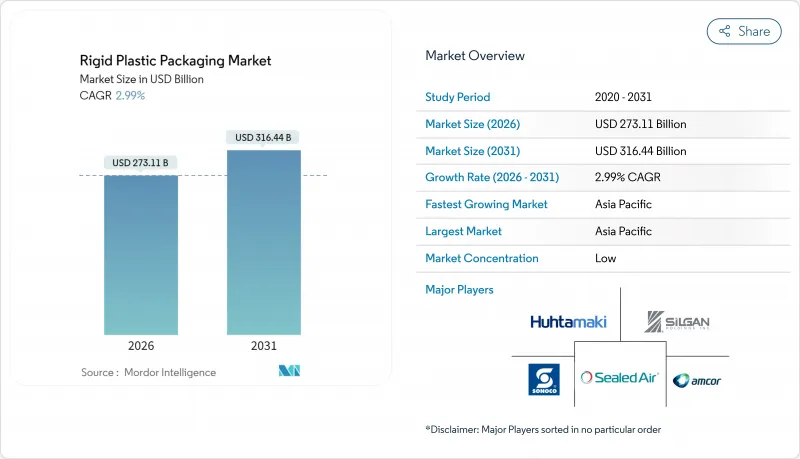

경질 플라스틱 포장 시장은 2025년의 2,651억 8,000만 달러에서 2026년에는 2,731억 1,000만 달러로 성장하고 2026년부터 2031년에 걸쳐 CAGR 2.99%로 성장을 지속하여 2031년까지 3,164억 4,000만 달러에 달할 전망입니다.

지속가능성에 대한 요구와 공급망의 탄력성 수요에 의해 양과 가치 창출 간의 균형을 맞춘 꾸준한 확대 단계가 강조되고 있습니다. 경질 플라스틱 포장 시장은 내충격성 형식을 선호하는 전자상거래의 성장, 단일 소재 설계를 장려하는 규제 압력, 식품 및 의료 분야에서의 일회용 수요를 높이는 인구 동태 동향의 혜택을 받고 있습니다. 생산자는 생산자책임재활용(EPR) 비용 곡선에 대응하기 위해 재생재 함량의 통합을 강화하고, 재활용 자산과의 수직 통합에 의해 원료의 가시성을 확보해, 폴리머 가격 변동에 대한 완충을 도모하고 있습니다. 아시아태평양은 규모 및 정책 인센티브와 급속한 도시 소비로 주도적 입장에 있으며, 유럽은 엄격한 순환형 경제 규제를 살려 고급 솔루션을 가속화하고, 북미는 견고한 용기를 필요로 하는 콜드체인 물류를 추진하고 있습니다. 주요 컨버터가 조달력과 기술 혁신의 폭 및 컴플라이언스 대응력을 강화하기 위해 합병을 진행하는 가운데, 경쟁 격화에 의해 중소기업의 진입 장벽이 재설정되고 있습니다.

현재 63개국이 재활용 가능성에 따라 급격히 증가하는 EPR(생산자책임재활용) 비용을 부과하고 있으며, 비용구조를 소비 후 재활용(PCR) 원료와 단일 소재 설계로 유리하게 전환하고 있습니다. PCR PET가 버진 수지에 대해 10-15%의 프리미엄을 형성함으로써 기존 가격 계층이 역전되어 컨버터는 인수나 장기 계약을 통해 재생재 공급을 확보하도록 요구받고 있습니다. 덴마크는 2025년 데이터 보고 규정에 대응하면서 디지털 추적성 시스템이 상승하고 엔드 투 엔드 투명성이 가속화되고 있습니다. EU의 재활용 의무 기한이 다가오는 가운데, 식품 등급의 인증 취득이 가능한 세정, 압출 및 화학 재활용 시설에 자본이 유입되고 있습니다. 이러한 요인이 규모 확대 투자의 근거가 되어 경질 플라스틱 포장 시장이 수량 지표에서 순환 가치 지표로 전환하는 흐름을 강화하고 있습니다.

소비자 직접 판매(D2C) 물류에서는 1차 용기가 기존 소매 루트보다 40% 높은 취급력에 노출되어 브랜드 소유자의 고장 비용 리스크가 높아집니다. 특히 사출성형 트레이나 열성형 트레이와 같은 경질 설계는 2차 포장 없이 충격을 흡수하여 용적 중량 요금과 파손 반품을 저감합니다. 소매업체는 자동 창고에서 50kg 초과의 적재를 견딜 수 있는 견고한 형태를 권장하는 "자체 용기 출하" 프로토콜을 의무화하고 있습니다. 현재 혁신의 초점은 내용물을 보호하면서 수지 사용량을 줄이는 코너 보강 구조와 내장 쿠션 리브에 집중되고 있습니다. 이 구조 요건은 지속가능성 요구와도 부합합니다. 두꺼우며 재사용 가능한 경질 용기는 라스트마일 배송에서 일회용 골판지 폐기물을 상쇄하기 때문입니다. 이러한 동향이 경질 플라스틱 포장 시장의 성장과 혁신을 견인하고 있습니다.

