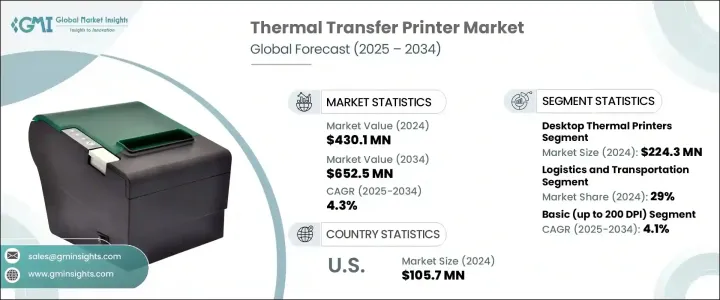

세계의 열전사 프린터 시장은 2024년 4억 3,010만 달러에 달했고, CAGR 4.3%로 성장하여 2034년까지 6억 5,250만 달러에 이를 것으로 예측됩니다.

이 성장은 신뢰성이 높고 오래 지속되는 라벨링 솔루션에 대한 요구가 높아지고 인쇄 기술의 지속적인 발전이 기여하고 있습니다. 또한 열 활성화 잉크리스 인쇄 방식은 기존 잉크의 필요성을 없애고 시장을 재구성하고 있습니다. 제조업체 각 회사는 석유 기반 플라스틱을 대신하여 재생 가능한 생분해성 소재를 사용하여보다 친환경적인 선택에 적극적으로 투자하고 있으며, 보다 광범위한 기업 책임의 목표에 부합합니다.

이러한 동향은 기능성을 향상시킬 뿐만 아니라, 서멀 프린트 기술을 환경 규제나 진화하는 고객의 기대에 부합하고 있습니다. 엄격한 컴플라이언스 기준에 대응하기 위해 기업은 저배출 기술을 통합하여 보다 친환경적인 생산 공정를 채택하여 이산화탄소 배출량을 줄이고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 4억 3,010만 달러 |

| 예측 금액 | 6억 5,250만 달러 |

| CAGR | 4.3% |

데스크톱형 서멀 프린터 분야는 2024년 2억 2,430만 달러를 창출했고 CAGR 4.1%를 보일 것으로 예측됩니다. 인기 증가는 컴팩트한 디자인, 무선 호환성, 사용자 친화적인 기능과 관련되어 있습니다. 이 기능은 공간을 최적화하면서 효율적인 업무를 지원합니다. 여러 미디어 유형과 크기를 지원하며 워크플로우의 유연성을 높이고 장비 설치 공간을 최소화할 수 있는 다기능 솔루션을 선호합니다.

물류 및 운송 분야는 2024년에 29%의 점유율을 차지했으며, 2034년까지 연평균 복합 성장률(CAGR) 4.7%를 보일 것으로 예측됩니다. 이 업계는 추적 및 운송을 위해 내구성이 있으며 스캔 가능한 라벨을 만들기 위해 열전사 프린터에 크게 의존합니다. 모바일 인쇄 기능도 인기를 끌고 있으며, 배송 중이나 물류 거점에서 온디맨드의 라벨 작성을 가능하게 하고 있습니다.

미국 열전사 프린터 시장은 83%의 점유율을 차지했으며, 2024년에는 1억 570만 달러를 창출했습니다. 인쇄된 출하 라벨, 바코드, 포장 식별자에 대한 요구가 높아지고 있으며, 이들은 모두 열전사 프린터로 효율적으로 작성됩니다.

