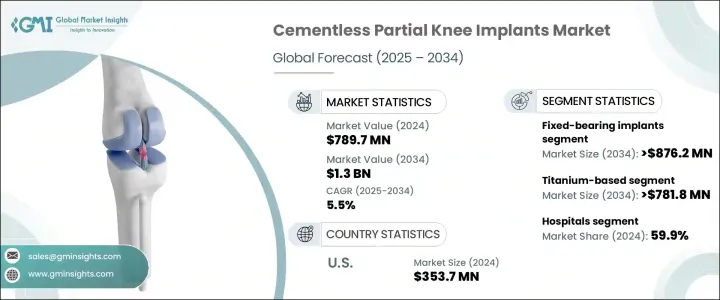

세계의 시멘트리스 부분 슬관절 임플란트 시장은 2024년에는 7억 8,970만 달러로 평가되었으며, 2034년에는 13억 달러에 이를 것으로 추정되며, CAGR 5.5%로 성장할 전망입니다.

이러한 성장에 기여하는 주요 요인은 무릎 재수술의 증가로 이어지는 감염률의 상승, 골관절염 및 류마티스 관절염의 유병률 증가, 그리고 최소 침습적 시술에 대한 선호도 증가 등입니다. 골관절염을 앓고 있는 노인의 수가 증가하고 있으며, 더 효과적이고 침습성이 낮은 수술 옵션에 대한 수요가 증가하고 있는 것이 이 시장의 중요한 성장 동력입니다. 시멘트리스 부분 슬관절 임플란트는 단일 관절면 무릎 관절 치환술(UKA)에 사용되며, 무릎 관절의 손상된 부분만 교체하여 자연스러운 뼈와 인대를 더 많이 보존합니다.

이 임플란트는 뼈 시멘트의 사용을 제거하여 생물학적 고정 방법을 가능하게 합니다. 이 방법은 임플란트 주변의 뼈 조직의 자연스러운 성장을 촉진하여 임플란트와 뼈 사이의 더 강하고 내구성이 뛰어난 통합을 이끌어냅니다. 뼈 시멘트의 부재는 시간 경과에 따른 임플란트 이완 위험을 최소화할 뿐만 아니라 시멘트 관련 감염 및 염증과 같은 합병증 발생 가능성도 줄입니다. 또한 생물학적 고정력은 임플란트의 전체적 안정성을 향상시켜 수명을 연장하고 장기적 환자 예후를 개선할 수 있습니다. 결과적으로 시멘트리스 임플란트는 더 자연스러운 치유 과정을 제공하며 재수술이 덜 필요할 수 있어 정형외과 수술에서 점점 더 선호되는 옵션으로 부상하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 7억 8,970만 달러 |

| 예측 금액 | 13억 달러 |

| CAGR | 5.5% |

고정식 임플란트 부문은 2034년까지 연평균 5.3%의 성장률을 보이며 8억 7,620만 달러 규모로 성장할 것으로 예상됩니다. 이 임플란트는 이동식 베어링 시스템보다 기계적으로 단순하고 고장률이 낮아 외과의사들 사이에서 더 인기가 있습니다. 저요구 환자에서 10년 후 90% 이상의 장기 생존율을 제공합니다. 또한 이동식 베어링 시스템은 일반적으로 더 비싸고 복잡해 수용과 광범위한 사용이 제한됩니다. 결과적으로 고정식 베어링 시스템은 많은 경우 선호되는 선택지로 자리 잡으며 채택이 가속화되고 시장 지배력을 강화하고 있습니다.

티타늄 기반 부문은 5.4%의 성장률을 보이며 2034년에는 7억 8,180만 달러에 달할 것으로 예상됩니다. 티타늄은 생체 적합성이 뛰어나 이러한 기기의 성공에 중요한 골 유착을 촉진하기 때문에 시멘트리스 임플란트에 이상적입니다. 티타늄 임플란트는 코발트-크롬 합금에 비해 뼈 조직에 대한 접착력이 뛰어나고 느슨해짐에 대한 저항성이 뛰어나 안정성과 수명이 향상됩니다. 티타늄 합금은 경량성과 강도를 겸비하여 수술 후 이동성이 더 필요한 젊고 활동적인 환자에게 특히 적합합니다. 또한 티타늄은 금속에 민감한 사람에게 이상적이며, 개인 맞춤형 무릎 관절 치환술에 대한 수요를 더욱 촉진합니다.

미국의 시멘트리스 부분 슬관절 임플란트 시장은 2024년에 3억 5,370만 달러로 평가되었습니다. 미국 인구의 고령화는 전 세계에서 가장 빠르게 진행되고 있으며, 무릎 교체 수술에 대한 수요 증가에 기여하고 있습니다. 골관절염, 특히 내측 단일 관절 골관절염은 부분 무릎 교체 수술의 필요성을 촉진하는 주요 질환 중 하나입니다. 또한 미국에서는 외래 정형외과 수술이 증가하고 있으며, 특히 외래 수술 센터에서 짧은 마취 시간, 최소 혈액 손실, 빠른 회복 등의 장점 때문에 더욱 확산되고 있습니다. 또한 미국은 강력한 보상 시스템을 갖추고 있으며, 민간 보험사 및 메디케어는 적합한 환자에게 부분 무릎 관절 치환술이 전체 무릎 관절 치환술보다 비용 효율적임을 점점 더 인정하고 있습니다.

