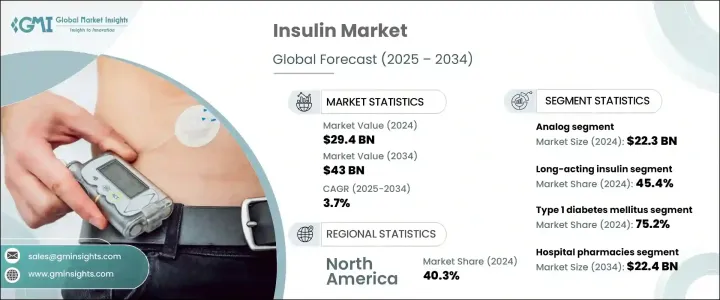

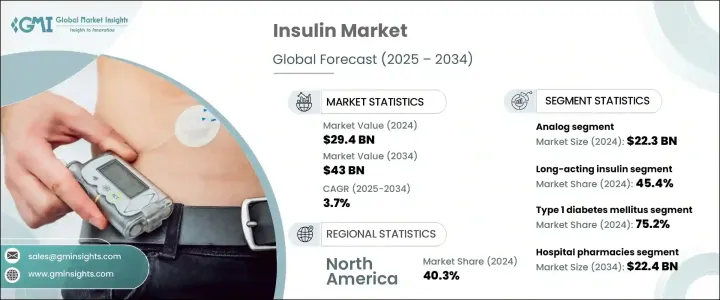

인슐린 세계 시장은 2024년 294억 달러로 2025년부터 2034년까지 CAGR 3.7%로 성장할 것으로 예상됩니다.

당뇨병, 특히 제 2형 당뇨병의 유병률 증가가 시장 확대의 원동력이 되고 있습니다. 좌식 생활습관, 비만율 증가, 고령화 등의 요인이 이러한 성장에 크게 기여하고 있습니다. 고칼로리 식단, 유전적 소인, 스트레스와 같은 다른 위험 요소도 당뇨병 유병률에 중요한 역할을 합니다.

당뇨병 관리에 필수적인 인슐린 요법에 대한 인식이 높아지고 조기 의료 개입이 증가함에 따라 인슐린 요법에 대한 수요가 증가하고 있습니다. 초속효성, 장기지속형, 바이오시밀러 등 인슐린 제제의 발전으로 치료 순응도와 환자 예후가 개선되고 있습니다. 또한, 신흥국 정부 및 NGO의 투자 확대로 인슐린에 대한 접근성이 확대되면서 시장이 더욱 강화되고 있습니다. 신흥국들의 유리한 리베이트 정책도 시장 확대에 기여하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 294억 달러 |

| 예상 금액 | 430억 달러 |

| CAGR | 3.7% |

인슐린은 혈당 조절에 필수적이며 효율적인 에너지 사용을 보장합니다. 이 시장에는 속효성, 단시간 작용형, 중간 작용형, 장시간 작용형, 프리믹스, 바이오시밀러 등 다양한 인슐린 제제가 포함됩니다.

시장은 인간 인슐린 제제와 인슐린 유사체 제제로 나뉩니다. 인슐린 유사체는 2024년 223억 달러 규모로 시장을 장악했습니다. 인슐린 유사체의 광범위한 채택은 기존 인슐린에 비해 우수한 효능, 저혈당 위험이 낮고 환자의 순응도가 높기 때문입니다. 인슐린 유사체는 투여의 유연성을 높이고, 식후 혈당 상승을 억제하며, 보다 예측 가능한 반응을 제공합니다. 또한, 인슐린데테밀과 같은 장기지속형 인슐린 유사체는 일반 인슐린에 비해 체중 증가를 최소화할 수 있습니다. 바이오시밀러 인슐린 유사체의 출시로 인슐린 유사체의 접근성과 구매 편의성이 더욱 확대되었습니다.

제품 유형별로 시장은 지속형 인슐린, 속효성 인슐린, 복합형 인슐린, 바이오시밀러, 기타 제품으로 나뉩니다. 지속형 인슐린은 2024년 45.4%로 가장 큰 점유율을 차지했습니다. 서방형 메커니즘을 통해 인슐린 농도를 안정적으로 유지하고, 주사 빈도를 줄이며, 환자의 순응도를 높입니다. 이러한 제제는 기저 인슐린 분비를 효과적으로 모방하여 저혈당 위험을 낮출 수 있습니다. 첨단 장시간 지속형 인슐린 제제의 개발과 인슐린 전달 장치의 개선은 시장에서의 우위를 계속 유지하고 있습니다.

