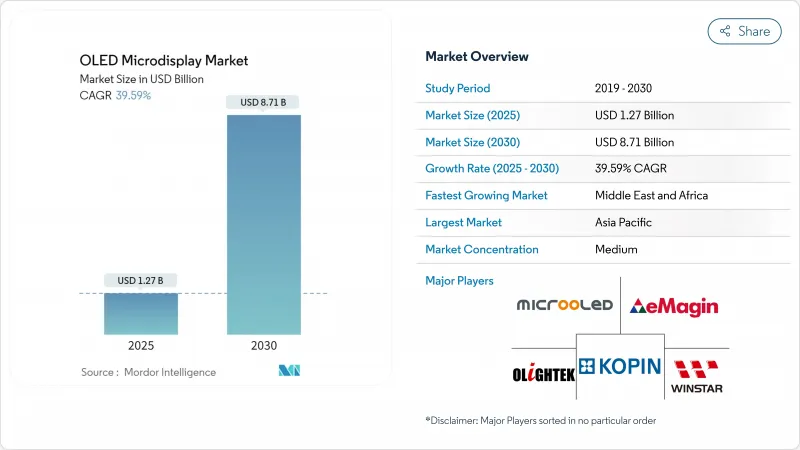

OLED 마이크로디스플레이 시장의 2025년 시장 규모는 12억 7,000만 달러로 평가되었고, 2030년에는 87억 1,000만 달러에 이를 것으로 예측되며, CAGR은 39.59%를 나타낼 전망입니다.

증강현실 및 가상현실 헤드셋, 군용 헬멧 시스템, 프리미엄 자동차 헤드업 디스플레이용 소형 고해상도 근접 디스플레이 패널에 대한 견고한 수요가 물량 증가를 가속화하고 있습니다. 직접 패턴화 및 탠덤 스택 구조는 전력 소모를 줄이면서 밝기 상한선을 60,000니트 수준으로 끌어올려 신흥 마이크로LED 대비 기술적 우위를 강화하고 있습니다. 중국 OLED-on-Silicon 파운드리들의 병렬적 생산 능력 확장은 단가를 낮추고 리드 타임을 단축시켜 소비자 가전 분야의 광범위한 채택을 촉진하고 있습니다. 전략적 인수합병(특히 삼성디스플레이의 2024년 eMagin 인수)은 첨단 공정 노하우를 대량 생산 라인에 도입하여 후발 경쟁사들과의 성능 격차를 확대하고 있습니다.

BOE, SeeYA, IRay Group의 생산량 증가는 OLED 마이크로디스플레이 시장에 대량 및 고수율 공급을 촉진하고 있습니다. 파운드리 업체들은 고밀도 픽셀 프론트플레인과 새로 구축된 실리콘 백플레인 라인을 결합해 처리량을 높이고 공정 제어를 강화하고 있습니다. 아이레이의 전용 백플레인 투자는 아웃소싱 단계를 줄여 비용 경쟁력을 강화하는 수직 통합 추진을 보여줍니다. 이러한 움직임은 아시아태평양 지역을 지역적 공급 거점에서 글로벌 공급 중심지로 재편하며, 규모와 기술 리더십 측면에서 일본 및 한국 기존 업체들에 도전장을 내밀고 있습니다. 확대된 생산 능력은 가격 안정화에도 기여하여 소비자 기기 OEM 업체들이 OLED 마이크로디스플레이 시장에 대한 장기 주문을 확정하도록 장려하고 있습니다.

