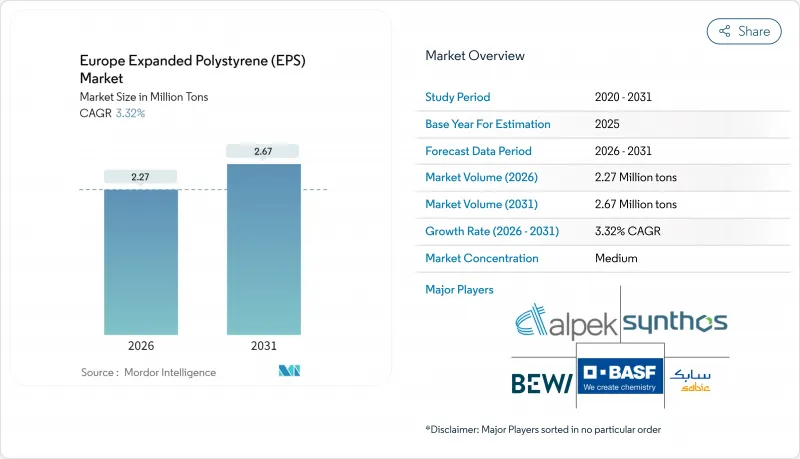

유럽의 발포 폴리스티렌(EPS) 시장은 2025년 220만 톤으로 평가되었고, 2026년 227만 톤에서 2031년까지 267만 톤에 이를 것으로 보입니다.

예측기간(2026-2031년)의 CAGR은 3.32%를 나타낼 전망입니다.

수요는 주로 건물 단열재 업그레이드와 민감한 상품의 보호용 포장재에서 발생하며, 강력한 국내 공급망, 점진적인 재활용 성과, 내재 탄소 발자국을 낮추는 기술 업그레이드로 인해 해당 분야의 회복탄력성이 강화되고 있습니다. 2025년부터 시행되는 EU 건물 에너지 성능 지침과 같은 규제 요인은 신축 및 리모델링 건물 전반에 걸쳐 더 높은 R값을 요구하여 대체재 점유율이 증가하더라도 단열재 사용량을 안정적으로 유지합니다. 동시에 mRNA 생물학적 제제 물류와 가전제품 리쇼어링 증가로 포장 수요가 유지되며, 이는 스티렌 가격 변동성으로 인한 원자재 부문의 마진 압박 완화에 기여합니다. 그럼에도 유럽의 발포 폴리스티렌 시장은 원료 가격 변동, 고밀도 도시 중심부의 화재 안전 규정, 종이·펄프·균사체 기반 대체재 고객 시험 사용 등 증가하는 헤드라인 리스크를 극복해야 합니다.

국가 및 EU 차원의 강화된 에너지 규정은 개발자들이 벽, 지붕, 바닥을 더 낮은 U-값으로 설계하도록 강제하여 단열 두께 요구사항을 높이고 유럽의 발포 폴리스티렌 시장 솔루션에 대한 꾸준한 수요를 뒷받침합니다. 독일의 Gebaudeenergiegesetz는 이미 외벽 U-값을 0.20 W/(m2K) 근처로 지정하고 있으며, 이는 일반적으로 12-16cm의 EPS를 필요로 하여, 높이 기반의 화재 안전 제한에도 불구하고 독일 외장 시스템에서 폼의 약 40% 점유율을 공고히 하고 있습니다. 프랑스와 북유럽 국가들도 유사한 성능 규정을 확대 적용하고 있으며, 2024년 개정된 '건물 에너지 성능 지침(EPBD)'은 2030년부터 신축 건물에 대한 탄소 중립 의무를 설정하여 장기적인 단열 수요를 고정시키고 있습니다. EU 리노베이션 웨이브(Renovation Wave) 하에서 리모델링 규모도 증가하며, 보조금이 주택 소유주들을 열효율이 높으면서도 경제적인 시스템으로 유도하고 있습니다. 이러한 규정 준수 중심 환경에서 제조사들은 비용이 많이 드는 구조적 변경 없이 우수한 R값을 제공하기 위해 네오포르(Neopor) 및 흑연 강화 제품 라인을 확대하고 있습니다.

