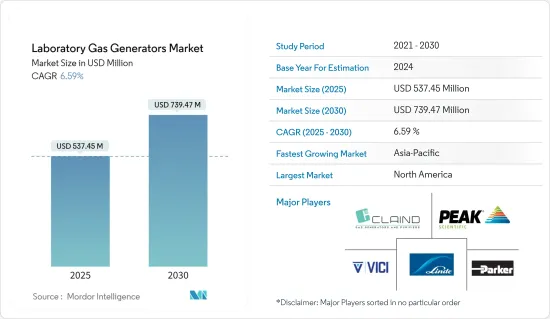

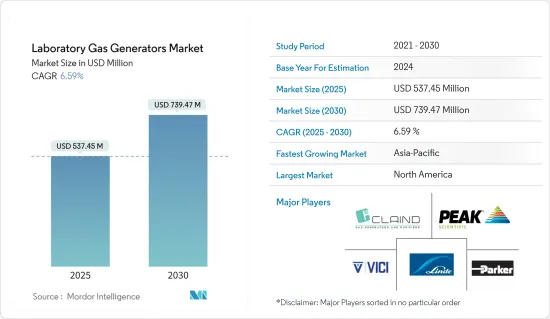

실험실용 가스 발생기 시장 규모는 2025년에 5억 3,745만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 6.59%로, 2030년에는 7억 3,947만 달러에 달할 것으로 예측됩니다.

COVID-19는 운영 및 공급망 중단, 고객 수요 감소, 세계 경기 둔화로 인해 실험실 가스 발생기 시장에 영향을 미쳤습니다. 따라서 전 세계 학술기관 및 실험실의 폐쇄로 인해 기업의 부문 매출이 크게 감소했습니다. 또한 COVID-19 관련 실험실 기반 연구개발 활동으로 인해 COVID-19 팬데믹 기간 중 실험실 가스 발생기에 대한 수요가 증가했습니다. 예를 들어 2021년 6월, Novagenix는 튀르키예에서 COVID-19 신약 개발 연구에 PEAK 질소 발생기를 사용하여 의약품의 효능과 품질을 평가하고 인증하는 데 사용했습니다. 이러한 COVID 신약 개발에 실험용 가스 발생기의 사용은 팬데믹 기간 중 실험용 가스 발생기 수요를 견인했습니다. 이처럼 COVID-19 팬데믹은 시장 성장을 가속했으며, 본 연구의 예측 기간 중에도 유사한 견인력이 지속될 것으로 예측됩니다.

이 시장의 성장은 주로 기존 가스 실린더 사용과 관련된 안전에 대한 우려 증가, 의약품 및 식품 승인 과정에서 분석 기술의 중요성 증가, 대상 산업의 R&D 비용 증가에 기인합니다.

분석화학은 의약품 개발에서 중요한 역할을 하며, 신약의 품질, 안전성, 유효성을 보장합니다. 제약 부문에서는 여러 가지 분석 기법이 사용되고 있지만, 주로 구조 결정, 분석 대상의 분리, 대상 화합물의 정량에 사용되는 세 가지 일반적인 분석 기법이 사용됩니다. 여기에는 크로마토그래피, 분광학, 전통적인 분석 화학 기술이 포함됩니다. 불순물 및 약학적으로 활성 화합물을 포함한 위험한 화학 물질의 검출 및 식별에 대한 분석 검사의 적용이 확대되고 있습니다. 이러한 맥락에서 2022년 3월에 발표된 Azo optics의 기사에 따르면 자외선/가시광선(UV/Vis)과 적외선(IR) 분광법은 완성된 식품에서 식품첨가제의 존재를 정량화하기 위해 사용되는 두 가지 표준 분광 기술이라고 언급되어 있습니다. 이 두 가지 방법은 식품첨가제의 화학적 조성, 식감 특성 및 품질과 관련된 측면에 대한 중요한 세부 정보를 제공할 수 있습니다. 따라서 식품 승인 프로세스의 분석 검사에서 분광법의 사용이 증가함에 따라 실험실 가스 발생기의 사용도 증가하여 시장 성장을 가속할 것으로 예측됩니다.

