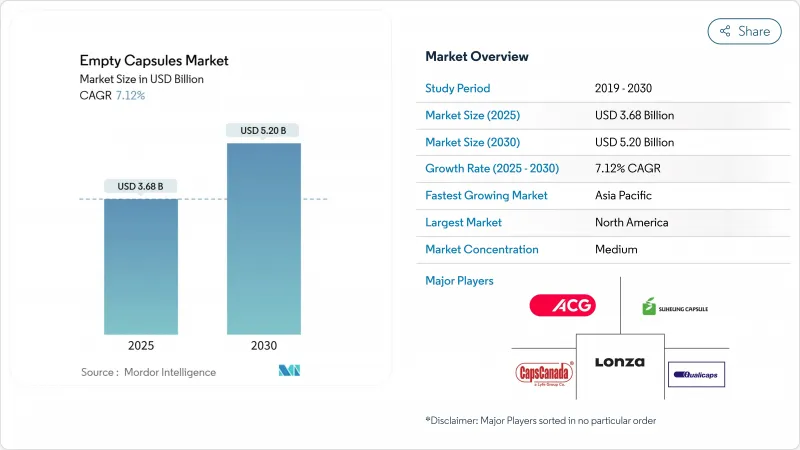

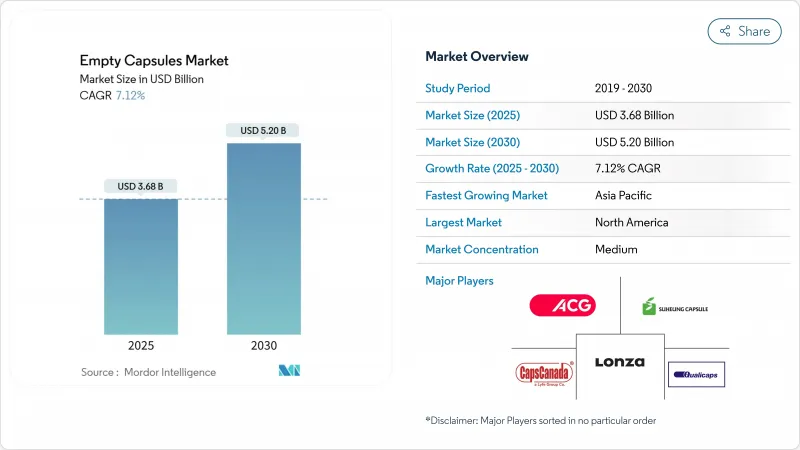

공캡슐 시장 규모는 2025년에 36억 8,000만 달러, 2030년에는 52억 달러에 이르고, CAGR 7.12%를 나타낼 것으로 예측됩니다.

성장의 배경으로는 의약품의 생산량 확대, 캡슐 기반 치료법의 보급, 고속 충전 장치의 급속한 개선이 있습니다. 특히 북미와 유럽에서는 개별 투여 포장에 대한 수요가 높아지고 있으며, 엄격한 규제와 환자 중심의 요건을 충족하는 프리미엄 캡슐 등급이 요구되고 있습니다. 머신 비전과 IoT 센서를 통합하는 기술의 업그레이드는 퍼스트 패스 수율을 높이고, 단가를 낮추고, 생산 능력의 확대를 촉진하고 있습니다. 동시에 영양 보충제 브랜드는 섬세한 성분을 보호하기 위해 캡슐로 전환하고 있으며 수요 다양성에 새로운 층이 추가되었습니다. 선도적인 공급업체들이 인도와 중국에서 생산량을 확대하는 한편, 보다 명확한 전략적 집중을 약속하는 사업 매각과 합작 사업을 모색하고 있기 때문에 경쟁의 치열성이 증가하고 있습니다.

고령화와 보험 적용 범위가 확대됨에 따라 의약품 생산이 확대되고 고정밀 공캡슐 시장 공급망에 대한 수요가 지속되고 있습니다. 론자의 8,500만 스위스 프랑으로의 업그레이드는 연간 300억 유닛의 추가를 가능하게 하고, 생산 능력을 확대함으로써 공급의 연속성을 확보하는 것을 보여줍니다. 연속 생산 라인에는 원료 균일성과 실시간 품질 데이터가 필요하며, 이는 프리미엄 캡슐 등급에 유리합니다. 생물학적 제제의 생산량 증가는 오염이 없는 쉘에 대한 요구를 강화시킵니다. 공장이 신속한 전환을 가능하게 하기 위해 더 많은 안전 재고를 보유한 유연한 제조 모델은 각 지역의 단위 소비량을 더욱 높여줍니다.

