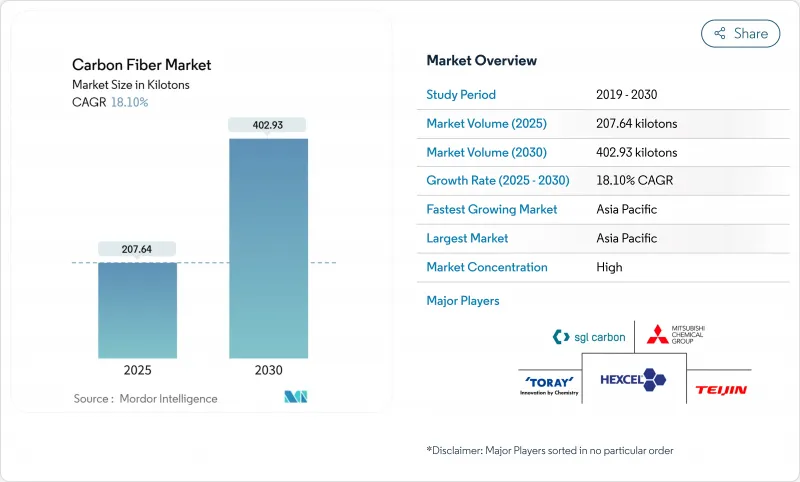

탄소섬유 시장은 2025년에 207.64킬로톤, 2030년에는 402.93킬로톤에 이르고, 2025-2030년의 CAGR은 18.10%를 나타낼 전망입니다.

연료 사용량 감소, 배출량 감소, 설계 유연성 향상으로 인해 여러 산업이 금속을 경량 복합재료로 대체하고 수요가 급속히 확대되고 있습니다. 주요 성장 촉매로는 급속히 진화하는 항공우주 프로그램, 풍력 터빈 설치 가속, 고압 수소 용기의 채택 증가, 전기자동차(EV)의 경량화 이니셔티브의 보급 등을 들 수 있습니다. 생산 에너지를 70% 줄이는 마이크로웨이브 어시스트 탄화와 같은 기술 혁신은 비용 역학을 개선하기 시작했으며, 대응 가능한 탄소섬유 시장 전체를 확대할 수 있습니다.

보잉 787, 에어 버스 A350, 새로운 우주 플랫폼은 탄소 복합재에 크게 의존하고 있으며, 주요 공급업체는 생산 능력을 강화하고 있습니다. 헥셀은 경량 부품이 알루미늄 스킨을 대체했기 때문에 2024년 민간 항공우주 사업 매출이 17.2% 증가했습니다. 매사추세츠공과대학의 연구자는 기존의 프리프레그를 보완하는 '나노스티치'를 도입하여 탄소나노튜브를 라미네이트층 사이에 임베디드하여 인성을 62% 향상시켜 층간박리를 억제했습니다. 1,500℃까지 대응 가능한 세라믹 매트릭스 복합재, 항공 CO2를 삭감하는 바이오 유래 섬유, 속경화성 열경화성 수지는 성능의 틀을 넓혀가고, 항공우주 설계의 업그레이드가 카본 파이버 시장의 상한을 어떻게 끌어올리는지를 명확하게 나타내고 있습니다.

블레이드가 길어지면 더 큰 용량의 터빈이 가능합니다. 탄소 스퍼 캡은 무게를 줄이면서 100m급 로터에 필요한 강성을 제공합니다. 2024년 9월에는 키네코 엑셀 컴포지트 인디아가 베스타스사에 인발판을 공급하는 계약을 체결했고, 블레이드 제조업체가 해외 성장을 지원하기 위해 지역적인 공급에 경주하고 있는 것으로 밝혀졌습니다. 유럽 건설 러시, 중국 경매, 미국 세금 공제는 탄소섬유 구조 부품에 유리하며 탄소섬유 시장에서 이 재료의 역할을 강화하고 있습니다.

기존의 라인은 1,000℃ 이상의 온도에서 긴 체류시간 운전하기 때문에 방대한 전력을 소비하고 운전 비용의 40% 이상이 고정됩니다. 에너지 가격 변동은 금리를 압박하고 생산 능력 증가를 억제합니다. 마이크로파 보조로와 대체 전구체는 결국 병목 현상을 해결할 수 있지만, 대규모 리노베이션은 여전히 자본 부담이 큽니다.