또한 고속 액체 크로마토그래피(HPLC) 기술은 단백질과 인지질을 포함한 고정형(stationary type)을 사용하여 약물 분자가 확산되는 생물학적 환경을 시뮬레이션하는 것으로, 생체 모방 크로마토그래피로 알려져 있습니다.2022년 4월 European Chemical Societies에서 발표한 논문에서는 생체 모방 크로마토그래피 데이터를 사용하여 약품 및 농약의 수생 독성을 예측할 수 있다고 언급했습니다. 이러한 분석 기술의 채택이 증가함에 따라 분석에 자주 사용되는 실험실용 가스 발생기에 대한 수요가 증가하여 시장 성장의 원동력이 될 것으로 예측됩니다.

또한 2022년 7월에 발표된 PharmaVoice의 기사에 따르면 2022년까지 5년 동안 생명공학 부문의 연구개발비가 약 2배로 증가했다고 합니다. 생명 공학 실험실은 통제된 환경이기 때문에 질소 실험실 가스 발생기는 주로 이러한 실험실에서 사용됩니다. 따라서 생명 공학 산업에 대한 투자가 증가함에 따라 실험실 가스 발생기의 성장이 예상됩니다.

또한 시장 진출기업은 인수, 합병, 제품 출시 등의 전략에 관여하고 있습니다. 예를 들어 2022년 8월, Tisch Environmental은 AADCO Instruments(Advanced Analytical Device Company)를 인수했으며, AADCO는 최첨단 제로 에어 발생기 라인을 개발하고 있습니다.

따라서 의약품 및 식품 승인 과정에서 분석 기술의 중요성 증가, R&D 비용 증가, M&A와 같은 시장 진출기업의 활동 활성화 등의 요인이 예측 기간 중 성장세를 보일 것으로 예측됩니다. 그러나 기존 가스 공급 방식에서 대체에 대한 소극적인 태도와 숙련된 인력의 부족은 시장 성장을 억제할 것으로 예측됩니다.

질소 가스 발생기는 예측 기간 중 조사 대상 부문의 성장에 기여할 것으로 예측됩니다. 질소 가스 발생기는 압축 공기에서 질소 분자를 분리하는 기계입니다. 식품 산업, 반도체, 석유, 화학, 연구 기관 등에서 널리 사용되고 있습니다. 의약품 및 식품 승인 과정에서 분석 기술의 중요성 증가, 식품 안전에 대한 우려 증가, 대상 산업의 R&D 비용 증가 등의 요인이 이 부문의 성장을 가속하고 있습니다. 또한 다른 화합물과의 반응성이 낮고 주변 산소 수준을 제어할 수 있다는 장점으로 인해 액체 크로마토그래피 질량분석(LC-MS) 분석, 증발광 산란 검출기(ELSD) 작동, 체외수정(IVF) 인큐베이터의 환경 조건 유지에 질소 가스 발생기의 채택이 증가하고 있습니다. 증가하고 있습니다.

기존의 질소 실린더는 누출 위험이 높은 등 몇 가지 단점이 있습니다. 예를 들어 2021년 1월에 발표된 NPR의 조사 기사는 조지아 북동부의 한 가금류 농장에서 위험한 질소 누출로 인해 6명이 사망하고 11명이 입원하는 사고가 발생했음을 입증했습니다. 이 보고서는 또한 가연성이 높은 가압된 질소를 실험실에 대량으로 보관하면 화재 및 폭발 위험이 높아진다는 점도 언급하고 있습니다. 따라서 이러한 위험을 줄여주는 첨단 질소 가스 발생기에 대한 수요가 증가하고 있습니다. 이러한 질소 가스 발생기는 콤팩트하고 일관성 있고, 비용 효율적이며, 조작이 간편합니다. 따라서 이러한 발전은 질소 가스 발생기에 대한 수요를 증가시키고 있습니다.

또한 기업은 인수, 합병, 제품 출시 등 마케팅 전략에도 관여하고 있습니다. 예를 들어 2021년 9월 Nikkiso Cosmodyne이 최근 TGNO-1,000 기체 산소 및 질소 플랜트를 가동했다고 Nikkiso Cryogenic Industries의 청정 에너지 산업 가스 그룹이 보고했습니다. 발생기이며, 중/고압 질소 및 산소 가스의 세 가지 가스 제품을 생산하도록 설계되었습니다.

