세계의 신약개발용 인공지능(AI) 시장은 2024년에는 36억 달러로 평가되었고, CAGR 30.1%로 성장할 전망이며, 2034년에는 495억 달러에 이를 것으로 추정됩니다.

이 예외적인 성장은 복잡하고 만성적인 건강 상태의 이환율 증가 및 AI 주도형 플랫폼을 이용한 의약품 개발 프로세스의 합리화에 대한 제약회사의 관심 고조가 맞물려 초래되고 있습니다. 보다 신속하고 정확한 검색 프로세스에 대한 요구는 바이오 기술 기업과 연구 기관을 딥러닝 및 예측 분석과 같은 첨단 기술을 연구개발 워크플로우에 통합하도록 뒷받침하고 있습니다. 또한, 데이터 통합의 지속적인 혁신, 디지털 인프라 성장, 이해관계자들의 의식 증가가 채택을 가속화하고 있습니다. 특히 기술 선진 지역에서는 AI 스타트업과 제약 제조업체와의 협업이 확대되고 있어 치료제의 특정 및 개발 방법이 재구축되며 헬스케어 에코시스템 전체에 새로운 가능성이 퍼지고 있습니다. 신약개발 영역에서 AI의 역할은 자연 언어 처리, 생성 알고리즘, 딥러닝 툴과 같은 고급 기술을 사용하여 표적 검증을 강화하고, 리드 화합물을 최적화하며, 효율적인 임상시험 계획을 지원하는 것을 포함합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 규모 | 36억 달러 |

| 예측 금액 | 495억 달러 |

| CAGR | 30.1% |

2024년 소프트웨어 분야의 점유율은 68.1%였습니다. 이 우위성은 주로 화합물 스크리닝이나 구조 활성 예측과 같은 의약품 개발의 초기 단계에서 널리 채용되고 있기 때문입니다. 소프트웨어 기반 AI 도구는 현재 자동화, 정확성 및 확장성을 제공하는 데 필수적이며 효율적인 연구개발 워크플로우에 대한 제약 기업 수요 증가에 대응하고 있습니다. NLP 및 신경망과 같은 핵심 기술의 급속한 진보는 정밀의료에서 소프트웨어가 제공할 수 있는 한계를 넓혀가고 있습니다.

머신러닝 분야는 신약개발의 다양한 단계에서 폭넓게 활용되고 있기 때문에 2024년에는 62.5%의 점유율을 차지했습니다. 이 부문에는 지도 학습 모델, 비지도 학습 모델 및 기타 ML 알고리즘이 포함됩니다. 클라우드 컴퓨팅 개선 및 오픈소스 프레임워크의 가용성을 통해 보다 유연하고 빠르고 확장 가능한 모델을 교육하고 전개할 수 있습니다. 제약 선도 기업과 AI 전문 기업과의 지속적인 협업은 모델 설계의 혁신을 지속적으로 자극하고 탐색 파이프라인 전반에 걸친 예측 도구 및 실시간 분석 개발을 가속화하고 있습니다.

북미의 신약개발용 인공지능(AI) 2024년 시장 점유율은 47.6%로, 강력한 연구개발 투자, 광범위한 디지털 인프라, AI 통합을 지원하는 유리한 규제 프레임워크에 뒷받침되고 있습니다. 디지털 치료제에 대한 정부의 지원 이니셔티브와 규제의 명확화가 시장 성장을 뒷받침하고 있습니다. 미국과 캐나다에서는 하이테크 기업과 제약 기업 간의 주요 제휴로 첨단 창약 솔루션의 개발이 진전되고 AI 플랫폼의 지역적 보급이 진행되고 있습니다.

세계의 신약개발용 인공지능(AI) 시장의 주요 기업은 Exscientia, BenevolentAI, Orakl Oncology, AVAYL, Atomwise, Aevai Health, Cyclica, Examol, IBM Corporation, NVIDIA Corporation, Microsoft, Insilico Medicine, Deep Genomics, DenovAI Biotech, chAIron, Aureka Biotechnologies, LinkGevity, 9Bio Therapeutics, Helical, Google(DeepMind), Deargen입니다. 세계의 신약개발용 인공지능(AI) 시장에서 경쟁력을 확보하기 위해 기업은 기술 혁신, 전략적 제휴, 데이터 주도의 제품 개발에 주력하고 있습니다. 대기업은 표적 식별, 분자 생성, 임상 성공률을 높이는 독자적인 AI 알고리즘 개발에 투자하고 있습니다. 바이오 벤처와 제약 선두와의 제휴는 대규모 데이터 세트, 도메인 지식, 확장 가능한 컴퓨팅 리소스에 대한 액세스를 가능하게 하여 더욱 보편화되고 있습니다.