북미 방위 프로그램은 조종사, 지상군 및 야간 투시경용 디스플레이로 AMLCD에서 OLED 마이크로디스플레이로 급속히 전환 중입니다. 2025년 4월 코핀(Kopin)의 750만 달러 수주는 우수한 명암비, 제로 모션 블러, 경량화를 갖춘 내구성 강화 근접 시야 모듈에 대한 수요 증가를 입증합니다. F-35 플랫폼 내 검증은 임무 핵심 신뢰성을 입증하여 다른 프로그램들도 유사한 디스플레이 아키텍처를 채택하도록 촉진하고 있습니다. 무기 조준경 및 지휘통제용 안경으로의 다각화는 조달 리스크를 분산시켜 군수 수요를 OLED 마이크로디스플레이 시장의 안정적인 초석으로 만들고 있습니다.

습기 침투라는 지속적인 과제는 특히 자동차 및 군사 애플리케이션과 같은 가혹한 작동 환경에서 OLED 마이크로디스플레이의 광범위한 채택에 대한 중대한 기술적 장벽을 나타냅니다. 기존 디스플레이와 달리 마이크로디스플레이의 초소형 폼 팩터는 기존 캡슐화 방법에 대한 공간을 최소화하여 제조 수율과 장기적 신뢰성 모두에 영향을 미치는 근본적인 엔지니어링 과제를 야기합니다. 한국 대학들의 최근 혁신은 섬유 기반 웨어러블 OLED를 위한 다기능 캡슐화를 도입하여 보다 견고한 솔루션으로의 길을 제시할 가능성이 있습니다. 이 과제의 기술적 복잡성은 광학 투명성을 유지하면서 완벽한 밀봉을 제공하는 캡슐화 솔루션의 필요성으로 인해 더욱 가중됩니다. 픽셀 밀도가 3,000 ppi를 초과할수록 이러한 균형을 맞추는 것은 점점 더 어려워집니다. 이 제약은 특히 10년 이상의 서비스 요구 사항을 가진 자동차 디스플레이와 같이 연장된 작동 수명이 예상되는 응용 분야에 영향을 미치며, 독자적인 캡슐화 기술을 개발할 수 있는 기업들에게 경쟁적 기회를 창출합니다.

2025년 근접 시야(Near-to-Eye) 기기용 OLED 마이크로디스플레이 시장 규모는 8억 1,000만 달러로 전체 매출의 64%를 차지했습니다. 혼합 현실 헤드셋, 훈련용 고글, 스마트 헬멧으로의 지속적인 출하가 수요를 견인하고 있습니다. 플랫폼 소유자의 생태계 투자는 해상도와 밝기 연례 업그레이드를 지원하며, 이는 다시 평균 판매 가격과 총마진을 끌어올립니다.

전자식 뷰파인더(EVF)는 2025년 기준 시장 점유율이 낮았으나, 2030년까지 41.2%의 연평균 성장률(CAGR) 전망은 충분한 성장 여력을 시사합니다. 소니, 니콘, 캐논의 전문 미러리스 바디는 지연 없는 프레임 설정과 HDR 미리보기를 제공하기 위해 OLED EVF를 표준화하고 있습니다. 카메라 제조사들이 모델 주기를 간소화함에 따라 패널 물량은 3년 내 두 배로 증가할 수 있으며, 이는 EVF를 OLED 마이크로디스플레이 시장 내 전략적 헤지 수단으로 자리매김하게 할 것입니다.

HD 720p 등급은 2024년 OLED 마이크로디스플레이 시장 점유율의 36%를 차지하며, 주류 AR 뷰어의 제한된 전력 예산 내에서 수용 가능한 선명도를 균형 있게 제공했습니다. 그러나 성장 동력은 픽셀 밀도가 3,000ppi를 초과하는 FHD 이상 등급에 있습니다. 삼성디스플레이의 2025년 초 샘플은 5,000ppi와 20,000니트의 최고 휘도를 달성하여 기업용 VR 및 군용 정찰 고글에 적합한 패널로 자리매김했습니다.

2030년까지 FHD 초과 출하량이 연평균 42.3% 성장할 것으로 예상되며, 이는 OLED 마이크로디스플레이 시장 규모 확대의 상당 부분을 흡수할 전망입니다. 이러한 패널에는 고대역폭 인터페이스와 저지연 드라이버가 동반되어 통합 공급업체에 유리한 부수적 반도체 수요를 창출합니다.

