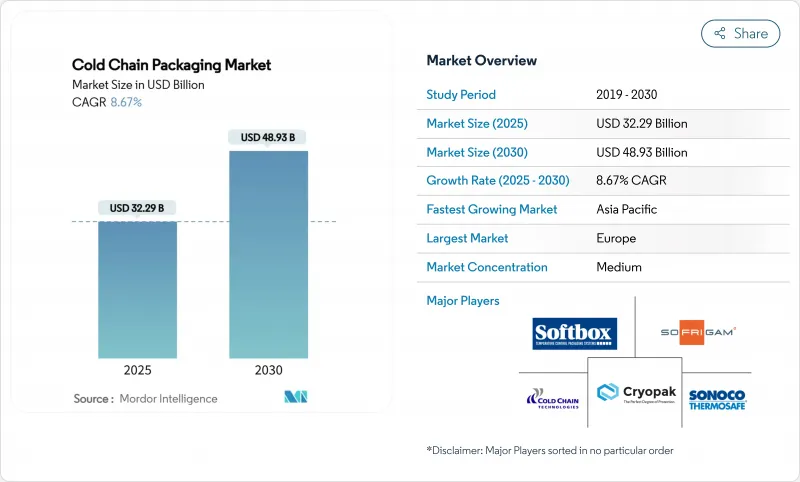

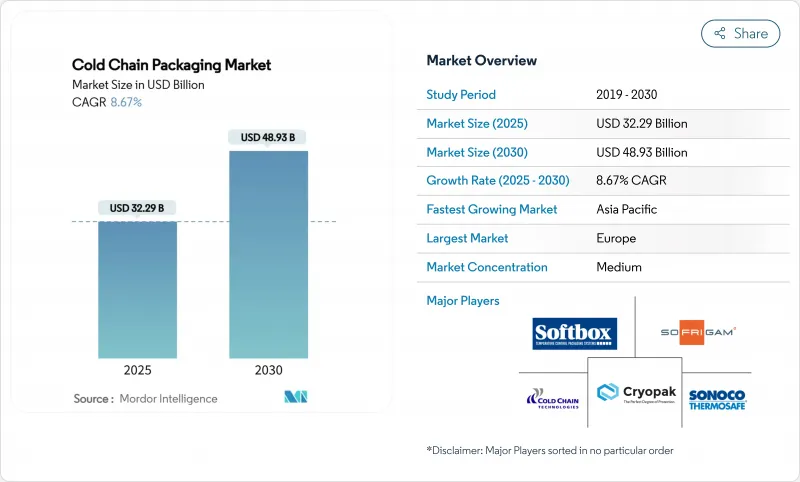

콜드체인 포장 시장 규모는 2025년에 322억 9,000만 달러, 2030년에는 489억 3,000만 달러에 이르고, CAGR 8.67%를 나타낼 것으로 예측됩니다.

성장을 뒷받침하는 것은 생물 제제의 수량 증가, 전자상거래를 통한 식료품 채우기 확대, 온도 관리 유통을 표준화하는 세계적인 백신 개념입니다. 미국 식품의약국(FDA)의 21 CFR 600.15와 유럽연합(EU)의 신포장·포장폐기물 규제와 같은 규제 프레임워크은 유효한 솔루션을 의무화하는 한편, 실시간 IoT 모니터링은 성능에 대한 기대를 높이고 있습니다. 또한 기업의 ESG 목표를 재사용할 수 있어 바이오 포맷으로 축발을 가속화하고 콜드체인 포장 시장 전체공급업체 전략을 재구성하고 있습니다.

새로운 의약품의 거의 절반이 온도 관리를 필요로 하며, 많은 첨단 요법은 -150℃ 이하의 극저온 조건을 필요로 합니다. 2025년 1월, Cryoport사는 이러한 초저온 레벨을 장시간 유지하는 HV3 시퍼를 발표하여 이 분야가 특수 설계로 이동하고 있음을 나타냈습니다. FDA의 생물학적 제제 인가 요건은 운송 중 안정성을 증명하는 효과적인 증거를 요구하며, 포장의 적격성은 제품 인가에 필수적입니다. 개인화된 의료 동향은 출하 빈도와 출하액을 증가시켜 콜드체인 포장 시장 전체의 프리미엄 수요를 촉진합니다.

냉장 식품과 냉동 식품의 온라인 식료품 판매량이 증가하고 마지막 마일의 변동을 견디는 경량으로 공간 효율이 높은 단열재에 대한 요구가 높아집니다. HelloFresh는 AI를 채택하고 날씨와 경로의 특정에 따라 팩 구성을 조정하여 데이터에 의한 재료 선택을 입증하고 있습니다. 2024년 4월에 출시된 Ranpak의 커브 사이드 재활용 가능한 climaliner Plus는 72시간의 열 보호를 제공하여 소비자의 지속가능성에 대한 기대에 부응합니다. 이러한 혁신은 콜드체인 포장 시장을 기존 의약품 레인을 넘어 확장합니다.

폴리에틸렌과 폴리프로필렌의 비용이 상승하면 컨버터 마진이 압박되어 초기 비용이 부과되는 재사용 가능한 포장으로의 전환이 지연될 수 있습니다. 소규모 제조업체는 종종 헤지 메커니즘이 없으며 포트폴리오를 간소화하고 고가치 의약품 계정을 선호하도록 촉구합니다.