원료 공급의 혼란으로 인해 2024년에는 6개월간 폴리에틸렌 가격이 35%나 변동해 고정 가격 계약에 묶인 컨버터를 압박했습니다. 헤지 능력이 제한되는 중소기업은 설비 가동률 70% 미만으로 운영하고 운전 자금 라인의 계약 위반 위험에 직면하고 있습니다. 아시아의 올레핀 크래커는 마이너스 스프레드 대책으로서 가동률을 낮춰 수지 공급을 제한함과 동시에 스팟 프리미엄을 밀어 올리고 있습니다. 경질 플라스틱 포장 시장은 비용 충격을 불균등하게 흡수하고 있으며, 세계의 대기업은 규모의 경제를 살린 계약을 활용하는 한편, 지역 기업은 투자를 늦춰 생산 능력의 근대화가 늦어지고 있습니다.

2025년 경질 플라스틱 포장 시장 규모의 42.83%를 병 및 단지가 차지했으며, 이는 음료, 퍼스널케어 및 일반의약품 분야에서의 정착한 수요를 반영하고 있습니다. 뛰어난 투명성, 변조 방지 및 라벨 적합성으로 인해 경량화 추진에 의한 단위 수지 사용량의 감축이 진행되어도 수요는 안정되고 있습니다. 혁신으로는 일회용 플라스틱 규제에 대응하여 재활용성을 향상시키는 테더드 캡 등을 들 수 있습니다. 성장은 파괴적 혁신보다 음료 생산량에 연동하고 있으며, 이 부문은 대규모 컨버터에게 안정적인 수익 기반이 되고 있습니다.

파렛트는 점유율이 작지만, RFID 내장 및 IoT 대응의 적재 용기를 중시하는 EC 자동화에 의해 4.43%의 연평균 복합 성장률(CAGR)로 가장 급성장할 것으로 예상되는 부문입니다. 재사용 가능한 플라스틱 파렛트는 내구성과 위생면에서 목재를 능가하며 의약품과 신선 식품의 콜드체인에서 매우 중요합니다. 표준화된 형상은 고층 창고의 로봇화를 촉진하고, 직렬화에 의해 자산 추적 데이터 서비스가 실현되어 부가 수익을 창출합니다. 소매업체가 폐쇄 루프 풀링 시스템을 도입하는 가운데 파렛트 공급업체는 추적 소프트웨어와 하드웨어를 설정하고 경질 플라스틱 포장 시장에서 서비스 중심의 차별화를 도모하고 있습니다.

PET는 2025년 우수한 장벽 특성과 확립된 재활용 루프를 통해 경질 플라스틱 포장 시장 점유율의 31.05%를 유지했습니다. 유럽의 예금제도는 PET 회수율 76.7%를 달성하여 높은 PCR 함유율에 의한 EPR 책임의 경감을 가능하게 하고 있습니다. 그러나 정책과 브랜드 노력이 바이오 원료를 우선시하는 가운데 바이오플라스틱은 4.98%의 연평균 복합 성장률(CAGR)을 나타냅니다. 중국의 PBAT 연산 70만 톤, PLA 연산 10만 톤의 생산 능력 확대는 공급을 안정화시키고 가격 프리미엄을 서서히 축소시키고 있습니다.

바이오 수지에 의한 온실 효과 가스 감축을 탄소 크레딧 제도가 금전화함으로써 라이프사이클 경제성이 변화하고 있습니다. 주요 음료 브랜드는 100% 바이오 PET 병의 시험 도입을 진행하고 캡 제조업체의 프로그램은 식물성 HDPE로 이행 중입니다. 따라서 경질 플라스틱 포장 시장은 기존 석유화학 체인의 비용 효율성과 규제 강화에 대비한 포트폴리오의 미래를 보장하는 저탄소 폴리머로의 전략적 다양화 간에 균형을 맞추고 있습니다.

본 '경질 플라스틱 포장 시장 보고서'는 제품 유형별(병 및 단지, 트레이 및 용기 등), 소재별(폴리에틸렌, 폴리에틸렌테레프탈레이트, 폴리프로필렌 등), 최종 사용자 산업(식품, 의료, 화장품 및 퍼스널케어, 공업 등), 제조 공정(사출 성형, 압출 블로우 성형 등), 지역별로 분석했습니다. 시장 예측은 금액 기준(달러)으로 제시됩니다.