mRNA 백신 및 첨단 치료제의 신속한 상용화를 위해서는 공장에서 진료소까지 2°C-8°C의 안정성이 요구됩니다. EPS 운송용기는 장거리 항공 운송 및 최종 배송 과정에서 예측 가능한 단열 및 완충 성능을 제공하는 폐쇄형 셀 구조로 이 분야를 주도합니다. 콜드 체인 테크놀로지스(Cold Chain Technologies)와 같은 제조사들은 특히 EU GDP 중심지의 80%를 6시간 이내에 도달할 수 있는 제약 유통망 지원을 위해 네덜란드 브레다에 유럽 생산 능력을 추가했습니다. 유럽 약전 부록 11.7의 규제 강화로 포장 공급업체들은 추출물 및 용출물 검증을 추진하게 되었으며, 이는 검증된 준수 기록을 보유한 기존 EPS 제형에 유리하게 작용합니다. 콜드 체인 기회는 프리미엄 마진을 제공하여 상품용 발포 스티렌의 스프레드 변동성을 부분적으로 상쇄합니다.

스티렌은 EPS 현금 비용의 최대 70%를 차지하므로, 수익성은 벤젠 및 나프타 가격 변동에 민감합니다. 트린스오(Trinseo)가 발표한 2025년 1월 계약 가격 톤당 55유로 인상은 생산자들의 마진 방어 시도를 보여줍니다. 베르살리스(Versalis)가 2025년 4월 브린디시(Brindisi) 크래커 가동을 중단함에 따라 구조적 공급 부족이 심화되어 지역의 수입 의존도가 확대되고 운임 및 환율 리스크가 증폭됩니다. 변동성 있는 원자재 지출과 고정 가격 건설 계약 간의 불일치는 변환업체의 현금 흐름을 압박하여 북서유럽 전역의 중소 규모 공장에 도전 과제를 안깁니다.

유럽의 백색 등급 팽창 폴리스티렌 시장 규모는 전체 소비량의 70.86%를 차지했습니다. 백색 EPS는 비용이 여전히 핵심 선택 요소이며, 규격 준수를 위해 적당한 패널 두께로 충분한 공동 벽체, 지반 슬래브 바닥, 주변 배수 보드에 지속적으로 사용됩니다. 그러나 흑연의 적외선 반사 입자가 λ값을 약 0.030 W/(m·K)로 낮추면서 회색 및 은색 등급은 2031년까지 3.74%의 가장 빠른 연평균 성장률(CAGR)을 기록할 전망입니다. 외부 단열 복합 시스템에서 회색 EPS는 동일한 U값을 유지하면서 층 두께를 16cm에서 12cm로 줄여, 좁은 대지 경계선을 가진 도시 지역의 외벽 리노베이션을 가능하게 합니다. BEWI의 CIRCULUM 라인은 성능 우위와 재활용 비드 함량을 결합하여 건축가가 에너지 효율과 순환성 목표를 동시에 달성할 수 있도록 지원합니다. 제조사들은 기계적 특성을 저하시키지 않으면서 더 많은 재생재를 포함시키기 위해 인라인 발포제 회수 및 연속 블록 성형 기술에 투자하고 있으며, 이는 유럽의 발포 폴리스티렌 시장에서 회색 EPS를 기술적·환경적 가치 측면에서 업그레이드된 솔루션으로 포지셔닝합니다.

유럽의 발포 폴리스티렌(EPS) 시장 보고서는 제품 유형(백색 EPS, 회색 및 은색 EPS), 최종 사용자 산업(건축, 건설, 전기, 전자, 포장 및 기타 최종 사용자 산업), 지역(독일, 영국, 프랑스, 이탈리아, 스페인, 노르웨이, 스웨덴, 덴마크, 핀란드 및 기타 유럽)별로 분류됩니다. 시장 예측은 수량(톤) 단위로 제공됩니다.

The Europe Expanded Polystyrene Market was valued at 2.20 million tons in 2025 and estimated to grow from 2.27 million tons in 2026 to reach 2.67 million tons by 2031, at a CAGR of 3.32% during the forecast period (2026-2031).

