With traditional mechanical servicing becoming inadequate, fleet operators and service centers are adopting advanced electronic tools to provide real-time diagnostics, software updates, and precise fault detection. These tools help reduce vehicle downtime, optimize fleet performance, and enhance maintenance efficiency. As the global commercial vehicle fleet grows, driven by the boom in e-commerce, logistics, and supply chain sectors, the need for regular diagnostics and maintenance is intensifying.

Fleet managers are increasingly relying on predictive maintenance solutions, powered by electronic service tools, to minimize downtime and improve resource allocation. This trend is especially critical as commercial vehicles experience increased wear and tear from extended operational hours, particularly in industries like logistics, construction, and long-haul trucking. The continuous operation of these vehicles puts added pressure on components, accelerating the need for frequent maintenance and timely diagnostics. With the growing demands on fleets, service providers and tool manufacturers are finding significant opportunities to introduce innovative solutions that can optimize maintenance schedules and enhance vehicle longevity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41.4 Billion |

| Forecast Value | $90 Billion |

| CAGR | 9.2% |

In 2024, the heavy-duty vehicle segment held a 47% share. This growth is driven by the increasing use of heavy-duty vehicles in global logistics, where real-time data and remote diagnostics are vital for ensuring operational efficiency, regulatory compliance, and quick problem resolution. As the logistics industry becomes more reliant on advanced technologies to improve fleet management, the demand for specialized electronic service tools continues to surge. These tools help monitor key vehicle parameters, such as fuel consumption, engine performance, and driver behavior, thus enhancing fleet operations, minimizing downtime, and maintaining regulatory standards, especially in cross-border transportation.

The scanners segment held a 41% share in 2024 and is expected to grow at a CAGR of 11.1% through 2034. The continuous evolution of diagnostic scanners has made them more versatile and efficient in diagnosing complex vehicle systems. New advancements, such as wireless communication capabilities, touchscreen interfaces, and live data streaming, have made these tools indispensable in workshops and service centers. They now offer more functionalities, including ECU programming, system tests, and bi-directional controls, which enhance technician productivity and service accuracy, further driving their adoption.

United States Commercial Vehicle Electronic Service Tools (EST) Market held a dominant 83% share and generated USD 10.8 billion in 2024. The vast and varied commercial vehicle fleet in the U.S. serves as a constant driver for demand in this sector, particularly in industries like long-haul trucking, delivery, and construction. The country's well-established automotive aftermarket infrastructure, including a wide network of independent workshops, OEM-authorized service centers, and fleet maintenance facilities, provides a solid foundation for the growth of electronic service tools.

Key players in the Commercial Vehicle Electronic Service Tools Market include Bendix, Bosch, Continental AG, Cummins, Daimler Trucks, Knorr-Bremse, Navistar, PACCAR, Snap-on, and Volvo. Key strategies that companies are adopting to strengthen their position in the market include the continuous development of advanced diagnostic tools that integrate seamlessly with the latest vehicle technologies. Companies are also focusing on expanding their product offerings to cater to a wide range of vehicle types, from heavy-duty trucks to smaller municipal vehicles. Additionally, partnerships with OEMs and fleet operators are being pursued to ensure tool compatibility with new vehicle models, while investment in research and development is a priority to enhance tool capabilities, such as incorporating artificial intelligence and machine learning for predictive diagnostics. Furthermore, many companies are focusing on expanding their global presence, particularly in emerging markets, to capitalize on the growing fleet and logistics sectors.