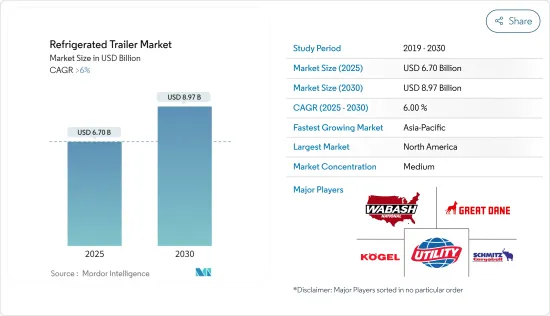

냉장 트레일러 시장 규모는 2025년에 67억 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR은 6%를 넘을 전망이며, 2030년에는 89억 7,000만 달러에 달할 것으로 예측됩니다.

냉장 트레일러 시장은 온도에 민감한 물품의 수송 수요 증가, 냉장 시스템의 기술 진보, 세계 콜드체인 물류 인프라의 확대 등 다양한 요인에 의해 강력한 성장을 이루고 있습니다. 냉장 트레일러(리퍼라고도 불린다)는 식품이나 의약품 등의 부패하기 쉬운 상품을 장거리 수송할 때, 주행중에도 바람직한 온도를 유지하면서 수송하는 중요한 역할을 담당하고 있습니다. 세계 식품 무역 증가와 식품 폐기를 줄일 필요성이 증가함에 따라 냉장 트레일러 수요는 향후 수년간 꾸준히 성장할 것으로 예상됩니다.

또한 세계 정부 및 규제기관이 정한 엄격한 식품안전 규제 및 품질기준으로 식품생산자, 유통업체, 물류회사는 신뢰성 높은 냉장 운송 솔루션에 대한 투자를 강요하고 있습니다. 첨단 온도 모니터링 및 제어 시스템을 갖춘 냉장 트레일러는 이러한 규정을 준수하고 운송 중 신선품의 품질을 보호하는 데 도움이 됩니다. 또한 식품의 안전성과 품질에 대한 소비자의 의식이 높아짐에 따라 소매업체와 전자상거래 기업이 신선한 식품 및 기타 온도에 민감한 제품을 운송하기 위한 냉장 트레일러의 채택을 촉진하고 있습니다.

게다가 지속 가능한 에너지원을 동력원으로 하는 전기식 및 하이브리드식 냉장 트레일러의 등장은 냉장 트레일러 시장에 혁명을 일으키는 태세입니다. 환경의 지속가능성과 온실가스 배출에 대한 우려가 커지고 있는 가운데 함대 운영자와 물류회사는 이산화탄소 배출량을 줄이기 위해 친환경 냉장 솔루션을 채택하는 경향이 커지고 있습니다. 전기식 냉장 트레일러는 종래의 디젤 엔진식 트레일러에 비해 보다 조용한 운전, 배출 가스의 삭감, 운전 비용 삭감 등의 이점을 제공합니다.

북미가 시장을 선도하는 지역으로, 아시아태평양, 유럽이 이에 이어집니다. 냉동 및 냉장 트레일러를 제조하는 주요 기업은 Wabash National Commercial Trailer Products, Great Dane Trailers, Utility Trailer Manufacturing Company, Schmitz Cargobull AG, Kogle Trailer GmbH 등입니다.

하드웨어, 텔레매틱스, 차량 기술의 다양한 진보가 북미 전역의 신선품 수송을 변화시키고 있으며, 냉동차 플릿이 경쟁력을 유지하기 위한 전략을 검토하도록 촉구하고 있기 때문에 콜드체인 기술에 흥미로운 시기가 되고 있습니다. 하지만 냉동차 산업은 전례 없이 복잡해진 사업 환경에서 과제에 직면해 있습니다. 예를 들어,

장기 계약 운임은 안정적이며, 전체 화물량은 감소하고 있기 때문에 많은 소규모 냉장 운송업체는 비즈니스 기회를 스팟 시장에 의존하게 되었습니다. 스팟 냉동운임은 2022년 동시기보다 약 7% 낮고 5년간 평균을 5% 이상 밑돌고 있습니다. 이러한 장애에도 불구하고, 냉동 함대는 함대 폐쇄, 규제 변경, 시장 역학 변화 등의 요인으로 인해 큰 흔들림을 경험하는 운전자 운송과 같은 다른 분야와 비교하여 트럭 운송 업계의 상대적으로 절연 부문으로부터 이익을 얻고 있습니다.

