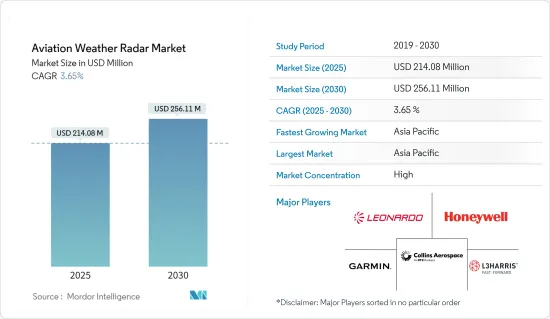

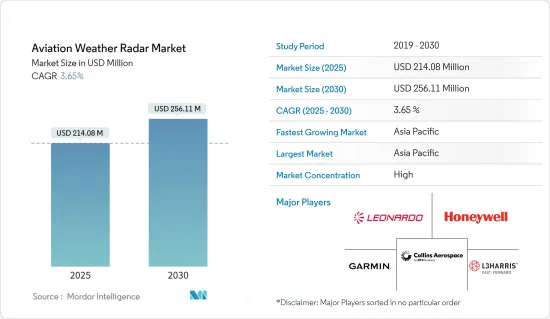

세계의 항공 기상 레이더 시장 규모는 2025년에 2억 1,408만 달러로 추정되며 예측기간 중(2025-2030년) CAGR 3.65%로 확대되어, 2030년에는 2억 5,611만 달러에 달할 것으로 예측되고 있습니다.

항공 기상 레이더 시장은 기상 모니터링의 중요한 필요성으로 인해 선진적 레이더 시스템 수요가 급증하고 있습니다.

최첨단 레이더 기술, 특히 펄스 도플러 레이더를 채용함으로써, 항공기는 악천후를 보다 효율적이고 안전하게 항행할 수 있게 됩니다. 또한, 산업에서는 보다 경량으로 컴팩트한 레이더 시스템으로의 시프트가 현저하고, 연료 효율의 향상과 유지관리 비용의 저감을 실현하고 있습니다.

그러나 레이더 시스템의 고비용과 복잡성, 규제 및 환경 장애 등 시장은 과제에 직면하고 있습니다. 이러한 장애물이 시장 성장을 방해할 수 있는 것, 선진적 레이더 시스템에 대한 민간항공, 일반항공, 군용항공산업에서의 수요 증가는 예측기간 동안 시장을 적극적으로 견인할 것으로 예상됩니다.

세계의 군사항공 부문은 지정학적 긴장의 고조와 대규모 근대화 프로그램에 의해 급성장을 이루고 있습니다. 각국은 방위 강화를 우선하고 있기 때문에 첨단 항공기 시장은 확대를 향하고 있습니다.

세계의 방위 지출이 증가함에 따라 각국은 자국의 안보를 강화하기 위해 군용기에 점점 주목 받고 있습니다. 예를 들어, 2024년 6월, 튀르키예와 미국은 기념비적인 계약을 체결했고, 튀르키예는 230억 달러로 40대의 신형 F-16을 취득했습니다. Lockheed Martin은 슬로바키아 최초의 F-16을 2기 납품했습니다. Block 70/72의 F-16에 탑재되어 있는 이 레이더는 F-22나 F-35로부터 선진적 기능을 계승해, 상황 인식 능력의 향상, 전천후형 조준, 상세한 디지털 지도 표시를 기재하고 있습니다 파일럿은 스루나 줌등의 커스터마이즈형 기능으로부터 혜택을 받아 조작능력을 더욱 높일 수 있습니다.

이에 이어 Honeywell은 레이더 기술을 다양한 군용기로 확장해 왔습니다. 최첨단 솔루션으로, 특히 수송기, 헬리콥터, 특수 임무기 등 폭넓은 군용기로 원활하게 통합할 수 있도록 설계되어 있습니다.

아시아태평양은 예측 기간 동안 가장 높은 CAGR을 기록하고 세계의 항공 섹터를 선도하게 될 것입니다. 2022년, 중국은 항공 인프라를 강화해, 새롭게 6개의 화물 공항과 29의 범용 공항을 도입해, 연말의 합계수는 각각 254와 399가 되었습니다. 향후, 중국은 여객 수요의 증대에 대응하기 위해, 2035년까지

비슷한 움직임으로 인도 민간 항공성은 2023년 6월, 향후 2-3년 이내에 이 나라의 공항수를 헬리포트를 포함해 200-220으로 늘릴 계획을 발표했습니다. 이 공항이 점점 다양한 기상 레이더 기술을 채용함에 따라, 시장 수요는 더욱 확대되고 있습니다.

또한 일부 지역의 군사는 기상 레이더 조달을 크게 강화했으며, 그 결과 항공 기상 레이더에 대한 수요가 증가하고 있습니다. 2024년 5월, Bharat Electronics가 도플러 기상 레이더 수주를 밝히고 총 48억 1,000만 루피(약 5,760만 달러)에 이르렀습니다. 당초 2021년 1월에 발표된 1,312만 달러의 프로젝트는 국제 협력 기구에 의해 지원되어 스쿨 레이더의 설치 후에는 파키스탄의 거의 90%를 커버하게 됩니다.

항공기상 레이더 시장은 Honeywell International Inc., Collins Aerospace(RTX Corporation), L3Harris Technologies Inc., Leonardo SpA, Garmin Ltd. 등의 주요 기업에 의해 통합되고 지배되고 있습니다.