건강 예방 습관은 프로바이오틱스, 아답토겐 및 민감한 활성 물질을 보호하기 위해 캡슐에 의존하는 맞춤형 블렌드로 소비자를 유도합니다. 제형 제조자는 동물 유래의 것을 피하기 위해 깨끗한 라벨의 주장을 위해 식물 유래의 HPMC 쉘을 선택합니다. 미국과 독일에서는 프로바이오틱스 캡슐의 매출이 두 자릿수 증가를 보이고 있으며, 이 동향은 분명합니다. 맞춤 영양 보충을 위한 소량 생산은 틈새 캡슐 크기의 신선한 주문을 생성합니다. 브랜드 소유자는 또한 투명 또는 착색된 쉘을 사용하여 투명 라벨을 표시하고 캡슐 형식을 고급 전달 수단으로 강화합니다.

소와 돼지 공급이 급박하고 의약품 등급 젤라틴에 10-25%의 수입 관세가 걸릴 수 있으므로 공캡슐 시장에는 단기적인 비용 압력이 걸립니다. 중국의 계절 공장 가동 중단은 물품 부족을 더욱 심화시키고 단일 소스 계약에 의존하는 기업을 위험에 빠뜨립니다. 의약품의 바이어는 이중 조달과 사전 예약으로 대응하지만, 이 전략은 운전 자금을 피폐시킵니다. 기후로 인한 가축의 혼란은 계속 될 수 있으며, 블렌더는 단가 상승에도 불구하고 식물 유래 껍질로 유도됩니다. 따라서 젤라틴의 불안정성이 계속되면 HPMC 캡슐의 채용이 가속화될 수 있습니다.

젤라틴 쉘은 2024년 공캡슐 시장 점유율에서 84.34%를 차지했습니다. 그러나 비 젤라틴 캡슐은 CAGR 10.32%로 추이하고 있으며, 클린 라벨의 선호와 다종교의 컴플라이언스 요건에 뒷받침된 구조적 축족을 나타내고 있습니다. 하드 젤라틴 캡슐은 많은 양의 경구 고형 제제를 지배하고 소프트젤라틴 캡슐은 지용성 제제를 지원합니다. 셀룰로오스 화학의 혁신으로 HPMC 쉘은 한때 젤라틴만이었던 용해성과 기계적 특성을 갖추고 있습니다. 풀루란 캡슐과 전분 캡슐은 산소 장벽 성능이나 특정 채식을 주장하는 프리미엄 틈새 시장을 차지합니다.

HPMC의 채택은 수분에 민감한 프로바이오틱스와 허브 추출물을 캡슐화한 영양 보충제 라인에서 가장 빠르게 증가하고 있습니다. 생산자는 건조시 수분 함량을 최적화하여 이전 취약점을 극복합니다. 풀루란의 우수한 산소 내성은 높은 역가의 식물 추출물에 이상적입니다. Enprotect와 같은 새로운 장용성 HPMC 캡슐은 2차 코팅 없이 98%의 완충액 방출 효율을 달성하고 공정을 줄이고 프리미엄 위치를 검증합니다. 전분 유형은 여전히 비용에 민감한 분야로 제한되지만, 전환 경제성이 더욱 개선되면 혜택을 누릴 수 있습니다.

2024년 공캡슐 시장 규모에서는 즉시 방출형 쉘이 72.45%의 점유율을 차지하며, 그 확립된 규격 기준이 지지되었습니다. 그러나 제약회사가 복약 준수를 높이는 1일 1회 복용 요법을 추구하고 있기 때문에 서방형 용도는 CAGR 9.84%를 나타낼 전망입니다. 지연 방출 캡슐은 부위 특이적인 용출을 유도하는 중합체의 라미네이션에 의해 진화하고 산에 불안정한 원료를위한 작지만 전략적인 틈새를 충족시킵니다. 연속 코팅 방법은 고분자의 분포를 보다 조밀하게 하고, 배치의 균일성을 향출시키고, 약사 신청을 용이하게 합니다.