또한 2021년 7월, Scientific Laboratory Supply는 SLS 실험실 프로가스 및 액체 질소 발생기 제품 라인을 출시하여 영국과 아일랜드에서 독점적으로 판매합니다. 이 기술을 통해 실험실은 가스 공급을 제어할 수 있으며, 가스 실린더를 국가 간 운송할 필요가 없어져 지속가능성을 촉진할 수 있습니다.

마찬가지로 다양한 생물제제 및 의약품 개발을 위한 연구개발 증가도 질소가스 발생기 수요 증가에 긍정적으로 작용할 것으로 예측됩니다.

이처럼 기존 질소 실린더보다 질소 가스 성능에 대한 선호도 증가와 혁신적인 제품 출시로 인해 전체 질소 가스 발생기 시장은 예측 기간 중 안정적인 성장을 이룰 것으로 보입니다.

북미는 이 지역의 많은 제약 및 기타 산업에서 R&D 활동이 증가함에 따라 큰 시장 점유율을 차지할 것으로 예측됩니다. 북미의 실험실 가스 발생기 시장의 성장을 가속하는 주요 요인으로는 잘 구축된 인프라와 제약 산업의 R&D 비용 증가가 있습니다.

미국에서는 최근 다양한 제약회사와 정부기관의 연구개발(R&D)에 대한 지출이 증가하고 있으며, 이는 예측 기간 중 시장 성장을 가속할 것으로 예측됩니다. 예를 들어 세계 제약사 중 하나인 Novartis AG의 2021년 연례 보고서에 따르면 2021년 R&D에 148억 8,600만 달러를 투자하며, 이는 2020년 141억 9,700만 달러에서 증가한 수치입니다. 또 다른 대형 제약사 화이자의 2021년 연례 보고서에 따르면 2021년 R&D 투자 금액은 138억 2,900만 달러로 2020년의 93억 9,300만 달러에서 크게 증가했습니다. 이처럼 제약업계의 연구개발비 증가는 실험용 가스발생기 수요에 긍정적으로 반영될 것으로 예측됩니다. 가스 발생기는 의약품 제조 및 다운스트림 공정에서 중요한 역할을 하므로 이 지역 시장 성장에 기여하고 있습니다.

또한 2021년 6월 사노피는 mRNA Center of Excellence를 설립하고 미국내 차세대 백신 개발 및 공급을 가속화하기 위해 4억 1,014만 달러 이상을 투자했습니다. 첨단 백신을 생산하기 위한 제조 시설의 설립은 제약 및 바이오 제약 산업 부문에서 실험용 가스 발생기를 사용할 수 있는 기회를 창출할 가능성이 높습니다. 따라서 이 지역 시장 성장의 원동력이 될 것으로 예측됩니다.

연구 기관과 대학은 새로운 기술 개발에 힘쓰고 있으며, 예측 기간 중 이 분야 시장 개발에 기여할 것으로 예측됩니다. 예를 들어 2022년 2월 매사추세츠공과대학(MIT) 링컨 연구소는 알루미늄을 수소 연료로 변환하는 프로토타입 장비인 휴대용 수소 연료 발생기를 시연했습니다. 이 장비는 H-TaRP(Hydrogen Tactical Refueling Point)라고 불립니다. 알루미늄 디스펜서, 반응 용기, 수냉 시스템, 수소 탱크에 충전하기 위한 제어 시스템 매니폴드로 구성되어 있습니다.

따라서 R&D 비용 증가, 첨단 신기술의 빠른 채택, 이 지역의 주요 시장 진출기업 등의 요인이 예측 기간 중 북미 시장 성장에 기여할 것으로 예측됩니다.

시장 경쟁은 완만하며, 여러 국가의 현지 기업과 몇몇 국제적인 진출기업으로 구성되어 있습니다. 실험실용 가스 발생기 시장의 주요 기업에는 Claind S.r.l., ErreDue spa, F-Dgsi, Labtech S.R.L., LNI Swissgas, Nel ASA, Parker-Hannifin Corporation, Peak Scientific Instruments, Ltd, VICI DBS S.r.l. 등이 있으며, 전 세계에서 이러한 제품을 제공하고 있습니다.

