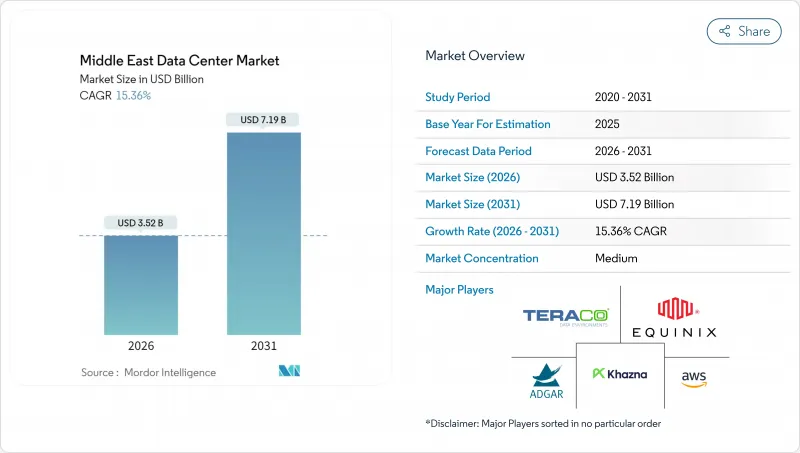

중동의 데이터센터 시장은 2025년 30억 5,000만 달러에서 2026년에는 35억 2,000만 달러로 성장하고 2026년부터 2031년에 걸쳐 CAGR 15.36%를 나타낼 것으로 예상됩니다. 2031년까지 71억 9,000만 달러에 달할 전망입니다.

설치 기준으로 시장은 2025년 1,820메가와트에서 2030년까지 2,840메가와트로 성장하고, 2025년에서 2030년 예측 기간에 CAGR 9.23%를 나타낼 것으로 전망됩니다. 시장 세분화의 점유율 및 추정치는 MW 단위로 계산 및 보고됩니다. 견조한 정부 자금, 하이퍼스케일 용량의 의무화, 고밀도 해저 케이블의 육양, 클라우드 우선의 지원적 규제가 결합되어, 자본과 인재를 지역에 불러들여, 기존의 건설 사이클을 단축해, 가동률을 향상시키고 있습니다. 사우디아라비아의 HUMAIN과 UAE-프랑스 AI 협정과 같은 국가 프로그램은 GPU 집적형 홀의 확실한 기간 수요를 창출하고 있으며, 유전 폐가스 발전 파일럿 사업은 구조적으로 낮은 에너지 비용을 시사하고 있습니다. 이로 인해 유럽 및 아시아 지역에 대한 비용 우위성이 확대될 수 있습니다. 토지·전력 공급 관리와 액체 냉각 기술의 노하우를 조합한 사업자는 다른 지역에서의 용량 부족을 회피하고 싶은 하이퍼스케일러 기업으로부터 장기 계약을 획득하고 있습니다. 국내 유력 기업, 세계의 코로케이션 브랜드, 에너지 대기업이 리야드, 아부다비, 텔아비브에서 입지를 다투는 가운데 경쟁 압력은 높아지고 있으며, 토지 가격을 밀어 올리는 한편, 국경을 넘은 워크로드의 이동성을 향상시키는 캠퍼스 간 섬유의 구축을 가속화하고 있습니다.

구속력 있는 클라우드 퍼스트 지령으로 각 부처와 국유기업은 정상적인 비용 최적화를 고려하지 않는 스케줄로 워크로드의 이행을 의무화하고 있으며, 개발자를 경기 순환에 의한 감속으로부터 보호하는 수요의 저견성을 효과적으로 창출하고 있습니다. 이러한 지침에는 엄격한 데이터 주권 조항도 포함되어 있으며 프리미엄 가격이 설정되는 소블린 클라우드 존의 홍보로 이어지고 있습니다. 공공 부문의 계약 획득에는 컴플라이언스가 필수이기 때문에 외국 클라우드 제공업체는 라이선싱을 받은 현지사업자와 제휴할 필요가 있어 국내에서의 가치 획득이 강화되어 현지 노동력으로의 기술 이전이 가속화되고 있습니다.

사우디 텔레콤 사의 「센터 3」과 같은 기함 프로그램은 1GW의 로드맵을 목표로 하고, 주요 테넌트의 확보를 보증하는 것과 동시에, 전력 구입 특권을 번들하는 경우가 많아, 리스크 프리미엄을 저하시켜, 개발 기간을 18-24개월로 단축합니다. 정부 주도의 자금 조달에 의해 오프 테이크 계약을 둘러싼 통상의 쟁탈전이 불필요하게 되어, 순수한 상업 시장에서는 자금 조달이 곤란한 복수 캠퍼스 동시 기동이 가능하게 됩니다. 초기 단계에서공급 과잉은 유럽과 아시아 간의 저지연 중복성을 요구하는 국제 하이퍼스케일러의 진입 장벽을 더욱 감소시킵니다.

