이 보고서에서는 인도 통신업계의 설비투자(CAPEX) 단기 전망을 조사하고, Airtel, BSNL, Jio Platforms, Vodafone Idea(Vi) 등 주요 사업자의 2025년 1분기 결산을 바탕으로 현재 지출 추세가 기존 예측과 어떻게 다른지, 투자 결정에 영향을 미치는 주요 요인을 분석합니다. 투자 판단에 영향을 미치는 주요 요인을 정리하고, 현재 지출 추세가 기존 예측과 어떻게 다른지 분석합니다. 또한 벤더에 미치는 영향과 AI, 대규모 언어 모델(LLMs), 데이터센터와 같은 새로운 분야의 움직임에 대해서도 소개합니다.

출처 MTN 컨설팅

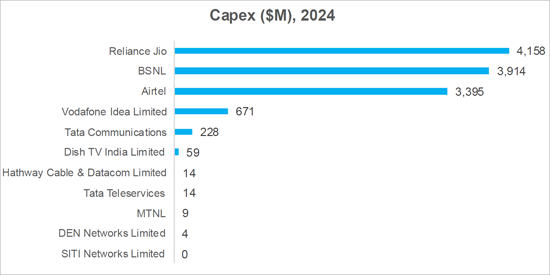

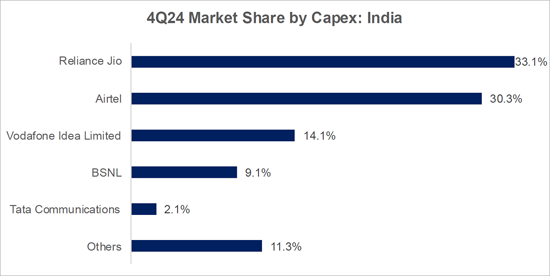

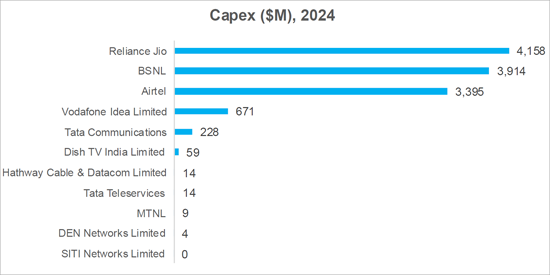

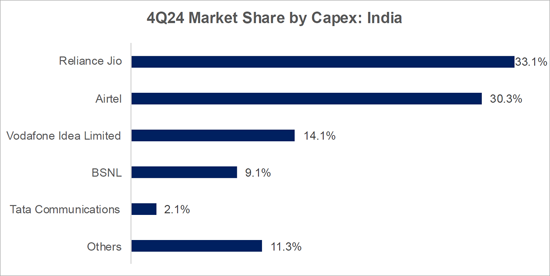

인도의 2024년 통신 부문은 설비투자가 140억 달러, 매출이 410억 달러에 달하며, 각각 세계 전체의 4.7%와 2.3%를 차지했습니다. 인도의 설비투자 대비 매출 비율(자본집약도)은 3년 연속 30%를 넘어섰습니다. 그러나 산업의 규모와 전략적 중요성에도 불구하고 인도의 주요 통신사들은 향후 수년간 설비투자를 축소할 방침을 보이고 있습니다. 이러한 추세는 당사의 예측과 일치하지만, 인도 정부의 정책 목표와는 상충되는 부분입니다.

새로운 정책 구상은 기존보다 자금력이 풍부하고 미래지향적인 형태로 활기찬 국내 통신 기술 생태계를 육성하는 것을 목표로 하고 있습니다. 그러나 차세대 통신장비를 개발하는 국내 스타트업 기업은 실제 환경에서 테스트와 개선의 기회를 필요로 하고 있습니다. 그러나 통신사업자들이 수익성 회복을 위해 예산을 긴축하면서 이러한 기회는 점점 줄어들고 있습니다.

이러한 흐름이 지속된다면, 인도는 스스로의 혁신 목표를 훼손할 위험에 처하게 될 것입니다. 현실적인 단기적 해결책으로는 BSNL의 본격적인 5G 네트워크 대규모 구축에 정부가 주도적으로 참여하고, 전국적인 5G 구축을 목표로 하는 Vi에 대한 우대 조치, 인도산 통신 장비가 해외 시장에 매력적으로 보일 수 있도록 보조금 및 각종 인센티브 제공 등을 들 수 있습니다. 이는 Astrome Tech, Coral Telecom, Frog Cellsat, Galore Networks, Niral Networks, Qbit Labs, Qnu Labs, Prenishq, Resonous Tech, Saankhya Labs, Scytale Alpha, Signaltron, Sooktha, VVDN, WiSig 등 주목 인도계 스타트업 기업의 지원으로 연결됩니다.

|

|

|

This brief examines the near-term outlook for telecom capital expenditures (capex) in India, based on the 1Q25 earnings of key operators: Airtel, BSNL, Jio Platforms, and Vodafone Idea (Vi). It analyzes how current spending patterns compare with previous forecasts, highlights the main forces shaping investment decisions, explores implications for vendors, and discusses trends in emerging areas such as AI, large language models (LLMs), and data centers.

Source: MTN Consulting

India closed 2024 with $14.0 billion in telco capex and $41.0 billion in revenues, representing 4.7% and 2.3% of global industry totals, respectively. India's capex to revenue ratio, or capital intensity, has remained above 30% for three straight years. Yet despite the sector's scale and strategic importance, most Indian telcos are now guiding capex downward over the next few years. That trend is aligned with our forecasts, but at odds with the Indian government's policy ambitions.

New policy initiatives aim to foster a vibrant domestic telecom tech ecosystem, better funded and more forward-looking than past efforts. But local startups developing next-gen telecom gear need real-world opportunities to test and refine their solutions. Those opportunities are set to shrink as telcos tighten their budgets to restore profitability.

Absent a shift in trajectory, India risks undercutting its own innovation goals. The most practical near-term solution? A government-led push for BSNL to deploy true 5G networks at scale, favorable treatment for Vi as it attempts to build out nationwide 5G, plus subsidies and other enticements aimed to make local Indian gear attractive to overseas buyers. That would help such Indian startups making waves like Astrome Tech, Coral Telecom, Frog Cellsat, Galore Networks, Niral Networks, Qbit Labs, Qnu Labs, Prenishq, Resonous Tech, Saankhya Labs, Scytale Alpha, Signaltron, Sooktha, VVDN, and WiSig.

|

|

|