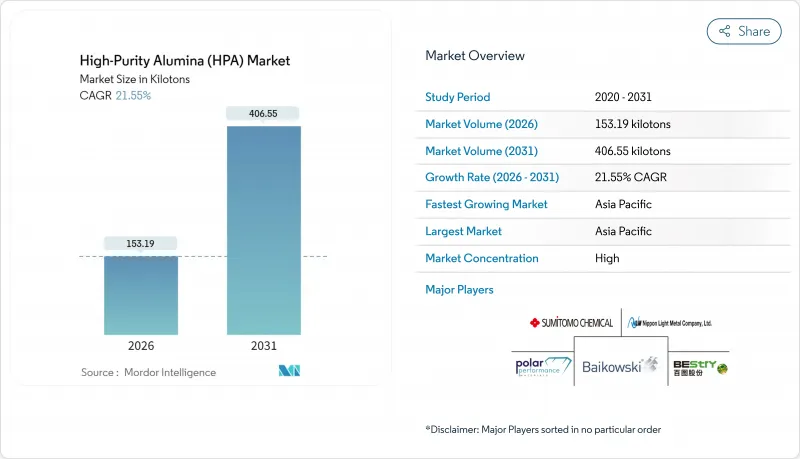

고순도 알루미나(HPA) 시장은 2025년 126.03킬로톤으로 평가되었으며, 2026년 153.19킬로톤에서 2031년까지 406.55킬로톤에 이를 것으로 예측되고 있습니다.

예측기간(2026-2031년)의 CAGR은 21.55%로 전망되고 있습니다.

이 급격한 성장 곡선은 리튬 이온 배터리에서의 수요 급증, LED 조명 분야에서의 지속적인 기세 및 첨단 패키징 분야에서의 도입 가속화를 반영합니다. 전기자동차 및 에너지 저장 프로젝트의 기반 확대로 HPA 등급은 초고순도로 향하고 있는 반면, 생산자는 염산 침출법과 용매 추출법에 근거한 저비용 및 저탄소 생산 능력의 개시를 서두르고 있습니다. 동시에 패터닝된 사파이어 기판과 대형 웨이퍼 포맷의 기술 혁신으로 LED 칩 수율이 향상되면서 기존의 4N 등급 수요는 안정적입니다. 반도체 팹에서는 공동 패키지 광학 소자나 수직형 GaN 디바이스에 대응하는 6N 등급의 도입을 추진하고 있으며, 구조적인 수요의 새로운 층이 더해지고 있습니다. 높은 생산 비용이 보급의 주요 장벽이지만, 급속한 스케일 업에 의해 저순도 알루미나와의 비용차가 축소되고 있으며, 전지나 파워 일렉트로닉스 분야의 조기 도입 기업이 프리미엄 가격을 흡수하고 있습니다.

사파이어 기판은 높은 열 부하를 견디며 광학 투명성을 유지하기 때문에 고휘도 LED의 기반으로 필수적입니다. 2-4인치에서 6-8인치 웨이퍼로의 이행에 의해 용해당 칩 생산량이 향상되어 수율이 향상되고 다이 비용이 저하되었습니다. 패터닝된 사파이어 기판은 광 추출 효율을 최대 40% 향상시켜 와트당 루멘을 직접적으로 개선합니다. 세슘 도핑 가넷 세라믹의 연구에 의해 발광 효율은 261.98lm/W1까지 향상되었고 고출력 백색 발광 소자의 성능 한계를 밀어 올렸습니다. 유연한 나노임프린트 리소그래피 기술은 공정 시간을 더욱 단축하고 미세구조 LED의 생산성을 6배로 높입니다. 이러한 발전과 함께 LED 제조업체는 4N HPA에 대한 의존성을 유지하면서 초고휘도 디바이스를 위한 5N 등급의 선택적 보급을 촉진하고 있습니다.

