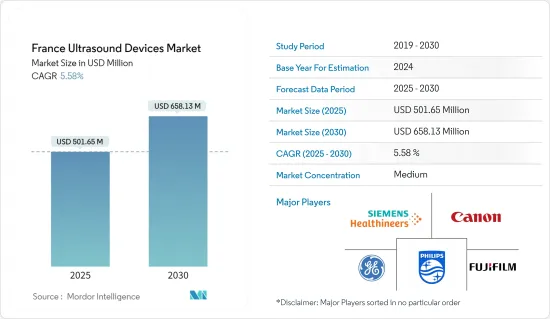

프랑스의 초음파 장치 시장 규모는 2025년 5억 165만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR은 5.58%로 확대되어, 2030년에는 6억 5,813만 달러에 달할 것으로 예측되고 있습니다.

팬데믹은 이 나라의 초음파 장치 시장에 부정적인 영향을 미쳤습니다. 2020년 2월 Springer Journal에 게재된 연구 논문에 따르면, COVID-19 팬데믹과의 싸움에 휴대용 초음파 장치는 불가결합니다. 프랑스에서는 집중 치료의가 침대 측에서의 화상 진단이나 ICU에서의 화상 진단에, 통상은 소형의 운반 가능한 초음파 진단 장치를 이용해 포인트 오브 케어 초음파 진단을 실시했습니다. COVID-19의 결과, 사립 센터에서 초음파 검사의 전체 수는 감소했지만, 이것은 방사선 시설의 52.8%가 COVID-19에 장치를 바친다는 프랑스의 권고에 따랐기 때문이며, 그 결과 초음파 장치의 수가 줄어 COVID-19 환자가 늘어나 다른 병태에 대한 액세스가 제한되었습니다. "Effect of the COVID-19 Pandemic on Colorectal Cancer Care in France"에 의하면 연구자들은 2020년(3월부터 5월)의 대장암의 신규 소개 건수가 그 이전 2년간 평균에 비해 31% 감소하고 있음을 발견했습니다. 그 결과, 국내에서 검진을 받는 사람이 줄어들기 때문에 전국적으로 초음파 검사의 실시건수가 감소했습니다.

프랑스의 초음파 시장은 심혈관질환 등 만성질환의 유병률 상승과 기술적 진보로 본 조사의 예측기간 중에 성장할 것으로 예상되고 있습니다. 심장 마비는 프랑스에서 약 100만 명, 국가 총 인구의 2.3%에 영향을 미칠 것으로 예측됩니다. 초음파 영상 진단장치는 관동맥 질환을 포함한 다양한 심혈관 이상을 진단하는 데 가장 중요한 영상 진단 시스템 중 하나입니다. 주요 기업은 다양한 전략적 활동을 수행합니다. 여기에는 제품 출시, 파트너십, 합병, 인수 등이 포함됩니다. 예를 들어 의료용 영상처리 AI 개발을 가속시키기 위해 GE Healthcare가 코디네이트하는 AI DReAM 이니셔티브는 2020년 9월 프랑스 중소기업, 신흥기업, 연구소, 임상센터를 결집합니다. 이것은 건강 관리 시스템의 효율성, 환자 관리 경로 및 진단 정확도를 높이는 것을 목표로 합니다.

집속된 초음파 에너지는 조직 절제를 위한 비침습적 접근이기 때문에 다양한 고형 종양의 치료에 이용할 수 있습니다. 암 이환율 증가나 주요 기업에 의한 대처 등의 요인이 시장 성장을 확대할 것으로 예측됩니다. Globocan 2020은 2040년까지 프랑스에서 약 579,388명의 신규암 환자가 발생할 것으로 예측했습니다.

프랑스에서는 여러 대형 시장 진출 기업의 고강도 초음파 제품이 도입되고 있으며, HIFU 시스템의 이용이 증가할 것으로 보입니다. 프랑스의 첨단 기업인 THERACLION은 2020년 10월에 HIFU 정맥류 치료 옵션인 SONOVEIN의 2세대 CE 마크를 취득했습니다. 이를 위해 주요 기업이 정맥류 치료에서 제품을 출시함으로써 이니셔티브를 높이고 있는 결과, 이 지역에서 HIFU 시스템의 수용이 증가하고 프랑스에서 이 시장의 성장을 가속할 것으로 예상됩니다. 향후 시장 확대는 프랑스 보건 당국의 승인뿐만 아니라 다양한 질병의 치료를위한 고강도 초음파 시스템에 대한 연구 활동 증가에 의해 촉진 될 것으로 예측됩니다. 2020년 8월 EDAP TMS SA는 프랑스 보건부의 허가를 받아 직장 심부 자궁 내막증 관리를위한 Focal One HIFU를 평가하는 2상 다시설 임상시험을 시작할 예정입니다. 이를 통해 다양한 질병에 대한 HIFU 시스템에 대한 조사 활동이 활발해지고 다양한 질병에 대한 HIFU 시스템의 도입이 진행되어 프랑스 시장의 성장이 촉진 될 것으로 기대됩니다.

따라서 고밀도 초점 초음파 시스템과 관련된 위의 개발은 일본 시장 성장을 가속할 것으로 예측됩니다.