Demand flows primarily from building insulation upgrades and protective packaging for sensitive goods, while sector resilience is reinforced by robust domestic supply chains, incremental recycling gains, and technology upgrades that lower embodied carbon footprints. Regulatory drivers such as the EU Energy Performance of Buildings Directive, effective from 2025, compel higher R-values across new builds and retrofits, keeping insulation volumes stable even as substitutes gain share. Simultaneously, the surge in mRNA biologic logistics and appliance reshoring sustains packaging volumes, helping buffer commodity segments against margin compression from styrene volatility. Nevertheless, the Europe Expanded Polystyrene market negotiates mounting headline risk tied to feedstock price swings, fire-safety regulations in dense urban cores, and customer trials of paper-, pulp-, and mycelium-based alternatives.

Stricter national and EU-wide energy codes compel developers to design walls, roofs, and floors with lower U-values, lifting insulation thickness requirements and supporting steady volume demand for Europe's Expanded Polystyrene market solutions. Germany's Gebaudeenergiegesetz already specifies exterior wall U-values near 0.20 W/(m2K), which typically necessitates 12-16 cm of EPS, cementing roughly 40% share for the foam in German facade systems despite height-based fire-safety limits. France and the Nordics extend similar performance stipulations, and the 2024 recast of the Energy Performance of Buildings Directive sets a net-zero mandate for new structures from 2030, locking in long-range insulation demand. Retrofit volumes also rise under the EU Renovation Wave, with grants steering homeowners toward thermally efficient yet affordable systems. Producers broaden their Neopor and graphite-enriched lines in this compliance-driven landscape to deliver superior R-values without costly structural modifications.

Rapid commercialization of mRNA vaccines and advanced therapeutics requires 2 °C-to-8 °C stability from factory to clinic. EPS shippers dominate this lane because the material's closed-cell matrix provides predictable insulation and cushioning over long-haul flights and last-mile parcels. Manufacturers such as Cold Chain Technologies have added European capacity in Breda, Netherlands, specifically to serve pharma corridors reaching 80% of EU GDP centers within a six-hour drive. Regulatory tightening under European Pharmacopoeia Supplement 11.7 pushes packaging suppliers to validate extractables and leachables, favoring incumbent EPS formulations with proven compliance records. The cold-chain opportunity carries premium margins that partially offset styrene spread volatility in commodity construction foam.

Styrene accounts for up to 70% of EPS cash costs, making profitability sensitive to benzene-and naphtha swings. January 2025 contract hikes of EUR 55 per ton announced by Trinseo illustrate producer attempts to defend margins. Structural tightness deepens as Versalis shutters its Brindisi cracker in April 2025, widening the region's import dependency and magnifying freight and currency risks. The mismatch between volatile raw-material outlays and fixed-price construction contracts squeezes converter cash flows, challenging smaller plants across Northwest Europe.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Europe's Expanded Polystyrene market size for white grades accounted for 70.86% share of overall consumption. White EPS persists in cavity walls, slab-on-grade floors, and perimeter drainage boards where cost remains the critical selector and modest panel thicknesses suffice for code compliance. However, gray and silver grades register the fastest 3.74% CAGR to 2031 as graphite's infrared-reflective particles lower λ-values to around 0.030 W/(m*K). In external thermal insulation composite systems, gray EPS reduces layer thickness from 16 cm to 12 cm for the same U-value, unlocking facade renovation in urban districts with tight lot lines. BEWI's CIRCULUM line couples the performance edge with recycled bead content, helping architects reconcile energy and circularity targets. Producers invest in in-line blowing-agent recovery and continuous block molding to embed more reclaim without sacrificing mechanical properties, positioning gray EPS as a technical and eco-credential upgrade within the Europe Expanded Polystyrene market.

The Europe Expanded Polystyrene (EPS) Market Report is Segmented by Product Type (White EPS, Gray and Silver EPS), End-User Industry (Building and Construction, Electrical and Electronics, Packaging, Other End-User Industries), and Geography (Germany, United Kingdom, France, Italy, Spain, Norway, Sweden, Denmark, Finland, Rest of Europe). The Market Forecasts are Provided in Terms of Volume (Tons).