승용 전기자동차(EV) 및 고정형 축전시스템에서 고출력 밀도 전지의 급속한 보급 확대가 5N 및 6N HPA를 이용한 분리막 코팅의 수요를 견인하고 있습니다. 알루미나 나노층을 기반으로 한 코팅은 열 셧다운 특성을 개선하고 덴드라이트 현상을 억제하여 급속 충전과 긴 수명 사이클을 실현합니다. 알텍사의 실리콘 음극 프로그램은 독일의 연간 8,000톤 규모 HPA 코팅 플랜트를 기반으로 하며, 흑연 기준비로 30% 높은 에너지 유지율을 목표로 하고 있습니다. 이 프로젝트의 6억 8,400만 유로(약 7억 9,355만 달러)에 달하는 순 현재 가치(NPV)와 34%의 내부 수익률(IRR)은 프리미엄 등급의 상업적 견인력을 뒷받침하고 있습니다. 중국의 배터리 OEM 제조업체는 차세대 급속 충전 셀용 세라믹 코팅 분리기를 사용한 6N HPA 테스트에 들어갔으며 이는 대량 생산을 위한 적격성 테스트의 전환점입니다.

소성 및 여러 번의 재결정 공정은 특히 가격 프리미엄이 있는 5N 및 6N 등급에서 에너지 소비를 높입니다. 알파 HPA의 용매 추출법은 알루미늄 금속 공정을 생략함으로써 탄소 배출량을 70% 저감하고 전력 소비량도 대폭 감소하는 것으로 나타나고 있습니다. 이로 인해 비용 차이가 줄어들지만 이러한 플랜트의 광범위한 가동 개시에는 아직 2-3년이 소요되기 때문에 단기적인 조달 예산에 영향을 미치고 있습니다. 산업용 알루미나의 스팟 가격 변동은 특수 용도 사용자의 장기 공급 계약 협상을 더욱 복잡하게 만듭니다.

2025년 시점에서 4N 등급은 총 규모의 73.12%를 차지하였고 범용 LED용 사파이어 웨이퍼가 주요 용도입니다. 한편, 6N 등급의 출하량은 CAGR 22.22%로 추이하고 있으며, ppm 이하의 불순물 레벨을 요구하는 반도체 및 차세대 전지 용도에 의해 뒷받침되고 있습니다. 알파 HPA사의 폐루프 용매 추출 파일럿 플랜트에서는 완전한 시약 재활용을 실현하여 변동 생산 비용을 절감하고 있습니다. 이는 5N 및 6N 등급의 보급을 촉진합니다. 제조업체 각사는 하이브리드 전략을 도입해, 대량 생산용 LED 용도에는 4N 등급을 공급하면서, 증산분은 고수익 계약용 6N 등급에 투자하고 있습니다. 배터리 OEM 제조업체가 급속 충전 셀용으로 5N 이상의 코팅을 의무화하기 시작하면서 기존의 가격에 민감한 지역에서도 수요의 탄력성이 향상되고 있습니다. 에너지 효율이 높은 정제 기술에 관한 연구개발의 활성화에 의해 비용차이의 일부가 해소될 것으로 예상되며, 고순도 알루미나 시장에서 프리미엄 등급의 비율이 급격히 확대될 전망입니다.

성숙한 공급망과 풍부한 보크사이트 원료로 인해 기존 알루미늄 알콕사이드 가수분해법은 2025년 세계 생산량의 87.25%를 차지했습니다. 그러나 신규 참가기업은 염산침출법을 선호하여 도입하고 있으며, 낮은 톤당 설비투자액과 불순물 제거의 용이성으로 인해 CAGR 22.35%로 확대하고 있습니다. 스파크 플라즈마 소결과 무가압 마무리를 조합한 2단계 소결 기술의 연구에서는 노내 처리 시간의 단축에 더해 굽힘 강도가 19% 높아지는 것으로 확인되었습니다. 신흥 동남아시아 제련소에서는 모듈식 염산 재생산 장치를 도입하여 산 소비량의 저감과 배수 부하의 감소를 도모하면서 지역에서 강화되는 환경규제에 대응하고 있습니다. 기존 기업은 솔벤트 추출을 통한 정제 공정을 기존 가수분해 라인에 추가하여 순도 수율을 향상시켜 시장에서의 지위를 유지하고 있습니다. 중기적으로는 유럽과 북미에서 제안된 탄소강도 공시제도가 기술 선택에서 갈등을 초래하여 잠재적인 투자는 저배출 침출법 플랜트로 기울 수 있습니다.

