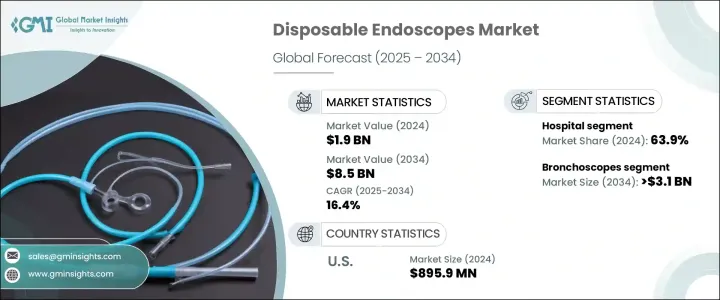

세계의 일회용 내시경 시장은 2024년에는 19억 달러로 평가되었고 CAGR 16.4%로 성장하여 2034년에는 85억 달러에 이를 것으로 추정됩니다.

이러한 현저한 성장은 저침습 처치에 대한 기호 증가와 암과 위장 장애 등의 만성 질환의 유병률 증가로 인한 점이 큽니다. 주로 앉아서 생활하는 라이프스타일, 고령화 등으로 인해 조기 진단 툴의 필요성이 계속 높아지고 있습니다. 일회용 내시경은 재사용 가능한 스코프로 원내 감염이나 교차 오염의 리스크를 줄여주는 보다 안전한 선택지로 등장했습니다.

일회용 내시경은 연성, 경성에 관계없이 진단과 치료의 목적 모두에서 사용할 수 있도록 설계되어 있습니다. CMOS 센서 기술을 통합한 비용 효율적인 설계의 도입으로 처리 중인 이미지의 선명도와 실시간 시인성이 향상되어 다양한 의료 환경 중에서도 특히 자원이 제한된 환경에서의 채용이 진행되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 19억 달러 |

| 예측 금액 | 85억 달러 |

| CAGR | 16.4% |

기관지 내시경 분야는 CAGR 17%로 성장하여 2034년에는 31억 달러에 이를 것으로 예측되고 있습니다. 특히 신속한 개입이 필요하거나 기존 스코프의 긴 재처리 시간이 치명적인 중증 환자나 외상 환자에게는 기기를 즉시 사용할 수 있는 기능성이 선호되고 있습니다.

2024년에는 병원 부문이 63.9%를 차지하면서 시장의 최대 점유율을 차지하였습니다. 기존의 재사용 스코프는 특히 수술 병동에서 감염 전파의 위험이 높습니다. 하지만, 일회용 스코프는 감염 프로파일이 낮고 HAI가 환자의 건강과 시설 비용에 심각한 위험을 초래하는 중요한 부문에서 선호되는 선택입니다.

미국의 일회용 내시경 2024년 시장 규모는 8억 9,590만 달러를 달성하였고, 2034년까지의 CAGR은 15.3%를 보일 것으로 예측됩니다. 미국에서는 감염 대책이 중시되면서 일회용 솔루션 수요가 더욱 높아지고 있습니다.

일회용 내시경 업계를 선도하는 주요 기업은 Olympus, HugeMed, Boston Scientific, RICHARD WOLF, Flexicare, Ambu, Karl Storz, CooperSurgical, Parburch MEDICAL, Hoya Corporation 등이 있습니다. 또한 진보된 영상기술과 인체공학에 투자하고 있는 기업도 다수 존재합니다. 그리고 병원 및 임상 연구 기관과의 제휴는 제품 성능을 검증하고 의료 현장에서 광범위한 채용을 촉진하는 데 도움이 됩니다.

The Global Disposable Endoscopes Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 16.4% to reach USD 8.5 billion by 2034. This notable growth is largely driven by the increasing preference for minimally invasive procedures and the growing prevalence of chronic diseases such as cancer and gastrointestinal disorders. A steady rise in conditions like inflammatory bowel disease, peptic ulcers, colorectal cancer, and esophageal complications-largely attributed to poor dietary habits, sedentary lifestyles, and aging populations-continues to boost the need for early diagnostic tools. As these conditions often demand frequent examinations, disposable endoscopes have emerged as a safer option, reducing the risk of hospital-acquired infections and cross-contamination that may occur with reusable scopes.

Designed for single-use, disposable endoscopes-whether flexible or rigid-offer both diagnostic and therapeutic capabilities. One of their major advantages is that they eliminate the need for complex sterilization processes, making them ideal for use in point-of-care or emergency settings. The introduction of cost-effective designs integrated with CMOS sensor technology has improved imaging clarity and real-time visibility during procedures, driving further adoption in various healthcare environments, especially in resource-limited settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 16.4% |

The bronchoscopes segment is forecasted to witness strong expansion, growing at a CAGR of 17% to reach USD 3.1 billion by 2034. The rising inclination toward single-use bronchoscopes stems from their ability to minimize infection risks in high-stakes environments like ICUs. These devices are now preferred for their ready-to-use functionality, especially in critical care and trauma scenarios where rapid intervention is necessary and time-consuming reprocessing of traditional scopes is impractical.

In 2024, hospitals accounted for the largest share of the market, generating 63.9%. With a high procedural load and established infrastructure, hospitals are increasingly transitioning to disposable endoscopic solutions to enhance safety and operational efficiency. Traditional reusable scopes, especially in surgical units, present a greater risk of infection transmission. In contrast, disposable scopes offer a lower infection profile, making them a preferred choice in critical departments where HAIs pose a significant risk to patient health and institutional costs.

United States Disposable Endoscopes Market generated USD 895.9 million in 2024 and is set to grow at a CAGR of 15.3% through 2034. The country's leading position is supported by a well-established healthcare system, high surgical volumes, and early adoption of innovative technologies. Growing emphasis on infection control practices has further fueled demand for disposable solutions. Favorable reimbursement structures, regulatory support from the FDA, and substantial R&D investments from domestic companies have also created an environment conducive to rapid product development and market expansion.

Key players leading the Disposable Endoscopes Industry include Olympus, HugeMed, Boston Scientific, RICHARD WOLF, Flexicare, Ambu, Karl Storz, CooperSurgical, Parburch MEDICAL, and Hoya Corporation. Leading companies in this market are focusing on new product launches, strategic collaborations, and technological innovation to strengthen their presence. Many are investing in advanced imaging technologies and ergonomics to enhance usability and procedural efficiency. Mergers and acquisitions are also being pursued to expand product portfolios and gain access to untapped regional markets. Some players are emphasizing scalable production capabilities and affordable designs to cater to growing demand from emerging economies. At the same time, partnerships with hospitals and clinical research institutions are helping to validate product performance and drive broader adoption across healthcare settings.