사막의 주위 온도는 온대 지역에 비해 연간 PUE를 3-5% 밀어 올리고, GPU 랙을 사양 범위 내로 유지하기 위해, 사업자에게는 대규모 냉수 플랜트의 자금 조달 또는 액체 냉각의 채용을 강요합니다. AI 클러스터는 열부하를 더욱 악화시키고, 물 부족 규제는 증발 냉각 시스템의 도입을 제한하기 때문에 신규 참가자에 의한 가격 압력이 높아지는 바로 그 타이밍에서 전기 구동 냉각 장치에 대한 의존도가 높아져 운영 비용을 밀어 올립니다.

대규모 시설은 기업의 지속적인 이용과 자산의 완전 상각으로 도입 용량의 39.62%를 차지했습니다. 그러나 차세대 캠퍼스가 가동을 시작함에 따라 이 비율은 떨어질 전망입니다. 한편 국가 주도의 AI 프로그램과 50MW 이상의 연속 전력 블록을 필요로 하는 하이퍼스케일러 기업에 견인된 대규모 캠퍼스는 부문 내에서 가장 높은 성장률(CAGR 16.69%)을 기록했습니다. 2026년부터 2031년까지 중동의 데이터센터 시장은 이러한 대규모 건설로 인해 규모가 2배 이상으로 확대될 것으로 예측됩니다. 수백 메가와트 규모의 송전망 연결을 확보한 사업자에게는 현재 우선 조달권이 부여되고 있습니다.

이 변화는 DataVolt와 같은 개발자에게 유리하게 작동합니다. 이 회사가 NEOM에 건설중인 1.5GW 넷 제로 AI 공장은 국가 주도 계획이 전통적인 공동 위치에서 단계적 확장 로직을 피하는 방법을 보여줍니다. 메가 및 중간 규모 형식은 국가별 거점이 필요하지만 대규모 실적의 경제성을 흡수할 수 없는 지역 클라우드 서비스에 여전히 중요한 역할을 합니다. 소규모 에지 노드는 낮은 지연이 요구되는 이용 사례와 규제 거주 조항에 대한 대응을 계속하고, 동일 지역 생태계 내에서 하이퍼스케일과 마이크로 배치를 융합시키는 바벨형 구조를 보장합니다.

2025년 시점에서 중동 데이터센터 시장의 67.05%를 Tier 3 시설이 차지하고, 멀티 테넌트 용도에 있어서 신뢰성과 비용 효율의 최적해로서의 지위를 확고한 것으로 하고 있습니다. 그러나 AI 교육, 디지털 결제 청산 처리, 국가 안보 워크로드가 내결함성 기준을 끌어올리는 가운데 Tier 4는 16.55%의 연평균 복합 성장률(CAGR)로 확대를 계속하고 있습니다. 중동의 데이터센터 시장에서 티어 4에 할당된 규모는 중요 인프라 프로젝트에 대한 국가 수준의 허가 절차의 신속화를 배경으로 2020년대 말까지 3배로 확대될 것으로 예측되고 있습니다.

지역사업자는 장기적인 신뢰성을 보여주기 때문에 Tier 4 도입에 대한 의욕을 표명합니다. 에티살랏의 운영 지속성에서 Tier 3 골드 인증을 포함한 업타임 인스티튜트 인증은 지정학적 위험 인식을 줄이는 성숙한 품질 문화를 입증합니다. 그러나 Tier 3과 티어 4의 MW당 설비투자액(CAPEX)의 차이는 가격에 민감한 테넌트가 주류의 지방도시에서는 여전히 장벽이 되고 있습니다. 개발자는 이중화 수준을 지역 수요 탄력성으로 조정해야 하며, 동일한 사이트에 3단계와 4단계 홀을 혼합하는 경우가 적습니다.

중동의 데이터센터 시장 보고서는 데이터센터 규모(대규모, 초대규모, 중규모, 메가, 소규모), 티어 기준(Tier 1.2, Tier 3, 티어 4), 데이터센터 유형(하이퍼스케일/자사 건설, 엔터프라이즈/에지, 공동 위치), 최종 사용자 산업(은행, 금융서비스 및 보험(BFSI), IT 및 ITES, 전자상거래, 정부, 미디어 엔터테인먼트)으로 분류됩니다. 시장 예측은 IT 부하 용량(MW) 단위로 제공됩니다.