단열 용기는 선적의 기간이 되어 2024년의 콜드체인 포장 시장의 35.53%를 차지했습니다. 이러한 우세에도 불구하고 공급망이 지속적인 시각화를 요구하고 있기 때문에 온도 감시 장치의 CAGR은 12.95%를 나타낼 전망입니다. Timestrip사의 세마글루티드 인디케이터와 같은 스마트 라벨은 고가치의 생물제제에도 컴플라이언스를 확대하고 의료 제공자 전체에서 채용되고 있습니다.

IoT 칩과 저전력 네트워크의 융합은 패시브 박스를 커넥티드 에셋으로 업그레이드합니다. SkyCell의 1500X 하이브리드 컨테이너는 270시간 동안 실행되며 라이브 데이터를 전송합니다. 이러한 진보는 현재 입증된 위험 감소에 보상하는 보험사를 끌어들여 콜드체인 포장 시장 내 장비 제조업체에 대응할 수 있는 수량을 확대하고 있습니다.

2024년 콜드체인 포장 시장 규모에서는 패시브 시퍼가 55.32%의 점유율을 유지하여 단순성과 규제에 익숙한 장점을 평가했습니다. 그러나 하이브리드 유형은 기존의 쉘 내에 센서와 제한적인 전력 보조를 통합하여 비용과 제어의 균형을 맞추고 CAGR 최고 속도의 10.32%를 나타낼 전망입니다. Va-Q-Tec의 Thermal Coat는 레거시 박스에 지능형 레이어를 추가하여 완전한 전원 공급 장치에 대한 의존성을 줄입니다.

전 세계 항공사는 리튬 배터리 수송 규칙을 강화하고 충전 상태의 상한을 30%로 설정합니다. 솔라 하베스팅과 슈퍼커패시터의 통합은 이 장애물을 경감하고 제조업체를 패시브 액티브 하이브리드로 향하게 합니다. 컴플라이언스 감사가 강화됨에 따라 추적성이 내장된 운송인이 조달을 선호하게 되어 콜드체인 포장 시장 전체에서 하이브리드 자동차의 성장이 강화됩니다.

The cold chain packaging market size stands at USD 32.29 billion in 2025 and is projected to reach USD 48.93 billion by 2030, expanding at an 8.67% CAGR.

Growth is underpinned by rising biologics volumes, expanding e-commerce grocery fulfilment, and global vaccine initiatives that standardize temperature-controlled distribution. Regulatory frameworks such as the United States Food and Drug Administration's 21 CFR 600.15 and the European Union's new Packaging and Packaging Waste Regulation compel validated solutions, while real-time IoT monitoring elevates performance expectations. Consolidation among logistics majors amplifies technology diffusion, and corporate ESG targets accelerate the pivot toward reusable and bio-based formats, reshaping supplier strategies across the cold chain packaging market.

Nearly half of new pharmaceuticals require temperature control, and many advanced therapies need cryogenic conditions below -150 °C. In January 2025 Cryoport introduced the HV3 shipper that maintains such ultra-low levels for prolonged periods, illustrating the sector's shift toward specialised designs. The FDA's biologics licensing requirements demand validated evidence of stability throughout transit, making packaging qualification integral to product approval. Personalised medicine trends intensify shipment frequency and value, driving premium demand across the cold chain packaging market.

Online grocery volumes for chilled and frozen foods increase the need for lightweight, space-efficient insulation that withstands last-mile variability. HelloFresh employs AI to adjust pack configuration to weather and route specifics, demonstrating how data drives material selection. Ranpak's curbside-recyclable climaliner Plus, launched April 2024, offers 72 hours of thermal protection and responds to consumers' sustainability expectations. These innovations expand the cold chain packaging market beyond traditional pharmaceutical lanes.

Upward swings in polyethylene and polypropylene costs compress converter margins and can delay switching to reusable packaging that carries higher upfront spend. Smaller producers often lack hedging mechanisms, prompting them to rationalise portfolios and prioritise high-value pharmaceutical accounts.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Insulated containers provided the backbone of shipments and accounted for 35.53% of the cold chain packaging market in 2024. Despite this dominance, temperature-monitoring devices post a 12.95% CAGR as supply chains demand continuous visibility. Smart labels such as Timestrip's semaglutide indicator extend compliance to high-value biologics, capturing adoption across healthcare providers.

The convergence of IoT chips and low-power networks upgrades passive boxes into connected assets. SkyCell's 1500X hybrid container runs for 270 hours and transmits live data, illustrating how monitoring devices integrate with insulation substrates to limit excursions. These advances attract insurers that now reward proven risk reduction, expanding addressable volumes for device makers within the cold chain packaging market.

Passive shippers retained 55.32% share of the cold chain packaging market size in 2024, valued for simplicity and regulatory familiarity. Hybrid formats, however, post the fastest 10.32% CAGR by embedding sensors and limited power assistance inside traditional shells, thereby balancing cost and control. Va-Q-Tec's Thermal Coat adds an intelligent layer to legacy boxes and reduces reliance on fully powered units.

Global airlines tighten lithium-battery carriage rules, capping state-of-charge at 30%, which constrains active container usage. Solar harvesting and supercapacitor integration mitigate this hurdle and push manufacturers toward passive-active hybrids. As compliance audits intensify, shippers with built-in traceability gain procurement preference, strengthening hybrid growth across the cold chain packaging market.

The Global Cold Chain Packaging Market Report is Segmented by Product (Insulated Containers, Insulated Shippers, Refrigerants, and More), Packaging System (Active, Passive, Hybrid), Material (EPS, PUR, VIP, EPP, and More), Usability (Single-Use, Reusable), Application (Pharmaceuticals and Biotechnology, Clinical Trials and Diagnostics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).