PAN계 등급은 2024년의 탄소섬유 시장량의 95%를 차지하며, 정교한 공급망과 알려진 기계적 특성에 지지되고 있습니다. 생산자가 피치와 리그닌 선택을 시도하는 중에도 2030년까지 연평균 복합 성장률(CAGR)은 18.3%를 유지할 것으로 예측됩니다. 그래핀을 0.075wt% 첨가한 실험에서는 PAN의 인장강도가 225%, 영률이 184% 향상되어 있어 더욱 향상을 기대할 수 있습니다. 나머지 점유율은 피치 섬유가 차지하고 있으며 탄성률의 우위성에 의해 위성이나 고강성 샤프트 등의 틈새를 확보하고 있습니다.

프리커서의 연구개발에 대한 지속적인 투자는 여러 원료가 공존하는 단계적 변화를 시사합니다. 그러나 PAN의 확립된 인프라, 입증된 품질 관리, 광범위한 인증 기반은 10년 내내 그 지위를 지킬 것으로 보입니다. 에너지 효율적인 산화로 인한 비용 절감으로 생산자는 절약을 전가하고 대체 고성능 플라스틱에 대항하여 점유율을 보호할 수 있습니다.

버진 재료는 2024년 탄소섬유 시장량의 63%를 차지했습니다. 성능의 일관성, 항공우주 분야에서의 적격성, 이용가능성으로부터 안전성이 중요한 부품에서는 버진재가 유리합니다. 그러나 현재는 고급 솔볼리시스에 의해 보다 낮은 에너지 부하로 파이버 강도가 최대 90%까지 회복해, 리사이클 그레이드의 CAGR은 19.5%를 나타냈습니다. 자동차, 가전, 스포츠 용품은 임베디드 배출량을 줄이고 비용을 절감하기 위해 재생 섬유 테스트를 실시하고 있으며, 도레이의 레노버 프로그램은 주류가 재생 섬유임을 보여줍니다.

OEM이 지속가능성 목표를 조달에 통합함에 따라, 버진 섬유 시장 점유율의 이점은 점차적으로 손실됩니다. 인프라를 확대하고 폐기물 규제를 조화시키고 안정적인 공급 품질을 확보하는 것이 보다 광범위한 채택의 전제조건임에 변화는 없습니다. 나노 기공, 금속과 같은 열전도성 및 기타 기능 특성을 가진 특수 섬유는 현재 방관자의 입장에 있지만, 수량이 전용 라인을 정당화할 수 있게 되면 이익 풀로서 상승할 가능성이 있습니다.

아시아태평양은 2024년 기준에서 탄소섬유 시장의 44.3%를 차지하고 있으며, 2030년까지 CAGR은 20.6%를 나타낼 전망입니다. 일본의 기존 기업인 도레이와 미쓰비시화학은 PAN라인 확보와 꾸준한 기술 혁신을 통해 세계적인 리더십을 유지하고 있습니다. 중국 제조업체는 적극적으로 규모를 확대하고 있으며 국가 에너지 전환 계획의 혜택을 받고 있습니다.

북미는 강력한 항공 산업의 허브를 유지하고 수소 트럭 시험을 확대하고 있습니다. 헥셀의 항공우주 분야의 백로그와 에너지성의 클린 소재에 대한 새로운 지원이 이 지역의 지위를 견고하게 하고 있습니다. 유럽은 해상 풍력 발전, 고급 자동차, 저탄소 생산에 보상하는 규제의 뒷받침에서 이익을 얻고 있습니다.

남미와 중동, 아프리카는 적은 양을 차지하지만 상승세를 보이고 있습니다. 브라질은 풍력 자원과 인프라 정비를 활용합니다.

The carbon fiber market stands at 207.64 kilotons in 2025 and is forecast to reach 402.93 kilotons by 2030, expanding at an 18.10% CAGR for 2025-2030.

Demand is scaling rapidly as multiple industries replace metals with lightweight composites to cut fuel use, shrink emissions, and unlock design flexibility. Major growth catalysts include fast-evolving aerospace programs, accelerating wind-turbine installations, rising adoption of high-pressure hydrogen vessels, and the spread of electric-vehicle (EV) lightweighting initiatives. Innovations such as microwave-assisted carbonization that trim manufacturing energy by as much as 70% are beginning to improve cost dynamics and could widen the total addressable carbon fiber market.