아시아태평양은 중국의 통합된 알루미나 밸류체인과 일본 및 한국의 LED 및 반도체 제조에서의 주도적 입장에 힘입어 2025년 고순도 알루미나 시장 규모의 75.61%를 차지했습니다. 이 지역 시장은 적극적인 전기자동차(EV) 보급, 웨이퍼 제조공장 증가, 호주의 신규 용매 추출 정제소 가동 개시에 의해 2031년까지 연률 22.85%의 성장이 전망되고 있습니다.

북미에서는 반도체 산업의 국내 복귀를 촉진하는 연방정부의 우대 조치와 리튬 이온 배터리 수요를 끌어올리는 공공 충전 인프라의 확충이 진행되고 있습니다. 캐나다와 미국은 안정적인 전력망을 활용하여 저탄소 생산 목표 달성을 뒷받침합니다. 남미, 중동 및 아프리카는 공헌도는 낮지만 보크사이트 자원국이 다운스트림 공정으로 다각화를 도모하는 가운데 장기적인 성장 기회를 보유하고 있습니다.

브라질은 특수 알루미나를 위한 우대 조치를 수립하고 있으며, 사우디아라비아는 광범위한 광물 전략과 연계된 알루미나 정제를 검토 중입니다. 이 지역은 지리적 위험 분산을 위해 고순도 알루미나 시장 진출 기업을 위한 선택권을 제공합니다.

The High-Purity Alumina Market was valued at 126.03 kilotons in 2025 and estimated to grow from 153.19 kilotons in 2026 to reach 406.55 kilotons by 2031, at a CAGR of 21.55% during the forecast period (2026-2031).

This steep growth curve reflects surging demand from lithium-ion batteries, sustained momentum in LED lighting, and accelerating adoption in advanced semiconductor packaging. An expanding base of electric-vehicle and energy-storage projects is pulling HPA grades toward ultra-high purities, while producers race to commission lower-cost, lower-carbon capacity based on hydrochloric-acid leaching and solvent-extraction routes. At the same time, breakthroughs in patterned sapphire substrates and larger wafer formats are lifting LED chip yields and keeping traditional 4N demand stable. Semiconductor fabs are pushing for 6N grades that support co-packaged optics and vertical GaN devices, adding another layer of structural demand. Although high production cost remains the primary brake on broader uptake, rapid scale-up is narrowing the cost gap versus lower-purity aluminas, and early adopters in batteries and power electronics are absorbing the premium.

Sapphire substrates remain the backbone of high-brightness LEDs because they tolerate high thermal loads and sustain optical clarity. Migration from 2-4 to 6-8 in wafers has raised chip throughput per melt, boosted yield, and lowered die cost. Patterned sapphire substrates now lift light-extraction efficiency by up to 40%, directly improving lumens per watt. Research on Ce-doped garnet ceramics has pushed luminous efficiency to 261.98 lm W-1, stretching the performance ceiling for high-power white emitters. Flexible nanoimprint lithography further cuts process time, raising microstructured LED productivity six-fold. Together, these advances keep LED producers firmly anchored to 4N HPA while opening selective pull-through for 5N grades in ultra-high-luminance devices.