이러한 기업들은 보다 광범위한 항공기 제조업체를 지원하기 위해 제품 제공을 확대하고 있습니다.

The Aviation Weather Radar Market size is estimated at USD 214.08 million in 2025, and is expected to reach USD 256.11 million by 2030, at a CAGR of 3.65% during the forecast period (2025-2030).

The aviation weather radar market is experiencing a surge in demand for advanced radar systems, driven by the critical need for weather monitoring. Safeguarding aircraft from adverse weather conditions emerges as a key market driver. Instances of unexpected weather disturbances lead to aircraft disruptions and, in severe cases, damage, underscoring the urgency for airports to adopt weather radars.

Adopting state-of-the-art radar technologies, notably pulse-doppler radar, enables aircraft to navigate adverse weather conditions more efficiently and safely. Additionally, the industry is witnessing a notable shift toward lighter, more compact radar systems, offering improved fuel efficiency and lower maintenance costs.

However, the market faces challenges, including the high costs and complexities of radar systems and regulatory and environmental obstacles. Market players need to focus on R&D, innovation, and collaboration to overcome these challenges and stay competitive. While these hurdles could potentially hinder market growth, the rising demand from the commercial, general, and military aviation industries for advanced radar systems is set to drive the market positively during the forecast period.

The global military aviation sector is experiencing a surge, driven by rising geopolitical tensions and extensive modernization programs. This surge is spurring the demand for advanced aircraft with heightened capabilities. With global military expenditures on the rise and nations prioritizing defense enhancements, the market for advanced aircraft is poised for expansion. In 2023, global military spending peaked at USD 2,440 billion, marking a significant 9% increase from 2022.

As global defense spending climbs, countries are increasingly looking to military aircraft to bolster their security. This heightened demand is underscored by certain events. For instance, in June 2024, Turkey and the United States sealed a monumental deal, with Turkey acquiring 40 new F-16 aircraft in a USD 23 billion agreement. Similarly, in January 2024, Lockheed Martin delivered Slovakia's first two F-16s, featuring Northrop Grumman's cutting-edge APG-83 AESA radar. This radar, found in the Block 70/72 F-16s, inherits advanced capabilities from its F-22 and F-35 counterparts, offering improved situational awareness, all-weather targeting, and detailed digital map displays. Pilots benefit from tailored features like slew and zoom, further enhancing their operational capabilities.

Following suit, Honeywell extended its radar technology to a range of military aircraft. The RDR-7000 weather radar system from Honeywell is a cutting-edge solution designed to provide unparalleled weather insights and situational awareness for defense and military applications. Notably, it is engineered for seamless integration across a broad spectrum of military aircraft, including transport, helicopters, and specialized mission planes. These advancements are primed to drive significant market growth in the years ahead.

Asia-Pacific is set to lead the global aviation sector, boasting the highest CAGR during the forecast period. Notably, China is on track to overtake the United States in commercial aviation, while India is poised to outstrip the United Kingdom, positioning itself as the largest and third-largest market. This growth surge is underpinned by airlines' robust fleet procurement strategies and substantial expansions in airport infrastructure. In 2022, China bolstered its aviation infrastructure, introducing six new freight airports and 29 general-purpose airports, bringing the year-end totals to 254 and 399, respectively. Looking forward, China has ambitious plans to add a further 215 airports by 2035 to cater to the escalating passenger demands.

In a similar vein, the Indian Ministry of Civil Aviation, in June 2023, unveiled plans to elevate the country's airport count to 200-220, including heliports, within the next 2-3 years. India has allocated a significant USD 12 billion for airport investments to support this expansion, drawing from both public and private funding. As these airports increasingly adopt diverse weather radar technologies, the market demand is further amplified. For instance, in February 2024, Terma clinched a contract with the India Airports Authority to deploy its renowned SCANTER 5502 surface movement radars (SMRs) in four major Indian airports, namely Bengaluru, Mumbai, Navi Mumbai, and Hyderabad. Renowned for its reliable all-weather detection capabilities, the SCANTER 5502 is poised to significantly enhance the operational efficiency of these pivotal Indian airports.

Furthermore, several regional militaries are significantly boosting their procurement of weather radars, consequently driving up the demand for aviation weather radars. On this note, in May 2024, Bharat Electronics revealed orders totaling INR 481 crore (approx. USD 57.6 million), with a notable Doppler weather radar order. Similarly, in April 2024, the Embassy of Japan in Pakistan pledged an additional USD 5.5 million grant for the Sukkur weather surveillance radar project. Initially announced in January 2021 at a cost of USD 13.12 million, the project, bolstered by the Japan International Cooperation Agency, is set to cover nearly 90% of Pakistan after the Sukkur radar's installation. These advancements are poised to be pivotal drivers for the regional market's growth in the years to come.

The aviation weather radar market is consolidated and dominated by key players, including Honeywell International Inc., Collins Aerospace (RTX Corporation), L3Harris Technologies Inc., Leonardo SpA, and Garmin Ltd. This dominance is due to the limited number of companies producing weather radars for aviation, resulting in a concentrated market.

These companies are expanding their product offerings to cater to a broader range of aircraft manufacturers. For example, in 2022, Spire Global secured a significant five-year contract to provide weather forecasts for TCOM, a US-based intelligence, surveillance, and reconnaissance (ISR) firm. The agreement entails delivering weather forecast services to 10 sites where TCOM operates aerostats (aircraft that utilize lifting gas for flight). Such strategic moves are poised to reshape the competitive landscape among market players.