Boeing 787, Airbus A350, and new space platforms depend heavily on carbon composites, which have pushed major suppliers to ramp up capacity. Hexcel posted 17.2% growth in its commercial-aerospace revenue in 2024 as lightweight parts replaced aluminum skins. Complementing established prepregs, Massachusetts Institute of Technology researchers introduced "nanostitching," embedding carbon nanotubes between laminate layers to boost toughness by 62% and curb delamination, which can lengthen service life while lowering lifecycle cost. Ceramic-matrix composites capable of 1,500 °C, bio-derived fibers that cut aviation CO2, and rapid-cure thermosets are widening performance envelopes, underscoring how aerospace design upgrades raise the carbon fiber market ceiling.

Longer blades enable higher-capacity turbines. Carbon spar caps deliver the stiffness needed for 100-meter rotors while holding weight down. In September 2024, Kineco Exel Composites India landed a contract to supply pultruded planks to Vestas, underscoring how blade makers lean on regional supply to support offshore growth. Europe's build-out, China's auctions, and United States tax credits favor carbon fiber structural parts, reinforcing the material's role in the carbon fiber market.

Conventional lines run above 1,000 °C for long dwell times, consuming vast power and locking in more than 40% of operating cost. Energy price swings squeeze margins and deter capacity adds. Microwave-assisted furnaces and alternative precursors could eventually resolve the bottleneck, yet large-scale retrofits remain capital-heavy.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

PAN-based grades held 95% of the carbon fiber market volume in 2024, backed by refined supply chains and known mechanical properties. They are projected to keep an 18.3% CAGR to 2030, even as producers test pitch and lignin options. Adding 0.075 wt% graphene lifted PAN tensile strength 225% and Young's modulus 184% in lab trials, pointing to scope for incremental gains. Pitch fibers claim the remaining share and are securing niches in satellites and high-rigidity shafts thanks to modulus advantages, which could widen automotive reach.

Sustained investment in precursor research and development points to a gradual shift where multiple feedstocks coexist. Yet PAN's entrenched infrastructure, proven quality control, and broad certification base will safeguard its position through the decade. Cost relief from energy-efficient oxidation could allow producers to pass savings and defend their share against alternative high-performance plastics.

Virgin material commanded 63% of the carbon fiber market volume in 2024. Performance consistency, aerospace qualification, and availability favor virgin output in safety-critical parts. However, advanced solvolysis now recovers up to 90% fiber strength at lower energy load, handing recycled grades a 19.5% CAGR, runway. Automotive, consumer electronics, and sporting goods are testing recycled fiber to lower embedded emissions and cut costs, and Toray's Lenovo program illustrates mainstream appeal.

The carbon fiber market share advantage of virgin fibers will erode incrementally as OEMs integrate sustainability targets into sourcing. Scaling infrastructure, harmonizing waste regulations, and ensuring stable supply quality remain prerequisites for broader adoption. Specialized fibers with nano-pores, metal-like thermal conductivities, or other functional properties sit on the sidelines for now, yet can emerge as profit pools once volumes justify dedicated lines.

The Carbon Fiber Market Report Segments the Industry by Raw Material (Polyacrylonitrile (PAN) and Petroleum Pitch and Rayon), Fiber Type (Virgin Fiber (VCF), Recycled Carbon Fiber (RCF), and Others), Application (Composite Materials, Textiles, and More), End-User Industry (Aerospace and Defense, Alternative Energy, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Asia-Pacific controlled 44.3% of the carbon fiber market in 2024 and should keep the fastest trajectory with a 20.6% CAGR to 2030. Japanese incumbents Toray and Mitsubishi Chemical sustain global leadership through captive PAN lines and steady innovation. Chinese producers are scaling aggressively and benefit from national energy transition programs.

North America retains a strong aviation hub and is expanding hydrogen-truck trials. Hexcel's aerospace backlog and emerging Department of Energy support for clean materials consolidate the region's position. Europe benefits from offshore wind, luxury autos, and regulatory pushes that reward low-carbon production; Brussels' debate over composite waste could, however, add compliance hurdles for imported parts.

South America and the Middle East, and Africa account for modest volumes yet offer upside. Brazil leverages wind resources and infrastructure buildouts.