아시아태평양 지역은 2024년 글로벌 매출의 57%를 차지했으며, 이는 해당 지역의 백플레인 팹, 이미터 공급업체 및 소비자 기기 조립업체의 밀집된 네트워크를 반영합니다. 삼성디스플레이와 주요 중국 파운드리 업체들의 지속적인 생산 능력 확장은 공급 지속성을 보장하는 한편, 국경을 초월한 합작 투자는 기술 이전을 원활하게 합니다. 한국과 중국의 정부 인센티브는 생산 비용을 더욱 낮추어 지역적 리더십을 유지합니다.

북미는 방위산업 및 기업용 XR(확장현실) 배포를 위한 견고한 고휘도 모듈 수요 등 고사양 수요의 중심지입니다. 실리콘밸리와 보스턴의 벤처캐피털 투자는 광학 및 드라이버 IC 개발 스타트업에 활력을 불어넣어, 결과적으로 프로토타입 디스플레이의 현지 조달을 촉진합니다. F-35 헬멧 업그레이드 프로그램 등 방위조달은 북미의 OLED 마이크로디스플레이 시장 구매에 안정적인 기반을 더합니다.

유럽은 자동차 시장 확대와 고마진 의료용 시각화 분야에 집중합니다. 독일과 프랑스의 1차 공급업체들은 패널 제조사와 협력해 자동차 헤드업 디스플레이 구현을 위한 저지연 인터페이스를 공동 설계합니다. 중동 및 아프리카 지역은 기반이 작지만, 방위 현대화 예산과 고급 AR-HUD를 탑재한 고급차 수입 증가로 연평균 42% 성장률을 기록 중입니다. 남미는 여전히 주로 소비자 지향적이며, 현지 카메라 생산과 급성장하는 게이밍 커뮤니티에서 점진적인 기회가 발생하고 있습니다.

The oled microdisplay market is valued at USD 1.27 billion in 2025 and is forecast to reach USD 8.71 billion by 2030, advancing at a 39.59% CAGR.

Robust demand for compact, high-resolution near-eye panels in augmented and virtual reality headsets, military helmet systems and premium automotive head-up displays is accelerating volume growth. Direct patterning and tandem-stack architectures are lifting brightness ceilings toward 60,000 nits while cutting power draw, strengthening the technology's position against emerging MicroLED. Parallel capacity expansions at Chinese OLED-on-Silicon foundries are lowering unit costs and shortening lead times, which encourages broader consumer-electronics adoption. Strategic acquisitions-most notably Samsung Display's 2024 purchase of eMagin-are pushing advanced process know-how into high-volume manufacturing lines, widening the performance gap with late-entry competitors

Production ramp-ups at BOE, SeeYA and IRay Group are injecting high-volume, high-yield supply into the oled microdisplay market. Foundries are pairing pixel-dense front-planes with newly built silicon backplane lines to raise throughput and tighten process control. IRay's dedicated backplane investment illustrates a vertical-integration push that reduces outsourcing steps, enhancing cost competitiveness.These moves reposition Asia Pacific from a regional to a global supply anchor, challenging Japanese and Korean incumbents on both scale and technology leadership. Wider capacity also stabilizes pricing, encouraging consumer device OEMs to commit to long-term oled microdisplay market orders.

North American defense programs are rapidly shifting from AMLCD to OLED microdisplays for pilot, ground-troop and night-vision optics. Kopin's USD 7.5 million award in April 2025 underscores rising demand for ruggedized near-eye modules with superior contrast, zero-motion blur and reduced weight.Validation within the F-35 platform demonstrates mission-critical reliability, prompting other programs to specify similar display architectures. Diversification into weapon sights and command-control eyewear spreads procurement risk, making military demand a stable cornerstone of the oled microdisplay market.

