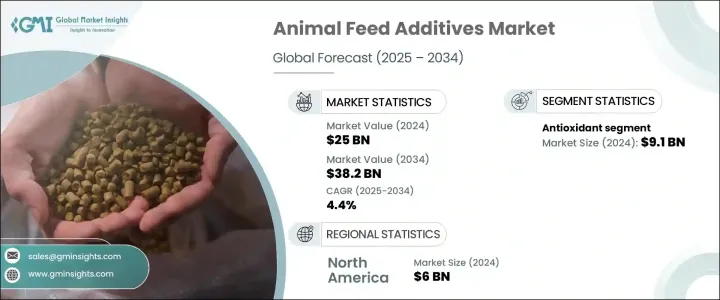

세계의 동물 사료 첨가제 시장은 2024년에 250억 달러에 이르렀고, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 4.4%를 나타낼 것으로 예측됩니다.

사료 첨가제는 가축 사료의 영양가를 높여 가축 전체의 생산성을 향상시킵니다. 수요가 증가하고 효과적인 사료 솔루션에 대한 필요성이 증가하고 있습니다.

사료 효율 개선에 중점을 두면 효소, 감미료, 프로바이오틱스 등 다양한 첨가제에 대한 관심이 높아지고 있습니다. 제품 및 기타 농산물 생산에서 축산 부문의 중요성은 특히 튀르키예, 육계, 돼지, 육우, 젖소 등의 분야에서 높아지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 250억 달러 |

| 예측 금액 | 382억 달러 |

| CAGR | 4.4% |

시장은 제품 유형에 따라 구분되며, 항산화제가 큰 점유율을 차지하고 있습니다. 필요한 필수 영양소를 확실히 섭취할 수 있도록 강화사료제품에 대한 투자를 늘리고 있습니다.

사료첨가제의 기술적 진보는 동물복지규제의 엄격화와 함께 시장의 성장을 가속하고 있습니다.

북미는 세계의 동물 사료 첨가제 시장을 선도하고 2024년에는 60억 달러의 매출을 창출했습니다. 특히 닭고기 부문은 닭고기 제품 수요 증가의 혜택을 받고 있습니다. 항생물질을 사용하지 않는 닭고기 생산으로의 변화의 확대, 고품질 단백질의 소비량 증가, 엄격한 식품 안전 규제가 시장 성장의 주된 촉진요인입니다. 또한, 진화하는 사료 배합 정책과 지속 가능한 유기 양계에 대한 주목의 고조가, 시장의 지위를 더욱 강화하고 있습니다.

The Global Animal Feed Additives Market reached USD 25 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Feed additives enhance the nutritional value of livestock feed and improve overall animal productivity. These substances include vitamins, amino acids, enzymes, antioxidants, and probiotics, playing a crucial role in boosting livestock health and production efficiency. As global populations rise, the demand for high-quality meat products increases, driving the need for effective feed solutions. With growing attention to animal welfare, farmers are seeking fortified feed products to ensure better digestion, nutrient absorption, and overall performance in poultry, swine, cattle, aquaculture, and other livestock categories.

The focus on improving feed efficiency has amplified interest in a diverse range of additives, including enzymes, sweeteners, and probiotics. These products enhance digestibility, promote gut health, and improve immune function, which, in turn, increases animal productivity. Additionally, the livestock sector's importance in producing meat, dairy, and other agricultural products is increasing, particularly in segments like turkeys, broilers, swine, beef, and dairy cattle. Rapid urbanization, the growing food and beverage industry, and expanding food service sectors further contribute to the rising demand for animal feed additives, particularly in North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25 Billion |

| Forecast Value | $38.2 Billion |

| CAGR | 4.4% |

The market is segmented based on product type, with antioxidants holding a significant share. The antioxidant segment generated USD 9.1 billion in revenue in 2024. The growing focus on animal nutrition and well-being in North America is contributing to the growth of the vitamins segment. Producers and farmers are increasingly investing in fortified feed products to ensure that livestock receive the essential nutrients required for better performance and higher yields. Enhanced animal productivity leads to increased production of meat, milk, and eggs, strengthening the market for feed additives. Vitamins such as A, D, E, and B complexes perform vital physiological functions in livestock, further driving the adoption of fortified feeds.

Technological advancements in feed additives, along with stricter animal welfare regulations, are fostering growth in the market. Producers are shifting towards fortified feed solutions to meet rising demands for animal protein while ensuring sustainable and efficient livestock production. This transition is further supported by legislative reforms and increasing awareness of feed quality standards, promoting the adoption of enhanced feed formulations.

North America leads the global animal feed additives market, generating USD 6 billion in revenue in 2024. The poultry sector, in particular, is benefiting from the rising demand for chicken products. Additives such as vitamins, minerals, amino acids, enzymes, and probiotics play a critical role in optimizing feed utilization, improving gut health, and boosting poultry productivity. The growing shift toward antibiotic-free chicken production, higher consumption of high-quality protein, and stringent food safety regulations are the primary drivers fueling the market's growth. Moreover, evolving feed formulation policies and a heightened focus on sustainable and organic poultry farming are further strengthening the market position.