아시아태평양은 2025년 경질 플라스틱 포장 시장에서 매출의 38.85%를 차지하였으며, 5.62%의 연평균 복합 성장률(CAGR)로 확대될 것으로 전망되고 있습니다. 이는 인도에서 14억 6,000만 달러의 생산연계 인센티브(PLI) 유치와 지역 공급망을 지원하는 중국의 생분해성 플라스틱의 확대에 의해 지원됩니다. 현지 컨버터는 세계 브랜드와 보조를 맞추고 운송 시 배출량을 줄이기 위해 소비자 근처에 생산 거점을 설치하여 생산 능력을 확대하고 있습니다. 재활용 가능 또는 바이오 포장재로의 규제 전환은 기술 이전 제휴를 맺는 기업에 선행 우위를 가져옵니다.

북미에서는 전자상거래와 콜드체인 의약품이 확대됨에 따라 장거리 물류경로에서 제품 품질을 유지하는 견고한 용기에 대한 수요가 지속적으로 증가하고 있습니다. 주 수준의 생산자책임재활용(EPR) 제안에 의해 설계의 재검토가 촉구되고 있지만, 실시 시기의 변동에 의해 규제 대응의 급격한 영향은 완화되고 있습니다. 높은 평균 소득 수준은 프리미엄 단일 소재 형태를 지원하고 높은 이익률의 경질 플라스틱 부문 판매 수량을 뒷받침하고 있습니다.

유럽에서는 수요량은 성숙하고 있지만, 순환형 경제에 관한 적극적인 지침에 의해 높은 부가가치 밀도가 특징입니다. 포장 및 포장폐기물 규정(PPWR)은 단일 소재 솔루션의 도입을 촉진하고 재활용 인프라로의 자본 유입을 가속화하여 150억 달러 규모의 컴플라이언스 시장을 형성하고 있습니다. 독일, 네덜란드, 프랑스의 혁신 클러스터에서는 화학적 재활용 파일럿 사업이 선행하여, 지역에서의 PCR(소비 후 재활용) 공급을 확보하는 것과 동시에, 아시아용 수출 루트를 확립하고 있습니다.

남미, 중동, 아프리카에서는 수집량 부족과 정책 지연으로 신흥 기회가 억제되고 있습니다. 다국적 기업은 모듈식 재활용 플랜트를 전개하고, 현지의 PCR(소비 후 재활용)을 확보하는 것과 동시에, 세계 함유율 목표의 달성을 목표로 하고 있습니다. 남아프리카의 EPR법(생산자책임재활용제도)과 케냐의 생산자책임법안은 설계기준의 강화와 적합성이 있는 경질 플라스틱 솔루션에 대한 수요 확대로 이어지는 정책의 수렴을 나타내고 있습니다. 투자 우대와 낮은 노동 비용은 압출기와 사출 성형 라인의 이전을 유도하고 있으며, 이러한 지역은 경질 플라스틱 포장 시장에서 미래의 수출 기지로서의 지위를 확립하고 있습니다.

The Rigid Plastic Packaging Market is expected to grow from USD 265.18 billion in 2025 to USD 273.11 billion in 2026 and is forecast to reach USD 316.44 billion by 2031 at 2.99% CAGR over 2026-2031.

Underscoring a steady expansion phase that balances volume with value creation driven by sustainability mandates and supply-chain resilience needs. The rigid plastic packaging market benefits from e-commerce growth that favors impact-resistant formats, regulatory pressure that rewards monomaterial design, and demographic trends that lift single-serve demand across food and healthcare channels. Producers elevate recycled-content integration to meet Extended Producer Responsibility (EPR) cost curves, while vertical integration into recycling assets secures feedstock visibility and buffers polymer price swings. Asia-Pacific leads with scale, policy incentives, and rapid urban consumption, Europe leverages stringent circular-economy rules to accelerate premium solutions, and North America advances cold-chain logistics that require robust containers. Competitive intensity rises as top converters merge to gain procurement muscle, innovation breadth, and compliance readiness, resetting entry barriers for smaller firms.

Sixty-three countries now levy EPR fees that scale sharply with recyclability, shifting cost structures in favor of post-consumer recycled (PCR) feedstock and monomaterial design. Premiums of 10-15% for PCR PET over virgin resin invert traditional price hierarchies, prompting converters to lock in recycled supply through acquisitions and long-term contracts. Digital traceability systems emerge as firms comply with Denmark's 2025 data-reporting rules, accelerating end-to-end transparency. As EU recyclability deadlines approach, capital flows toward washing, extrusion, and chemical recycling facilities that can certify food-grade output. This driver underpins scale investment rationales and reinforces the rigid plastic packaging market's pivot from volume metrics to circular-value metrics.