Rapid scale-up of power-dense cells in passenger EVs and stationary storage propels separator-coating demand for 5N and 6N HPA. Coatings based on alumina nanolayers improve thermal shut-down behavior and suppress dendrite growth, enabling faster charging and longer cycle life. Altech's silicon-anode program, underpinned by an 8,000 tons/year HPA coating plant in Germany, targets 30% higher energy retention versus graphite baselines. The project's EUR 684 million (~USD 793.55 million) NPV and 34% IRR confirm commercial traction for premium grades. Battery OEMs in China are already trialing 6N HPA on ceramic-coated separators for next-generation fast-charge cells, marking a pivot point for large-volume qualifying runs.

Calcination and multiple recrystallization stages keep energy use high, especially for 5N and 6N grades, which can trade at price premiums. Alpha HPA's solvent-extraction route, which bypasses the aluminum-metal step, claims 70% lower carbon emissions and a significant cut in power intensity. While this narrows the cost delta, widespread commissioning of similar plants is still two to three years away, exposing near-term procurement budgets. Spot price volatility in industrial alumina further complicates long-term offtake negotiations for specialty users.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

In 2025, the 4N grade commanded 73.12% of total volume, anchored by sapphire wafers for general-purpose LEDs. At the same time, 6N shipments are on a 22.22% CAGR path, lifted by semiconductor and next-generation battery uses that demand sub-ppm impurity levels. Alpha HPA's closed-loop solvent-extraction pilot demonstrated full reagent recycling, lowering variable production cost, and making 5N and 6N more accessible. Manufacturers are adopting hybrid strategies, producing 4N for mass LED use and diverting incremental capacity to 6N to serve high-margin contracts. As battery OEMs begin to mandate more than or equal to 5N coatings for fast-charge cells, demand elasticity improves even in traditionally price-sensitive regions. Heightened research and development around energy-efficient purification is expected to close a portion of the cost gap, accelerating the premium-grade mix within the High-Purity Alumina market.

The legacy aluminum-alkoxide hydrolysis route delivered 87.25% of global output in 2025, owing to mature supply chains and ample bauxite feedstock. However, new entrants are favoring hydrochloric-acid leaching, which is scaling at a 22.35% CAGR, encouraged by lower capex per tonne and easier impurity bleed-off. Two-step sintering studies that combine spark-plasma densification with pressureless finishing showed a 19% flexural-strength gain alongside reduced furnace time. Emerging Southeast Asian refineries use modular HCl regeneration units to cut acid consumption and shrink effluent loads, aligning with stricter regional environmental norms. Incumbents are retrofitting older hydrolysis lines with solvent-extraction polishing stages to raise purity yields, preserving market position. Over the medium term, technology choice may hinge on proposed carbon-intensity disclosure rules in Europe and North America, potentially tipping marginal investment toward leach-based plants that score lower on embedded emissions.

The High Purity Alumina Market Report Segments the Industry by Type (4N, 5N, and 6N), Production Technology (Hydrolysis and Hydrochloric Acid Leaching), Application (LED Lighting, Phosphor, Semiconductor, Lithium-Ion (Li-Ion) Batteries, and More), End-User Industry (Electronics, Automotive, Energy Storage, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Asia-Pacific accounted for 75.61% of the High Purity Alumina market volume in 2025, supported by China's integrated alumina value chain and Japan's and South Korea's leadership in LED and semiconductor fabrication. The region's market is projected to add 22.85% annually through 2031, thanks to aggressive EV roll-outs, growing wafer fabs, and new solvent-extraction refineries coming online in Australia.

North America is leveraging federal incentives for semiconductor reshoring and growing public-charging infrastructure that lifts lithium-ion battery demand. Canada and the United States benefit from stable electricity grids, supporting low-carbon production ambitions. South America, the Middle East, and Africa contribute modestly but represent long-run opportunities as bauxite-rich nations seek downstream diversification.

Brazil has outlined incentives for specialty alumina, while Saudi Arabia investigates alumina refining linked to its broader minerals strategy. These regions provide optionality for High-Purity Alumina market participants seeking geographic risk diversification.