The persistent challenge of moisture ingress represents a significant technical barrier to widespread OLED microdisplay adoption, particularly in harsh operating environments like automotive and military applications. Unlike conventional displays, the ultra-compact form factor of microdisplays leaves minimal space for traditional encapsulation methods, creating a fundamental engineering challenge that impacts both manufacturing yield and long-term reliability. Recent innovations from Korean universities have introduced multi-functional encapsulation for fiber-based wearable OLEDs, potentially offering pathways to more robust solutions. The technical complexity of this challenge is compounded by the need for encapsulation solutions that maintain optical clarity while providing hermetic sealing-a balance that becomes increasingly difficult as pixel densities exceed 3,000 ppi. This constraint particularly impacts applications where extended operational lifetimes are expected, such as automotive displays with 10+ year service requirements, creating a competitive opportunity for companies that can develop proprietary encapsulation technologies.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

The oled microdisplay market size for Near-to-Eye devices stood at USD 0.81 billion in 2025, equal to 64% of total revenue. Sustained shipments to mixed-reality headsets, training goggles and smart helmets anchor demand. Ecosystem investment from platform owners supports annual resolution and brightness upgrades, which in turn lift average selling prices and gross margins.

Electronic Viewfinders contributed a smaller base in 2025, yet their 41.2% CAGR prospect through 2030 signals ample headroom. Professional mirrorless bodies from Sony, Nikon and Canon are standardizing OLED EVFs to deliver lag-free framing and HDR previews. As camera makers streamline model cycles, panel volumes could double within three years, establishing EVFs as a strategic hedge within the oled microdisplay market.

The HD 720p tier held 36% of oled microdisplay market share in 2024, balancing acceptable clarity with tight power budgets for mainstream AR viewers. Growth momentum, however, lies in the Above-FHD tier where pixel densities exceed 3,000 ppi. Early 2025 samples from Samsung Display achieve 5,000 ppi and 20,000 nits peak luminance, positioning these panels for enterprise VR and military recon goggles.

A 42.3% CAGR forecast to 2030 for Above-FHD shipments will absorb much of the incremental oled microdisplay market size expansion. Higher bandwidth interfaces and low-latency drivers accompany these panels, creating ancillary silicon demand that benefits integrated suppliers.

The OLED Microdisplay Market Report is Segmented by Type (Near-To-Eye, Projections, and More), Resolution (SVGA and Below (<=800 X 600), XGA (1, 024 X 768), and More), Technology (RGB OLED-On-Silicon, and More), Panel Size (Diagonal) ( Less Than 0. 5 Inch, 0. 5-1. 0 Inch, and More), End-User Industry (Automotive, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Asia Pacific commanded 57% of global revenue in 2024, reflecting the region's dense network of backplane fabs, emitter suppliers and consumer-device assemblers. Ongoing capacity expansions by Samsung Display and leading Chinese foundries ensure supply continuity, while cross-border joint ventures smooth technology transfer. Government incentives in South Korea and China further lower production costs, sustaining regional leadership.

North America anchors high-specification demand, especially for defense and enterprise-XR deployments that demand ruggedized, high-brightness modules. Venture-capital funding in Silicon Valley and Boston fuels start-ups developing optics and driver ICs, which in turn elevates local sourcing of prototype displays. Defense procurement, led by programs such as the F-35 helmet upgrade, adds a stable layer to North American oled microdisplay market purchases.

Europe focuses on automotive rollouts and high-margin medical visualization. German and French tier-one suppliers work with panel makers to co-design low-latency interfaces for automotive head-up implementations. The Middle East & Africa region, although starting from a small base, is pacing at a 42% CAGR due to defense-modernization budgets and luxury-vehicle imports that include advanced AR-HUDs. South America remains largely consumer-oriented, with gradual opportunities arising from local camera production and burgeoning gaming communities.