전 세계 시멘트리스 부분 슬관절 임플란트 시장의 주요 업체로는 Stryker, Medacta, Amplitude Surgical, Smith+Nephew, Waldemar Link, GRUPPO BIOIMPIANTI, ZIMMER BIOMET, Lepine, Just Medical 및 Medacta가 있습니다. 시멘트리스 부분 슬관절 임플란트 업계의 기업들은 시장 입지를 강화하기 위해 여러 가지 전략에 집중하고 있습니다. 이들은 임플란트 디자인과 기능성을 개선하기 위해 지속적인 혁신에 투자하고 있습니다. 예를 들어, 임플란트의 생체적합성과 골융합 특성을 향상시키는 것이 포함됩니다. 의료 제공자, 클리닉, 병원과의 파트너십도 제품의 시장 확대와 채택률 향상을 위해 구축되고 있습니다. 또한 기업들은 특히 정형외과 수술 수요가 증가하는 신흥 시장에서의 지역 확장에도 집중하고 있습니다.

The Global Cementless Partial Knee Implants Market was valued at USD 789.7 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 1.3 billion by 2034. The key factors contributing to this growth include the rising infection rates leading to an increase in knee revision surgeries, the growing prevalence of osteoarthritis and rheumatoid arthritis, and a greater preference for minimally invasive procedures. The increasing number of elderly individuals with osteoarthritis and the demand for more effective, less invasive surgical options are crucial drivers for this market. Cementless partial knee implants, used in unicompartmental knee arthroplasty (UKA) procedures, only replace the affected portion of the knee joint, preserving more natural bone and ligaments.

These implants eliminate the need for bone cement, facilitating biological fixation instead. This method encourages the natural growth of bone tissue around the implant, leading to stronger and more durable integration between the implant and the bone. The absence of bone cement not only minimizes the risk of implant loosening over time but also reduces the likelihood of complications such as cement-related infections and inflammation. Moreover, biological fixation can enhance the overall stability of the implant, potentially extending its lifespan and improving long-term patient outcomes. As a result, cementless implants offer a more natural healing process and may require fewer revisions, making them an increasingly preferred option in orthopedic procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $789.7 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 5.5% |

Fixed-bearing implants segment is expected to grow at a CAGR of 5.3% to reach USD 876.2 million by 2034. These implants are mechanically simpler and less prone to failure than mobile-bearing systems, making them more popular among surgeons. They offer long-term survival rates of over 90% at ten years in low-demand patients. Additionally, mobile-bearing systems are typically more expensive and complex, which limits their acceptance and widespread use. As a result, fixed-bearing systems are the preferred choice in many cases, accelerating their adoption and contributing to their market dominance.

The titanium-based segment is anticipated to experience a growth rate of 5.4%, reaching USD 781.8 million by 2034. Titanium's biocompatibility makes it ideal for cementless implants, as it promotes osseointegration, which is crucial for the success of these devices. Titanium implants offer better adhesion to bone tissue and greater resistance to loosening compared to cobalt-chromium alloys, enhancing their stability and lifespan. The lightweight nature of titanium alloys, combined with their strength, makes them particularly suitable for younger, more active patients who require greater mobility post-surgery. Additionally, titanium is ideal for individuals with metal sensitivities, further driving demand for personalized knee arthroplasty.

U.S. Cementless Partial Knee Implants Market was valued at USD 353.7 million in 2024. The aging population in the U.S. is one of the fastest-growing demographics globally, contributing to the rising demand for knee replacement procedures. Osteoarthritis, especially medial unicompartmental osteoarthritis, is one of the primary conditions driving the need for partial knee replacements. Additionally, outpatient orthopedic surgeries are on the rise in the U.S., particularly in ambulatory surgical centers, due to the advantages of shorter anesthesia times, minimal blood loss, and quicker recovery. Moreover, the U.S. benefits from a robust reimbursement system, with both private insurers and Medicare increasingly recognizing the cost-effectiveness of partial knee replacements over total knee replacements for suitable patients.

The leading players in the Global Cementless Partial Knee Implants Market include Stryker, Medacta, Amplitude Surgical, Smith+Nephew, Waldemar Link, GRUPPO BIOIMPIANTI, ZIMMER BIOMET, Lepine, Just Medical, and Medacta. To strengthen their market presence, companies in the cementless partial knee implants industry are focusing on several strategies. They are investing in continuous innovation to improve implant designs and functionality, such as enhancing the biocompatibility and osseointegration properties of the implants. Partnerships with healthcare providers, clinics, and hospitals are also being forged to expand product reach and ensure higher adoption rates. Additionally, companies are focusing on regional expansion, particularly in emerging markets where the demand for orthopedic procedures is increasing.