프랑스의 초음파 장치 시장은 중등도의 경쟁이며, 여러 대형 기업으로 구성되어 있습니다.

The France Ultrasound Devices Market size is estimated at USD 501.65 million in 2025, and is expected to reach USD 658.13 million by 2030, at a CAGR of 5.58% during the forecast period (2025-2030).

The pandemic had an adverse effect on the ultrasound devices market in the country. Additionally, the well-known for its effectiveness French healthcare system was put under a great deal of stress in the early phases of the pandemic. Portable ultrasound machines are essential in the fight against the COVID-19 pandemic, according to a research paper that appeared in the Springer Journal in February 2020. In France, intensive care physicians use point-of-care ultrasounds, typically with small transportable ultrasound devices, for bedside imaging, and in the ICU. Although there was a decrease in the overall number of ultrasounds in private centers as a result of COVID-19, this was because 52.8% of the radiologic structures followed the French recommendations to dedicate devices to COVID-19, which led to fewer ultrasound devices and more COVID-19 patients, which in turn limited access for other pathologies. According to the article "Effect of the COVID-19 Pandemic on Colorectal Cancer Care in France" published in the Lancet magazine in May 2021, researchers found a 31% decrease in new referrals for colorectal cancer in 2020 (March to May) compared to the average of the preceding two years. On the other hand, the epidemic has moved attention away from cancer treatment. Because fewer people were screened within the nation as a result, fewer ultrasound scans were performed nationwide. Thus, the market had an adverse effect during the pandemic however, it is expected to grow as pending cases will boost the market in the upcoming period.

The ultrasound market in France is expected to grow during the study's forecast period due to the rising prevalence of chronic diseases such as cardiovascular diseases, as well as technical advances in the country. For instance, according to a report titled "Heart Failure Policy and Practice in Europe: France" that was released in November 2020, heart failure is predicted to impact approximately one million people in France or 2.3% of the country's total population. Heart attacks are significantly increased by coronary artery disease and other cardiovascular disease risk factors like diabetes and hypertension. Ultrasound imaging devices are one of the most crucial diagnostic imaging systems for the diagnosis of a variety of cardiovascular abnormalities, including coronary artery disease. Major players are engaged in a variety of strategic activities. These include of product launches, collaborations, partnerships, mergers, and acquisitions. For instance, to speed up the development of AI in medical imaging, the AI DReAM initiative, coordinated by GE Healthcare, will bring together French SMEs, start-ups, research labs, and clinical centers in September 2020. The "Investments for the Future" program (PIA), which is run by Bpifrance and is overseen by the French General Secretariat for Investment, provided funding for the AI DReAM project. It strives to increase the effectiveness of the healthcare system, patient care pathways, and diagnosis accuracy. Thus, the abovementioned factors are expected to increase market growth.

Focused ultrasonic energy can be utilized to treat a variety of solid tumours because it is a non-invasive approach for tissue ablation. High-intensity focused ultrasound is being utilised more frequently to treat both primary and metastatic tumours because it can accurately identify tumours for ablation. Factors such as increasing cancer prevalence and initiatives by key players are expected to increase the market growth. In 2020, France recorded 467,965 new cancer cases, while there were 1,501,881 new cases of cancer overall. Globocan 2020 predicted that by 2040, there will be roughly 579,388 new cancer cases in France. Increased use of high-intensity focused ultrasound systems for the diagnosis will result from the country's increasing number of new cancer cases, which is anticipated to propel this market's expansion in France over the course of the projected period.

High-intensity ultrasound products from several major market players are being introduced in France, which will increase the use of HIFU systems. For instance, THERACLION, a forward-thinking French company that specializes in echotherapy (using HIFU or High-Intensity Focused Ultrasound) treatment, received the CE Mark for the second generation of SONOVEIN, its HIFU varicose vein treatment option, in October 2020. Increased acceptance of HIFU systems in this region is anticipated to fuel the growth of this market in France as a result of the key players' increasing initiatives by releasing their products in the treatment of varicose veins to provide patients access to non-invasive varicose vein treatments. Future market expansion is anticipated to be fueled by rising research activities on high-intensity ultrasound systems for the treatment of various illnesses as well as approvals from the French health authorities. For instance, in August 2020, EDAP TMS SA will launch a Phase II multicenter clinical trial evaluating its Focal One HIFU for the management of deep rectal endometriosis with permission from the French Ministry of Health. This Phase II multicenter trial will assess safety and efficacy in a single patient group of 38 women with a confirmed diagnosis of deep rectal endometriosis in a total of five major French hospitals. This will lead to increased research activities on HIFU systems for different ailments and result in the adoption of HIFU systems for different diseases, thereby expected to drive the market growth in France.

Hence, the above developments pertaining to high-intensity focused ultrasound systems, it is expected to drive market growth in the country.

France ultrasound devices market is moderately competitive and consists of several major players. Some of the companies that are currently dominating the market are Canon Medical Systems Corporation, GE Healthcare, Fujifilm Holdings Corporation, Siemens Healthineers AG, and Koninklijke Philips NV among others.