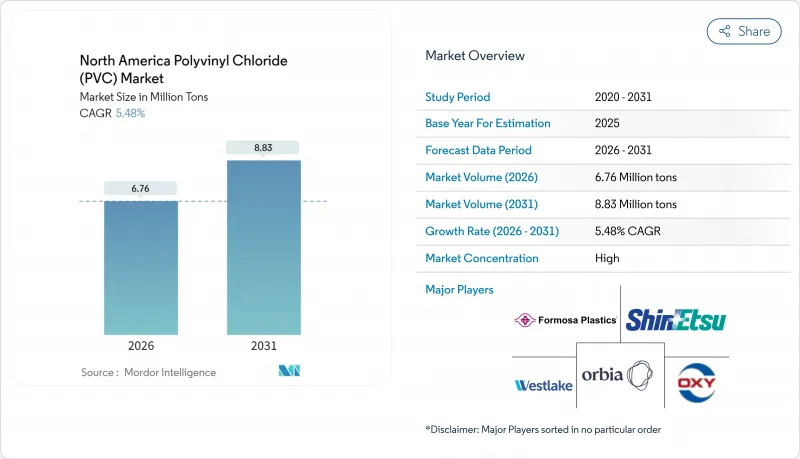

북미의 폴리염화비닐(PVC) 시장은 2025년 641만 톤에서 2026년 676만 톤으로 성장했으며, 2026년부터 2031년까지 연평균 복합 성장률(CAGR) 5.48%를 나타내 2031년까지 883만 톤에 이를 것으로 전망됩니다.

인프라의 근대화가 계속되고 있는 것, 특히 연방정부 자금에 의한 납제 급수관의 교환 사업이, 공급 체인의 변동이 계속되는 가운데에서도 이 확대를 지지하고 있습니다. 지자체는 납 배관의 전면 교환을 10년 이내에 완료할 의무가 있기 때문에 수요 전망은 견조하고, 배관 구입은 광범위한 경제 변동의 영향을 받기 어려운 상황입니다. 지역별로는 미국이 최대의 PVC 소비국이며, 원료 가격의 급등으로부터 생산자를 보호하는 유리한 에탄 코스트가 이를 지원하고 있습니다. 의료 분야는 인구 역학의 동향과 프탈산이없는 의료기기로의 전환을 배경으로 가장 성장이 뛰어난 최종 사용자로서 중요성을 늘리고 있습니다. 경쟁의 격화는 수직 통합, 특수 컴파운딩, 지속가능성 혁신에 초점을 맞추고 있으며, 이들은 세계적으로 공급 과잉 상태에 있는 수지 시장에서 이익률을 지키는 역할을 합니다.

건설 분야에서의 PVC 소비량은 유틸리티 지출의 회복에 연동하고 있어 배관·피팅 용도가 전 용도의 거의 절반을 차지합니다. 연방규칙에 의한 연기금지를 위해 주·지방자치단체에서는 노후화된 배관망의 갱신이 진행되고 있습니다. 납 함량을 규제하는 건축 기준에 따라 프로젝트는 경질 비닐 시스템으로 이행하는 한편, 생산자는 통합 에틸렌 체인을 활용하여 비용 안정화를 도모하고 있습니다. 장기 인프라 계획은 예측 가능한 수주 기반을 창출해 민간 주택 사이클에 좌우되지 않고, 국내 공장의 설비 증강을 촉진해 수지 수요를 지속시키고 있습니다.

의료 분야 수요는 CAGR 6.34%로 확대되고 있으며, 병원에서는 혈액백, 튜브, 카테터에 비 DEHP 화합물을 지정하고 있습니다. 재료 배합 제조업체는 현재 투명성, 유연성 및 멸균 내성을 손상시키지 않고 FDA 시험을 통과하는 프탈산 에스테르 프리 첨가제를 제공합니다. 규제 장벽 증가와 밸리데이션 비용 증가는 확립된 공급업체에 유리하게 작용하여 북미의 폴리염화비닐(PVC) 시장에서 상품 마진의 압력을 상쇄하는 프리미엄 가격을 설정할 수 있습니다. 고령화와 재택치료의 확대가 이 수요의 성장 여지를 더욱 확대하고 있습니다.

원료 비용이 제조 원가의 최대 70%를 차지하기 때문에 원료 가격의 변동은 마진을 압박합니다. 최근의 철도사고는 물류위험을 돋보이게 하고, 주요 크래커의 계획 정지는 지역적인 공급 핍박을 초래해, 스팟 시장의 변동성을 증폭시키고 있습니다. 통합 기업은 우세한 에탄 공급으로 영향의 일부를 완화할 수 있지만, 무역 바이어는 보다 급격한 가격 상승에 직면하여 북미의 폴리염화비닐(PVC) 시장 전체의 재고 계획을 복잡하게 하고 있습니다.