용도별로는 1형 당뇨병, 제2형 당뇨병, 임신성 당뇨병으로 분류되며, 1형 당뇨병은 2024년 시장의 75.2%를 차지하며 CAGR 3.6%로 성장했으며, 1형 당뇨병 환자는 혈당을 유지하기 위해 매일 인슐린 주사를 맞아야 합니다. 생활습관 개선과 경구용 약물이 효과적인 제 2형 당뇨병과 달리 제 1형 당뇨병은 인슐린을 지속적으로 투여해야 합니다.

유통 채널 중 병원 약국이 2024년 시장을 주도했으며, 2034년에는 224억 달러에 달할 것으로 예측됩니다. 당뇨병 관련 입원 환자 수, 다양한 종류의 인슐린 제제에 대한 접근성, 선진화된 의료 시스템 등이 이 부문의 우위에 기여하고 있습니다.

지역별로는 북미가 2023년 40.3%의 점유율을 차지하며 시장을 주도했습니다. 미국 시장은 2022년 96억 달러에서 2023년 102억 달러로 성장했습니다. 높은 당뇨병 유병률, 탄탄한 의료 인프라, 인슐린 연구개발에 대한 강력한 투자가 시장 성장을 주도하고 있습니다. 주요 인슐린 제조업체의 존재는 시장 확대를 더욱 촉진하고 있습니다.

The Global Insulin Market was valued at USD 29.4 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2034. The increasing prevalence of diabetes, especially type 2, is driving market expansion. Factors such as a sedentary lifestyle, rising obesity rates, and an aging population significantly contribute to this growth. Other risk factors, including high-calorie diets, genetic predisposition, and stress, also play a crucial role in diabetes prevalence.

Growing awareness and early medical interventions have increased the demand for insulin therapy, which remains essential for diabetes management. Advances in insulin formulations, including ultra-rapid-acting, long-acting, and biosimilar insulins, have improved treatment adherence and patient outcomes. Additionally, increased government and NGO investments in developing regions have expanded insulin access, further strengthening the market. Favorable reimbursement policies in developed economies have also contributed to market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.4 Billion |

| Forecast Value | $43 Billion |

| CAGR | 3.7% |

Insulin is essential in regulating blood glucose levels, ensuring efficient energy utilization. The market includes various insulin formulations, including rapid-acting, short-acting, intermediate-acting, long-acting, and premixed options, as well as biosimilars.

The market is segmented into human insulin and insulin analogs. Insulin analogs dominated the market, accounting for USD 22.3 billion in 2024. Their widespread adoption stems from superior efficacy, lower risk of hypoglycemia, and better patient adherence compared to traditional human insulin. Insulin analogs provide greater dosing flexibility, reduce postprandial glucose spikes, and offer a more predictable response. Long-acting insulin analogs, such as insulin detemir, also minimize weight gain compared to regular insulin. The availability of biosimilar insulin analogs has further expanded accessibility and affordability.

By product type, the market is divided into long-acting insulin, rapid-acting insulin, combination insulin, biosimilars, and other products. Long-acting insulin held the largest share at 45.4% in 2024. Its slow-release mechanism ensures stable insulin levels, reducing the frequency of injections and enhancing patient adherence. These formulations effectively mimic basal insulin secretion, lowering the risk of hypoglycemia. The development of advanced long-acting insulin products and improvements in insulin delivery devices continue to support market dominance.

The market is categorized by application into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 1 diabetes accounted for 75.2% of the market in 2024 and is expected to grow at a CAGR of 3.6%. Patients with type 1 diabetes rely on daily insulin injections to maintain blood glucose levels. Unlike type 2 diabetes, where lifestyle modifications and oral medications may be effective, type 1 diabetes necessitates consistent insulin administration.

In terms of distribution channels, hospital pharmacies led the market in 2024, projected to reach USD 22.4 billion by 2034. High diabetes-related hospital admissions, access to a wide range of insulin products, and advanced healthcare systems contribute to this segment's dominance.

Regionally, North America led the market with a 40.3% share in 2023. The US market grew from USD 9.6 billion in 2022 to USD 10.2 billion in 2023. The country's high diabetes prevalence, robust healthcare infrastructure, and strong investments in insulin research and development continue to drive market growth. The presence of leading insulin manufacturers further supports market expansion.