The Laboratory Gas Generators Market size is estimated at USD 537.45 million in 2025, and is expected to reach USD 739.47 million by 2030, at a CAGR of 6.59% during the forecast period (2025-2030).

COVID-19 impacted the laboratory gas generators market due to the disruption of operation and supply chain, decreased customer demand, and global economic slowdown. Thus, the closure of academic institutions and laboratories across the globe has resulted in a significant loss of segmental revenue for businesses. Moreover, the demand for laboratory gas generators increased during the pandemic due to COVID-19-related laboratory-based research and development activity. For instance, in June 2021, Novagenix used PEAK nitrogen generators in their COVID-19 drug discovery study to assess and certify the efficacy and quality of medications in Turkey. Such usage of laboratory gas generators in drug discovery of COVID drove the demand for laboratory gas generators during the pandemic. Thus, the COVID-19 pandemic has boosted the market's growth and is expected to follow the same traction during the forecast period of the study.

The growth in this market is primarily driven by the rising safety concerns related to conventional gas cylinders use, the growing importance of analytical techniques in drug and food approval processes, and increasing R&D spending in target industries.

Analytical chemistry plays a crucial role in drug development, ensuring novel medications' quality, safety, and efficacy. Although several analytical methods are utilized in the pharmaceutical sector, three general analytical techniques are chiefly used to determine the structure, separate analytes, and quantify target compounds. These include chromatography, spectroscopy, and conventional analytical chemistry techniques. The application of analytical testing is growing for detecting and identifying dangerous chemicals, including both adulterants and pharmaceutically active compounds. In this context, the Azo optics article published in March 2022 stated that ultraviolet/visible (UV/Vis) and infrared (IR) spectroscopy are two standard spectroscopic techniques used to quantify the presence of food additives in their finished food items. These two methods can offer crucial details about the chemical composition, textural traits, and quality-related aspects of food additives. Thus, with the increasing spectroscopy use for analytical testing of the food approval process, laboratory gas generators are also expected to increase, thereby boosting the market growth.

Furthermore, high-performance liquid chromatography (HPLC) techniques use stationary phases containing proteins and phospholipids to simulate the biological environment where diffused drug molecules are known as biomimetic chromatography. The article published by European Chemical Societies in April 2022 mentioned using biomimetic chromatographic data to forecast the aquatic toxicity of drugs and pesticides. Such increasing adoption of these analytical techniques is expected to generate the demand for laboratory gas generators, frequently used to perform them, thereby driving the market growth.

Additionally, the PharmaVoice article published in July 2022 stated that in the five years running up to 2022, the biotechnology sector's R&D spending nearly doubled. As the biotechnology labs are a controlled environment, the nitrogen laboratory gas generators are primarily used in such labs. Thus, with the increasing investment in the biotechnology industries, the growth of laboratory gas generators is anticipated.

Moreover, market players are also involved in strategies such as acquisitions, mergers, and product launches, among others. For instance, in August 2022, Tisch Environmental acquired AADCO Instruments (Advanced Analytical Device Company). The company AADCO is developing a state-of-the-art line of Zero Air Generators.

Hence, factors such as the growing importance of analytical techniques in drug and food approval processes, growing R&D expenditure, and increased market player activities such as mergers and acquisitions are expected to witness growth over the forecast period. However, reluctance to replace conventional gas supply methods and lack of skilled personnel is expected to restrain the market's growth.

Nitrogen gas generator is expected to contribute to the growth of the studied segment over the forecast period. Nitrogen gas generators are machines that separate nitrogen molecules from compressed air. It is widely adopted in the food industry, semiconductors, petroleum, chemistry, and research institutes. Factors such as the growing importance of analytical techniques in drug and food approval processes, rising food safety concerns, and increasing R&D spending in target industries are driving segment growth. Additionally, advantages such as low reactivity with other compounds and the ability to control ambient oxygen levels are increasing the adoption of nitrogen gas generators in carrying out liquid chromatography-mass spectrometry (LC-MS) analysis to operating evaporative light scattering detectors (ELSDs) and maintaining environmental conditions in Vitro Fertilization (IVF) incubators.