2025년의 총 생산량의 59.65%를 경질 염화비닐이 차지해 수명과 비용 안정성이 중시되는 지하수도 인프라 분야에서의 강점을 나타냈습니다. 이 점유율은 북미의 폴리염화비닐(PVC) 시장 규모에서 가장 큰 비율에 해당하며 연방 정부 자금 프로젝트에서 의무화 된 파이프 수요가 기반이됩니다. 경질 배합은 창틀이나 사이딩에도 사용되어 유틸리티 이외에도 안정된 수요를 낳고 있습니다.

연질 카테고리는 의료기기, 호스, 전선 피복재에 있어서 특수 화합물의 채용에 의해 CAGR 5.82%를 나타낼 전망입니다. 제조업체는 투명성, 저온 유연성, 프탈산 프리 화학 조성으로 차별화를 도모하고 있습니다. 염소화 PVC는 급탕관에서 틈새 시장을 유지하고 저발연 등급은 교통기관과 고점유율 빌딩에서의 방화 안전 기준에 대응하고 있습니다. 제품 구성은 높은 이익률을 실현하고 세계 상품 사이클에 대한 의존도를 줄이는 특수 등급으로 지속적으로 전환하고 있습니다.

북미의 폴리염화비닐(PVC) 시장 보고서는 제품 유형(경질 PVC, 연질 PVC, 저연 PVC, 염소화 PVC), 용도(파이프·피팅, 필름 및 시트 등), 최종 사용자 산업(건축 및 건설, 전기 및 전자, 의료, 자동차 등), 지역(미국, 캐나다, 멕시코)별로 분류됩니다. 시장 예측은 수량(톤) 단위로 제공됩니다.

The North America Polyvinyl Chloride market is expected to grow from 6.41 million tons in 2025 to 6.76 million tons in 2026 and is forecast to reach 8.83 million tons by 2031 at 5.48% CAGR over 2026-2031.

Continued infrastructure modernization, especially the federally funded replacement of lead service lines, underpins this expansion even as supply-chain volatility persists. Demand visibility is strong because municipalities must comply with the ten-year mandate for full lead pipe replacement, insulating pipe purchases from broader economic swings. The United States accounts for the largest regional PVC consumption, supported by advantaged ethane costs that cushion producers from feedstock price shocks. Healthcare is gaining importance as the fastest-growing end user, propelled by demographic trends and the shift to phthalate-free medical devices. Competitive intensity centers on vertical integration, specialty compounding, and sustainability innovations that protect margins in a globally oversupplied resin market.

PVC consumption in construction tracks the recovery of public works spending, with pipes and fittings representing almost half of all applications. States and provinces are replacing aging distribution networks because federal rules prohibit deferrals. Building codes that cap lead content steer projects toward rigid vinyl systems, while producers leverage integrated ethylene chains to stabilize costs. Long-term infrastructure programs create predictable order books, encouraging capacity upgrades at domestic plants and sustaining resin uptake regardless of private housing cycles.

Healthcare demand expands at 6.34% CAGR as hospitals specify non-DEHP compounds for blood bags, tubing, and catheters. Material formulators now offer phthalate-free additives that pass FDA tests without trade-offs in clarity, flexibility, or sterilization resistance. Higher regulatory barriers and validation costs favor established suppliers, enabling premium pricing that offsets commodity margin pressure in the North America Polyvinyl Chloride market. An aging population and the growth of home-based care further extend this demand runway.

Feedstock swings erode margins because raw materials represent up to 70% of production cost. Recent rail incidents underscore logistical risk, while planned shutdowns at major crackers tighten regional availability and amplify spot volatility. Integrated firms cushion some of the impact through advantaged ethane, but merchant buyers face sharper price spikes, complicating inventory planning across the North America Polyvinyl Chloride market.

Other drivers and restraints analyzed in the detailed report include:

For complete list of drivers and restraints, kindly check the Table Of Contents.

Rigid PVC accounted for 59.65% of total volume in 2025, underscoring its strength in underground water infrastructure, where lifespan and cost stability prevail. That share translates to the largest slice of the North America Polyvinyl Chloride market size, anchored by pipes mandated in federally funded projects. Rigid formulations also serve window profiles and siding, adding steady demand outside public works.

The flexible category advances at a 5.82% CAGR as medical devices, hoses, and wire coatings adopt specialized compounds. Manufacturers differentiate through clarity, low-temperature flexibility, and phthalate-free chemistries. Chlorinated PVC retains a niche in hot-water lines, while low-smoke grades address fire-safety codes in transit and high-occupancy buildings. Product mix continues shifting toward specialty grades that command higher margins and reduce exposure to global commodity cycles.

The North America Polyvinyl Chloride (PVC) Market Report is Segmented by Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, and Chlorinated PVC), Application (Pipes and Fittings, Films and Sheets, and More), End-User Industry (Building and Construction, Electrical and Electronics, Healthcare, Automotive, and More), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Volume (Tons).