바이 레이어 쉘은 즉각적이고 지속적인 프로파일을 하나의 유닛에 통합하여 정제 및 캡슐의 하이브리드를 필요로 하지 않습니다. pH에 의존하지 않는 매트릭스는 위장 상태에서 환자별 편차에 해당합니다. 연속 라인에 통합된 실시간 분석을 통해 운영자는 코팅의 중량 증가를 직접 제어할 수 있어 편차를 줄일 수 있습니다. 디지털 치료제가 약물 방출 데이터를 환자 대시보드에 통합함에 따라, 맞춤형 방출 프로파일에 대한 수요는 예측 기간 동안 강화될 것으로 예측됩니다.

북미는 2024년 공캡슐 시장에서 38.54%의 점유율을 차지하며 주도권을 유지했습니다. 이것은 고급 GMP 시설과 문서화와 배치의 일관성을 중시하는 FDA의 감독에 의해 지원됩니다. 미국의 지속적인 제조 테스트를 통해 공급업체는 엄격한 사양 범위와 실시간 릴리스 테스트를 처리해야 합니다. 캐나다 제네릭 의약품 제조와 멕시코 수탁 제조거점은 지역의 캡슐 수요에 두께를 더하고 있습니다. FDA, 캐나다 보건부, USP 표준 인증을 취득할 수 있는 공장은 우선 공급업체로서의 지위를 획득하고 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR)이 8.72%로 가장 높아 세계적인 양의 흐름을 재형성하게 됩니다. 중국은 의약품 인프라를 업그레이드하는 한편, 저비용의 캡슐 수출에 대한 안티 덤핑 조사에 의해 조달 전략의 재조합이 강요되고 있습니다. 인도는 비용 우위와 숙련 노동력을 활용하고, 자연 캡슐의 2억 5,000만 루피에서의 확대는 수출 계약에 대한 자신감을 보여줍니다. 일본은 삼키기 쉬운 껍질을 필요로 하는 노인용 제제를 타겟으로 하고, 보다 작은 사이즈와 강화된 활택제를 선호합니다. 국민 모두 보험제도에 의해 경구요법에의 액세스가 확대되는 가운데, 동남아시아 국가도 이것에 추종하고 있습니다.

유럽은 성숙하면서도 혁신적인 상황을 유지하고 있습니다. 독일 생명공학의 중심지에서는 특수 의약품을 위한 고급 캡슐 기술이 필요하며, 브렉짓 후 정책 조정은 영국을 기반으로 한 투자를 자극합니다. EU의 환경 지침은 식물 유래 쉘에 축발을 촉진하고 HPMC의 채택은 기세를 늘리고 있습니다. 생산자는 기업의 지속가능성 목표에 맞추어 저탄소 실적와 무용제 공정을 판매하고 있습니다. EU권 전체에서는 맞춤형 의료의 파일럿이 전자 처방 플랫폼을 이용해, 신속한 소 로트 배송이 가능한 캡슐 공급자가 경쟁력을 획득하고 있습니다.

The empty capsules market size is valued at USD 3.68 billion in 2025 and is forecast to reach USD 5.20 billion by 2030, expanding at a 7.12% CAGR.

Growth springs from larger pharmaceutical production runs, wider acceptance of capsule-based therapies and rapid improvements in high-speed filling equipment. Rising demand for personalized dose packaging, especially in North America and Europe, lifts premium capsule grades that meet strict regulatory and patient-centric requirements. Technology upgrades that integrate machine vision and IoT sensors are raising first-pass yield rates and lowering unit costs, encouraging producers to scale capacity. Simultaneously, nutraceutical brands are shifting to capsules to protect delicate ingredients, which adds a fresh layer of demand diversity. Competitive intensity is sharpening as leading suppliers expand output in India and China while exploring divestitures or joint ventures that promise sharper strategic focus.

Expanding drug output, propelled by aging populations and wider insurance coverage, creates sustained demand for high-precision empty capsules market supply chains. Lonza's CHF 85 million upgrade that adds 30 billion units a year shows how producers scale capacity to secure continuity of supply. Continuous production lines need feedstock uniformity and real-time quality data, which favors premium capsule grades. Heightened biologics output intensifies requirements for contamination-free shells. Flexible manufacturing models, where plants hold larger safety stocks to enable rapid changeovers, further lift unit consumption across regions.

Preventive-health habits are steering consumers toward probiotics, adaptogens and bespoke blends that rely on capsules to protect sensitive actives. Formulators pick plant-based HPMC shells for clean-label claims because they avoid animal derivatives. Double-digit sales growth of probiotic capsules in the United States and Germany demonstrates the trend. Smaller batch runs for personalized nutrition create fresh orders for niche capsule sizes. Brand owners also use clear or tinted shells to signal transparent labeling, which reinforces the capsule format as a premium delivery vehicle.