세계의 열전사 프린터 산업의 성장에 기여하고 있는 주요 기업은 APS Group, Domino Printing, SATO America, Markem-Imaje, Linx Printing Technologies, Videojet Technologies, Weber Packaging Solutions, PrintJet, Brother, Hanin(HRPT), Kite Packaging, DNP Group, Brady, Connectivity 등입니다. 세계의 열전사 프린터 시장에서의 지위를 확고히 하기 위해, 각사는 혁신, 커스터마이즈를 중심으로 한 전략을 실행하고 있습니다. 또, 주요 제조업체는 환경에 대한 영향을 저감해, 환경 의식이 높은 구매층에 어필하기 위해, 생분해성 리본과 같은 지속 가능한 제품을 발매하고 있습니다. 또한, 각 제조업체는 다양한 산업용도에 적합한 모듈식의 콤팩트 설계를 제공하는 것으로, 제품의 유연성을

The Global Thermal Transfer Printer Market was valued at USD 430.1 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 652.5 million by 2034. This growth is fueled by the rising need for reliable, long-lasting labeling solutions and continued advancements in printing technologies. As businesses prioritize efficient labeling systems, the demand for smart thermal transfer printers is climbing. Recent innovations such as cloud printing, mobile connectivity, and wireless setup are enhancing usability and driving wider adoption. Emerging heat-activated, inkless printing methods are also reshaping the market by eliminating traditional ink needs. Meanwhile, the shift toward sustainability is driving the development of environmentally friendly ribbon alternatives that reduce ecological impact. Manufacturers are actively investing in greener options using renewable, biodegradable materials to replace petroleum-based plastics, aligning with broader corporate responsibility goals.

These trends are not only improving functionality but also aligning thermal printing technology with environmental regulations and evolving customer expectations. Manufacturers are now placing greater emphasis on sustainable product development by introducing biodegradable ribbons, recyclable components, and energy-efficient printing systems. In response to stricter compliance standards, companies are integrating low-emission technologies and adopting greener production processes to reduce their carbon footprint. At the same time, users are demanding printers that offer more than just performance-they want smart, connected, and eco-conscious devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $430.1 Million |

| Forecast Value | $652.5 Million |

| CAGR | 4.3% |

The desktop thermal printers segment generated USD 224.3 million in 2024 and is forecast to grow at a 4.1% CAGR. Their increasing popularity is linked to compact designs, wireless compatibility, and user-friendly features. Widely adopted in sectors such as healthcare, logistics, and retail, these printers support efficient operations while optimizing space. Businesses prefer multifunctional solutions capable of handling multiple media types and sizes, improving workflow flexibility, and minimizing equipment footprint.

The logistics and transportation segment represented a 29% share in 2024 and is projected to grow at a 4.7% CAGR through 2034. These industries rely heavily on thermal transfer printers to create durable, scannable labels for tracking and shipping. High-resolution, long-lasting labels are critical for supply chain management, as they withstand environmental stress and constant handling. Mobile printing capabilities are also gaining popularity, enabling on-demand label production during deliveries and at distribution points. This portability enhances accuracy and speed across logistics workflows, supporting real-time inventory control and seamless operations.

United States Thermal Transfer Printer Market held an 83% share and generated USD 105.7 million in 2024. This leadership position is driven by the growing need for durable labeling solutions in fast-paced industries and the rapid development of e-commerce. With the rise in direct-to-customer fulfillment, there's a higher requirement for printed shipping labels, barcodes, and packaging identifiers, all of which are produced efficiently with thermal transfer printers. U.S. companies are embracing these technologies to meet high-volume demands with speed and reliability.

Leading players contributing to the growth of the Global Thermal Transfer Printer Industry include APS Group, Domino Printing, SATO America, Markem-Imaje, Linx Printing Technologies, Videojet Technologies, Weber Packaging Solutions, PrintJet, Brother, Hanin (HRPT), Kite Packaging, DNP Group, Brady, Hellermann Tyton, and TE Connectivity. To solidify their positions in the global thermal transfer printer market, companies are executing strategies centered on innovation, customization, and sustainability. They are developing smart printers with cloud-based printing, remote access, and seamless mobile integration to cater to tech-savvy users and boost operational convenience. Key players are also launching sustainable products like biodegradable ribbons to reduce environmental impact and appeal to eco-conscious buyers. Additionally, manufacturers are enhancing product flexibility by offering modular, compact designs suitable for varied industry applications.