Conventional nitrogen cylinders are associated with several downsides, such as a higher risk of leaks. For instance, an NPR study article published in January 2021 demonstrated how dangerous nitrogen leaks had killed six people and caused 11 hospitalizations in the Northeast Georgia poultry plant. The report also mentions that storing vast amounts of pressurized, highly flammable nitrogen in laboratories increases the risk of fire and explosions. Hence there is an increase in demand for advanced nitrogen gas generators as it mitigates these risks. These nitrogen gas generators are compact, consistent, cost-effective, and easy to operate. Thus, such advancements boost the demand for nitrogen gas generators.

Moreover, companies are also involved in marketing strategies such as acquisitions, mergers, and product launches. For instance, in September 2021, another company Nikkiso Cryogenic Industries' Clean Energy & Industrial Gases Group, reported that Nikkiso Cosmodyne recently commissioned its TGNO-1000 gaseous oxygen and nitrogen plant. TGNO is a cryogenic oxygen and nitrogen generator designed to produce three gaseous product streams, which are medium and high-pressure nitrogen and oxygen gas.

Additionally, in July 2021, Scientific Laboratory Supplies launched a line of SLS lab pro gas and liquid nitrogen generators, available exclusively in the UK and Ireland. This technology gives laboratories control over their gas supplies and promotes sustainability by eliminating the need for cross-country transportation of gas canisters.

Likewise, the rising research and expenditure for developing various biologics or pharmaceutical products are also expected to reflect positively on the growing demand for nitrogen gas generators.

Thus, due to the growing preference for nitrogen gas performance over conventional nitrogen cylinders and innovative product launches, the overall market for nitrogen gas generators will grow steadily over the forecast period of the study.

North America is expected to hold a significant market share, owing to the rise in research and development activities among numerous pharmaceutical and other industries in the region. The major factors driving the growth of the laboratory gas generators market in the North American region include the well-established infrastructure and increased R&D spending for the pharmaceutical industry.

The high expenditure on research and development (R&D) by various pharmaceutical companies and government organizations has been increasing recently in the US, anticipated to drive market growth over the forecast period. For instance, per the 2021 annual reports of Novartis AG, one of the global pharmaceutical companies, invested USD 14,886 million in 2021 for R&D, which increased from USD 14,197 million in 2020. In addition, another major pharmaceutical manufacturer, Pfizer Inc., invested USD 13,829 million in 2021 on R&D, which increased heavily compared to USD 9,393 in 2020, as mentioned in the 2021 annual report of the company. Thus, the increased research and development expenses in the pharmaceutical industry are expected to reflect positively on the demand for laboratory gas generators. They play a crucial role in drug production and down-streaming processes, thereby contributing to the market's growth in this region.

Additionally, in June 2021, Sanofi launched the mRNA Center of Excellence and invested over USD 410.14 million to accelerate developing and delivering next-generation vaccines in the US. Establishing manufacturing facilities to produce advanced vaccines will likely create opportunities for using laboratory gas generators in the pharmaceutical and biopharmaceutical industry segment. Thus, it is expected to drive market growth in the region.

Research organizations and universities are taking initiatives to develop new technologies, which are expected to contribute to the market growth in the country during the forecast period. For instance, in February 2022, the Massachusetts Institute of Technology (MIT) Lincoln Laboratory demonstrated a portable hydrogen fuel generator, a prototype device to convert aluminum into hydrogen fuel. The device is called the Hydrogen Tactical Refueling Point (H-TaRP). It comprises an aluminum dispenser, reactor vessel, water cooling system, and a control system manifold to fill a hydrogen tank.

Therefore, the factors such as rising research and development expenditure, quick adoption of advanced new technologies, and significant market players in this region are expected to contribute to the market's growth in North America during the forecast period.

The market studied is moderately competitive and consists of local players across several countries and some international players. The major players in the laboratory gas generators market include Claind S.r.l., ErreDue spa, F-Dgsi, Labtech S.R.L., LNI Swissgas, Nel ASA, Parker-Hannifin Corporation, Peak Scientific Instruments, Ltd and VICI DBS S.r.l., providing these products across the globe.