Direct-to-consumer fulfillment exposes primary containers to handling forces 40% higher than traditional retail routes, elevating failure-cost risk for brand owners. Rigid designs- especially injection-molded tubs and thermoformed trays- absorb shock without secondary packaging, reducing dimensional weight fees and damage returns. Retailers mandate "ship-in-own-container" protocols that favor sturdy formats capable of stack loads exceeding 50 kg during automated warehousing. Innovation now focuses on corner-reinforcement geometry and built-in cushioning ribs that protect contents while trimming resin use. This structural requirement aligns with sustainability imperatives because thicker, reusable rigid containers offset single-use corrugated waste in last-mile delivery. These trends are driving growth and innovation in the rigid plastic packaging market.

Feedstock disruptions lifted polyethylene price swings to 35% within six months during 2024, squeezing converters locked into fixed-price contracts. Smaller firms with limited hedging capability operate at sub-70% plant utilization, risking covenant breaches on working-capital lines. Asian olefin crackers cut run rates to manage negative spreads, constraining resin availability and inflating spot premiums. The rigid plastic packaging market absorbs cost shocks unevenly; global majors leverage scale contracts, whereas regional players delay investments, slowing capacity modernization.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Bottles and jars accounted for 42.83% of the rigid plastic packaging market size in 2025, reflecting entrenched usage in beverages, personal care, and over-the-counter medicines. Superior clarity, tamper evidence, and label compatibility keep demand steady even as lightweight initiatives trim resin per unit. Innovations include tethered caps that satisfy single-use plastics directives and improve recyclability. Growth remains volume-linked to beverage output rather than disruptive technology shifts, positioning the segment as a stable revenue base for large converters.

Pallets, though a smaller share, are the fastest-rising product at a 4.43% CAGR, powered by e-commerce automation that values RFID-embedded, IoT-ready load carriers. Reusable plastic pallets outperform wood on durability and hygiene, which is critical for cold-chain pharmaceuticals and fresh produce. Standardized footprints facilitate high-bay warehouse robotics, and serialization unlocks asset-tracking data services that generate ancillary revenue. As retailers adopt closed-loop pooling systems, pallet suppliers bundle tracking software with hardware, creating service-driven differentiation within the rigid plastic packaging market.

PET retained 31.05% of the rigid plastic packaging market share in 2025, owing to its strong barrier profile and established bottle-to-bottle recycling loops. Deposit schemes in Europe achieve 76.7% PET recovery, enabling high PCR content that lowers EPR liabilities. Yet bioplastics show a 4.98% CAGR as policy and brand commitments prioritize bio-based feedstocks. Chinese capacity expansions to 700,000 t/y PBAT and 100,000 t/y PLA stabilize supply and chip away at price premiums.

Lifecycle economics shift as carbon-credit schemes monetize greenhouse-gas savings from bio-based resins. Major beverage brands test 100% bio-PET bottles, and cap manufacturer programs move toward plant-derived HDPE. The rigid plastic packaging market, therefore, balances cost efficiencies in legacy petrochemical chains with strategic diversification into low-carbon polymers that future-proof portfolios against regulatory escalation.

The Rigid Plastic Packaging Report is Segmented by Product Type (Bottles and Jars, Trays and Containers, and More), Material (Polyethylene, Polyethylene Terephthalate, Polypropylene, and More), End User Industry (Food, Healthcare, Cosmetics and Personal Care, Industrial, and More), Manufacturing Process (Injection Molding, Extrusion Blow Molding, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Asia-Pacific generated 38.85% of 2025 sales in rigid plastic packaging and is forecast to expand at 5.62% CAGR, buoyed by India's USD 1.46 billion PLI-attracted investments and China's biodegradable-plastic build-out that anchors regional supply chains. Local converters scale capacity alongside global brands, locating production near consumers to cut freight emissions. Regulatory pivots toward recyclable or bio-based packaging create first-mover advantages for firms with technology transfer alliances.

North America enjoys steady growth as e-commerce and cold-chain pharmaceuticals escalate demand for robust containers that preserve product integrity across extended logistics routes. State-level EPR proposals prompt design re-evaluation, yet fragmented timelines moderate compliance shocks. High average incomes support premium single-serve formats, reinforcing volume for high-margin rigid segments.

Europe exhibits mature volume but high value density because of aggressive circular-economy directives. The Packaging and Packaging Waste Regulation drives adoption of monomaterial solutions and propels capital into recycling infrastructure, creating a USD 15 billion compliance market. Innovation clusters in Germany, the Netherlands, and France pioneer chemical recycling pilots that secure local PCR supplies and feed export channels into Asia.

South America and the Middle East and Africa present emerging opportunities tempered by collection shortfalls and policy lag. Multinationals deploy modular recycling plants to capture local PCR and fulfill global content pledges. South Africa's EPR law and Kenya's producer-responsibility draft demonstrate policy convergence that will tighten design standards and escalate demand for compliant rigid solutions. Investment incentives and lower labor costs attract extruder and injection-molding line relocations, positioning these regions as future export hubs within the rigid plastic packaging market.