The Middle East Data Center Market is expected to grow from USD 3.05 billion in 2025 to USD 3.52 billion in 2026 and is forecast to reach USD 7.19 billion by 2031 at 15.36% CAGR over 2026-2031.

In terms of the installed base, the market is expected to grow from 1.82 thousand megawatts in 2025 to 2.84 thousand megawatts by 2030, at a CAGR of 9.23% during the forecast period from 2025 to 2030. The market segment shares and estimates are calculated and reported in terms of MW. Solid sovereign funding, hyperscale capacity mandates, dense subsea cable landings, and supportive cloud-first regulations combine to attract capital and talent to the region at a pace that shortens traditional build cycles and boosts utilization rates. Sovereign programs such as Saudi Arabia's HUMAIN and the UAE-France AI pact create guaranteed anchor demand for GPU-dense halls, while oil-field waste-gas-to-power pilots hint at structurally lower energy costs that could widen regional cost advantages over Europe and parts of Asia. Operators that pair land and power control with liquid-cooling know-how are securing long-term commitments from hyperscalers eager to hedge against capacity shortages elsewhere. Competitive pressure is mounting as domestic champions, global colocation brands, and energy majors jostle for sites in Riyadh, Abu Dhabi, and Tel Aviv, driving up land prices but also accelerating inter-campus fiber builds that improve cross-border workload mobility.

Binding cloud-first mandates oblige ministries and state-owned firms to migrate workloads on timelines that ignore typical cost optimization, effectively creating a demand floor that cushions developers against cyclical slowdowns. These directives also embed strict data-sovereignty clauses, encouraging sovereign-cloud zones that fetch premium pricing. Because compliance is required to win public-sector contracts, foreign cloud providers must partner with licensed local operators, reinforcing domestic value capture and accelerating skill transfer to the local workforce.

Flagship programs such as Saudi Telecom Company's center3 target a 1 GW roadmap, guarantee anchor tenancy, and often bundle power-purchase concessions, dropping risk premiums and compressing development timelines to 18-24 months. Sovereign financing removes the typical scramble for off-take agreements, enabling simultaneous multi-campus launches that would be hard to fund in purely commercial markets. The oversupply that results in early years further reduces entry barriers for international hyperscalers seeking low-latency redundancy between Europe and Asia.

Desert ambient temperatures push annual PUE up by 3-5% over temperate sites and force operators to finance large chilled-water plants or adopt liquid-cooling in order to keep GPU racks within spec. AI clusters exacerbate the heat profile, and water-scarcity regulations restrict evaporative systems, increasing dependence on electrically driven chillers that inflate operating costs just when price pressure from new entrants intensifies.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Large facilities accounted for 39.62% of deployed capacity, thanks to enterprise loyalty and fully depreciated assets. However, as new-generation campuses come online, this share is set to decline. Meanwhile, massive campuses, driven by sovereign AI programs and hyperscalers requiring contiguous power blocks exceeding 50 MW, recorded the highest growth in the segment with a 16.69% CAGR. Between 2026 and 2031, the Middle East data center market is expected to more than double in size due to these massive builds. Operators securing multi-hundred-megawatt grid connections are currently enjoying a status of preferential procurement.

The shift favors developers like DataVolt, whose 1.5 GW net-zero AI factory in NEOM underlines how sovereign planning circumvents the incremental build logic of traditional colocation. Mega and medium formats remain relevant for regional cloud services that require country-specific presence yet cannot absorb the economics of massive footprints. Small edge nodes continue to address latency-critical use cases and regulatory residency clauses, ensuring a barbell-sized structure that blends both hyperscale and micro deployments within the same regional ecosystem.

Tier 3 facilities accounted for 67.05% of the Middle East data center market share in 2025, confirming their status as the cost-effective sweet spot for reliability in multi-tenant applications. Tier 4, however, is advancing at 16.55% CAGR as AI training, digital payments clearing, and national security workloads raise the bar on fault tolerance. The Middle East data center market size allocated to Tier 4 is expected to triple by the end of the decade, driven by expedited sovereign permitting for critical infrastructure projects.

Regional operators showcase Tier 4 ambitions to signal long-term reliability. Uptime Institute certifications, such as Etisalat's Tier III Gold for Operational Sustainability, illustrate a maturing quality culture that reduces perceived geopolitical risk. Yet the CAPEX per MW differential between Tier 3 and Tier 4 remains a hurdle for second-tier cities where price-sensitive tenants dominate. Developers must therefore calibrate redundancy levels to local demand elasticity, often blending Tier 3 and Tier 4 halls on the same site.

The Middle East Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Standard (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-Built, Enterprise/Edge, and Colocation), End User Industry (BFSI, IT and ITES, E-Commerce, Government, Media and Entertainment, and More), and Geography. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).