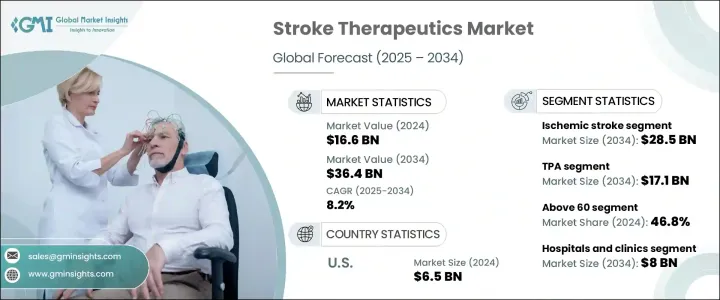

세계의 뇌졸중 치료제 시장은 2024년 166억 달러로 평가됐으며 비만, 고혈압, 앉기 쉬운 라이프스타일, 당뇨병 등 만성질환 등 위험요인의 만연 증가와 함께 노인 인구 증가에 힘입어 CAGR 8.2%로 성장해 2034년까지 2034년

고령자층은 특히 뇌졸중에 영향을 받기 쉽기 때문에 선진적인 의약품 치료에 대한 수요가 높아지고 있습니다.

제약 기업은 연구 개발에 투자하고 임상 결과를 개선하기 위해 설계된 신규 생물 제제, 유전자 치료제, 표적 약물에 주력하고 있습니다. 맞춤형 의료는 보다 정확하고 효과적인 치료 접근을 가능하게 하는 중요한 분야가 되고 있습니다. 뇌졸중 치료제에는 향혈소판약이나 항응고제에서 혈전용해제와 신경보호약에 이르기까지 의약품이 포함되어 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 166억 달러 |

| 예측 금액 | 364억 달러 |

| CAGR | 8.2% |

허혈성 뇌졸중은 뇌로의 혈관이 폐색되어 일어나는 것으로, 치료제 시장을 독점하고 있습니다. 심방세동, 당뇨병 등 뇌졸중에 기여하는 질병의 유병률이 상승하고 있기 때문에 보다 효과적인 치료법의 필요성이 높아지고 있습니다.

연령층별로 보면 2024년에는 60세 이상이 46.8%로 가장 큰 점유율을 차지했습니다. 가령은 싱경혈관의 반응성에도 영향을 미치기 때문에 노인은 치료 개입의 중요한 층이 될 것입니다.

미국 뇌졸중 치료제 2024년 시장 규모는 65억 달러로, 고급 헬스케어 시스템, 높은 연구개발 집약도, 강력한 의약품 존재에 의해 지원되고 있습니다. 정밀의료와 디지털 헬스 플랫폼에 대한 주목의 고조에 의해 조기 발견과 치료 효과의 향상이 한층 더 진행되고 있습니다.

Lupin, Pfizer, Boehringer Ingelheim, Sanofi, Genentech, Novartis, Bayer, AstraZeneca, Daiichi Sankyo, Johnson & Johnson Services, Cadrenal Therapeutics, Prestige Consumer Healthcare, Merck, Eisai, Bristol-Myers Squibb와 같은 주요 기업은 적극적인 성장 전략을 채택하고 있습니다. 여기에는 임상 파이프라인 확대, 연구 개발 파트너십 형성, 획기적인 신약 규제 당국의 승인 추구, 표적 치료를 제공하기위한 맞춤형 의료 탐구 등이 포함됩니다.

The Global Stroke Therapeutics Market was valued at USD 16.6 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 36.4 billion by 2034, fueled by the rising elderly population, coupled with increased prevalence of risk factors like obesity, hypertension, sedentary lifestyles, and chronic illnesses such as diabetes. An aging demographic is especially susceptible to stroke, leading to greater demand for advanced pharmaceutical treatments. At the same time, increased public health awareness and stronger government initiatives around early diagnosis and prevention are accelerating the adoption of therapeutics.

Pharmaceutical firms invest in research and development, focusing on novel biologics, gene therapies, and targeted drugs designed to improve clinical outcomes. Personalized medicine is becoming a key area of interest, allowing for more precise and effective treatment approaches. Stroke therapeutics includes medications, from antiplatelet agents and anticoagulants to thrombolytics and neuroprotective drugs. Substantial financial backing for R&D is helping expand the development pipeline, with new therapies aimed at improving outcomes for both ischemic and hemorrhagic stroke types.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.6 Billion |

| Forecast Value | $36.4 Billion |

| CAGR | 8.2% |

Ischemic stroke, which occurs when a blood vessel to the brain is blocked, dominates the therapeutic market. This segment generated USD 13.1 billion in 2024 and is forecasted to hit USD 28.5 billion by 2034, growing at a CAGR of 8.1%. Given that ischemic strokes account for the majority of total cases globally, this demand trajectory remains strong. The rising prevalence of contributing conditions like high cholesterol, atrial fibrillation, and diabetes continues to push the need for more effective treatments. Drug innovations, especially in thrombolytic therapy and antiplatelet development, are helping improve survival rates and recovery outcomes.

When segmented by age group, individuals aged 60 and above have the largest share at 46.8% in 2024. The risk of stroke significantly increases with age due to declining vascular health and common comorbidities. Aging also affects neurovascular responsiveness, making seniors a key demographic for therapeutic intervention. The ongoing improvement of healthcare infrastructure and age-focused health initiatives are expected to sustain segment growth through 2034.

United States Stroke Therapeutics Market was valued at USD 6.5 billion in 2024, supported by advanced healthcare systems, high R&D intensity, and strong pharmaceutical presence. Rapid innovations, including stem cell therapies and AI-based diagnostic integration, reinforce the country's leadership. The growing focus on precision medicine and digital health platforms is further enhancing early detection and improving treatment efficacy. Robust public and private sector collaboration is fueling the expansion of clinical trials and pipeline development.

Key players such as Lupin, Pfizer, Boehringer Ingelheim, Sanofi, Genentech, Novartis, Bayer, AstraZeneca, Daiichi Sankyo, Johnson & Johnson Services, Cadrenal Therapeutics, Prestige Consumer Healthcare, Merck, Eisai, and Bristol-Myers Squibb are adopting aggressive growth strategies. These include expanding clinical pipelines, forming R&D partnerships, pursuing regulatory approvals for breakthrough drugs, and exploring personalized medicine to deliver targeted therapies. Many invest in AI platforms and biologics innovation to optimize treatment delivery and patient outcomes.