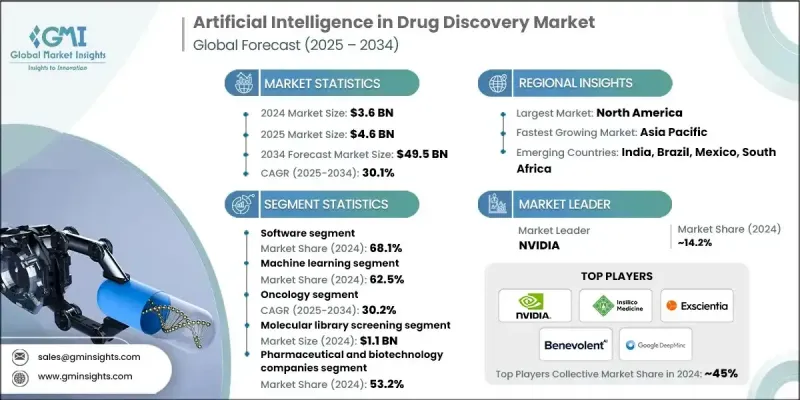

The Global Artificial Intelligence in Drug Discovery Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 30.1% to reach USD 49.5 billion by 2034.

This exceptional growth is being driven by the rising incidence of complex and chronic health conditions, combined with increasing interest from pharmaceutical companies in streamlining the drug development process using AI-driven platforms. The demand for faster, more accurate discovery processes is pushing biotech firms and research institutions to integrate advanced technologies like deep learning and predictive analytics into their R&D workflows. Additionally, ongoing innovation in data integration, growing digital infrastructure, and greater awareness among stakeholders are accelerating adoption. Expanding collaboration between AI startups and pharmaceutical manufacturers, particularly in technologically advanced regions, is reshaping how therapeutics are identified and developed, opening new possibilities across the healthcare ecosystem. AI's role in the drug discovery space involves using sophisticated technologies such as natural language processing, generative algorithms, and deep learning tools to enhance target validation, optimize lead compounds, and support efficient clinical trial planning.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $49.5 Billion |

| CAGR | 30.1% |

The software segment held 68.1% share in 2024. This dominance is primarily due to widespread adoption during early drug development stages such as compound screening and structure-activity predictions. Software-based AI tools are now integral in providing automation, accuracy, and scalability, meeting the growing demand among pharma companies for efficient R&D workflows. Rapid advancements in core technologies like NLP and neural networks are pushing the boundaries of what software can deliver in precision medicine.

The machine learning segment held a 62.5% share in 2024, owing to its extensive utility across various stages of drug discovery. This segment encompasses supervised and unsupervised learning models along with other ML algorithms. Cloud computing improvements and the availability of open-source frameworks are enabling more flexible, fast, and scalable model training and deployment. Ongoing collaborations between pharmaceutical giants and AI-focused firms continue to spark innovation in model design and accelerate the development of predictive tools and real-time analytics across discovery pipelines.

North America Artificial Intelligence in Drug Discovery Market held 47.6% share in 2024, propelled by strong R&D investments, broad digital infrastructure, and favorable regulatory frameworks supporting AI integration. Government-backed initiatives and regulatory clarity around digital therapeutics are encouraging market growth. Major collaborations between tech firms and pharma companies in the U.S. and Canada are driving progress in the creation of advanced drug discovery solutions and deepening the regional footprint of AI platforms.

Key players in the Global Artificial Intelligence in Drug Discovery Market are Exscientia, BenevolentAI, Orakl Oncology, AVAYL, Atomwise, Aevai Health, Cyclica, Examol, IBM Corporation, NVIDIA Corporation, Microsoft, Insilico Medicine, Deep Genomics, DenovAI Biotech, chAIron, Aureka Biotechnologies, LinkGevity, 9Bio Therapeutics, Helical, Google (DeepMind), and Deargen. To secure a competitive edge in the Global Artificial Intelligence in Drug Discovery Market, companies are focusing on technology innovation, strategic collaborations, and data-driven product development. Leading players are investing in the development of proprietary AI algorithms that enhance target identification, molecule generation, and clinical success rates. Partnerships between biotech startups and pharma leaders are becoming more prevalent, enabling access to large datasets, domain knowledge, and scalable computing resources.