신선한 신선한 식품에 대한 소비자 선호도가 높아지고, 특히 인구 밀도가 높은 도시 지역에서는 이러한 제품을 생산 센터에서 유통 허브 및 소매점으로 운송하기 위한 효율적이고 신뢰할 수 있는 냉장 트레일러에 대한 요구가 지역 전체에서 높아지고 있습니다. 또한 아시아태평양은 열대에서 온대까지 다양한 기후를 포함하고 있으며 공급망 전반에 걸쳐 신선품의 품질과 안전성을 유지하기 위해 냉장 트레일러의 중요성을 더욱 두드러지게 합니다. 예를 들어,

또한 식품안전기준 개선 및 운송 인프라의 현대화를 목표로 하는 정부의 이니셔티브가 아시아태평양의 냉장 트레일러 채용에 박차를 가하고 있습니다. 중국, 인도, 일본, 한국 등의 국가에서는 온도 변화에 민감한 제품 수요 증가를 지원하기 위해 냉장 창고, 냉장 보관 시설, 냉장 수송 차량 등의 콜드체인 물류 인프라에 대규모 투자가 이루어지고 있습니다. 또한 IoT(사물인터넷) 센서와 실시간 모니터링 솔루션의 통합 등 냉동 시스템의 기술적 진보가 냉장 트레일러의 효율성과 신뢰성을 높이고, 이 지역 시장 성장을 더욱 촉진하고 있습니다.

냉장 트레일러 제조 기업은 환경법을 준수하면서 트레일러를 보다 효율적으로 하기 위해, 다양한 선진 기술을 채용 및 개발하고 있습니다. Great Dane LLC, Wabash National Corporation, Kogel GmbH, Schmitz Cargobull AG, Utility Manufacturing Company 등의 기업이 냉장 트레일러 시장의 주요 기업입니다.

2024년 3월-ATA 기술 및 유지보수 협의회가 주최하는 연차 총회 및 운송 기술 전시회는 업계의 혁신, 진보, 업적을 기리는 플랫폼 역할을 했습니다. 올해 회의에서 유틸리티 트레일러 매뉴팩처링 컴퍼니 LLC는 혁신적인 카고블 북미 LLC(CBNA)의 운송용 냉동 유닛(TRU) 출시를 발표했습니다. 이 TRU는 유틸리티의 광범위한 딜러 네트워크를 통해 북미 전역에서 유틸리티의 유명한 3000R 리퍼 트레일러에 독점적으로 설치됩니다.

2023년 8월-Muller Milk & Ingredients는 냉동 및 냉장 트레일러의 대체 전원으로 태양전지판과 운동 에너지를 테스트했습니다.

The Refrigerated Trailer Market size is estimated at USD 6.70 billion in 2025, and is expected to reach USD 8.97 billion by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The refrigerated trailer market is experiencing robust growth driven by various factors, including the increasing demand for the transportation of temperature-sensitive goods, technological advancements in refrigeration systems, and expanding cold chain logistics infrastructure globally. Refrigerated trailers, also known as reefers, play a crucial role in transporting perishable goods such as food and pharmaceuticals over long distances while maintaining the desired temperature throughout the journey. With the rise in global food trade and the growing need to reduce food wastage, the demand for refrigerated trailers is expected to grow steadily in the coming years.