Tighter bovine and porcine supply and potential 10-25% import tariffs on pharmaceutical-grade gelatin raise short-term cost pressure on the empty capsules market. Seasonal plant shutdowns in China compound scarcity, exposing firms that rely on single-source contracts. Pharmaceutical buyers respond by dual-sourcing and pre-booking volumes, but that strategy ties up working capital. Climate-driven livestock disruptions may persist, nudging formulators toward plant-based shells despite higher unit prices. Broader adoption of HPMC capsules could therefore accelerate if gelatin volatility persists.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Gelatin shells retained 84.34% of empty capsules market share in 2024, thanks to entrenched cost advantages and proven functionality. Yet non-gelatin capsules are moving at a 10.32% CAGR, signaling a structural pivot driven by clean-label preferences and multi-faith compliance requirements. Hard gelatin variants dominate high-volume oral solids, while soft gelatin capsules support lipid-soluble formulations. Innovation in cellulose chemistry equips HPMC shells with dissolution and mechanical properties once exclusive to gelatin. Pullulan and starch capsules occupy premium niches where oxygen barrier performance or specific vegetarian claims hold sway.

HPMC adoption rises fastest in nutraceutical lines that encapsulate moisture-sensitive probiotics or herbal extracts. Producers overcome previous brittleness by optimizing moisture content during drying. Pullulan's superior oxygen resistance makes it ideal for high-potency botanicals. Emerging enteric HPMC capsules such as Enprotect reach 98% buffer-conditioned release efficiency without secondary coating, cutting process steps and validating the premium positioning. Starch variants remain limited to cost-sensitive segments but stand to benefit if conversion economics further improve.

Immediate-release shells held 72.45% share of the empty capsules market size in 2024, favored for their established compendial standards. However, sustained-release uses are growing at 9.84% CAGR as pharma companies chase once-daily regimens that lift adherence. Delayed-release capsules fill a smaller yet strategic niche for acid-labile APIs, evolving through polymer layering that triggers site-specific dissolution. Continuous coating methods yield tighter polymer distribution, enhancing batch uniformity and easing regulatory filings.

Bi-layer shells merge immediate and sustained profiles in a single unit, eliminating the need for tablet-capsule hybrids. pH-independent matrices counter patient-to-patient variability in gastric conditions. Real-time analytics embedded in continuous lines give operators direct control over coating weight gain, reducing deviations. As digital therapeutics integrate drug release data into patient dashboards, demand for bespoke release profiles is poised to strengthen over the forecast horizon.

The Empty Capsules Market Report is Segmented by Product (Gelatin Capsules and Non-Gelatin Capsules), Functionality (Immediate-Release Capsules, and More), Therapeutic Application (Antibiotic & Antibacterial, and More), End User (Pharmaceutical Industry, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

North America retained leadership with a 38.54% stake in the empty capsules market in 2024, backed by advanced GMP facilities and FDA oversight that prizes documentation and batch consistency. Continuous manufacturing pilots in the United States push suppliers to meet tight specification ranges and real-time release testing. Canada's generics production and Mexico's contract-manufacturing base add depth to regional capsule demand. Plants that can certify for FDA, Health Canada and USP standards thus win preferred-supplier status.

Asia-Pacific records the highest 8.72% CAGR through 2030 and is set to re-shape global volume flows. China upgrades its pharmaceutical infrastructure while antidumping probes into low-cost capsule exports force realignment of sourcing strategies. India leverages cost advantages and a skilled workforce; Natural Capsules' INR 250 million expansion indicates confidence in export contracts. Japan targets geriatric formulations that demand easy-to-swallow shells, favoring smaller sizes and enhanced glidants. Southeast Asian economies follow suit as universal healthcare programs expand access to oral therapies.

Europe maintains a mature yet innovative landscape. German biotechnology hubs require advanced capsule technologies for specialty drugs, while post-Brexit policy tweaks stimulate United Kingdom-based investments. EU environmental directives encourage a pivot to plant-based shells, with HPMC uptake gathering momentum. Producers market low-carbon footprints and solvent-free processes to align with corporate sustainability targets. Across the bloc, personalized medicine pilots tap into e-prescription platforms, and capsule suppliers that can provide rapid small-lot deliveries gain competitive edges.