Moreover, stringent food safety regulations and quality standards set by governments and regulatory bodies across the world are compelling food producers, distributors, and logistics companies to invest in reliable refrigerated transportation solutions. Refrigerated trailers equipped with advanced temperature monitoring and control systems help ensure compliance with these regulations, safeguarding the quality of perishable goods during transit. In addition, increasing consumer awareness regarding food safety and quality is driving the adoption of refrigerated trailers by retailers and e-commerce companies for the transportation of fresh produce and other temperature-sensitive products.

Furthermore, the advent of electric and hybrid refrigerated trailers powered by sustainable energy sources is poised to revolutionize the refrigerated trailer market. As concerns over environmental sustainability and greenhouse gas emissions intensify, fleet operators and logistics companies are increasingly embracing eco-friendly refrigeration solutions to reduce their carbon footprint. Electric refrigerated trailers offer benefits such as quieter operation, reduced emissions, and lower operating costs compared to traditional diesel-powered trailers.

North America is the region leading the market, followed by Asia-Pacific and Europe. The major players manufacturing refrigerated trailers include Wabash National Commercial Trailer Products, Great Dane Trailers, Utility Trailer Manufacturing Company, Schmitz Cargobull AG, and Kogle Trailer GmbH.

This is an exciting period for cold-chain technology as various advancements in hardware, telematics, and vehicle technology are transforming the transportation of perishable goods across North America, prompting refrigerated fleets to contemplate strategies to stay competitive. However, the reefer community is facing challenges amid business conditions that are more complex than ever before. For instance,

While long-term contract freight rates remain stable, overall freight volume has decreased, leading many smaller refrigerated haulers to rely on the spot market for business opportunities. Spot refrigerated rates are approximately 7% lower than the same period in 2022 and more than 5% below their five-year average. Despite these obstacles, refrigerated fleets benefit from a relatively insulated segment of the trucking industry compared to other sectors like dry van transportation, which is experiencing significant upheaval due to factors such as fleet closures, regulatory changes, and shifts in market dynamics.

With rising consumer preferences for fresh and perishable goods, particularly in densely populated urban areas, there is a heightened need for efficient and reliable refrigerated trailers to transport these products from production centers to distribution hubs and retail outlets across the region. Moreover, Asia-Pacific encompasses diverse climates ranging from tropical to temperate, further accentuating the importance of refrigerated trailers in maintaining the quality and safety of perishable goods throughout the supply chain. For instance,

Furthermore, government initiatives aimed at improving food safety standards and modernizing transportation infrastructure are fueling the adoption of refrigerated trailers in Asia-Pacific. Countries such as China, India, Japan, and South Korea are witnessing significant investments in cold chain logistics infrastructure, including refrigerated warehouses, cold storage facilities, and refrigerated transportation fleets, to support the growing demand for temperature-sensitive products. Additionally, technological advancements in refrigeration systems, such as the integration of IoT (Internet of Things) sensors and real-time monitoring solutions, are enhancing the efficiency and reliability of refrigerated trailers, further driving market growth in the region.

Refrigerated trailer manufacturing companies are adopting and developing various advanced technologies to make the trailers more efficient while adhering to environmental laws. Companies like Great Dane LLC, Wabash National Corporation, Kogel GmbH, Schmitz Cargobull AG, and Utility Manufacturing Company are the major players in the refrigerated trailer market.

In March 2024, the Annual Meeting & Transportation Technology Exhibition organized by the ATA Technology & Maintenance Council served as a platform to celebrate industry innovation, progress, and achievements. During this year's conference, Utility Trailer Manufacturing Company LLC announced the availability of the innovative Cargobull North America LLC (CBNA) transport refrigeration units (TRUs). These TRUs will be exclusively available on Utility's renowned 3000R reefer trailer throughout North America via Utility's extensive dealer network.

In August 2023, Muller Milk & Ingredients tested solar panels and kinetic energy as alternative power sources for its refrigerated trailers, seeking eco-friendly alternatives to diesel-powered refrigeration systems.